Companies Mentioned

Why It Matters

MSCI’s dominant data and indexing platform drives recurring revenue streams, making it a bellwether for the broader asset‑management industry and a potentially undervalued investment opportunity.

Key Takeaways

- •$18.3 trillion assets benchmarked to MSCI indexes.

- •Index subscription run‑rate grew 9.4% Q4 2025.

- •Asset‑based fees from ETFs rose 21% YoY.

- •EBITDA margin projected 62.5% in FY2026.

- •Shares trade at 26× earnings, below five‑year average.

Pulse Analysis

The index market has evolved from Charles Dow’s 11‑stock experiment to a trillion‑dollar ecosystem where benchmarks dictate fund performance and investor expectations. MSCI, alongside S&P Dow Jones and FTSE Russell, dominates the global arena with its MSCI World index covering 23 developed markets and representing roughly 85% of worldwide equity capitalisation. This breadth gives MSCI unparalleled leverage over fund licensing agreements, ensuring that virtually every major passive and active strategy references its data, reinforcing its status as the backbone of modern finance.

Financially, MSCI’s model thrives on recurring subscription fees and asset‑based charges that scale with market growth yet incur minimal marginal costs. In Q4 2025, subscription run‑rates rose 9.4% while custom‑index sales jumped 16%, and ETF‑linked fees surged 21% year‑on‑year. The company’s focus on AI‑driven efficiency and economies of scale is projected to lift EBITDA margins to 62.5% in fiscal 2026, up 170 basis points, underscoring the high profitability of data‑centric businesses with entrenched switching costs.

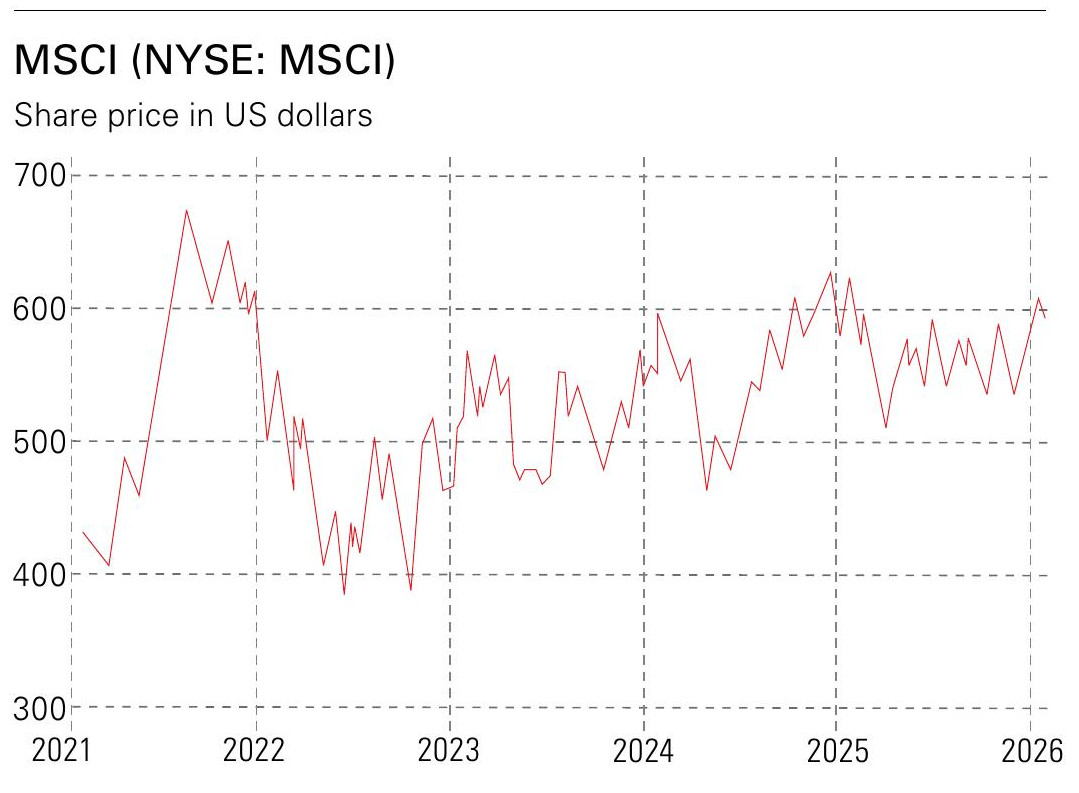

Valuation analysts see a disconnect between MSCI’s market dominance and its current share price, which trades at 26× forward earnings—significantly below the five‑year average of 40× and a standard deviation under the S&P 500 baseline. This discount, combined with a forecasted net income of $1.5 billion for 2026 and a potential $2.4 billion by 2030, positions MSCI as an attractive candidate for investors seeking exposure to the expanding passive‑investment wave and the resilient cash‑flow profile of a data monopoly.

