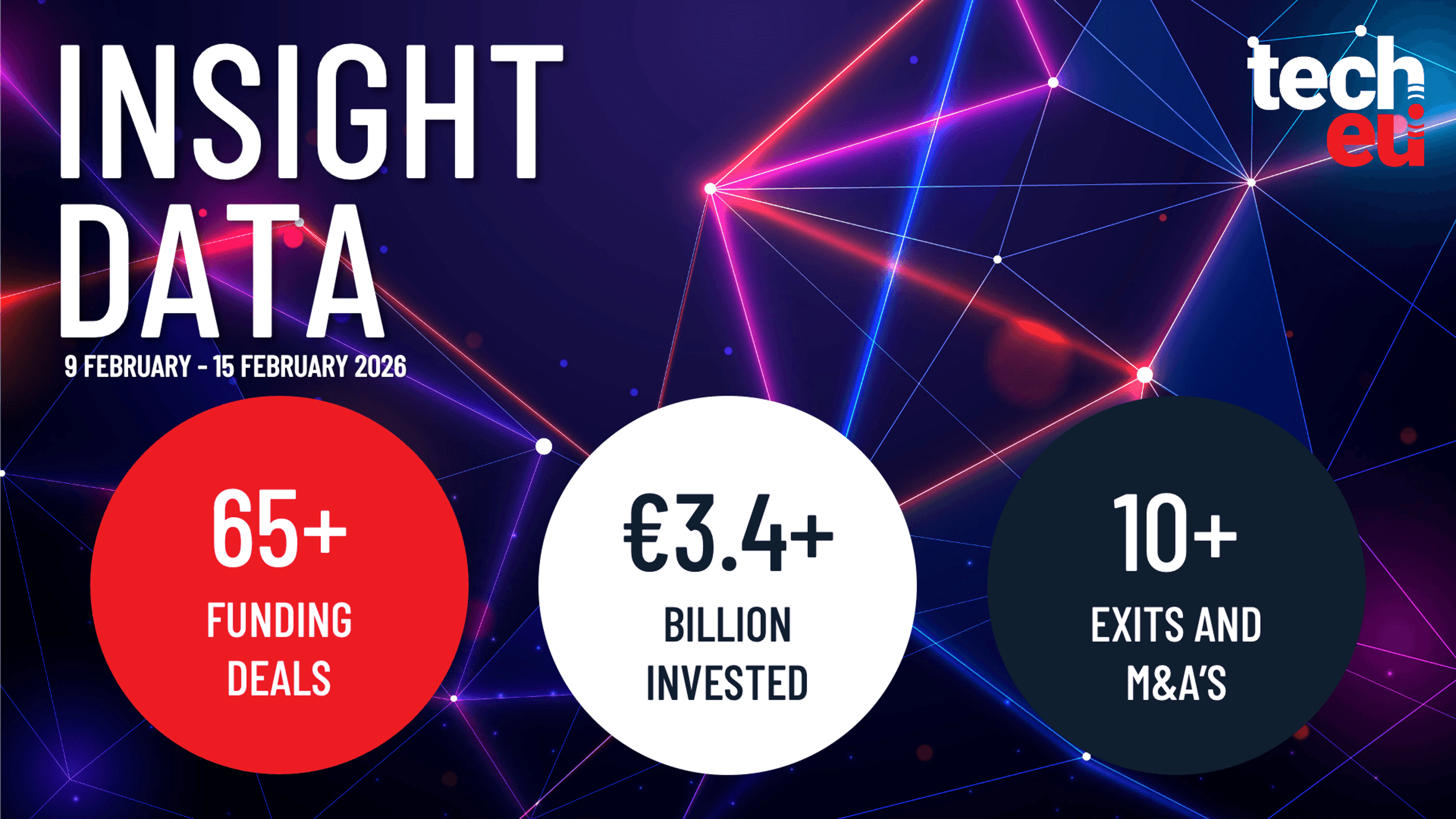

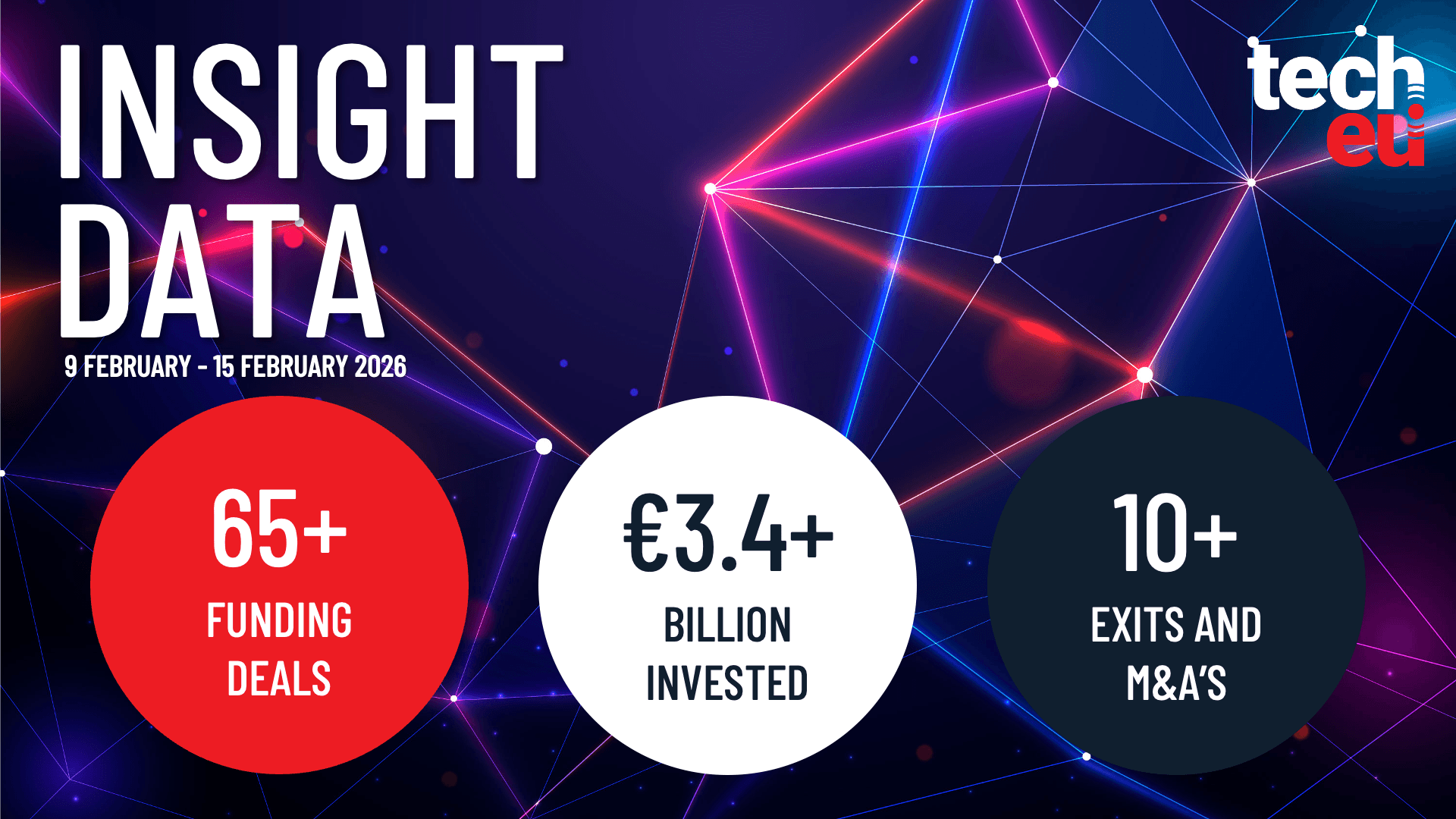

European Tech Weekly Recap: More than 65 Tech Funding Deals Worth over €3.4B

•February 16, 2026

0

Why It Matters

The influx of capital underscores Europe’s growing attractiveness for high‑growth tech sectors and signals accelerating consolidation and exit opportunities.

Key Takeaways

- •€1.2B invested in European cloud startups.

- •Space sector attracted €1.1B funding.

- •UK leads with €1.5B in deals.

- •Over 10 exits and M&A activities occurred.

- •Healthtech funding exceeds €200M this week.

Pulse Analysis

Europe’s venture‑capital landscape is entering a new phase of depth and breadth, as evidenced by more than €3.4 billion flowing into 65+ deals in a single week. This level of financing rivals the combined annual totals of many individual European markets just a few years ago, reflecting both a maturing investor base and supportive policy frameworks such as the EU’s Horizon initiatives. The capital surge also aligns with broader macro trends, including rising corporate digital transformation budgets and a post‑pandemic appetite for resilient, technology‑driven business models.

The sectoral split reveals where investors see the most immediate upside. Cloud infrastructure, now a €1.2 billion magnet, benefits from enterprises accelerating migration to hybrid and multi‑cloud environments, while Europe’s ambitious satellite constellations and launch services drive the €1.1 billion space influx. Healthtech’s €214 million share, though smaller, is propelled by AI‑enabled diagnostics and tele‑medicine platforms that are gaining regulatory clearance across the EU. These verticals are not only capital‑rich but also strategically aligned with EU strategic autonomy goals, positioning Europe as a competitive alternative to U.S. and Asian tech hubs.

