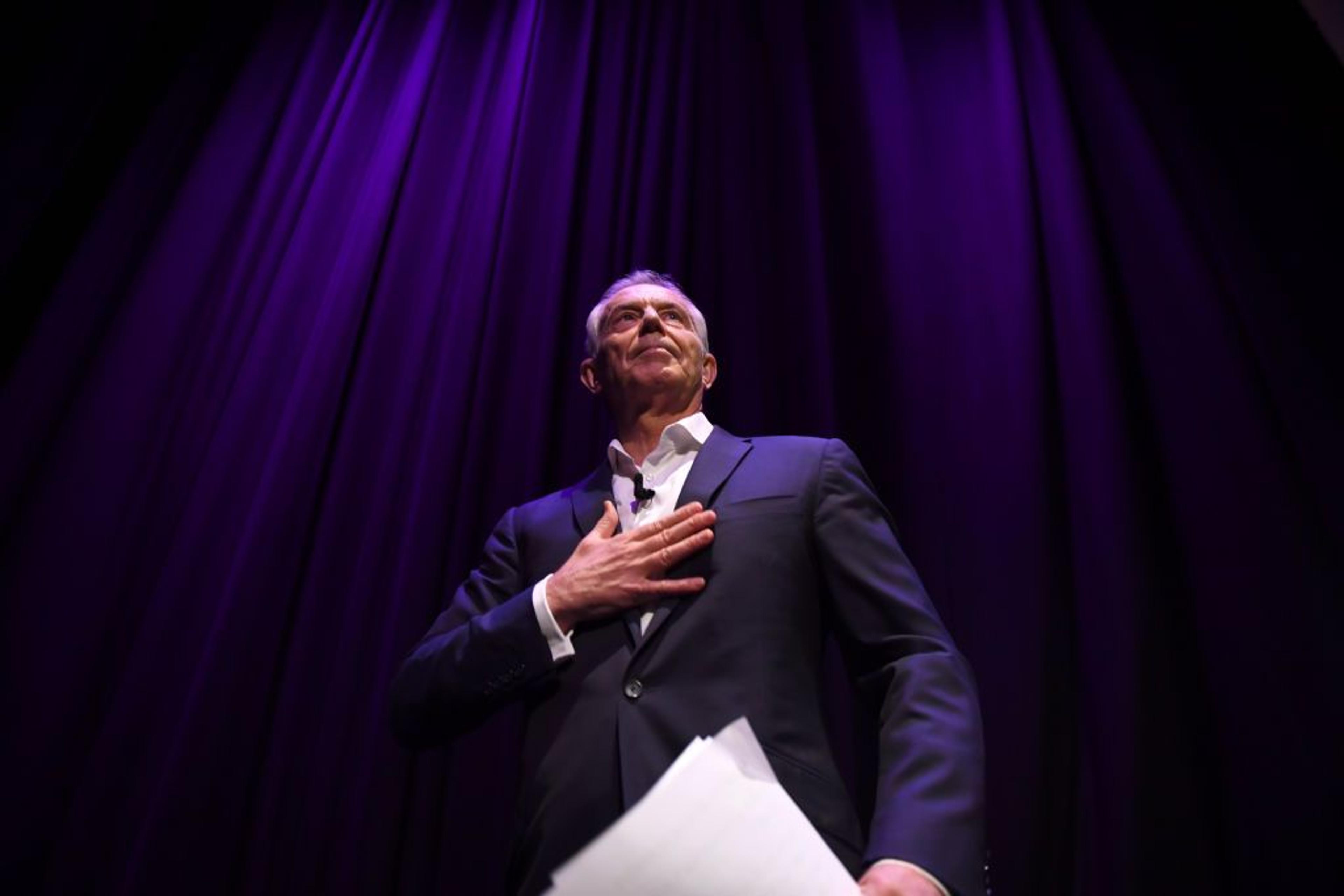

Tony Blair's Terrible Legacy Sees Britain Still Suffering

•February 8, 2026

0

Companies Mentioned

Why It Matters

Understanding Blair’s policy legacy clarifies the structural constraints that hinder UK growth and informs current debates on fiscal prudence, public‑sector reform, and investment incentives.

