Platters: WD New Disk Drive Tech Hits Lucky 14

•February 18, 2026

0

Companies Mentioned

Why It Matters

The higher platter count accelerates enterprise storage capacity growth while easing engineering constraints, forcing rivals to rethink their own density and design strategies.

Key Takeaways

- •WD's 14‑platter HDD adds ~27% capacity

- •40TB drives expected 2026 using existing ePMR

- •100TB HAMR drives slated for 2029

- •Seagate must boost areal density more than WD

- •Higher platter count eases engineering, may shift market balance

Pulse Analysis

The data‑center storage market is still hungry for higher‑density hard‑disk drives despite the rise of flash. Western Digital’s recent Innovation Day revealed a 14‑platter architecture that pushes raw capacity up by roughly 27 percent over its current 11‑platter line. By stacking three additional platters inside the standard 3.5‑inch chassis, WD can ship 40‑TB drives this year without waiting for a breakthrough in areal density. The roadmap also promises 44‑TB HAMR models later in 2026 and a 100‑TB offering by 2029, positioning the company as a capacity leader.

The advantage stems from a simple physics trade‑off: more platters mean each surface can carry less data, reducing the pressure on areal‑density advances. WD’s existing energy‑assisted magnetic recording (ePMR) can already deliver 2.91 TB per platter, so a 14‑platter stack yields about 40.7 TB. In contrast, Seagate’s 10‑platter HAMR drives must reach 10 TB per platter to hit 100 TB, a 213 percent density jump. This disparity translates into less aggressive head‑positioning, signal‑to‑noise, and firmware challenges for WD, while Seagate may need to redesign actuators or add platters to stay competitive.

For enterprise buyers, the immediate benefit is lower cost‑per‑terabyte and longer refresh cycles, as larger drives can replace multiple smaller units. Competitors will feel pressure to either adopt higher platter counts or accelerate HAMR scaling, potentially reshaping the HDD supply chain. Moreover, the ability to reach 100 TB within a decade keeps magnetic storage relevant for cold‑data workloads that remain cost‑sensitive. Analysts will watch WD’s production yields closely; any delay could give Seagate a temporary edge, but the platter‑count strategy offers a clear engineering path that could dominate the high‑capacity segment.

Platters: WD new disk drive tech hits lucky 14

Chris Mellor · Blocks & Files editor · Published Wed 18 Feb 2026 // 11:39 UTC

WD, currently shipping 11‑platter disk drives, announced new disk‑drive technology with up to 14 platters, enabling an up to 27 percent capacity increase.

The company announced this at its Innovation Day event earlier this month, along with high‑bandwidth drives, dual‑pivot drives, power‑optimized drives, and more. We’re concentrating on the 14‑platter angle here as it opens up the possibility of WD achieving increased drive capacity levels faster than Seagate, its main competitor.

That’s because it will have a less demanding engineering job to increase areal density so as to reach new capacity levels than Seagate, as that company has 10‑platter technology.

A WD Ultrastar HC690 32 TB drive has 11 platters, each holding 2.91 TB. A Seagate Exos M 32 TB drive has 10 × 3.2 TB platters with its HAMR technology. (Toshiba has demonstrated 12‑platter technology but is shipping 10‑platter drives.)

WD matches Seagate’s capacity despite having less advanced ePMR recording technology compared to Seagate’s HAMR with its higher areal density. Seagate has to push its data‑recording technology further than WD because it has less surface area in its disk drives on which to record data; 10 platters instead of 11.

