🎯Today's Euro Stocks Pulse

Updated 20m agoWhat's happening: Airbus posts strong FY2025 results with record backlog

Airbus delivered 793 commercial jets and generated €73.4 billion in revenue, a 6% year‑on‑year rise. Adjusted EBIT jumped 33% to €7.1 billion and net income grew 23% to €5.2 billion, while the order backlog reached a record 8,754 aircraft and a €123.3 billion order intake. The company proposed a €3.20 per‑share dividend and set targets for 2026.

Also developing:

- •European equities rally on strong PMI data ahead of PCE index

- •STOXX 600 climbs as investors digest mixed earnings, Reuters reports

- •European markets slip as financial stocks falter and Greece debt worries surface

News•Feb 20, 2026

Airbus Reports Full-Year (FY) 2025 Results

Airbus announced FY2025 results, delivering 793 commercial jets and generating €73.4 billion in revenue, a 6% year‑on‑year increase. Adjusted EBIT rose 33% to €7.1 billion, while net income grew 23% to €5.2 billion and EPS to €6.61. The order backlog hit a record 8,754 aircraft and total order intake climbed 19% to €123.3 billion. Airbus proposed a €3.20 per‑share dividend and set 2026 guidance for 870 deliveries and €7.5 billion adjusted EBIT.

By Airbus – Newsroom

Social•Feb 20, 2026

VNET CEO Purchases 40k Shares at 69p

Joint Chairman and CEO at #VNET bought 40,000 shares at 69p each. I don't hold.

By WheelieDealer

Social•Feb 20, 2026

AZN's Calquence + Venetoclax Approved for CLL Treatment

#AZN Calquence combined with Venetoclax approved in US for treating Adults with Chronic Lymphocytic Leukaemia in a particular form.

By WheelieDealer

Video•Feb 19, 2026

Next Generation 3D Cabin Tech - Seeing Machines CEO on Tech Leading Automotive and Robotics Future

Seeing Machines Ltd says it is approaching a major inflection point ahead of the July 2026 EU GSR deadline. CEO Paul McGlone highlights 67% royalty growth and expects positive adjusted EBITDA in Q3, while CFO Martin Ive confirms a strengthened...

By Proactive Investors

Social•Feb 20, 2026

UK Retail Sales Record Fastest Growth in 20 Months

UK retail sales begin the year with the fastest growth in 20 months https://t.co/GPGNaZk4Oa via @irinaanghel12 https://t.co/kAm5UcAWvQ

By Zöe Schneeweiss

Social•Feb 20, 2026

European Small‑Cap Funds Eye Amadeus Fire Amid Labor Uncertainty

Any European small/mid cap FMs catching the falling knife in Amadeus Fire? If Germany's labour market turns, it should have some legs, though perhaps its model is doomed?

By Claus Vistesen

Video•Feb 19, 2026

Seeking Resilient Income and Capital Growth with Dunedin Income Growth Investment Trust

Jeremy Naylor is joined by Fund Manager Ben Ritchie to discuss Dunedin Income Growth’s differentiated approach to growing a stable income. The Aberdeen managed Dunedin Income Growth Investment Trust has grown or maintained its dividend for over 40 years and currently...

By UK Investor Magazine

News•Feb 19, 2026

Overlooked and Undervalued: Why Novo Nordisk Stock Deserves Attention

Novo Nordisk’s shares have slumped 66% from their 2024 peak, reflecting weak 2026 guidance and fierce competition from Eli Lilly in the GLP‑1 arena. The Danish firm recently introduced the first oral GLP‑1 pill, positioning it ahead of Lilly’s upcoming tablet and...

By Motley Fool Investing

News•Feb 19, 2026

Centrica Earnings: In Line With Expectations, Share Buyback Pause Disappoints

Centrica reported a 41% plunge in 2025 earnings per share to GBX 11, matching FactSet consensus. After completing a £2 billion share‑buyback programme, the company announced a pause to the scheme. Soft 2026 guidance, driven by weaker gas and power trading, pushed...

By Morningstar UK – News

News•Feb 19, 2026

BAE Systems Shares Are Up 23% in 2026. Is This FTSE 100 Defense Stock a Buy?

