Europe Urged to Follow China’s Industrial 3D Printing Strategy

•February 11, 2026

0

Companies Mentioned

Why It Matters

Additive manufacturing reshapes supply chains, defense and health systems, so Europe’s lag threatens both economic competitiveness and strategic resilience.

Key Takeaways

- •China leads 94% of global desktop 3D printer shipments.

- •Europe views AM as niche, lacks coordinated industrial policy.

- •CECIMO's AM‑Europe pushes EU-wide additive manufacturing strategy.

- •Dependence on Chinese printers raises cyber and supply‑chain risks.

- •Desktop printers now approach industrial precision, opening growth opportunities.

Pulse Analysis

The pandemic and the Ukraine conflict highlighted how quickly additive manufacturing can produce critical items, from face shields to drone parts. China capitalized on this momentum, integrating 3D printing into its Made in China 2025 roadmap and subsidizing domestic firms to dominate the global desktop market. This state‑backed approach has created a virtuous cycle of rapid innovation, scale, and export strength, positioning Chinese printers as the default choice for many emerging applications.

In Europe, the response has been fragmented. Funding has largely remained research‑centric, while industrial deployment, public procurement, and cross‑border standards lag behind. The AM‑Europe coalition, representing over 700 companies, is pushing for a unified EU policy that treats additive manufacturing as a core industrial capability. By aligning standards, incentivising demand‑side adoption, and embedding AM in sectoral strategies, Europe could accelerate the transition from prototype to production and reduce reliance on foreign suppliers.

Strategic implications extend beyond economics. Dependence on Chinese‑made printers raises concerns about data security, software control, and the ability to repair critical assets in defense or healthcare settings. Yet the convergence of desktop and industrial printer capabilities offers European firms a niche to innovate, especially in regulated sectors where domestic sourcing is preferred. If the EU embraces coordinated investment and procurement, it can reclaim a competitive edge, safeguard supply‑chain resilience, and foster a new wave of high‑value manufacturing jobs.

Europe urged to follow China’s industrial 3D printing strategy

The Covid‑19 pandemic and the Ukraine war showed the strategic importance of 3D printing, with the technology used to make face shields and drone components quickly, yet Europe risks falling behind China if it does not change how it views the sector, analysts tell Nikkei Asia.

Beijing has incorporated 3D printing into its “Made in China 2025” strategy, while European leaders regard the sector as niche and an emerging technology rather than a strategic industrial asset. Support has focused on research funding, with less attention paid to industrial scale‑up, market creation or demand‑side incentives.

“If Europe is to remain competitive, additive manufacturing (AM) must be treated as a core industrial capability,”

— Vincenzo Belletti, director of European Union public affairs at the European Association of Manufacturing Technologies (CECIMO), told Nikkei in a recent interview.

3D printing is referred to as “additive manufacturing” because construction involves stacking layer upon layer of materials to create 3D models. 3D printing can be used to build and manufacture a wide range of things including weapons, houses, and even food items.

Already, the desktop 3D market is dominated by Chinese state‑backed players, said Josef Prusa, founder of Prusa Research in Czechia.

Prusa said his business is one of the few remaining players in the West and that many of his peers went bust or left the industry over the past five years. He blames government subsidies for Chinese competitors.

“The development is very unhealthy. Instead of competing on a level playing field, we are seeing state‑backed players selling subsidized printers for less than the cost of their components,” he said.

But even desktop printing companies like his have the capability to build strategic assets quickly. Prusa Research designed prototypes, secured medical approval and began manufacturing face shields within three days.

Similar capabilities have proved valuable in the Ukraine war, where access to spare parts and drone components on the front line can be unpredictable.

“Because it is just a digital file, we were able to start producing designs at scale, anywhere in the world,” Prusa said.

Prusa Research now makes AM systems used by hobbyists, engineers, and even businesses like aerospace company SpaceX, defense manufacturer Lockheed Martin and Czech carmaker Škoda Auto.