Geographically, the United Kingdom’s €1.5 billion lead reflects its deep talent pool, robust fintech ecosystem, and favorable tax incentives for startups. France’s strong showing, backed by state‑led funding programs, signals a resurgence in Paris‑based deep‑tech ventures, while Germany’s €321 million indicates a steady, if more conservative, investment rhythm. The concurrent wave of exits and M&A activity suggests that investors are beginning to realize returns, fostering a virtuous cycle that will likely attract further capital. As European founders continue to scale globally, the region’s tech ecosystem is poised for sustained growth, making it a focal point for both domestic and international stakeholders.

European tech weekly recap: More than 65 tech funding deals worth over €3.4B

By Tamara Djurickovic · 16 February 2026

Last week, we tracked more than 65 tech funding deals worth over €3.4 billion, and over 10 exits, M&A transactions, rumours, and related news stories across Europe.

📊 Top three industries by funding

-

Cloud: €1.2 billion

-

Space: €1.1 billion

-

Healthtech: €214.4 million

🌍 Regional breakdown

-

United Kingdom: €1.5 billion (largest)

-

France: €1.2 billion

-

Germany: €321 million

❗ To dive deeper, you can download the full dataset for the week here: handy.csv file.

Featured image:

0

Comments

Want to join the conversation?

Loading comments...