Anthony Pompliano

QE Is Back and Asset Prices Are Going Higher

AI Summary

The episode analyzes the Federal Reserve’s recent 25‑basis‑point rate cut and the restart of $40 billion monthly Treasury‑bill purchases, signaling a return to quantitative easing that is driving all major asset classes to record highs. Host Anthony Pompliano and guest Jeff Park explain how QE lowers bond yields, pushes investors toward risk assets such as stocks, real estate, and crypto, while weakening the dollar and cash‑like investments. They also discuss deflationary pressures from AI, robotics, tariffs, and immigration, and caution that the portfolio’s heavy tilt toward private and crypto holdings is vulnerable if the Fed’s easing slows. The conversation highlights Bitcoin’s mixed sentiment, institutional interest from firms like BlackRock and Stripe, and the broader macro impact of AI on investment strategies.

Episode Description

Today’s Letter is Brought To You by Abra!

Show Notes

To investors,

Quantitative easing is back. The Federal Reserve announced a 25‑basis‑point cut yesterday, which brings the federal funds rate down to 3.50‑3.75 %. The vote had three dissenters, including two people who thought we should have left rates unchanged and Fed Governor Stephen Miran who wanted a 50‑basis‑point cut.

While the interest‑rate cut is important, it was consensus across Wall Street that the central bank would reduce the cost of capital by 25 bps. The big surprise coming out of the two‑day meeting was the Fed’s announcement to restart balance‑sheet expansion with $40 billion in monthly Treasury‑bill purchases.

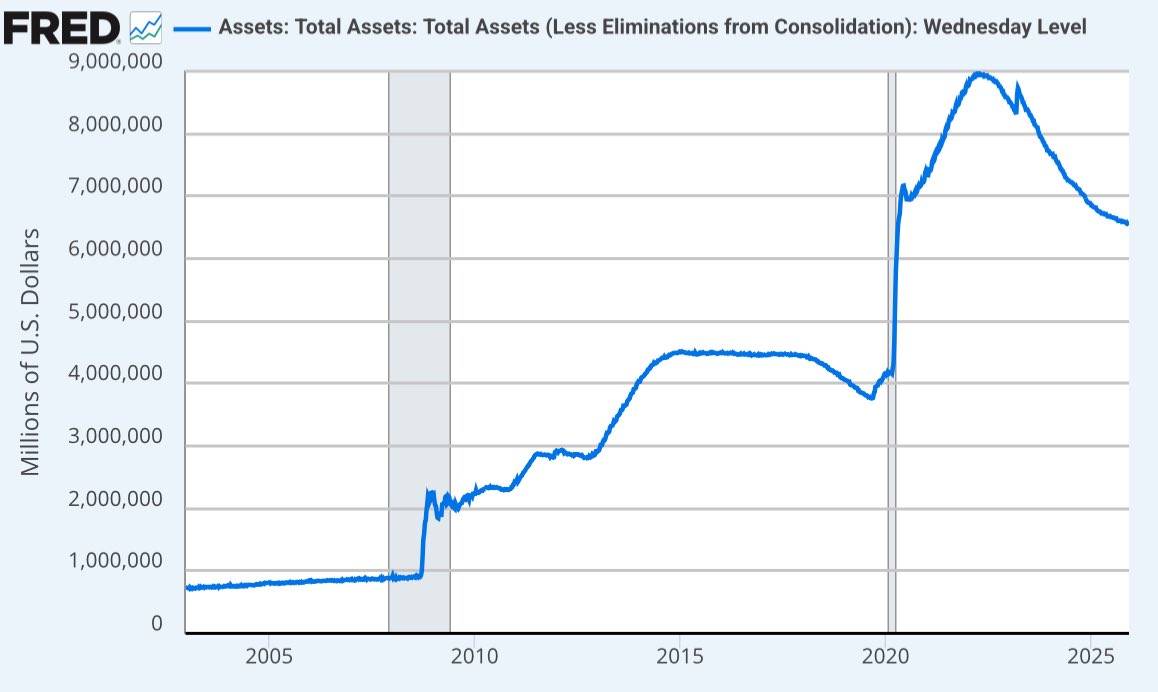

My friends at Geiger Capital put it best when they reminded us that Ben Bernanke promised in 2008 that QE was temporary and the Fed’s balance sheet would soon be lower than when they started.

