The Data Center Surge Has a Hidden Source of Carbon Emissions

•January 29, 2026

0

Companies Mentioned

Why It Matters

Embodied carbon from concrete can negate operational clean‑energy gains, making material choices decisive for net‑zero data‑center strategies. Accelerating low‑carbon cement adoption also unlocks a fast‑growing market for climate‑tech investors.

Key Takeaways

- •Data centers need 2 million tons cement by 2030.

- •Traditional concrete could emit 1.9 million tons CO₂.

- •Tech firms sign low‑carbon concrete offtake agreements.

- •Funding cuts threaten scaling of green cement industry.

- •Embodied emissions now a critical climate target.

Pulse Analysis

The rapid expansion of AI‑driven workloads is fueling a data‑center construction boom across the United States. While operational power use dominates headlines, the sector’s embodied emissions—particularly from cement and concrete—are set to rival those figures. Roughly 2 million metric tons of cement will be required through 2030, a volume that could generate nearly 2 million tons of CO₂ if built with traditional mixes, underscoring a hidden carbon hotspot that predates any server activation.

In response, leading cloud providers are turning to low‑carbon concrete suppliers. Microsoft’s multi‑year offtake with Sublime Systems and Amazon’s partnership with Brimstone illustrate a strategic shift toward greener building materials. The Sustainable Concrete Buyers Alliance, backed by Amazon, Meta and Prologis, aims to signal demand to producers, accelerating the commercialization of carbon‑reduced cement technologies. Yet the sector’s growth is fragile; the loss of $1.6 billion IRA funding has already forced layoffs and delayed plant construction, highlighting the need for private capital and policy support to scale supply.

For the industry, addressing embodied emissions is no longer optional. Climate‑focused investors and corporate sustainability officers view low‑carbon concrete as a prerequisite for meeting aggressive net‑zero pledges. As data‑center operators improve energy efficiency and shift to renewable power, the carbon intensity of the built environment will become the decisive factor in overall emissions accounting. Continued collaboration between tech firms, material innovators, and policymakers will be essential to unlock the full decarbonization potential of the next generation of data infrastructure.

