BANKING PULSE

Friday, February 20, 2026

Market Intelligence for Banking Professionals

🎯 Today's Banking PulseUpdated 1h ago

What's happening: Banks eye six tech trends to stay competitive in 2026

Banks are under mounting regulatory, economic and consumer pressure, prompting a shift toward targeted technology investments. nCino outlines six 2026 trends, from AI‑driven mobile banking that functions as a personal financial command centre to AI‑powered verification that can dramatically cut loan‑processing time. The focus moves from blanket AI deployments to purpose‑built solutions that boost efficiency and compliance.

Also developing:

By the numbers: Bank of America pledges $25bn private credit fund

🚀 Top Banking Headlines

Criminals Outpacing Banks as Firms Struggle with AI Defence, Report Warns

ComplyAdvantage reports that AI-enabled criminals are outpacing banks, with 99% of firms admitting detection flaws as cybercrime and human trafficking top the 2026 threat list The post Criminals Outpacing Banks as Firms Struggle with AI Defence, Report Warns appeared first on The Fintech Times.

The Fintech Times

Subprime Demand Drives US Loan Growth to New Heights

Unsecured loans increase in the US as more consumers consolidate credit card debt

BusinessLIVE (South Africa) – RSS hub

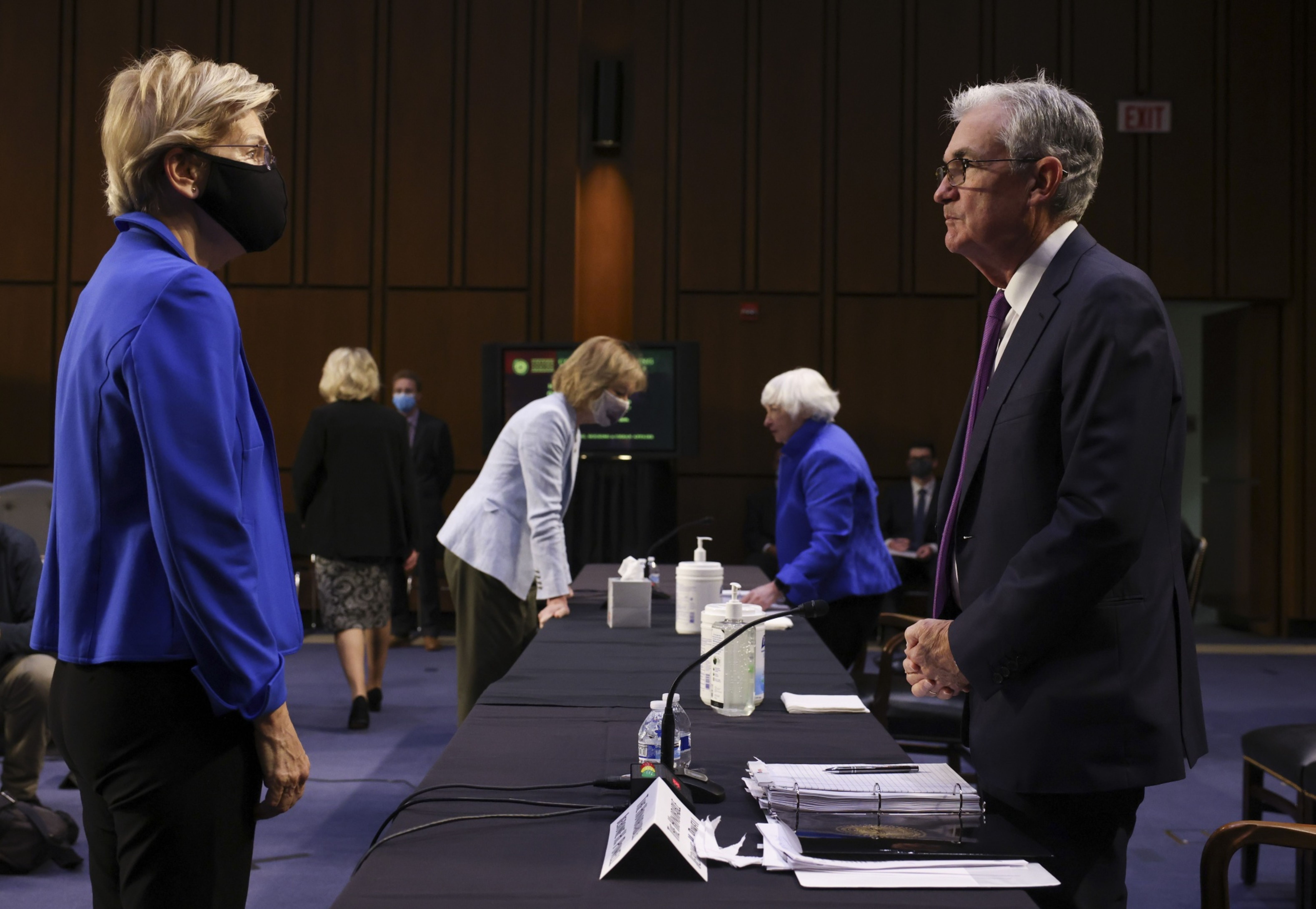

Warren Warns Fed, Treasury Against Crypto Bailout

Senate Banking Committee ranking member Elizabeth Warren, D-Mass., warned the Treasury Department and Federal Reserve in a Wednesday letter not to bail out cryptocurrency firms in the wake of sharp declines in digital asset values over the last several months.

American Banker

The Six Tech Trends Banks Need on Their Radar for 2026

Banks may already have a clear view of the market forces shaping 2026, from shifting consumer expectations to mounting regulatory and economic pressures. But insight alone will not be enough. The technology decisions financial institutions make now will determine whether they can turn those forces into opportunity or risk being overtaken by more agile competitors. […] The post The six tech trends banks need on their radar for 2026 appeared first on FinTech Global.

Fintech Global

FBI: Over $20 Million Stolen in Surge of ATM Malware Attacks in 2025

The FBI warned that Americans lost more than $20 million last year amid a massive surge in ATM "jackpotting" attacks, in which criminals use malware to force cash machines to dispense money. [...]

BleepingComputer

💰 Banking Fundraising

Bank of America Commits $25bn to Private Credit Lending

Bank of America announced a $25bn commitment to expand its private credit lending activities, aiming to capture more opportunities in the sector as concerns rise about its health. The move follows similar initiatives by other Wall Street institutions.

Debt FinancingBank of America

Banco De Bogotá Buys Back 2026 Notes

Colombian lender Banco de Bogotá announced it will repurchase close to half of its subordinated notes due in May 2026, reducing its outstanding debt. The buyback is part of the bank's effort to manage its balance sheet and improve liquidity. The transaction amount was not disclosed.

Debt FinancingBanco de Bogotá

💬 Top Banking Social Posts

Tweet by @JimMarous

The 2026 Retail Banking Trends research reveals a clear gap between strategy and execution across digital, payments, AI, and partnerships. Watch the full video: https://t.co/qrsFZDRVT6 https://t.co/pesk3Lrhfe

by Jim Marous•