Global Chip Sales To Top $1 Trillion In 2026: How It Could Hit Your Wallet And Tech Plans This Year

•February 6, 2026

0

Companies Mentioned

Why It Matters

The chip price inflation directly inflates the cost of everyday electronics, squeezing consumer budgets and delaying product rollouts. It also signals supply‑chain bottlenecks that could curb growth for downstream tech markets.

Key Takeaways

- •Global chip sales projected to exceed $1 trillion in 2026.

- •Advanced AI chips grew 40%, driving consumer price hikes.

- •Memory chip sales rose 35%, tightening supply for smartphones.

- •Manufacturers pre‑book capacity, extending lead times for consumer devices.

- •Higher chip costs pressure budgets of schools, gamers, small businesses.

Pulse Analysis

The semiconductor sector is entering an unprecedented expansion phase, propelled by AI‑driven workloads that demand ever‑more powerful processors. After a 25.6% year‑over‑year increase to $792 billion in 2025, industry analysts forecast sales breaching the $1 trillion mark in 2026. This growth is not uniform; advanced computing chips—used in data‑center AI, high‑end gaming rigs, and next‑gen laptops—accounted for $302 billion, a 40% surge, while memory chips added $223 billion, up 35%. The rapid scaling reflects both corporate cloud spend and the proliferation of generative AI applications across enterprises.

For consumers, the macro trend translates into tangible price pressure and inventory constraints. Higher component costs cascade into retail pricing, meaning new smartphones, laptops, and consoles carry larger price tags or reduced specifications. Supply‑chain analysts note that manufacturers are now booking fab capacity months ahead, a practice that elongates lead times and forces retailers to limit stock. Schools budgeting for student laptops, gamers seeking the latest graphics cards, and small businesses upgrading IT infrastructure all face tighter margins and longer wait periods, reshaping purchasing decisions.

Businesses must adapt to a market where chip scarcity is a strategic variable. Companies can mitigate risk by diversifying supplier bases, investing in inventory buffers, or redesigning products to use lower‑tier silicon where performance trade‑offs are acceptable. Meanwhile, semiconductor firms are expanding capacity through new fab projects, though these require years to become operational. Stakeholders should monitor AI‑related demand forecasts closely, as any acceleration could further tighten supply and amplify price volatility, influencing everything from consumer adoption rates to broader tech sector profitability.

Global Chip Sales To Top $1 Trillion In 2026: How It Could Hit Your Wallet And Tech Plans This Year

Shoppers and tech users are already feeling the ripple effects of soaring chip prices. From the cost of the latest iPhones to delays in laptops and gaming consoles, supply shortages are showing up on store shelves and e-commerce carts alike.

Executives at Apple, Nvidia, and Intel warn that the AI-driven demand for advanced chips could push prices higher and make certain devices harder to get this year.

The Semiconductor Industry Association reported that global chip sales hit nearly $792 billion in 2025, a 25.6% jump over the previous year.

With spending on artificial intelligence infrastructure continuing to surge, that number is expected to top $1 trillion in 2026, directly affecting everyday users who rely on devices powered by these components.

Advanced Chips Lead The Surge

The fastest-growing category is advanced computing chips, including those made by Nvidia, AMD, and Intel. Sales jumped nearly 40% last year, totaling $301.9 billion. These chips power AI applications, gaming PCs, data centers, and high-performance laptops.

For consumers, that growth means higher prices and tighter availability for products that depend on these components. Gamers looking for new graphics cards, professionals updating AI-ready workstations, and even schools purchasing laptops for students may find themselves paying more or waiting longer for devices.

The soaring demand for AI chips is driving up prices for memory and electronics, potentially affecting everything from smartphones to PCs in 2026.

Memory Chips Are Feeling The Pressure Too

Memory chips, used in everything from smartphones to servers, are the second-largest category, with sales rising 34.8% to $223.1 billion. Prices are climbing as AI firms and cloud providers compete for limited supply.

This shortage translates into immediate impacts for everyday users. New phones and laptops may come with smaller storage, higher price tags, or delayed shipping. Even tech hobbyists and small businesses building custom PCs are feeling the squeeze, as memory modules become both costlier and harder to source.

What The AI Build-Out Means For You

Executives in Silicon Valley report that orders for chips are already filling factories for months in advance. John Neuffer, president of the Semiconductor Industry Association, says no one knows exactly what demand will look like next year, but companies are booking capacity now.

For individuals, that means a new normal: products could be priced higher, shipped later, or limited in quantity. The devices we take for granted—phones, laptops, gaming consoles, and smart home tech—may suddenly become harder to buy or more expensive, simply because AI data centers are using so much of the available supply.

A Market Feeling The Strain

This trend isn’t isolated. From Apple stores to online retailers, shoppers notice fewer devices in stock and price tags creeping upward. Even minor upgrades, like a higher-storage SSD in a laptop or extra RAM in a PC, can carry premium costs.

As AI continues to expand, smaller manufacturers and startups face the toughest constraints. Their customers, in turn, may delay purchases, settle for less powerful equipment, or pay significantly more to get the technology they need.