The Data Center Surge Has a Hidden Source of Carbon Emissions

Olivia Raimonde, Bloomberg · January 29, 2026

4 Min Read

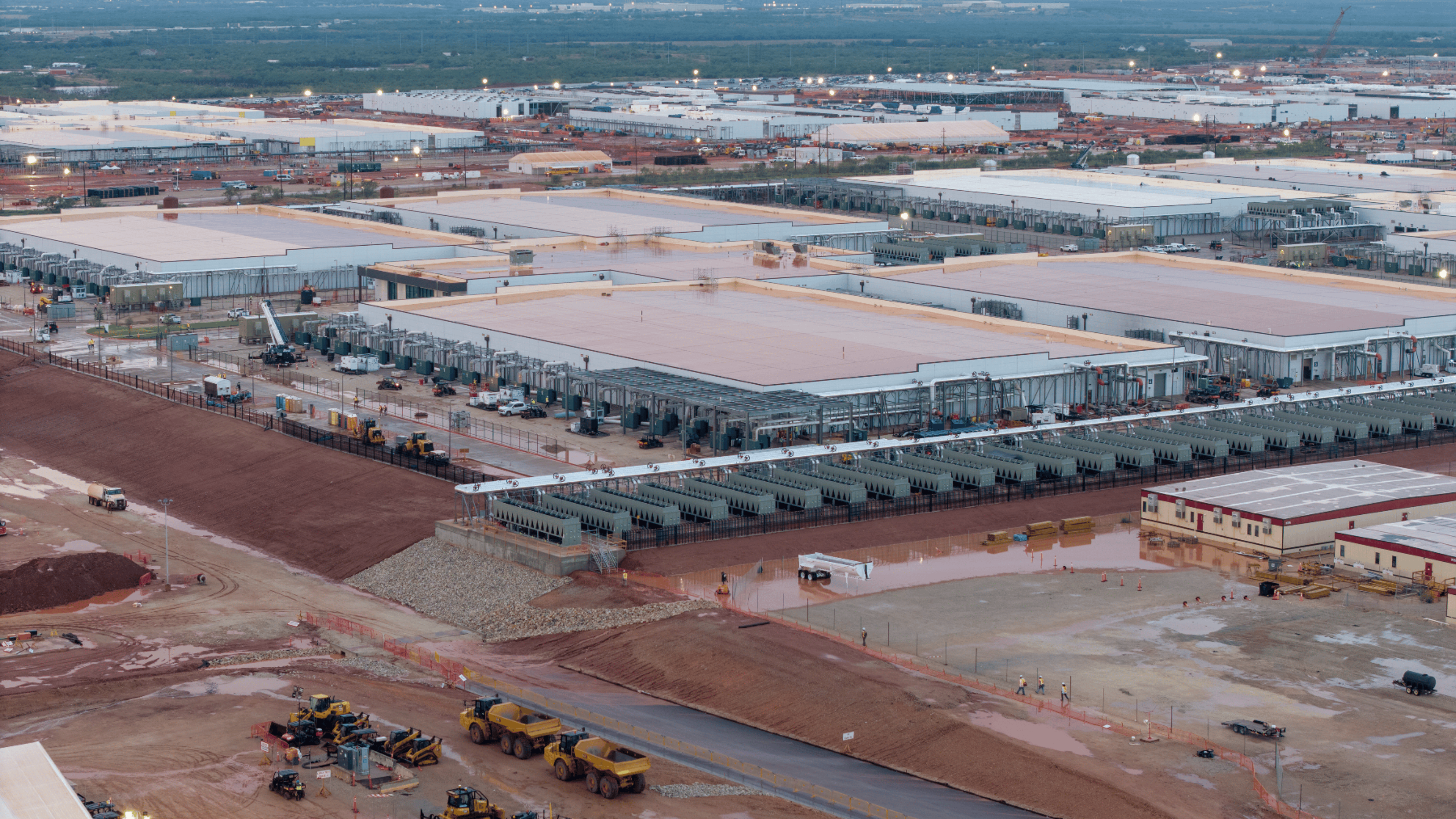

(Bloomberg) – Data centers siphon huge amounts of energy to power artificial intelligence. But their environmental footprint starts to balloon even before the first server switches on due to the immense amount of carbon‑intensive concrete needed to build them.

As the US data‑center build‑out surges, with construction beginning on multibillion‑dollar facilities from Texas to Wisconsin, tech companies are becoming buyers of low‑carbon concrete.

Through 2030, data‑center expansion is expected to require 2 million metric tons of cement, the binding agent in concrete, according to environmental nonprofit RMI. If these facilities are constructed with traditional concrete, they could generate 1.9 million metric tons of CO₂ emissions, according to Chandler Randol, a senior associate with the group’s cement and concrete team. That’s the equivalent of annual emissions from 415,000 gas‑powered cars.

Concrete – as well as steel – is a significant portion of the emissions associated with building data centers, said Katherine Vaz Gomes, a decarbonization engineer at Carbon Direct, a climate advisory firm.

Related: EPA Prioritizes Data Center Chemical Reviews Amid TSCA Debate

“The boom in data centers is providing an opportunity to evaluate, address, and move on the carbon impacts of concrete,” said Vaz Gomes. “As AI infrastructure explodes, data‑center construction is accelerating and bringing concrete demand with it.”

Microsoft Corp. announced a deal with low‑carbon concrete maker Sublime Systems last year, allowing the tech company to purchase up to 622,500 metric tons of cement over a period of six to nine years.

“As demand for AI and cloud services grows, we are advancing how we design, build, and operate our data centers and campuses. Decarbonizing the built environment is a crucial element in this process,” said Melanie Nakagawa, Microsoft’s chief sustainability officer.

In August, Amazon.com Inc. struck a similar deal with startup Brimstone, though it did not disclose how much concrete it would purchase. To help support the industry, Amazon, along with Meta Platforms Inc. and Prologis Inc., signed a low‑carbon concrete pact in September called the Sustainable Concrete Buyers Alliance. The group was brought together by RMI and the Center for Green Market Activation, a nonprofit focused on decarbonizing industries. Its aim is “sending clear demand signals to producers” that they’ll find buyers of their low‑carbon products, said Heather House, principal of RMI’s cement and concrete practice.

Amazon has started using low‑carbon concrete in data centers under construction in Virginia and Oregon, and the company also invests in startups with the “potential to help accelerate decarbonization progress,” according to Chris Roe, the company’s director of worldwide carbon.

Related: Can Advanced Nuclear Reactors Solve the Data Center Power Puzzle?

In addition to Brimstone, Amazon has also invested in CarbonCure, another startup that helps retrofit concrete plants to create a low‑carbon product. The tech company has also put in place carbon‑intensity standards for any concrete it uses that factor in production and transportation emissions, according to Roe.

The maturation of the green cement industry is going to require a lot of capital, said Christina Theodoridi, policy director for industry at the Natural Resources Defense Council. “The technology for low‑carbon cement is there, but the industry hasn’t yet scaled to meet the enormous demand coming over the next several years. But the partnerships between large tech companies and startups are crucial.”

“Having an offtake agreement with a large data center is a very clear demand signal,” Theodoridi says. “That’s a really critical mechanism to scale up those technologies.”

Funding from big‑tech companies might not be enough, though. The green concrete industry was set to receive roughly $1.6 billion in support from the Inflation Reduction Act, but President Donald Trump pulled the funding last year.

Related: Data Center Growth Draining Global Water Supplies

“That was going to breathe real momentum into the industry,” Theodoridi said. “The data centers present an opportunity for which we would have been much better prepared for had we continued those investments in heavy industry.”

The impacts of funding cuts are starting to ripple through the industry. In December, Sublime laid off 10 % of its staff, citing a loss of $87 million in government funding. It also said it was pausing construction on its factory in Holyoke, Mass., which was scheduled to open as early as this year.

Data‑center operations will put much more carbon in the atmosphere than their construction. Operational emissions, however, can be lowered over time as data centers become more efficient or rely more heavily on clean energy. But using green building materials is the only way to reduce what’s known as the embodied emissions associated with data centers.

And for tech companies to meet their climate goals, those emissions will have to be dealt with.

“Quite a few of those large tech companies actually have quite aggressive and meaningful climate targets,” said Chris Magwood, a manager on RMI’s carbon‑free buildings team. “Internally, they obviously have identified that data centers and particularly the concrete use in those data centers is a key driver for them.”

0

Comments

Want to join the conversation?

Loading comments...