U.S. Treasury Rates Weekly Update for February 6, 2026

•February 10, 2026

0

Why It Matters

Lower Treasury yields reduce financing costs for corporations and consumers, influencing credit markets and investment strategies. The shift also signals market expectations about Federal Reserve policy and economic growth.

Key Takeaways

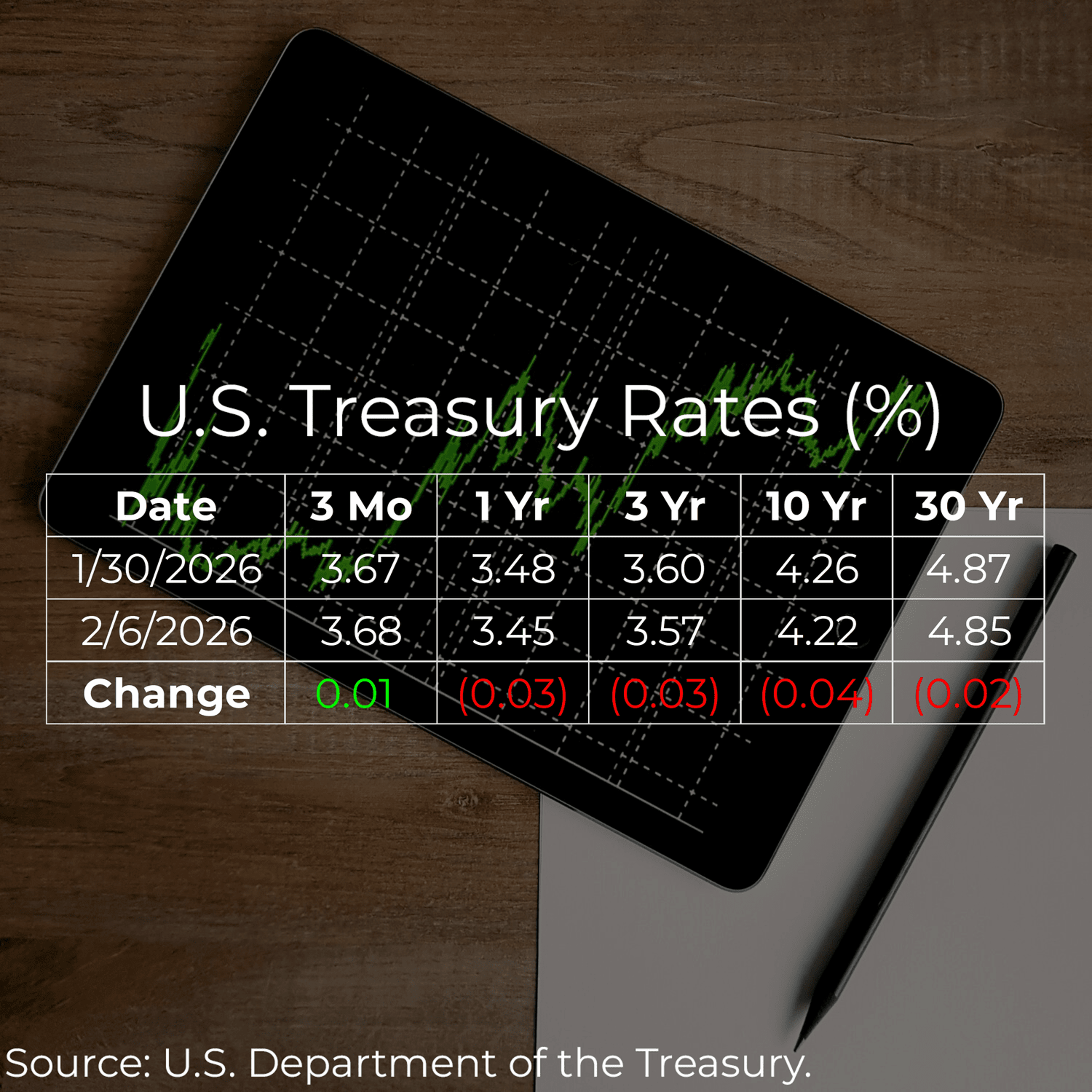

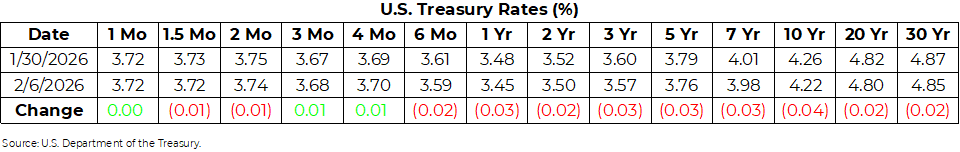

- •30‑year Treasury yield slipped 0.02% this week

- •10‑year yield fell 0.04% to 4.22%

- •3‑year Treasury rate stands at 3.57%

- •Majority of Treasury yields moved lower this week

- •Rate declines may ease financing costs for borrowers

Pulse Analysis

The recent dip in U.S. Treasury yields arrives amid a backdrop of mixed economic data and a cautious Federal Reserve stance. While inflation pressures have eased, the central bank has maintained a steady policy rate, allowing market participants to price in modestly lower long‑term expectations. This environment nudges the 10‑year benchmark down to 4.22 %, a level that still reflects a relatively tight credit market but offers a slight reprieve for borrowers seeking fixed‑rate financing.

Investors interpret the downward tick as a signal that risk‑off sentiment is gaining traction, prompting a rotation into safer assets. A flatter yield curve, highlighted by the 3‑year rate at 3.57 %, can compress spreads for corporate bonds, potentially tightening funding conditions for issuers with lower credit ratings. Meanwhile, mortgage lenders benefit from the marginally lower long‑term rates, which can stimulate housing demand and support home‑builder earnings in the coming quarters.

Looking ahead, Treasury yields will likely track the trajectory of Fed policy guidance and upcoming economic releases. Should inflation remain subdued, the market may anticipate a pause or even a modest rate cut, further pressuring yields downward. Conversely, any surprise in employment or consumer spending could reignite expectations of tighter monetary policy, pushing yields back up. Stakeholders—from portfolio managers to corporate treasurers—should monitor these dynamics closely to adjust duration exposure and financing strategies accordingly.

U.S. Treasury Rates Weekly Update for February 6, 2026

February 09, 2026 · Chet Wang

A majority of U.S. Treasury rates decreased this week. The 30‑year Treasury rate fell by 0.02 %. The 10‑year Treasury rate dropped by 0.04 % and is now 4.22 %. The 3‑year Treasury rate as of February 6, 2026 is 3.57 %.

0

Comments

Want to join the conversation?

Loading comments...