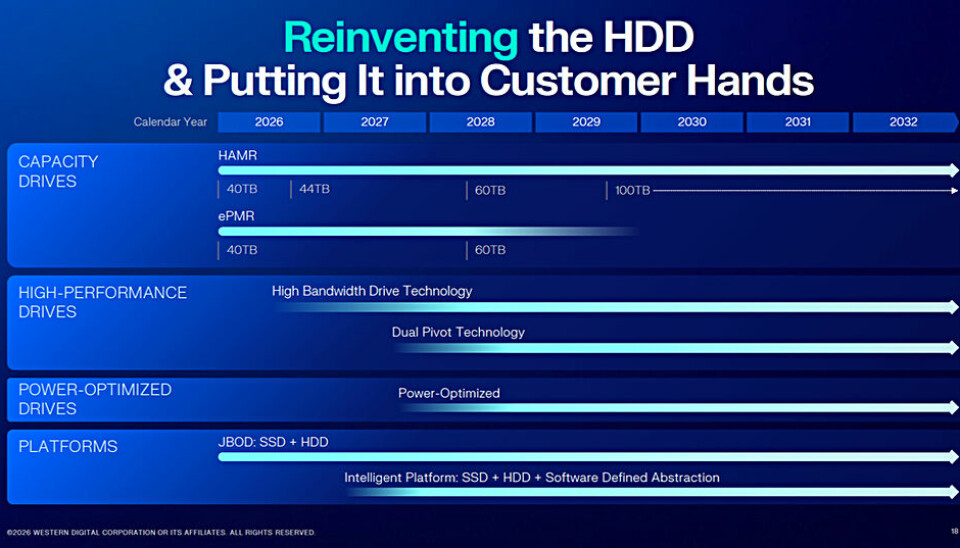

If WD were to produce a 14‑platter drive with its existing ePMR technology, it would deliver a drive with 14 × 2.91 TB = 40.7 TB, giving it a substantial 21 percent capacity advantage. WD predicts it will deliver 40 TB drives this year, with ePMR and HAMR variants. A 44 TB HAMR drive will follow later this year, with 60 TB ePMR and HAMR drives in 2028 and 100 TB HAMR drives in 2029, at which point its ePMR tech will run out of roadway.

WD HDD roadmap February 2026.

The 40 and 44 TB drives will have 11 × 4 TB platters while the 100 TB product is set to have 14 × 7.14 TB platters. Without the platter‑count increase WD would need to achieve a 9.1 TB/platter areal‑density level, pushing its media‑recording, read/write‑head positioning and signal‑writing/detection technology, and drive‑controller error‑detection and other firmware far harder.

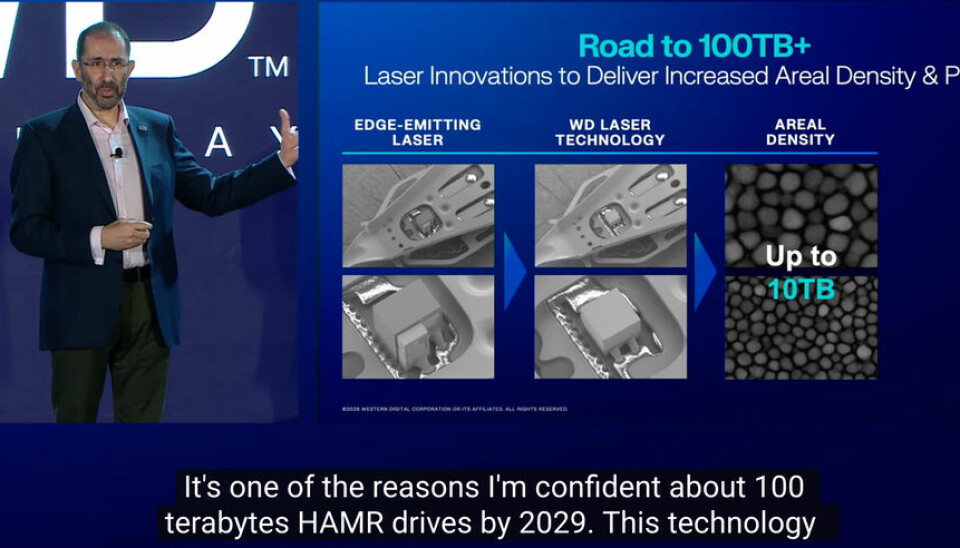

Competitor Seagate has said it will introduce a 100 TB drive by 2030. At its current 10‑platter level that means having 10 TB platters, with almost 3 TB more per platter than WD. At its Innovation Day WD said it will have reached the 10 TB areal‑density level through new and thinner laser tech in 2028. Chief Product Officer Ahmed Shibab said this is: “one of the reason’s I’m confident about 100 TB HAMR drives by 2029.”

WD new laser tech and 10 TB/platters.

Thinner read/write heads take up less space, enabling more platters to be packed into the standard 3.5‑inch disk‑drive enclosure. And 14 × 10 TB platters suggest WD could produce a 144 TB drive, as Shibab mentioned in his presentation.

Put another way, by moving up from 11 to 14 platters WD needs to increase its current areal density by 155 percent. Seagate has to increase its areal density 213 percent. That means bit areas and track widths on the platters will be smaller, giving it more difficult development work in the recording medium, read/write‑head positioning, signal writing and reading, and controller‑firmware areas. WD has more headroom in these areas because of its platter‑count advantage.

We think Seagate may increase its platter count. Although having only 10 platters keeps its cost of goods (COGs) down, lower than WD’s, the concomitant need to push its disk technology significantly harder may override this and force a move to increase its platter count.

Our understanding is that it’s possible Seagate could match WD’s coming high‑bandwidth technology by evolving its existing Mach2 actuator tech. The dual‑pivot technology could also arrive. Both of these things would increase bandwidth but not capacity.

Mass‑capacity drive customers want more capacity. We have asked Seagate for a briefing on its roadmap to see if our platter‑count‑increase supposition is correct.

0

Comments

Want to join the conversation?

Loading comments...