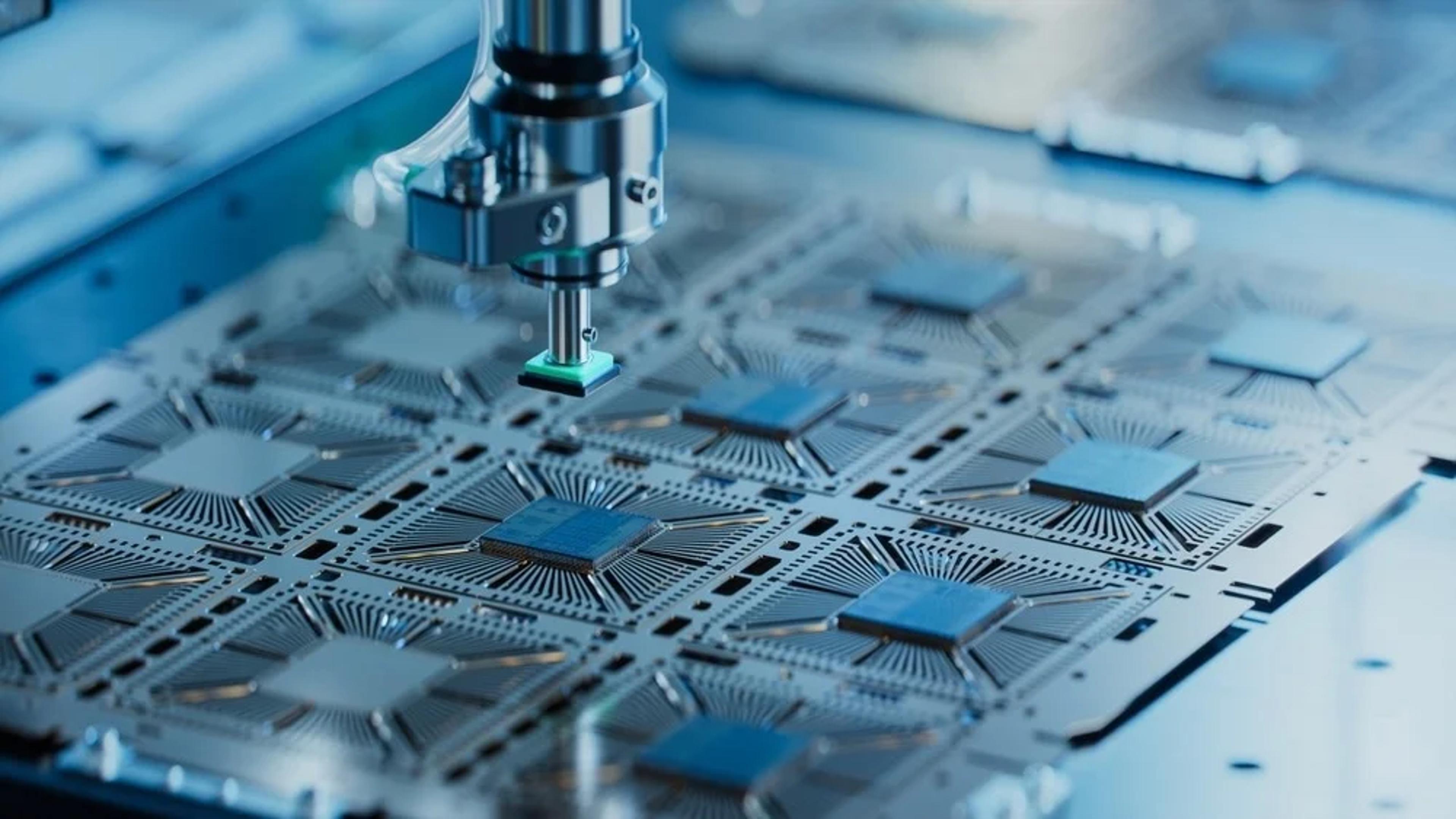

Nvidia logo next to a cutting-edge AI chip, symbolizing the company's role in powering the global semiconductor boom.

The Ripple Effect On Daily Life

It’s not just tech enthusiasts who feel the impact. Schools budgeting for laptops, families replacing phones, gamers upgrading consoles, and small businesses expanding IT systems all see immediate effects. Every chip sold to a data center or cloud provider is one less available for a consumer device.

The global semiconductor surge shows how a decision at the top—AI investment and corporate buying—can cascade down to affect individual budgets, schedules, and access to everyday technology.

Uncertainty Remains

While the chip industry projects strong growth, the reality for consumers remains unpredictable. Prices could spike further, shortages could deepen, and shipping times could extend. Every new announcement about AI infrastructure or chip sales could immediately influence what’s available on store shelves.

For now, shoppers must weigh choices carefully, whether to pay more, wait longer, or adjust expectations. The boom in semiconductors has reached your pocket, your desk, and your devices—forcing everyday people to adapt to a market shaped by the most powerful tech companies in the world.

0

Comments

Want to join the conversation?

Loading comments...