Companies Mentioned

Why It Matters

NexaVM offers a cost‑effective, sovereign‑ready alternative that could reshape virtualization choices for service providers seeking flexibility and predictable economics.

Key Takeaways

- •NexaVM offers hardware‑agnostic, subscription‑based VMware replacement.

- •Focus on mid‑market CSPs, sovereign cloud, OEM integrators.

- •Alibaba investment fuels Chinese market access and growth.

- •4,500 customers, 300k sockets shipped by 2025.

- •Roadmap adds backup, storage connectors, larger provider automation.

Pulse Analysis

The virtualization market has long been dominated by VMware, but rising demand for open, hardware‑agnostic solutions is creating space for challengers. Enterprises and service providers are increasingly wary of vendor lock‑in and are looking for platforms that combine compute, storage, and container orchestration in a single stack. NexaVM’s European roots and backing from Alibaba give it a unique blend of regional compliance focus and access to the fast‑growing Chinese cloud ecosystem, positioning it as a credible alternative for midsize CSPs and sovereign‑cloud projects.

Technically, NexaVM integrates a KVM‑based hypervisor with Ceph‑style hyper‑converged storage, offering block, file, and S3‑compatible object services. Its native multi‑tenancy, quota management, and REST APIs enable automated, self‑service provisioning of VMs, Kubernetes clusters, and AI workloads. By decoupling software from specific hardware, the platform lets OEMs design flexible BOMs and supports external storage protocols such as NFS, iSCSI, Fibre Channel, and NVMe. The inclusion of a migration facility eases transitions from legacy VMware environments, while the ZStack‑powered cloud control plane adds a familiar management layer for providers already using Alibaba‑linked tools.

For the broader market, NexaVM’s growth trajectory—over 4,500 customers and 300,000 sockets shipped—signals a maturing ecosystem that could pressure incumbents like Nutanix and VergeIO. Its subscription‑licensing model promises predictable economics, a key factor for MSPs managing tight margins. As regulatory pressures drive sovereign‑cloud adoption, platforms that combine compliance, automation, and vendor neutrality are likely to see accelerated uptake, making NexaVM a strategic watch‑list player for investors and cloud architects alike.

VMware exiteeers targeted by Alibaba’s NexaVM

Switzerland-based NexaVM has an all‑in‑one VMware replacement suited for mid‑market and regional CSPs, sovereign cloud, and local integrators.

It says it’s a European‑led virtualization and private‑cloud platform positioned as a modern alternative to VMware environments, with a production‑grade hypervisor, integrated software‑defined storage, Kubernetes services, and multi‑tenant cloud management in a single stack, with a strong focus on MSPs and service providers building sovereign or regional cloud offerings. It provides vSAN‑style hyper‑converged Infrastructure (HCI) storage, providing block (Ceph), file, and object (S3) services, with erasure coding and multi‑interface I/O paths, as well as having support for external storage connected by NFS, iSCSI, Fibre Channel, and NVMe.

Manuel Minzoni.

The NexaVM software stack includes native multi‑tenancy, quotas, metering, and REST APIs, and service‑catalog use cases. There is a cloud control plane with integrated Kubernetes‑as‑a‑Service and Private AI‑as‑a‑Service, and a VMware migration facility. We wondered how NexaVM differentiates itself from other VMware migration targets such as Nutanix and VergeIO.

Sales Manager Manuel Minzoni told us:

“Nutanix and others are highly capable platforms, particularly in global enterprise HCI estates. Our experience is simply that NexaVM is frequently selected where customers prioritize usability and TCO, automation, sovereignty, and predictable economics over large‑scale appliance‑centric deployments.”

In his view, there are three broad VMware‑replacement customer types:

-

Mid‑market and regional CSPs looking for

-

Predictable subscription licensing

-

No HW lock‑in

-

Multi‑tenant isolation with quota‑based self‑service

-

API‑driven for VM, Kubernetes, and object‑storage services

-

-

Customers in sovereign cloud and regulated environments want

-

On‑prem or sovereign deployments

-

Full lifecycle control of compute, storage, and Kubernetes from one control plane, with lighter operational overhead than large multi‑product stacks

-

-

HW‑agnostic OEMs and local integrators who need

-

Certified operation across multiple server vendors

-

Flexible BOM design

-

Tight integration with enterprise SAN or NVMe‑based SDS, without being bound to a vertically integrated appliance strategy

-

The curious and somewhat mysterious NexaVM Technologies AG company was founded around 2005 in Lugano; its history, funding, and leadership team details are akin to a private Swiss bank—meaning opaque and hidden. The only executive we know of is CTO Jack Chan, who joined in October last year according to LinkedIn. Minzoni tells us: “The CEO of NexaVM is Jack Chan – we were former colleagues at Sangfor.” Four or five other salespeople and engineers are mentioned on LinkedIn.

