Report Finds Trump’s Tariffs Cost U.S. Households $1,000 on Average in 2025

•February 10, 2026

0

Why It Matters

The analysis quantifies the direct cost burden on consumers, highlighting how tariff policy can translate into reduced disposable income and broader economic drag. It also fuels political debate ahead of a pending Supreme Court ruling on the tariffs’ legality.

Key Takeaways

- •Tariffs added $1,000 average household cost in 2025.

- •Effective tariff rate hit 9.9%, highest since 1946.

- •Tax Foundation predicts $1,300 cost rise in 2026.

- •Companies passed tariff costs to consumers via higher prices.

- •Democrats use report to attack Trump’s trade strategy.

Pulse Analysis

The Tax Foundation’s February 6 report quantifies the hidden tax that Trump‑era tariffs have imposed on American families. By applying a weighted average tariff rate of 13.5% to all imports, the analysis shows an average $1,000 increase in household expenses for 2025, climbing to $1,300 in 2026. This figure reflects not only direct duties but also the downstream price adjustments firms make to preserve margins. While the administration touts tariffs as a revenue‑generating, national‑security tool, the data frames them as a broad‑based consumption tax.

The cost pass‑through is already evident in retail shelves, where manufacturers cite higher import fees as justification for price hikes on everything from electronics to apparel. Economists warn that such incremental increases erode disposable income, dampening consumer confidence and potentially slowing the post‑pandemic recovery. Moreover, the elevated effective tariff rate of 9.9%—the highest since the mid‑1940s—creates a distortion in trade flows, encouraging domestic substitution but also inviting retaliatory measures from trading partners. The net effect is a modest inflationary pressure that compounds existing supply‑chain challenges.

Politically, the findings have become ammunition for Democrats who accuse the president of imposing a de facto tax on ordinary Americans. The report arrives weeks before the Supreme Court is expected to rule on the legality of several Trump‑initiated tariffs, a decision that could force a rapid policy reversal. If the Court curtails the tariffs, businesses may face abrupt cost adjustments, while lawmakers could push for targeted trade remedies instead of blanket duties. Either outcome underscores the need for transparent, data‑driven trade policy that balances security concerns with household affordability.

Report Finds Trump’s Tariffs Cost U.S. Households $1,000 on Average in 2025

By Lauren Sforza · NJ.com

President Donald Trump’s tariffs cost American households an average of $1,000 last year, according to a new analysis.

The report from the nonpartisan Tax Foundation found that U.S. households had a tax increase of $1,000 in 2025 and an increase of $1,300 in 2026 as a result of Trump’s tariffs. Trump has repeatedly boasted about his tariffs, arguing that it will drive up revenue for the country.

Despite Trump’s claims, experts repeatedly warned that the tariffs will only increase costs for Americans. Many companies said that they would need to increase prices as a result of the looming tariffs.

The report said that the weighted average applied tariff rate on all imports rose to 13.5% as of Feb. 6, while the average effective tariff rate rose to 9.9%. This is the highest average effective rate since 1946, according to the report.

Democrats seized on the report to criticize the tariff policies.

Rep. Nellie Pou (D‑N.J.) said Trump is to blame for the increase in costs.

“$1,000 less towards buying a home. $1,000 less towards grocery shopping. $1,000 less in your savings account. You paid $1,000 more last year thanks to Donald Trump,” Pou wrote on social media platform X.

Sen. Andy Kim (D‑N.J.) wrote on X:

“This is a tax on you. You paid $1,000 more in a tax because of Trump.”

Rep. Malcolm Kenyatta (D‑Pa.) posted:

“Does paying an extra $1,000 a year so the President and his family rake in billions in cash make us great??”

The report was published on Feb. 6, just days before Trump touted his tariffs again on his social media platform Truth Social. It also comes as Trump awaits a Supreme Court ruling that could force him to remove his tariffs.

“Record Stock Market, and National Security, driven by our Great TARIFFS. I am predicting 100,000 on the DOW by the end of my Term. REMEMBER, TRUMP WAS RIGHT ABOUT EVERYTHING! I hope the United States Supreme Court is watching,” Trump wrote in a Truth Social post last week.