Key Takeaways

- •Sold 40% of gold reserves, reducing fiscal buffer.

- •Windfall tax shifted burden to privatized utilities, spurring PE takeovers.

- •Abolished advance corporation tax, discouraging pension fund equity investment.

- •Abolished GP fundholding, halting NHS productivity improvements.

- •Higher education expansion created £255bn student debt burden.

Pulse Analysis

Blair’s fiscal choices reshaped Britain’s balance sheet at a pivotal moment. The 1999 sale of nearly half the country’s gold reserves generated a short‑term cash influx but stripped the Treasury of a valuable hedge against future shocks, leaving the public sector more vulnerable during downturns. Simultaneously, the windfall tax on newly privatised utilities and the removal of advance corporation tax eroded incentives for private equity and pension funds to back UK equities, contributing to a prolonged decline in capital market depth and a weaker investment pipeline.

Public‑sector reforms under New Labour also left mixed legacies. While increased NHS funding raised headline spending, the abolition of GP fundholding removed a proven mechanism for localised resource allocation, curbing productivity gains that had previously narrowed waiting times. The ambitious expansion of university places, financed through high‑interest student loans, produced a £255 billion debt mountain that now weighs on household finances and dampens consumer spending. Additionally, Blair’s decision to reduce the historic EU rebate signalled a willingness to concede fiscal concessions, feeding Eurosceptic narratives that later shaped the Brexit debate.

The cumulative effect of these policies is evident in today’s stagnant growth trajectory. By the time the global financial crisis hit, the UK’s fiscal cushion was thin, its corporate equity market under‑invested, and its public institutions burdened with structural inefficiencies. Recognising the long‑run impact of Blair’s reforms provides policymakers with a clearer roadmap for rebuilding fiscal resilience, restoring private‑sector confidence, and recalibrating public‑service delivery to support sustainable economic recovery.

Tony Blair's terrible legacy sees Britain still suffering

The blunders, mishaps and poor performance of the current government have led to nostalgia for the golden years of New Labour under Tony Blair. In reality, Blair’s government made decisions that have proved extremely damaging in the long term, sowing the seeds of Britain’s subsequent poor performance and many of its current problems. Here are my top ten.

1. Selling 40% of Britain’s gold reserves

2. Windfall tax

Labour’s first Budget included a £5 billion “windfall” tax on the businesses privatised under the Conservative government, a programme that the Labour Party had consistently opposed despite the appalling record of these businesses in the public sector.

This tax on the businesses, rather than on the investors who had profited from under‑priced flotations – combined with the castigation of the bosses of the privatised businesses and regulation intended to favour lower prices at the expense of investment – drove most of the utilities into the hands of unaccountable, often overseas, private equity.

3. Tax raid on pension funds

Labour's first budget raised £5 billion a year by abolishing advance corporation tax (ACT). Until then, UK‑listed companies had deducted the standard rate of income tax from gross dividends and paid the resulting amount to the Inland Revenue as ACT. The ACT paid was credited against the company’s mainstream corporation tax and investors (such as pension funds) that were not liable for income tax could claim the tax back.

Abolition discouraged pension funds from investing in UK equities, severely undermined final‑salary schemes in the private sector and significantly increased pension costs to businesses. The result was the relentless decline in the London Stock Exchange as a source of capital for British businesses.

4. Bankrupting British Energy

The government made a concerted effort to close down nuclear‑power generation in the UK, largely because of the industry’s role in undermining the effectiveness of the coal miners’ strike in 1984.

Nuclear‑power generation was struggling to compete with gas‑fired generation due to a glut of gas and the government made this worse by piling other financial obligations on British Energy. It was forced to sell assets at knock‑down prices in the UK and Canada and a lucrative fuel‑reprocessing business was shut down.

