Bitcoin Spot Demand Builds as Short Squeeze Risk Increases

•January 15, 2026

0

Companies Mentioned

Why It Matters

A spot‑driven rally signals genuine demand and could trigger a short‑squeeze, attracting additional capital and reshaping crypto‑asset allocation strategies.

Key Takeaways

- •Bitcoin up ~10% YTD, hovering just below $97,000.

- •Spot purchases now dominate rally, replacing leveraged buying.

- •Futures open interest stable around 679,000 BTC.

- •Negative funding rates heighten short‑squeeze risk.

- •Bitcoin outperforms Nasdaq 100, fueling asset rotation.

Pulse Analysis

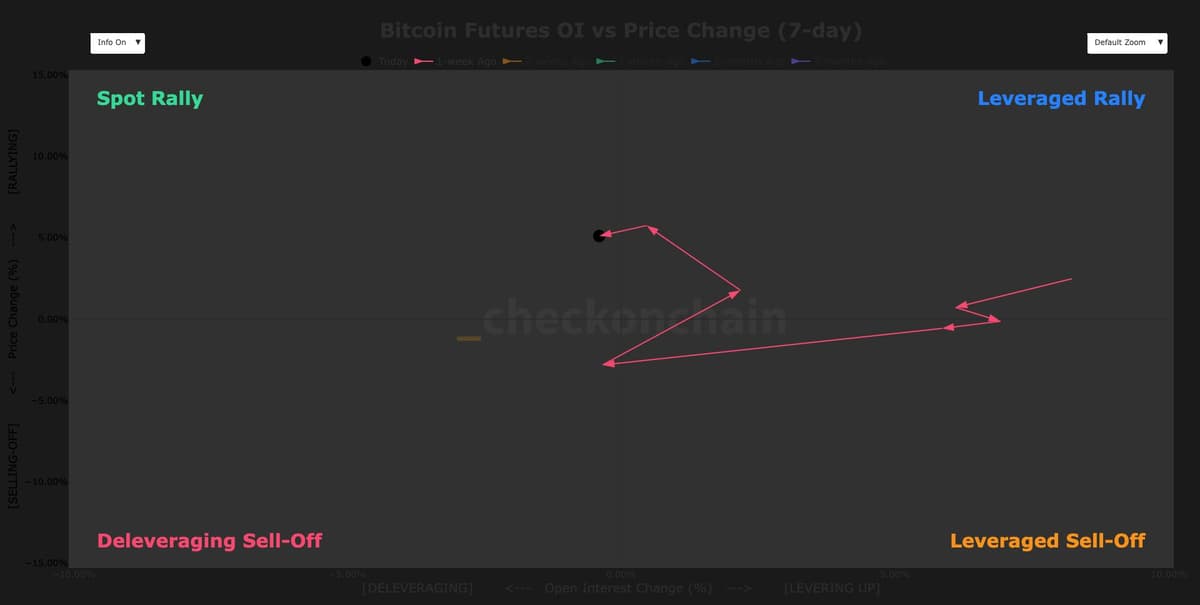

The current Bitcoin surge illustrates a rare market dynamic where spot demand eclipses leveraged exposure. Data from Checkonchain confirms that the recent climb from $90,000 to $97,000 is anchored in investors taking actual ownership of the digital asset, a pattern traditionally associated with more sustainable price appreciation. By contrast, futures contracts—while still sizable at roughly 679,000 BTC—show little net growth, suggesting that speculative leverage is not the primary engine behind the rally. This shift toward spot buying reduces the risk of abrupt unwind events that have plagued prior crypto booms.

Negative perpetual funding rates, as highlighted by Glassnode, add a nuanced layer to the market narrative. When funding is below zero, short sellers receive payments from longs, creating an incentive to maintain short positions even as prices rise. However, a continued spot‑driven ascent can force those shorts to cover, precipitating a short‑squeeze that accelerates upward momentum. Traders monitoring open‑interest and funding differentials can gauge the timing of potential liquidations, which often act as catalysts for rapid price spikes in cryptocurrency markets.

Beyond the technical metrics, Bitcoin’s 10% year‑to‑date gain versus a flat Nasdaq 100 points to a broader asset‑allocation shift. Institutional investors increasingly view Bitcoin as a high‑beta, tech‑linked hedge, especially in environments where traditional equities offer limited upside. This rotation could deepen as risk appetite returns, drawing more capital into spot markets and reinforcing the current demand‑driven trajectory. Analysts therefore anticipate that, barring macro shocks, Bitcoin may sustain its premium over equity benchmarks throughout 2026.

Bitcoin spot demand builds as short squeeze risk increases

0

Comments

Want to join the conversation?

Loading comments...