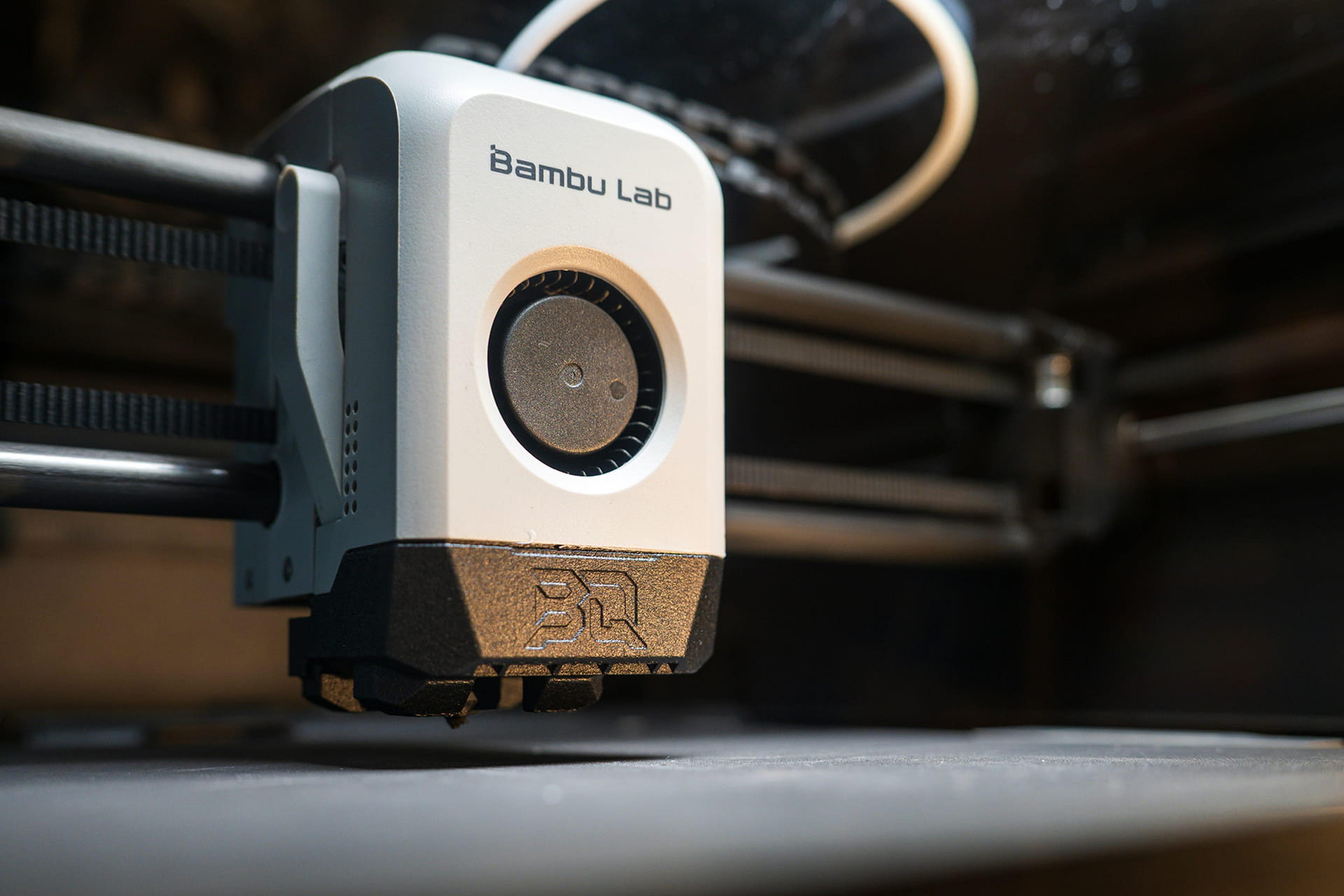

Data compiled by market‑intelligence consultancy Context illustrates China’s dominance in the desktop space. Prusa Research is the only company outside China among the world’s top five desktop 3D printer makers, behind Bambu Lab, Creality, Elegoo and Anycubic.

“Almost all consumer‑centric products in the desktop segment are produced in China,” said Chris Connery, global vice president of research at Context. “In the third quarter of 2025, 94 % of units shipped worldwide came from Chinese vendors.”

Seeing the potential and the need in the industrial segment, CECIMO launched an initiative called AM‑Europe last July, bringing together ten national associations representing more than 700 3D printing companies. The initiative urged Brussels to develop a coordinated additive manufacturing strategy.

AM‑Europe wants the EU to place greater emphasis on industrial deployment and integrate 3D printing into sectoral policies and demand‑side measures including public procurement.

Chris Kremidas‑Courtney, a senior visiting fellow at the Brussels‑based European Policy Centre, said Europe must take note of China’s stance.

“China treats additive manufacturing as foundational to its future industrial power,” said Kremidas‑Courtney, who also previously served as a NATO official. “It integrates AM into national procurement, links it to long‑term industrial policy, funds it at scale, and embeds it across civil‑military frameworks.”

Fragmented and incompatible national standards across Europe prevent companies from scaling across borders, Kremidas‑Courtney said.

“Treating 3D printing as a specialized niche rather than investing in it at scale risks missing the next great leap,” he added, noting that the technology reshapes supply chains and will affect military readiness, infrastructure resilience, transport and health systems.

UK newspaper The Daily Telegraph reported in November 2025 that the British army deployed Chinese‑made 3D printers during a military exercise in Kenya, raising alarm in Europe over supply‑chain dependence and potential cyber vulnerabilities.

“Resilience considerations arise particularly around data management and software control when additive manufacturing systems are used in sensitive applications,” said CECIMO’s Belletti.

Kremidas‑Courtney warned that dependence on foreign‑made AM systems could also mean ceding control over the ability to repair, reconfigure and sustain critical systems.

But Connery at Context suggests it’s not too late for European companies in the industrial 3D printing space, where they remain strong performers.

“Western vendors primarily serve demand in the West, while Chinese vendors mainly supply their domestic market,” Connery said, citing geopolitics and the highly regulated nature of end markets such as aerospace, defense and medical devices, which tend to favor domestic suppliers.

3D printing also has advanced so quickly in recent years that desktop manufacturers are encroaching on the capabilities of industrial printers in terms of precision and materials, which gives smaller players like Prusa Research space for growth.

For Prusa now, though, the key to survival is to continue making what he calls “bloody good” 3D printers.

“As a manufacturer, I don’t want free money. I just want a level playing field,” he said.

0

Comments

Want to join the conversation?

Loading comments...