BAE Systems posted an 8% revenue rise and a 9% jump in operating profit for 2025, expanding its order book by £2.7 bn versus 2024. The company lifted its dividend 10% to 36p per share, while its stock surged 23% year‑to‑date,...

By Morningstar UK – News

News•Feb 19, 2026

Pernod Ricard’s First-Half Sales Slip Limited by Improved Second Quarter

Pernod Ricard reported a first‑half sales decline across all five priority markets, with profits pressured by foreign‑exchange volatility and higher costs. The second quarter showed a modest rebound, helped by stronger demand in India and duty‑free channels. The group reaffirmed its...

By BusinessLIVE (South Africa) – RSS hub

Video•Feb 18, 2026

The “European Onion” + China, Brazil, and India Take On MAGA

The Spillover episode spotlights Europe at a crossroads, after Munich Security Conference and a Belgian summit, as the bloc wrestles with its strategic role amid US‑China rivalry and the war in Ukraine. Hosts note that while Europe’s macro picture is strained—aging...

By Council on Foreign Relations

Social•Feb 18, 2026

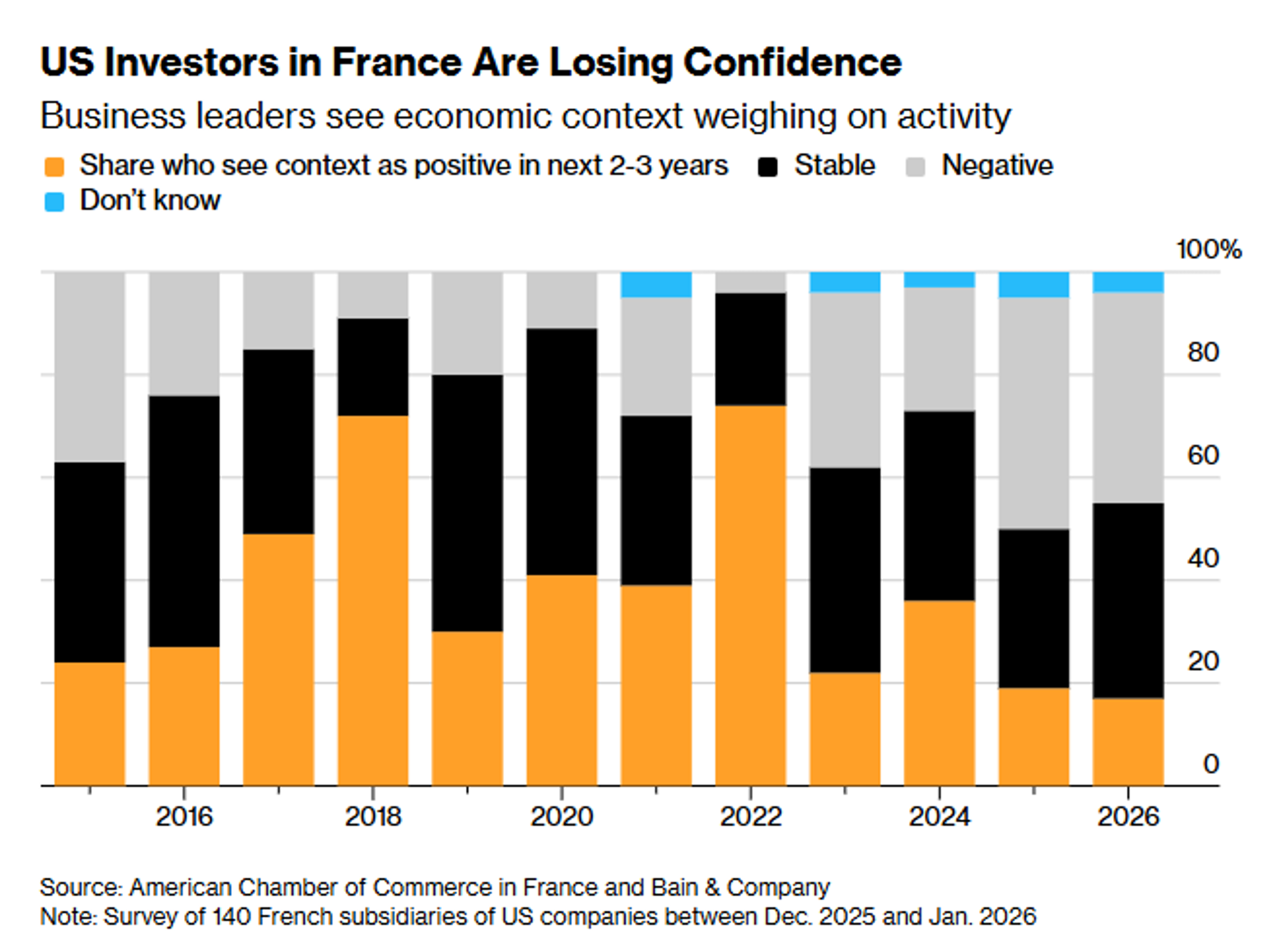

US Investors Turn Bearish on France as Macron Exits

US investors are gloomy on France as Macron era approaches its end https://t.co/a4q0NEuH3I via @WHorobin https://t.co/vhSuc9Ovr6