The destruction of industrial expertise, the crippling of a viable domestic nuclear generator and the heaping of excessive “safety” requirements on the remaining plants has made it eye‑wateringly expensive to build new nuclear plants at Hinkley Point and Sizewell.

5. Railtrack

Labour had hated rail privatisation and used the excuse of a rail crash at Hatfield in 2000 to take control of Railtrack, which owned the infrastructure. As a nationalised industry, its safety record had been poor, not least because British Rail had a policy of replacing only 1 % of its track each year, a strategy embedded into Railtrack’s financial model at privatisation.

When privatisation brought a reversal in the long decline of rail usage, the problem of under‑investment became critical. Renationalisation brought a massive increase in the cost of investment projects, chaotic management and relentless political involvement – but for which HS2 would have been completed long ago at a far lower cost.

6. Abolishing GP fundholding

Reforms in the 1990s turned the NHS upside down, enabling general practitioners (GPs) to decide which hospitals their patients were sent to for treatment. This was resented by hospital doctors and consultants, who looked down on GPs, and also by the Labour Party, which preferred a centralised, top‑down structure.

The system wasn’t perfect, but it cut waiting times, improved patient care and facilitated significant gains in productivity. Labour abolished the system and put centralised commissioning agencies in charge, rather than the GPs who knew their patients and where to send them. For the subsequent 25 years, NHS productivity stagnated at best.

7. Throwing money at the NHS

Blair’s government thought that the only problem with the NHS was that it was underfunded. So it significantly increased the organisation’s funding without any attempt to get value for money. Now, little more than half the 1.4 million full‑time equivalents employed by the NHS are clinical.

At least the extension of the Private Finance Initiative (PFI) meant that, for a change, hospitals (and other public‑sector projects) were built or rebuilt on time and on budget and properly maintained. However, a financial squeeze on the private‑sector provision of care homes after Labour’s election has meant that the number of residential places has fallen from 520 000 in 1998 to 440 000, despite an ageing population.

8. Over‑expansion of higher education

The government had the noble ambition to increase access to higher education to half the population. But it didn’t think through the consequences. This led to a ratcheting up of course fees financed by student loans at what are now usurious rates of interest. Outstanding student debt now totals £255 billion; £30 billion is expected to be written off each year by the end of the 2040s.

Meanwhile, the gap between graduate and non‑graduate salaries has fallen sharply, while many jobs are no longer open to non‑graduates. Moreover, professions requiring long years of study, such as medicine, put a ruinous financial burden on their practitioners.

9. Handing back part of the EU rebate

In 1984, Margaret Thatcher negotiated a 66 % rebate of Britain’s net contribution to the EU, in recognition of its low call on funds in the Common Agricultural Policy. As a goodwill gesture to the EU, Blair reduced the rebate by £7 billion; not significant in itself, but it irritated EU‑sceptics in the UK. Arguably, it also gave the EU the impression that the UK would always fold in negotiations, so it felt no need to make concessions before the Brexit vote.

10. Poor crisis management

The global financial crisis blew up after Blair had resigned, but Blair must bear some responsibility for the credit‑fuelled growth that led to it and for keeping Gordon Brown as his chancellor, enabling him to become prime minister. In 2007, Brown mistook the liquidity crisis at Northern Rock for a solvency crisis, undermining confidence in the banking system. Lloyds Bank was bullied into bailing out HBOS, critically undermining its own viability. And while the US government made a huge profit from rescuing the financial system, the UK didn’t.

Despite Blair’s abysmal record, David Cameron was happy to be regarded as “the heir to Blair” and did little to reverse the damage. As a result, the UK economy has persistently underperformed its pre‑2008 trend path of growth, hampered by structural problems in both the public and private sectors. It may be possible to correct these and return the UK to the path it was once on, but only if the mistakes dating back to 1997 are first recognised.

This article was first published in MoneyWeek's magazine.

0

Comments

Want to join the conversation?

Loading comments...