DeFi’s Missing Primitive: Insurance

DeFi’s missing primitive: Insurance

This post was co-authored with Francesco Mangia, a quantitative researcher with experience in both DeFi and traditional finance, specializing in risk analysis, quantitative strategies, and financial infrastructure.

DeFi insurance is emerging as a critical, but structurally difficult, layer of the decentralized finance stack. Its core promise is to provide protection against smart contract failures, protocol exploits, oracle breakdowns, and other risks that are native to on-chain systems, in an environment where transactions are irreversible and intermediaries are absent.

[

](https://substackcdn.com/image/fetch/$s_!eu9M!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Ff50a117c-ab72-47f6-8c05-c3aa50974fea_1024x721.png)

J.M.W. Turner – The Shipwreck

In traditional finance, insurance is rarely optional. Banks, funds, and operating companies are required - by regulation, counterparties, or fiduciary duty - to insure against operational, legal, and counterparty risks.

DeFi evolved in the opposite direction. For most of its history, participants operated in a deliberately risk-on environment, prioritizing yield and speed over protection, and treating losses as an accepted cost of experimentation. This is beginning to change, as institutional capital enters the space and regulatory expectations become clearer, professional investors and mature protocols are increasingly forced to measure, manage, and externalize risk. That shift creates real demand for insurance-like primitives.

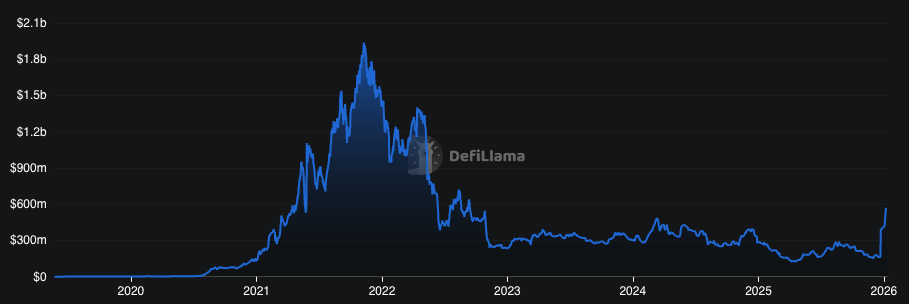

Despite this demand, the market remains small. At its peak, capital committed to DeFi insurance protocols reached only a low single-digit percentage of total DeFi TVL, with total insurance-dedicated capital measured in the hundreds of millions of dollars, against a DeFi market that fluctuates in the hundreds of billions.

[

](https://substackcdn.com/image/fetch/$s_!LSYF!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F55ab2156-012a-44be-bd1d-d2d00e75598a_909x304.png)

Source: Defillama - Insurance Protocols TVL

This gap is not a question of relevance, but of feasibility: claims verification is difficult, capital efficiency is low, and correlated failures can overwhelm mutualized pools. As a result, designing insurance products that are simultaneously credible, scalable, and economically sustainable remains one of the hardest open problems in DeFi.

The goal of this post is to shed light on the existing DeFi insurance landscape, identify its defining characteristics, and outline an approach better suited to on-chain risk.

Existing DeFi insurance landscape

At its core, DeFi insurance is on-chain risk mutualization. It is not an “insurance company on a blockchain”, but a capital pool governed by code where participants collectively underwrite specific risks and bear losses together. There is no balance sheet owned by a firm. The balance sheet is the protocol.

In its native form, DeFi insurance consists of three elements:

-

Risk sellers - users who stake capital into a pool and earn premiums in exchange for absorbing losses

-

Risk buyers - users who pay a premium to receive protection against a clearly defined on-chain event

-

A rule-based system - smart contracts that define coverage conditions, capital requirements, and payouts

If a covered event occurs, losses are paid directly from the pool. If not, stakers keep the premiums. There is no legal promise, only economic finality enforced by code.

The result is a mutualization of the risk, not a transfer. This distinction matters. Traditional insurance transfers risk from policyholder to insurer. DeFi insurance shares risk among participants. Every DeFi insurance system is therefore closer to a mutual than to a commercial insurer. There is no external entity standing behind the guarantees: solvency depends entirely on how well risks are priced, diversified, and capped.

Over the last few years a few projects emerged in the space: Nexus Mutual, Y2K, Ante Finance.

Nexus Mutual

Nexus Mutual is the earliest and most established DeFi insurance protocol, launched on Ethereum in 2019 to provide coverage against smart contract failures and protocol exploits through a mutualized risk-sharing model in which pooled capital is used to pay claims when covered events occur. Despite being the market leader, adoption has remained limited. Nexus Mutual reached a peak of nearly $800M TVL in 2022, but has since declined and stabilized around $200M, significantly underrepresenting a DeFi market whose total value fluctuates in the hundreds of billions.