By Zöe Schneeweiss

Social•Feb 18, 2026

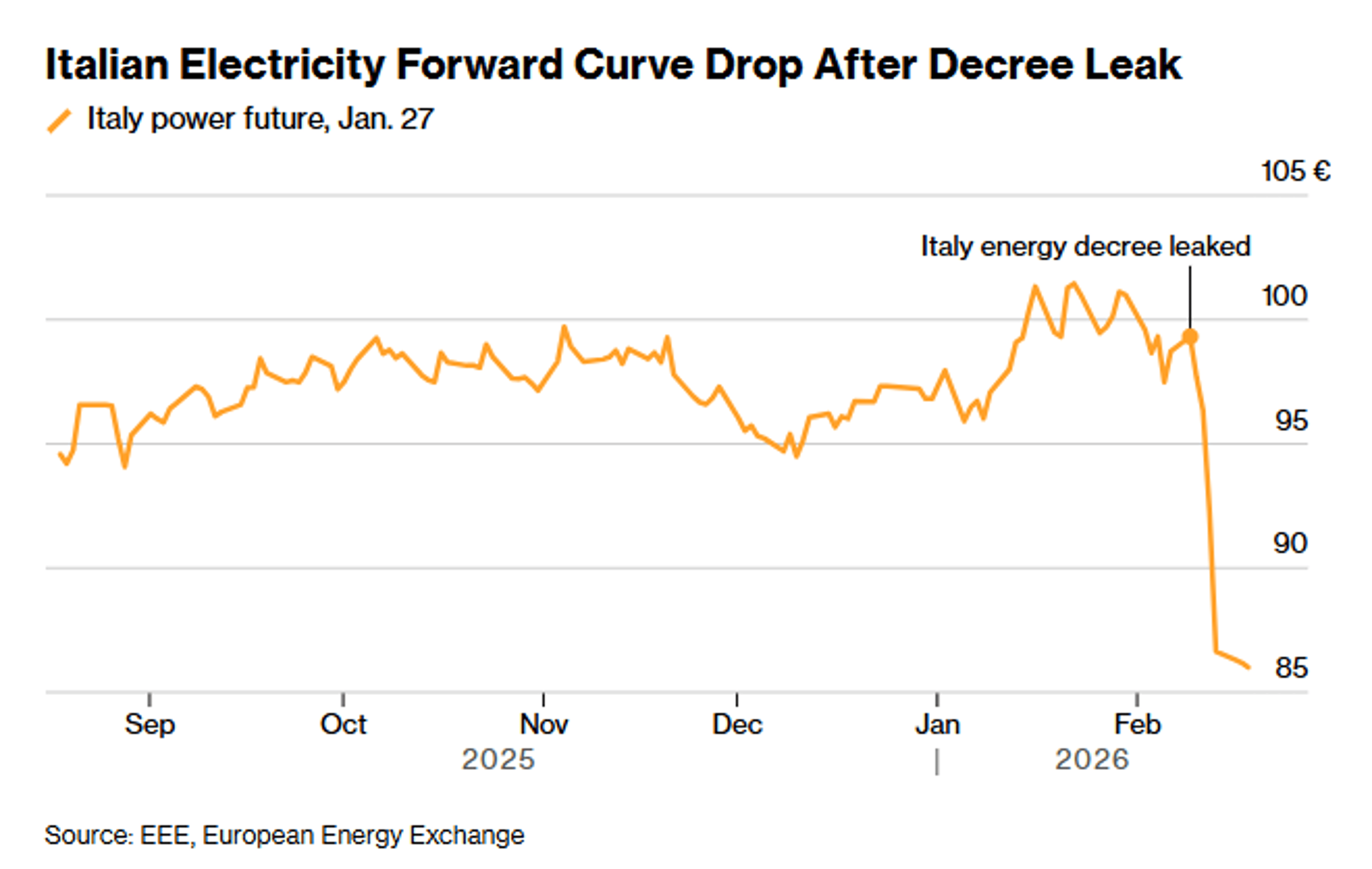

Italy Cuts Carbon Charge on Electricity, Rattles Markets

Italy’s plan to strip carbon cost from power bills jolts markets https://t.co/RZ9Dw7uUKq via @E_Krukowska @Al_Brambilla https://t.co/aVgbxP1Rxm

By Zöe Schneeweiss

Video•Feb 18, 2026

Scott Livingston on Funding Pulsin, Marketing and New Distribution Growth

Scott Livingston used the interview to outline Pulsin's current funding and distribution strategy, emphasizing the rollout of new sales channels and recent wins with major retailers such as Asda and Tesco. He described the operational shift from closing an older...