Profit from MSCI – the backbone of finance

The world’s first stock market index, the Dow Jones Transportation Average, was created in 1884 by Charles Dow. It consisted of just 11 companies. Dow didn’t know it at the time, but he had created what would later become the backbone of the global investment market.

Dow and other index pioneers set out to make the chaotic movements of Wall Street and the City of London understandable to the average person and today indexes dominate the investment world. Tens of trillions of dollars are benchmarked to key indexes and every quarter investment managers all over the world publish their results and judge themselves against the performance of these vital financial indicators.

MSCI is one of three main index providers

There are three main index providers: S&P Dow Jones, FTSE Russell and MSCI. Each index has its own strengths and weaknesses and some are better known than others in key markets. For example, most UK investors are aware of the FTSE 100, managed and owned by FTSE Russell, which itself is owned by the owner of the London Stock Exchange, LSEG. S&P Dow Jones runs the two main US market indexes, the S&P 500 and Dow Jones Industrial Average. MSCI manages the world’s global stock benchmarks.

These companies provide benchmarking data to fund managers. When a company such as BlackRock (iShares) or Vanguard launches a fund, it signs a licensing agreement with the index provider. The index provider then tracks every dollar that flows into that fund to calculate the “licensing fee” they are owed, while providing up‑to‑date data on changes to the index. The fund managers could do this themselves, but using a third‑party removes any conflicts of interest and allows investors to compare performance across different fund providers.

The flagship product of MSCI (NYSE: MSCI) is its MSCI World index, which covers the world’s 23 biggest and most important developed equity markets. The 1,320 constituents account for around 85 % of global equity market capitalisation. The size and scale of this index means the company has become one of, if not the most important index provider in the world. According to its latest results, MSCI officially reported about $18.3 trillion in total assets benchmarked to its equity indexes. Of that, $12 trillion is in indexed (passive) products and $6.3 trillion is in actively managed strategies. It also noted a record $2.2 trillion specifically in ETFs linked to its indexes.

The scale of the company’s reach means that receiving its approval can be a make‑or‑break decision for companies and countries. Towards the end of January, shares on Indonesia’s Jakarta Composite index plunged 8 % in a single day as MSCI warned that deteriorating liquidity could lead to the country’s removal from its leading developing‑markets index.

MSCI is a profit engine

MSCI has four main business segments. Its index business is the flagship division. Revenue is generated through recurring subscriptions and asset‑based fees tied to products, such as ETFs and open‑ended unit trusts. It also has an analytics business that sells portfolio and risk‑management tools. A sustainability division provides data and ratings to help investors address emerging environmental and social risks, which in turn has some overlap with the index division, as these ratings can help managers benchmark against environmental indexes. Finally, there’s the group’s private‑asset division, which provides performance data for private‑equity and real‑estate managers.

Virtually all of the company’s revenue comes from subscriptions, either fixed‑fee or asset‑based subscriptions that asset managers essentially have to pay in order to maintain access to MSCI’s data and use its indexes as benchmarks. In many respects, this is a perfect business model. The industry is consolidated across three major players, revenue is recurring and the actual construction and maintenance of indexes has almost zero marginal cost.

In the fourth quarter of 2025, MSCI recorded subscription run‑rate growth of 9.4 % in its index business, with subscriptions growing 16 % year‑on‑year in the custom‑index division. Analysts at UBS believe the overall growth rate could return to double digits in 2026, driven by rising demand for global passive trackers and the continued growth of private markets. Asset‑based fees, mainly tied to ETFs, rose 21 % year‑on‑year in the fourth quarter, while revenue from private markets rose 7 %.

Management is also focused on reducing costs, leveraging AI to speed up processes while benefiting from economies of scale. UBS calculates the company’s EBITDA margin will expand by 170 basis points in fiscal 2026 to 62.5 % and a further 60 basis points in the following year to 63.2 %. These high margins reflect the fact that the business is a data company with substantial economies of scale, high switching costs for customers and long‑term contracts. Indeed, last year the group extended its partnership with BlackRock until 2035.

UBS expects net income of $1.5 billion for fiscal 2026, up from $1.3 billion in 2025. As the global asset‑management industry continues to expand, it could hit $2.4 billion by 2030. Despite this growth, MSCI’s shares are trading at only 26 times estimated 2027 earnings, compared with its five‑year average of 40 times. It’s also trading one standard deviation below its long‑term valuation relative to the wider S&P 500. That seems cheap considering the firm’s global dominance.

Image credit: MSCI

0

Comments

Want to join the conversation?

Loading comments...