As you can see, the Fed’s balance sheet has continued to grow over time and now Jerome Powell is telling us that it is time to go back higher. This entire situation is highly unusual. Creative Planning’s Charlie Bilello outlined it perfectly:

-

Stocks – all‑time high

-

Home Prices – all‑time high

-

Gold – all‑time high

-

Money Supply – all‑time high

-

National Debt – all‑time high

-

CPI Inflation – 4 % per year since Jan 2020, 2× the Fed’s “target”

-

Fed – cut rates again today & will start QE on Friday

But as I wrote earlier this week, multiple deflationary forces are headed for a collision with the U.S. economy. We have AI, robotics, tariffs, and a surge in deportations. Each would be worth watching on its own, but they collectively create the perfect storm for the Fed to fail at monetary policy.

Add in weakness in the job market and it becomes clear why the Fed has to get interest rates lower. So now that we know QE is coming back, what will happen to asset prices?

Remember, when the Fed buys bonds, it pushes bond yields down and encourages investors to move into riskier assets in search of higher returns. This “liquidity wave” makes borrowing cheaper, boosts confidence, and raises demand across financial markets.

The biggest beneficiaries of QE are almost always risk assets. Stocks tend to rise because future earnings are discounted at lower rates, making companies appear more valuable. Bitcoin and other digital assets benefit because investors look for assets that outperform cash when money supply expands. Real estate goes up because mortgages become cheaper and investors chase hard assets. Long‑duration assets—like tech stocks, growth companies, and venture‑backed businesses—often rise the most because their value depends on future cash flows, which become more attractive when rates fall.

So what assets suffer during QE?

One of the big losers should be the U.S. dollar, which tends to weaken when more dollars are created, and short‑term cash‑like investments, which offer lower yields and become less attractive relative to risk assets. Traditional value stocks, commodities tied to economic stress, and defensive sectors may lag because QE shifts investor appetite away from safety and toward growth and speculation. Overall, QE is designed to inflate financial assets, and historically it has done exactly that.

This means investors are about to be very happy.

I took my analysis of QE’s impact one step further and asked Silvia, the AI CFO that we built, to explain how the return of QE should impact my personal portfolio. She told me:

“The rate cuts are highly favorable for your portfolio, particularly your private investments and crypto. Your Opendoor position is also well‑positioned to benefit from housing‑market recovery.

However, the Fed’s signal of fewer cuts ahead means the easy gains may be behind us. The key risk is your extreme concentration in private investments, which makes you exceptionally sensitive to any Fed policy changes.

Your portfolio is essentially a leveraged bet on lower rates — which has worked brilliantly so far, but requires careful monitoring as the Fed slows its cutting pace in 2026.”

You can ask Silvia to analyze your personal portfolio by signing up for free at cfosilvia.com.

Hope everyone has a great day. I’ll talk to you tomorrow.

‑ Anthony Pompliano

Founder & CEO, Professional Capital Management

Jeff Park is a Partner & Chief Investment Officer at ProCap Financial.

In this conversation, we break down the Fed’s year‑end shift toward rate cuts and easier liquidity, what it means for markets, and why Bitcoin sentiment feels so negative despite strong performance.

Jeff also digs into how AI investment is reshaping the macro landscape, what institutional players like BlackRock and Stripe signal for crypto, and why ProCap’s mission centers on Bitcoin and the coming age of abundance.

Comments

Want to join the conversation?

Loading comments...