By London South East

Social•Feb 18, 2026

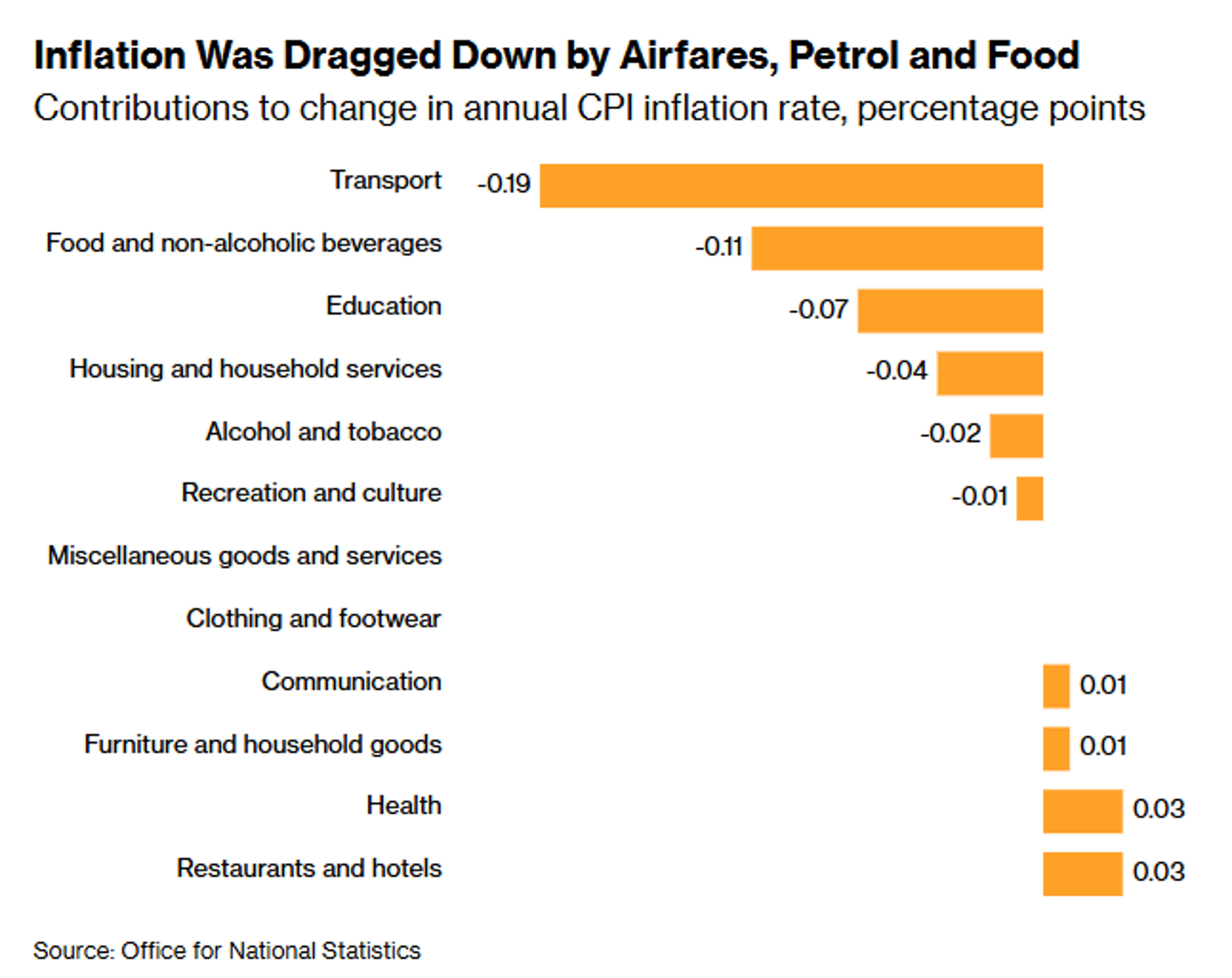

UK Inflation Hits 2025 Low, Strengthening BoE Rate‑Cut Case

UK inflation slowed to its weakest level since March 2025, bolstering the case for an interest rate cut when the Bank of England meets next month https://t.co/yJqzpiJ61p via @irinaanghel12 @PhilAldrick https://t.co/a5Mov7Jkhv

