CFO Confidence Slips Amid Washington Uncertainty

•January 26, 2026

0

Why It Matters

The swing in CFO confidence highlights how political uncertainty directly curtails corporate investment and hiring plans, signaling tighter profit outlooks for U.S. businesses in 2026.

Key Takeaways

- •CFO confidence fell 7% from Q4 to Q1 2026.

- •Tariff uncertainty caused 9% dip, then rebound.

- •Revenue growth expectations slipped to 73% of CFOs.

- •Healthcare costs rising for 90% of CFOs.

- •Capex plans fell to 38%, down from 45%.

Pulse Analysis

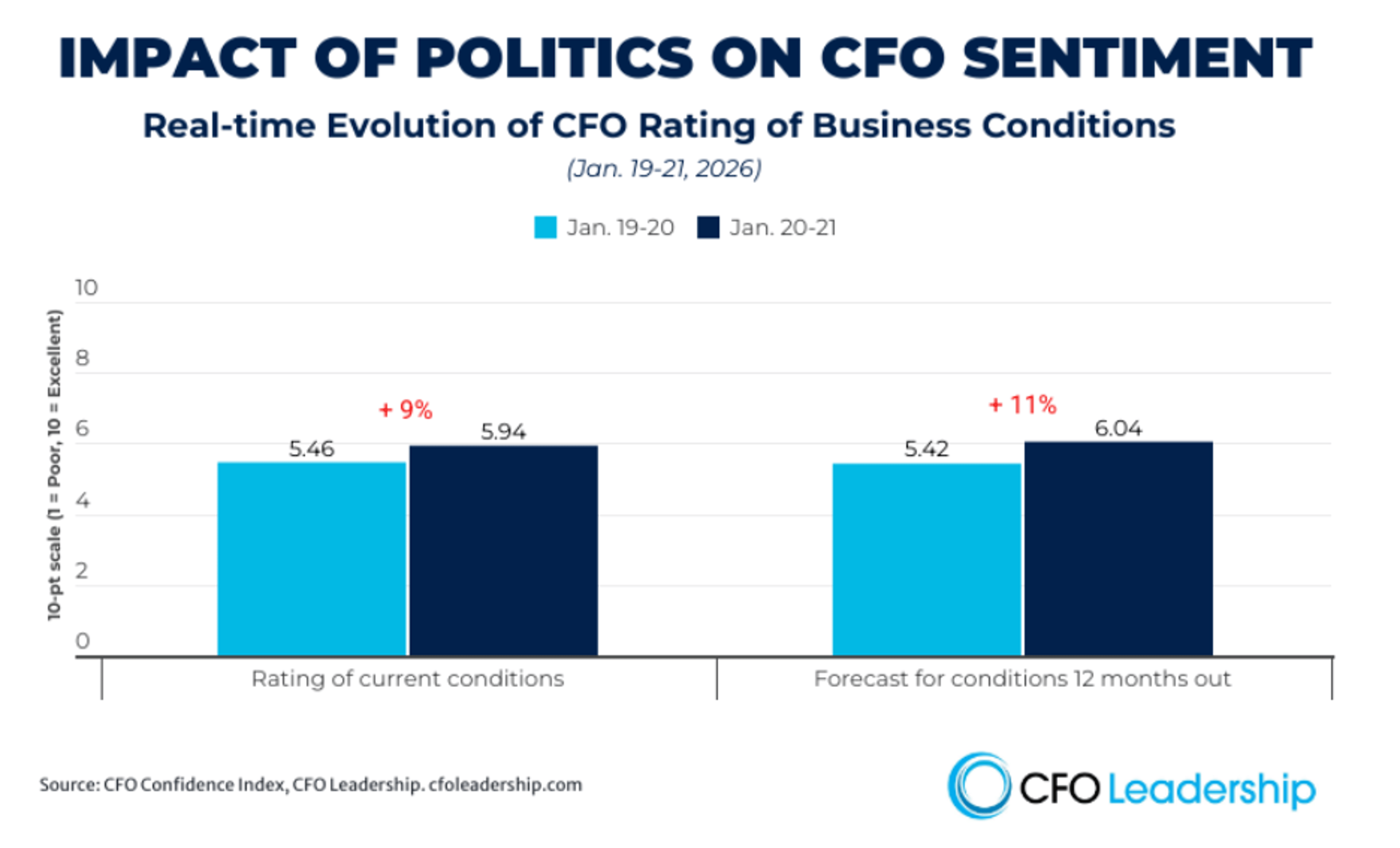

The latest CFO Leadership Confidence Index reveals how quickly corporate finance sentiment can swing in response to Washington’s policy turbulence. In early January, 130 CFOs surveyed before President Trump’s tariff announcement rated current conditions at 5.5, a 9 percent drop from the previous quarter. Within 24 hours, after the deal framework with NATO allies was disclosed, the remaining 60 respondents lifted the score to 5.9, erasing most of the loss. This real‑time reversal underscores the sensitivity of senior finance leaders to geopolitical cues and highlights the uncertainty that now permeates short‑term outlooks.