The protocol is curated and permissioned. Nexus Mutual decides which protocols and coverage types can be offered, and full participation requires membership and KYC. This design reduces adverse selection and governance attack vectors, but limits permissionlessness, composability, and rapid market expansion. Claims settlement is discretionary rather than automatic: while coverage terms are defined ex-ante, whether a covered event has occurred is determined ex-post through a human-led process. Claims are reviewed by a small committee of publicly known experts, with acceptance requiring a supermajority and additional oversight from an Advisory Board. In practice, the protocol acts as the ultimate policy arbiter.

From the underwriters’ perspective, the risk–return profile is often unattractive. Premiums are generally low relative to the tail risks being insured, capital is locked and illiquid, and losses can be sudden and highly concentrated, making coverage provision less appealing than alternative DeFi strategies with comparable yields and simpler risk exposures. Discretionary claims assessment further introduces edge cases that can harm underwriters. A notable example is the Euler exploit, where Nexus Mutual paid out claims to cover holders, but a large portion of the stolen funds was later recovered. The recovery did not flow back to the capital pool, leaving underwriters with permanent losses and highlighting a structural asymmetry between discretionary payouts and post-incident recoveries.

Y2K

Y2K Finance was a DeFi insurance protocol focused exclusively on stablecoin depeg risk, launched in late 2022. Instead of offering broad smart contract coverage, Y2K attempted to isolate a single, well-defined risk factor and create on-chain markets around it, positioning itself at the boundary between insurance and derivatives. Adoption remained limited from the start: the protocol peaked at around $12M TVL shortly after launch, then steadily declined to below $3M by mid-2023, after which the project was effectively abandoned.

Coverage was structured around weekly epochs. Users could take either the “peg” or “depeg” side of a stablecoin pair, effectively underwriting or buying protection against a loss of peg within a fixed time window. At the end of each epoch, positions expired, and users were required to manually roll over their capital into the next week to maintain exposure. While conceptually clean, this design introduced continuous operational friction and made insurance a short-lived, opt-in activity rather than a persistent risk allocation.

These mechanics proved structurally fragile. Mandatory weekly rollovers required constant user attention and led to capital leakage, as missed rollovers automatically forced users out of positions. This severely limited long-term underwriting commitment and made it difficult to bootstrap durable liquidity. At the same time, liquidity was highly fragmented: each stablecoin, chain, and epoch constituted a separate market, preventing capital from being reused or aggregated efficiently. Underwriters were asked to allocate capital across many rare and sporadic tail events, while positions remained largely non-composable with the broader DeFi stack. As depeg events are infrequent by nature, capital sat idle most of the time, eroding incentives and ultimately leading to a steady withdrawal of liquidity.

Ante Finance

Ante Finance is a decentralized protocol launched in late 2021 with the goal of turning implicit trust assumptions in DeFi - such as “protocol X remains solvent” or “team Y will not rug” - into explicit, on-chain guarantees called Ante Tests. Adoption remained marginal: the protocol never exceeded $1M TVL, and activity steadily declined over time, in part due to its developer-heavy focus and limited business development and market outreach.

At its core, Ante allows users to create permissionless risk assertions tied to verifiable conditions. Each test is associated with an Ante Pool, where participants can stake capital on the test continuing to hold, while challengers stake against it. Challengers pay a continuous decay fee to stakers over time, and if the test fails, funds are redistributed according to predefined rules. The arbiter that determines test outcomes can be either an on-chain condition (oracle or direct state inspection) or a designated human judge.

Ante’s main strength is flexibility. Tests are fully programmatic, positions are on-chain, and markets can be either discrete or continuous. In principle, these pools can be composed into other contracts, used as building blocks for higher-level products, or aggregated into protocol-agnostic trust metrics, such as the Decentralized Trust Score. Compared to Nexus Mutual or Y2K, Ante comes closer to a native, composable trust primitive. The same flexibility, however, is also its core weakness. The system is complex and unintuitive: participants must understand test definitions, staking mechanics, decay rates, and arbitration logic. Capital allocation is unpredictable, and there is no mechanism to ensure that tests focus on economically meaningful risks rather than edge cases. Liquidity is difficult to bootstrap, especially for long-tail or low-visibility guarantees, and the lack of curation makes capital fragmentation likely.

Key Dimensions

Designing an effective DeFi insurance system is not a matter of solving a single problem, but of balancing a set of tightly coupled dimensions. Verification, capital, curation, pricing, and composability are not independent choices: decisions in one dimension directly constrain the others.

Clear and narrow verification enables automated claims and reduces uncertainty, which in turn lowers capital requirements and improves pricing. Capital attraction depends on predictable downside and credible pricing, both of which are shaped by how risks are verified and who is allowed to underwrite them. The choice between permissionless and curated markets determines capital concentration and diversification, influencing liquidity, premiums, and solvency. Pricing mechanisms feed back into capital formation and market participation, while poor pricing amplifies tail risk and undermines trust. Finally, composability determines whether insurance positions remain isolated products or become reusable financial primitives that can be traded, hedged, or layered into more complex structures.