By Zöe Schneeweiss

Social•Feb 18, 2026

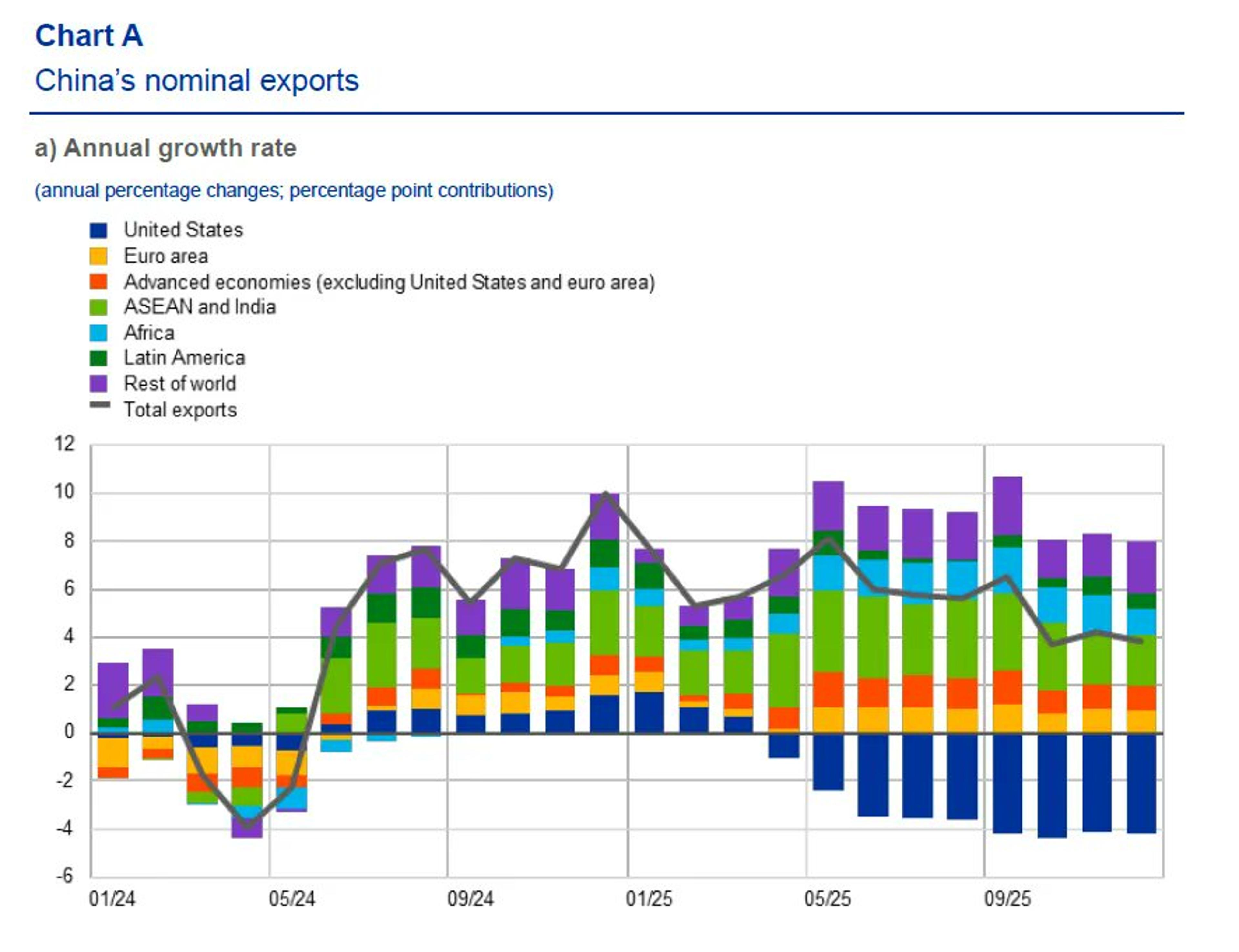

ECB Study Finds Tariffs Sparked Minor China Trade Diversion

Tariffs caused just a small China trade diversion, ECB study shows https://t.co/2xTwmZXdG6 via @weberalexander https://t.co/NfggkusEyQ

By Zöe Schneeweiss

News•Feb 18, 2026

The Norwegian Group Delivers Record Results for 2025 and Increases Dividend

The Norwegian Group posted a record operating profit of NOK 3.732 billion for 2025, the highest in its history, and a NOK 21 million EBIT in Q4 after a loss the previous year. Passenger traffic rose to 27.3 million for the full year, with Norwegian’s...

By Breaking Travel News

Social•Feb 18, 2026

Successor Must Be Independent, Pro‑Europe After Surprise Resignation

Bank of France Governor Francois Villeroy de Galhau says his successor must be independent and committed to Europe after his early resignation gave President Emmanuel Macron a surprise opportunity to pick the next central bank chief https://t.co/VVGP1D9Dj6 via @WHorobin https://t.co/rmqeTU4qJ7

By Zöe Schneeweiss

Video•Feb 17, 2026

Chesnara CEO on €110 Million Acquisition of Scottish Widows Europe, Pipeline and Future Prospects

Chesnara PLC announced the €110 million purchase of Scottish Widows Europe, adding roughly 1.4 million policies and an administrative hub in Luxembourg to its portfolio. The deal is projected to generate €250 million of lifetime cash, with about €100 million expected in the first five...

By Proactive Investors

Video•Feb 16, 2026

Oral GLP-1 Breakthrough - Arecor CEO on Improving Bioavailability for Obesity Treatment

The video centers on Arecor’s effort to develop an oral GLP‑1 formulation that overcomes the chronic low‑bioavailability problem plaguing peptide therapeutics, especially for obesity treatment. The CEO highlights that while more than a hundred peptide candidates are in development for...