Beyond sentiment, the poll shows tangible shifts in operational plans. The share of CFOs expecting revenue growth in 2026 slipped to 73 percent, while profit‑increase expectations fell sharply to 56 percent, down from 69 percent in Q4. Capital‑expenditure intentions also weakened, with only 38 percent planning to raise spend, a notable decline from 45 percent. Meanwhile, 90 percent of respondents report rising healthcare costs, a third seeing increases of 10‑20 percent year‑over‑year, pressuring margins. Despite these headwinds, 44 percent intend to add headcount, suggesting cautious optimism about talent needs.

For investors and policymakers, the data signals that fiscal and trade volatility can quickly translate into corporate budgeting restraints. Companies may delay or scale back expansion projects until policy signals stabilize, potentially slowing overall economic momentum. CFOs’ reluctance to commit to higher capex or profit growth also raises questions about the resilience of U.S. corporate earnings in a landscape of unpredictable tariffs and regulatory shifts. Stakeholders should monitor forthcoming Supreme Court rulings on IEPA tariffs and any further executive statements, as these will likely dictate the next swing in confidence and capital allocation decisions.

CFO Confidence Slips Amid Washington Uncertainty

By Melanie C. Nolen

New poll finds U.S. finance chiefs more pessimistic about business conditions in early 2026, citing unpredictable policy shifts on tariffs and geopolitics.

The volatility in Washington is showing up in corporate finance departments. CFO Leadership’s Q1 CFO Confidence Index, conducted among 195 U.S. CFOs January 19‑21, unfolded as President Trump warned of higher tariffs on the European Union and later announced a deal framework with NATO allies.

Sentiment shifted sharply in real time.

-

The 130 CFOs polled before the deal announcement rated current business conditions 5.5 out of 10, a 9 % decline from the 6.0 rating offered in Q4.

-

The 60 CFOs polled after the announcement reported a brighter perspective, rating conditions 5.9 out of 10, a 9 % turnaround in less than 24 hours—recouping almost all of the earlier losses.

When asked to forecast conditions for the year ahead:

-

The first group expressed pessimism, forecasting business conditions would deteriorate slightly in 2026 to end the year at 5.4.

-

The second group showed cautious optimism, forecasting conditions would improve to 6 out of 10—an 11 % higher rating than the first group.

While the second group provided some upside to the overall index for Q1 2026, it wasn’t enough to completely reverse course.

Overall, CFOs’ assessment of current business conditions is now 5.6 / 10, still down from Q4 (‑7 %). CFOs’ expectations for conditions by this time next year also landed at 5.6, down 10 % from last quarter’s 6.3—indicating that despite the uptick at the end of the polling window, CFOs are still not expecting business conditions in 2026 to take a much different turn than in 2025.

THE POLITICAL INFLUENCE

The political (and geopolitical) environment is playing a significant role in how CFOs and leadership teams approach growth, risk, investments, and hiring. CFOs shared how policy shifts emanating from Washington—from tariffs to regulations to what one called “the Greenland madness”—are impacting their planning and creating challenges for business.

“The fundamentals of the economy seem to be good,” said one of the most positive CFOs in the survey, adding: “Geopolitics, however, is a giant mess.”

“The markets can contend with only so much,” said another.

“Inconsistent, volatile and unpredictable actions from U.S. government/president makes it hard for businesses to operate,” said another, echoing a common sentiment.

One CFO explained:

“Tariff uncertainty, including upcoming Supreme Court decision on IEPA tariffs. Trump administration uncertainty re tariffs, foreign policy and disruption to historical gov’t structures i.e., the Fed. All this impacts economic outlooks, investment, employment, consumer spending.”

That uncertainty is reflected in CFOs’ 2026 forecasts for their respective organizations:

-

73 % forecast revenue to increase in 2026 (down from 76 % in Q4)

-

56 % expect profits to increase this year (down from 69 % in Q4)

-

38 % plan to increase capex this year (down from 45 % in Q4)

The findings contrast with CEOs (as reported by Chief Executive, our sister publication) that their top priority this year is to increase profitability.

One factor impacting profitability, reported by polled CFOs, is the rising cost of healthcare. 90 % of respondents say their healthcare spend is increasing in 2026, with one‑third saying their cost has risen by 10‑20 % year over year.

A positive sign: 44 % of CFOs say they plan to add to their headcount in 2026, up from 41 % in Q4.

About the author

Melanie C. Nolen is research director for Chief Executive Group. She oversees custom and proprietary research projects across the firm and acts as research editor for CFO Leadership, StrategicCIO360, StrategicCHRO360, as well as sister publications Chief Executive and Corporate Board Member.

0

Comments

Want to join the conversation?

Loading comments...