An insurance protocol is therefore a system, not a product. Weakness in any single dimension propagates through the rest, while coherent design across all five is required to achieve scalability, capital efficiency, and credibility. The following sections examine each dimension in turn.

Verification Problem

Even when claim conditions are fully encoded on-chain, verification remains complex. Some risks involve multiple protocols, external oracles, or rare, context-dependent events. While outcomes are deterministic, assessing them may require aggregating data from multiple sources and calculating the expected value of positions, which enables arbitrage, hedging, and structured reinsurance.

The challenge is to define coverage narrowly enough to be tractable, but broadly enough to address meaningful risks without fragmenting the market. Well-structured verification reduces uncertainty and allows capital to be reused efficiently across multiple policies or reinsurance layers.

Capital Attraction

In current DeFi insurance solutions, premiums are often low relative to the underlying risk, and tail risks are extremely high. Capital is locked, illiquid, and underwriting exposes participants to asymmetric losses from unpredictable events, such as smart contract exploits or protocol failures.

This creates a self-reinforcing cycle: insufficient capital → limited coverage → reduced demand → lower premiums → difficulty attracting new capital.

Effective solutions require either higher risk-adjusted returns, mechanisms to reduce exposure volatility, or alignment of incentives by involving protocols, curated entities, or chains as primary underwriters.

Permissionless vs Curated Markets

A key design choice is who decides which risks can be insured.

-Permissionless markets allow anyone to underwrite, but risk liquidity fragmentation and under-diversified exposure

- Curated markets concentrate capital and improve capital efficiency, but may restrict coverage options and limit market growth

Potential approaches include:

- Curated vaults of policies, which aggregate multiple risks and allow liquidity to be concentrated efficiently

- Protocol-backed liquidity, where a protocol bootstraps coverage for its own products to attract initial capital and reduce tail risk

- Hybrid approaches, combining curated pools for common risks with open participation for edge-case or niche risks, improving scalability while maintaining capital efficiency

Premium Pricing Mechanisms

Pricing insurance in DeFi is challenging due to limited historical data. Approaches include:

- Supply-and-demand pricing, where premiums emerge from market participation

- Actuarial or model-based pricing, which estimates risk probabilistically, but is constrained by sparse exploit data

Efficient pricing mechanisms are essential to align incentives, ensure liquidity, and avoid underpricing high-tail risks that could threaten solvency. Dynamic market feedback, secondary markets, and redemption mechanisms can improve risk assessment and refine premiums over time.

Composability Mismatch

DeFi promises fully composable financial primitives, yet insurance policies are typically non-fungible, protocol-specific, and non-transferable. This limits integration with other protocols, secondary markets, or derivatives structures.

Tokenizing underwriting positions could create composable risk primitives, allowing them to:

-

Be traded or pooled across multiple protocols.

-

Serve as collateral in lending or leveraged positions.

-

Enable derivative-like strategies, such as hedging, leverage, or structured risk transfer.

Composability unlocks liquidity, attracts sophisticated capital, and allows the ecosystem to treat insurance as a modular building block, improving efficiency and market depth.

Conclusions

The current DeFi insurance landscape reveals a consistent pattern. Existing solutions tend to solve one dimension well while failing on others. Some protocols achieve credible claims verification but sacrifice composability and capital efficiency. Others enable permissionless participation but struggle to attract durable underwriting capital. In almost all cases, insurance remains siloed, illiquid, and structurally fragile in the face of correlated tail risk.

What is missing today is not demand, nor capital in absolute terms, but an insurance primitive designed as financial infrastructure rather than a standalone product. A system where verification is programmatic and narrow enough to be automatable, where capital can move, hedge, and be reused across multiple risks, and where pricing emerges from continuous market feedback instead of static assumptions. Most importantly, what is missing is a way to align incentives between protocols that generate risk and capital providers that absorb it.

One approach that moves in this direction is Cassa. Instead of relying on pooled reserves and discretionary settlement, Cassa represents insurance exposure as two fully collateralized, tradable positions: an insured leg and an underwriting leg. This structure allows coverage and risk-bearing capital to be priced continuously by the market, exited without relying on liquidity events, and composed with other DeFi protocols. Capital remains productive while underwriting risk, and coverage can be structured across time horizons, risk bands, or specific events, with deterministic, on-chain settlement at expiry. By turning insurance into a set of transferable risk instruments rather than static policies, Cassa addresses several of the capital efficiency and composability constraints observed in existing designs

Whether through Cassa or other designs, insurance remains one of the most important missing primitives in DeFi. It will only scale when risk itself becomes a liquid, composable asset - no longer an opaque byproduct of yield, but a first-class financial instrument. Only then can DeFi move beyond experimental markets and mature into a durable, resilient financial system.

Comments

Want to join the conversation?

Loading comments...