Java Capital Launches Rs 400 Cr Fund to Back Seed-Stage Deeptech Startups

•February 9, 2026

0

Why It Matters

The fund injects critical early‑stage capital into India’s deep‑tech ecosystem, accelerating ventures with long development cycles and strengthening the country’s position in high‑value technology markets.

Key Takeaways

- •Rs 400 cr fund targets seed‑stage deep‑tech startups.

- •Covers semiconductors, aerospace, AI, robotics, climate tech.

- •Initial checks of Rs 6‑8 cr per startup.

- •Aims to back 15‑20 companies over 3‑4 years.

- •Greenshoe option adds Rs 150 cr for flexibility.

Pulse Analysis

India’s deep‑tech sector has long grappled with a financing gap, as traditional venture capital often shies away from the extended R&D timelines and capital intensity these ventures demand. Java Capital’s Rs 400 crore seed fund directly addresses this shortfall, providing the kind of patient capital that can sustain early product development and protect nascent IP. By earmarking a substantial greenshoe option, the firm also signals confidence in the pipeline of high‑potential startups, ensuring flexibility to scale commitments as promising opportunities emerge.

The fund’s sectoral breadth—spanning semiconductors, aerospace, defence, cybersecurity, AI infrastructure, robotics, advanced manufacturing, energy, climate tech, and synthetic biology—mirrors the strategic priorities of both the Indian government and global investors seeking next‑generation technologies. Initial investments of Rs 6‑8 crore per company are sizable enough to cover prototype development and early market validation, while the commitment to follow‑on funding helps founders avoid dilution pitfalls and maintain momentum through later growth stages. This approach not only de‑risk‑mitigates for the fund but also creates a pipeline of Indian‑origin deep‑tech firms capable of competing on a global stage.

Beyond capital, Java Capital brings operational expertise, mentorship, and access to international markets, which are crucial for deep‑tech firms that must navigate complex regulatory landscapes and long sales cycles. The fund’s launch could catalyze a virtuous cycle: attracting more talent to deep‑tech domains, encouraging ancillary service providers, and prompting other investors to allocate resources to similarly high‑impact areas. As India strives to become a hub for advanced technology manufacturing and innovation, this fund positions the ecosystem to capture a larger share of future global tech value chains.

Java Capital launches Rs 400 Cr fund to back seed-stage deeptech startups

By Shashank Pathak · 09 Feb 2026 17:40 IST

/entrackr/media/media_files/2026/02/09/java-capital-2026-02-09-17-28-02.png)

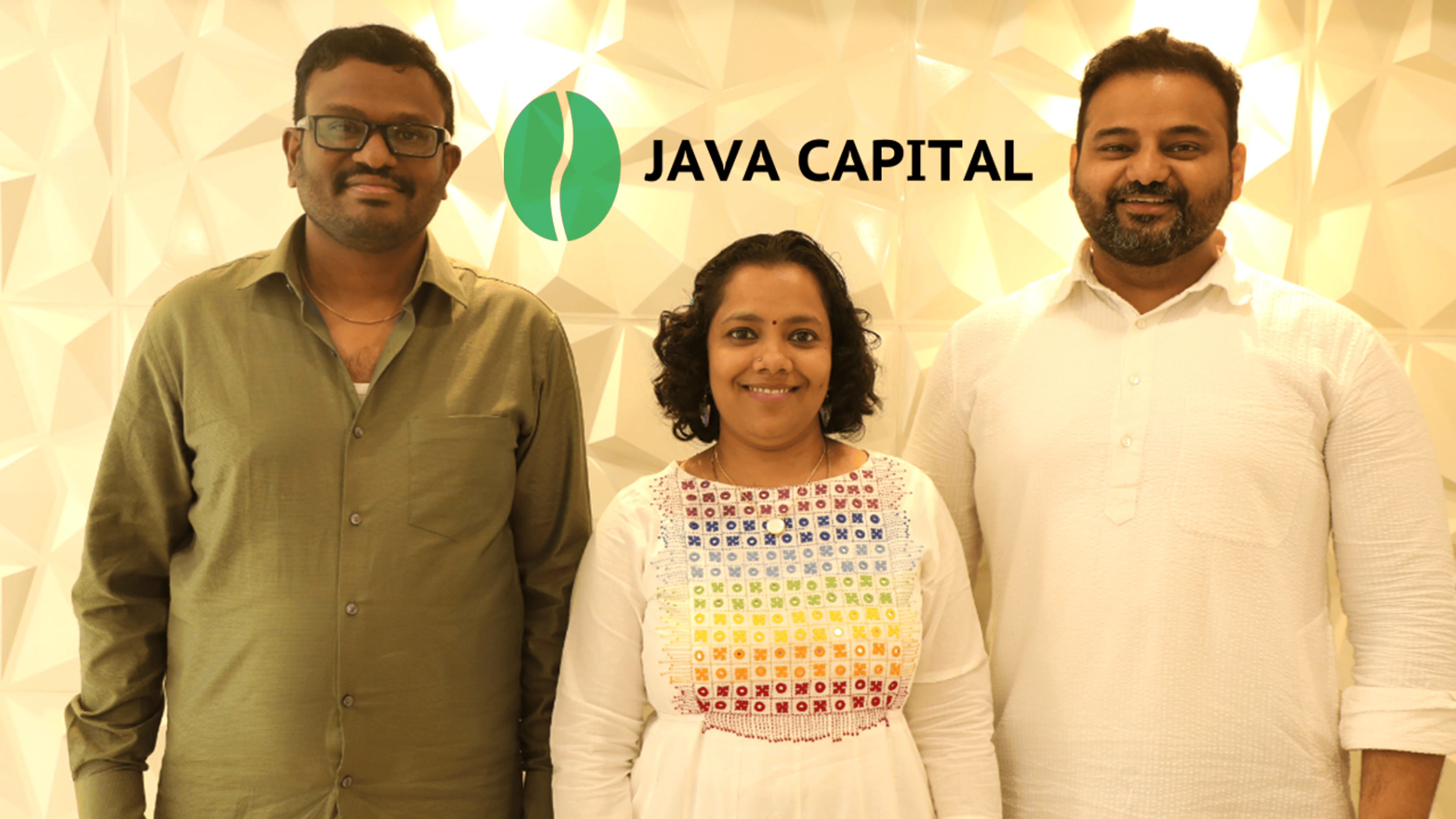

Java Capital has launched a Rs 400 crore deep‑tech‑focused fund to invest in seed‑stage startups building IP‑led technology businesses.

The fund will back companies across sectors such as semiconductors, aerospace, defence, cybersecurity, AI infrastructure, robotics, advanced manufacturing, energy, climate tech, and synthetic biology.

The new fund includes a greenshoe option of Rs 150 crore and plans to invest in 15–20 startups over the next three to four years. Java Capital expects to write initial cheques in the range of Rs 6–8 crore and will reserve capital for follow‑on investments through later stages.

Java Capital focuses on startups with long product‑development cycles and defensible technology moats. The firm aims to partner early with founders building globally relevant deep‑tech companies from India.

The firm’s existing portfolio includes early‑stage, technology‑led startups across areas such as space and aerospace, AI infrastructure, enterprise software, robotics, and advanced engineering. Java Capital typically backs companies at the seed stage and works closely with founders on product development, hiring, and access to global markets.

Disclaimer:

Bareback Media has recently raised funding from a group of investors. Some of the investors may directly or indirectly be involved in a competing business or might be associated with other companies we might write about. This shall, however, not influence our reporting or coverage in any manner whatsoever. You may find a list of our investors here.

0

Comments

Want to join the conversation?

Loading comments...