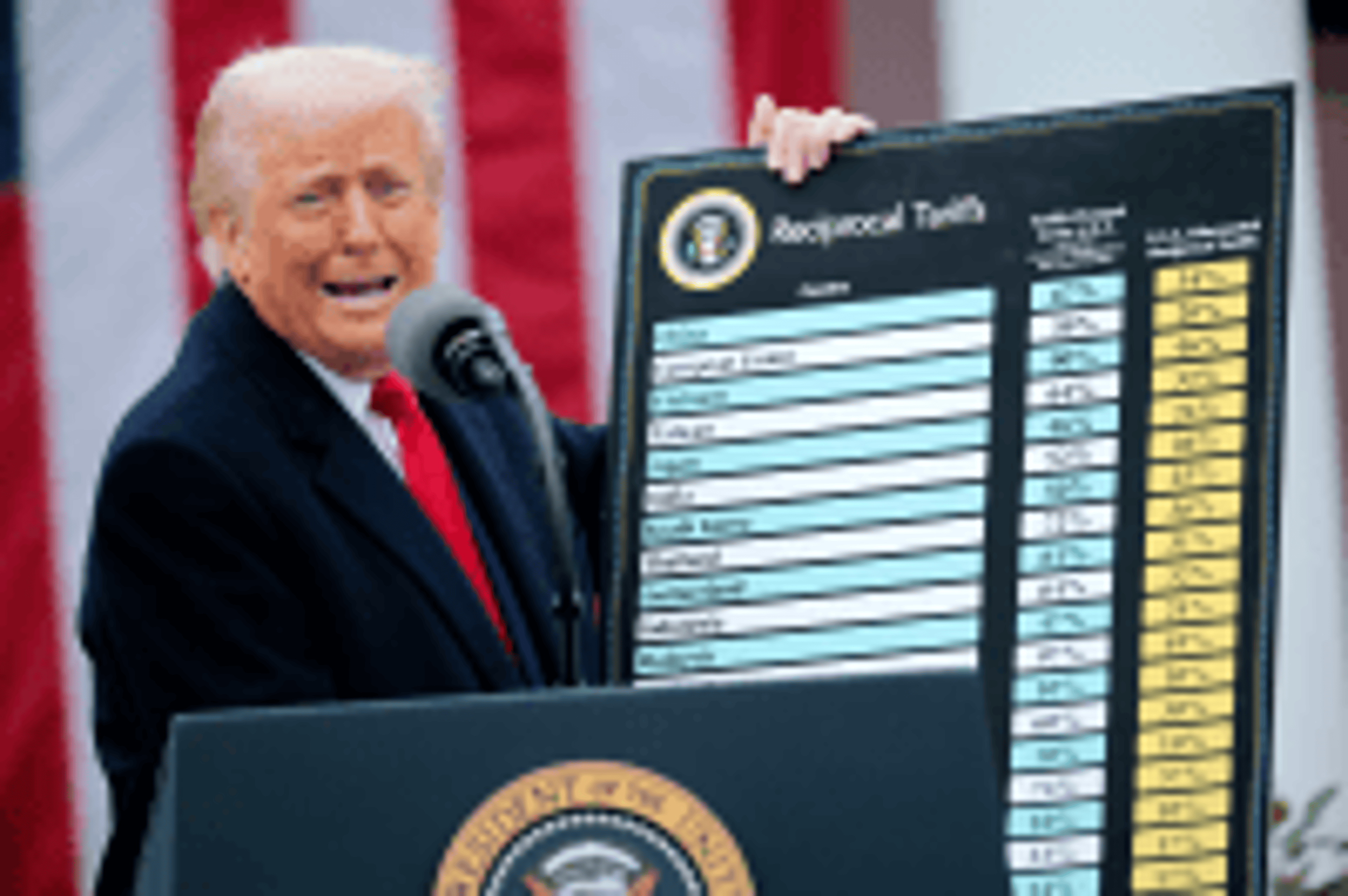

Photo credit: President Donald Trump speaks during a trade announcement event in the Rose Garden at the White House on April 2, 2025, in Washington, D.C. Touting the event as “Liberation Day,” Trump announced additional tariffs targeting goods imported to the U.S. (Chip Somodevilla/Getty Images/TNS)

0

Comments

Want to join the conversation?

Loading comments...