By Proactive Investors

Video•Feb 16, 2026

Valereum & Integra Partner Partner on Tokenised Real Estate

Valereum Markets and the Integra Foundation announced a partnership to expand tokenised real‑estate offerings, moving from an initial pilot that sold a single apartment to investors from 140 nationalities to a second phase that introduces secondary trading of fractional property...

By Proactive Investors

Video•Feb 16, 2026

Buccaneer Energy CEO on Oil Production Doubling at Pine Mills Pilot

Buccaneer Energy’s chief executive Paul Welch announced that an organic‑recovery pilot in the Pine Mills field has already doubled oil production in two of the four test wells. The project injects a nutrient blend that stimulates native reservoir microorganisms, causing a...

By Proactive Investors

Video•Feb 13, 2026

Public Services Are Breaking — and These Private Stocks Are Cashing In

The video examines accelerating shift from publicly funded services to private sector as governments confront mounting debt and demographic pressures, arguing that “demographics is destiny” for long‑term portfolio construction. It highlights fiscal tightening in the US and looming UK austerity, noting...

By Investors’ Chronicle

Deals•Feb 13, 2026

Gulf Keystone Petroleum Completes EUR 1 Million Private Placement, Issuing 538,087 New Shares

Gulf Keystone Petroleum Ltd. announced the successful completion of a private placement of 538,087 new shares, raising gross proceeds of approximately EUR 1 million. The new shares were registered and will begin trading on Euronext Growth Oslo on 18 February 2026, with a concurrent...

Business Insider – Markets Insider