Companies Mentioned

Why It Matters

A dovish Fed could lower borrowing costs and reshape asset‑allocation strategies, while policy tension over yields may increase market volatility. Understanding these shifts helps investors adjust portfolios amid uncertain inflation and rate trajectories.

Key Takeaways

- •Warsh likely to cut short‑term rates aggressively.

- •Fed may shrink its bond portfolio, raising long‑term yields.

- •Treasury seeks to cap longer‑term yields, creating policy tension.

- •Investors favor short‑term bonds, maintain 10% gold exposure.

- •Market volatility persists amid AI‑driven tech moves.

Pulse Analysis

The appointment of Kevin Warsh marks a departure from the more hawkish leadership that has characterized recent Federal Reserve policy. Warsh’s background and public statements suggest a preference for rapid short‑term rate reductions, a move that could stimulate borrowing and support equity markets in the near term. At the same time, his inclination to unwind the Fed’s massive balance sheet by reducing bond purchases introduces a countervailing force, likely nudging long‑term Treasury yields upward and steepening the yield curve. This dual approach reflects a nuanced, albeit potentially contradictory, monetary stance.

Balancing the Fed’s dovish agenda, Treasury Secretary Scott Bessent has signaled a desire to keep longer‑term yields in check, aiming to protect government financing costs and broader market stability. The tension between rate cuts and yield‑capping measures could generate heightened volatility in bond markets, as investors grapple with mixed signals about future inflation and growth. A steeper curve may benefit banks’ net interest margins but could also raise borrowing costs for corporations and consumers reliant on longer‑term financing, prompting a reassessment of debt strategies across sectors.

For portfolio managers, the evolving policy landscape underscores the importance of flexibility. Short‑term bond exposure offers a defensive buffer against rising yields, while a modest gold allocation serves as an inflation hedge and a safe‑haven asset amid market turbulence. Additionally, the surge in AI‑driven technology stocks adds another layer of risk, as valuation swings may be amplified by monetary policy shifts. Investors should monitor Fed communications closely, consider rebalancing toward assets less sensitive to yield fluctuations, and remain vigilant about the broader macroeconomic implications of a dovish Federal Reserve.

How a dovish Federal Reserve could affect you

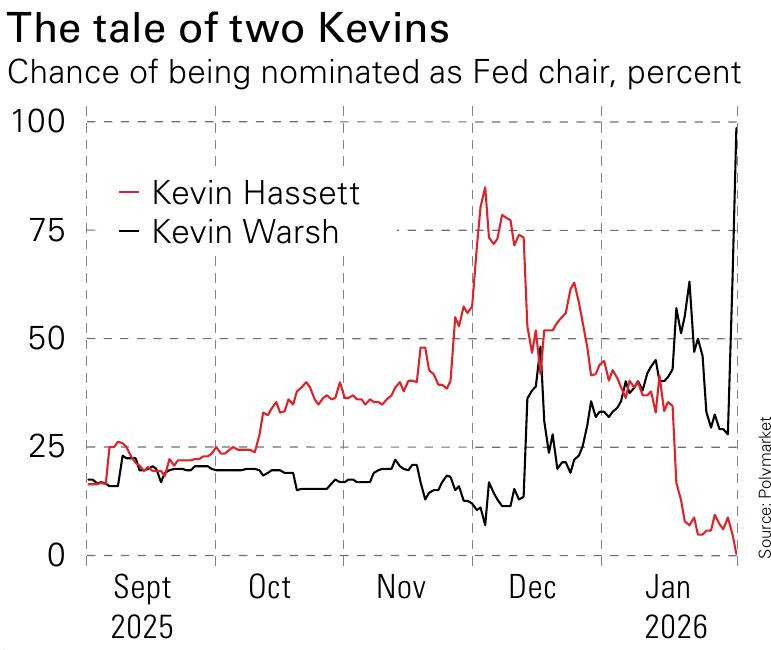

I must admit to being rather disappointed that Donald Trump has chosen the wrong Kevin to be the next chair of the Federal Reserve. For many months, Kevin Hassett – who investors with long memories may know as the author of the laughable Dow 36,000 – sat in pole position. Appointing him would not have been good for the Federal Reserve’s credibility, but his obsequious enthusiasm for cutting interest rates promised to be very entertaining. Sadly, Trump changed his mind, and we have been robbed of the central‑bank boss that our peculiar times deserve.

Image credit: Polymarket

Still, any idea that Kevin Warsh will be some kind of interest‑rate hawk does not sound plausible, regardless of his position when he was last at the Federal Reserve 15 years ago. He appears to be in favour of cutting short‑term rates aggressively, if not quite as aggressively as Hassett. At the same time, he also wants to shrink the Fed’s bond holdings. The latter course of action should, in theory, mean higher long‑term yields, since the Fed will no longer be mopping up so many longer‑dated bonds, and a steeper yield curve. How that squares with Treasury Secretary Scott Bessent’s desire to cap longer‑term yields is unclear, to say the least. All told, the outlook could get quite confusing.

The Federal Reserve is an institution that Republicans still seem to care about

Of course, this assumes Warsh is confirmed as chair and manages to get enough of the Fed governors on his side, which is by no means certain. One of the few US institutions the Supreme Court and Republican senators still seem to care about shielding from presidential whim is the cargo cult of modern central banking. Trump has been able to get away with extreme levels of overreach in practically every sphere, but giving him free rein over the panel of technocrats who can supposedly guide the direction of a $30 trillion economy by tinkering with interest rates is apparently a step too far. Nonetheless, past experience suggests he will more or less get his way. If so, Warsh’s statements seem consistent with how our asset‑allocation portfolio is positioned. We remain concerned that longer‑term bonds offer too little compensation for the risk of higher yields and higher inflation (not just in the US but in the UK and elsewhere) and so we are sticking to short‑term bonds.

Part of our protection against central banks getting it badly wrong is our 10 % allocation to gold. I am doubtful that the rapid sell‑off in gold at the end of last week had much to do with Warsh’s appointment, even though that explanation has been widely quoted. Metals had rocketed the previous week with clear signs of speculative excess; a pull‑back was overdue. Huge moves in data and digital companies that might – or might not – be affected by AI point to a twitchy and volatile market in any case.

We are not making any changes to our holdings, but investors who have held gold for a while may find that it now accounts for a much larger share of their portfolio than originally intended. If you find that you are now heavily overweight, you may want to trim a bit back to target. We will do this in our regular rebalance at the end of the tax year.

0

Comments

Want to join the conversation?

Loading comments...