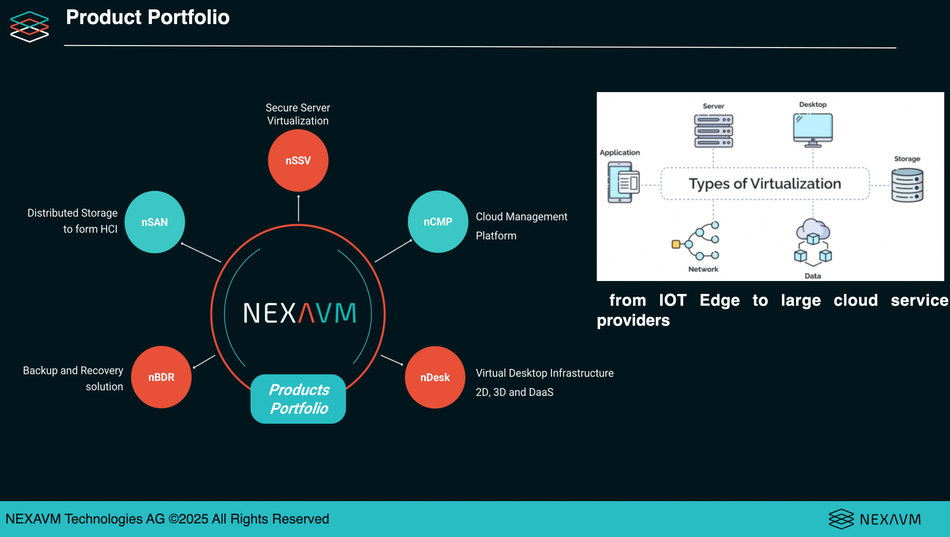

It started its NexaVM product development in 2015 with nSSV (Secure Server Virtualization – based on KVM), and its software suite includes nSAN, nCMP (Cloud Management Platform), nDesk (VDI) and nBDR (Backup and Disaster Recovery). Alibaba invested in 2017, and it reached the 200‑customer point, with 1,000+ claimed in 2019. We think Alibaba provided a gateway into the Chinese market. Arm support came in 2020 and it claimed 80,000 sockets (it uses per‑CPU licensing) shipped that year. There were 600+ partners in 2022, and 3,000+ enterprise customers in 2023, by which time it had shipped 150,000 sockets.

In 2025 it went past 4,500 customers in 25 countries worldwide, and 300,000 sockets shipped. Alibaba put in more money. This is, to say the least, respectable growth by anybody’s standards. NexaVM has made its software available to OEMs and the company started expanding, building on its existing global presence, supported by ZStack (Chinese cloud‑infrastructure software provider) and Alibaba, which now has a controlling stake in ZStack.

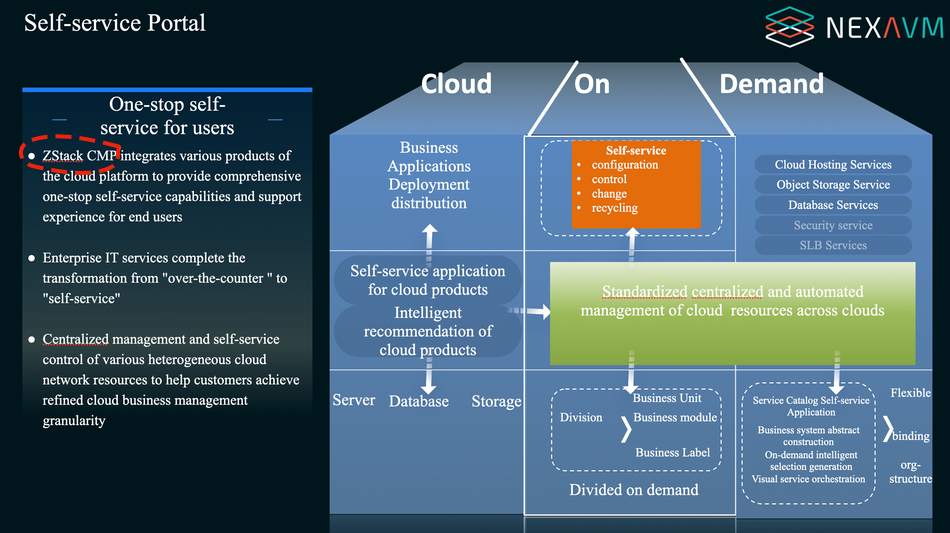

Interestingly, a NexaVM self‑service portal uses the ZStack CMP (Cloud Management Platform):

We think there could be some level of integration between the ZStack and NexaVM software components.

All‑in‑all, our understanding is that NexaVM is already a successful VMware‑replacement business that now wants to expand beyond its more than 4,500 customers. It’s expanding partnerships across hardware vendors, storage platforms, and backup/DR providers, alongside certification programs for integrators and MSPs. Roadmap priorities include deeper backup integrations, extended Kubernetes services, additional enterprise‑storage connectors, and automation features for large‑scale service‑provider environments.

We would think Nutanix, VergeIO and other VMware‑replacement businesses are facing a relatively new competitor with a good track record.

Download a NexaVM company profile slide deck here.

0

Comments

Want to join the conversation?

Loading comments...