Acquisition

Warburg Pincus in Final Talks to Acquire Integrace Health for ₹1,200 Crore

•February 19, 2026

0

Participants

Why It Matters

The deal highlights accelerating private‑equity interest in India’s high‑growth pharmaceutical market and could accelerate Integrace’s scale and product diversification. It also reinforces Warburg Pincus’s strategy to build a consolidated healthcare platform in the region.

Key Takeaways

- •Warburg Pincus nearing Rs 1,200 crore Integrace deal.

- •Integrace revenue ~₹300 crore, EBITDA ₹60‑70 crore FY 26.

- •OPM segment provides 74% of Integrace’s revenue.

- •Top five products generate 69% of Integrace’s sales.

- •Deal expands Warburg’s footprint in Indian pharma market.

Pulse Analysis

India’s pharmaceutical sector has become a magnet for private‑equity capital, driven by robust domestic demand and a favorable regulatory environment. Warburg Pincus’s pending Rs 1,200 crore acquisition of Integrace Health reflects this trend, adding a mid‑size branded‑generic player to its portfolio that already includes cataract‑lens maker Appasamy Associates and stakes in Micro Life and Laurus Labs. The valuation signals confidence in Integrace’s growth trajectory, particularly its strong foothold in orthopaedics‑pain‑management and gynecology therapies, which are resilient to economic cycles.

Integrace’s business model relies on a concentrated product suite, with its top five offerings accounting for 69% of sales and the OPM segment delivering three‑quarters of revenue. While such concentration poses risk, the high‑volume, stable‑demand nature of these drugs mitigates volatility. Under Warburg’s ownership, Integrace could benefit from operational expertise, access to broader distribution networks, and potential cross‑selling opportunities with other portfolio assets. The infusion of capital may also fund R&D to diversify its pipeline, reducing reliance on a few key products and positioning the firm for export growth in emerging markets.

Strategically, the acquisition deepens Warburg’s footprint in a market projected to exceed $100 billion by 2030. By consolidating fragmented players, the firm can leverage economies of scale, negotiate better terms with raw‑material suppliers, and enhance bargaining power with insurers and retailers. The move also aligns with a broader wave of foreign investors seeking to capitalize on India’s rising healthcare spending, suggesting further consolidation and potential exits for investors as the sector matures.

Deal Summary

US private‑equity firm Warburg Pincus is in advanced talks to acquire Mumbai‑based formulations maker Integrace Health for about ₹1,200 crore. Integrace, currently owned by True North Fund VI LLP and Temasek’s V‑Science Investments, is expected to sign the deal in a few weeks.

Article

Source: ETCFO – Corporate Finance

Warburg Pincus talks in final lap to buy Integrace Health for Rs 1,200 crore

By Reghu Balakrishnan & ET Bureau

Published Feb 19 2026 at 08:44 AM IST

Mumbai: US private‑equity firm Warburg Pincus is in advanced talks to acquire Mumbai‑based formulations maker Integrace Health for about ₹1,200 crore, said people familiar with the matter.

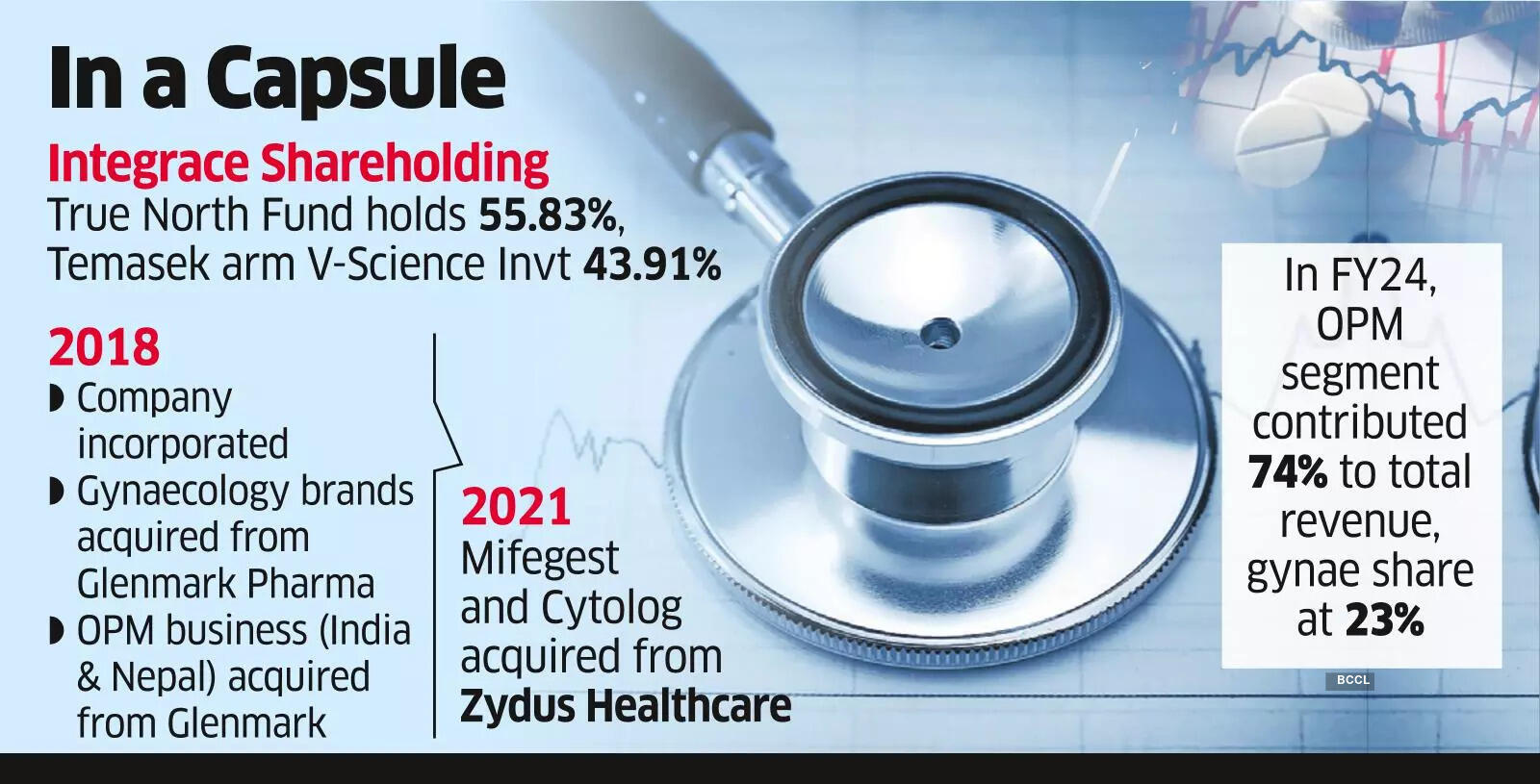

Integrace is currently owned by home‑grown PE fund True North and Singapore sovereign investor Temasek Holdings. True North Fund VI LLP holds a 55.83 % stake in Integrace, while Temasek arm V‑Science Investments Pte owns 43.91 %.

Discussions are at a final stage, with the deal expected to be signed in a few weeks, the people said.

Incorporated in August 2018, Integrace began operations with the acquisition of branded generic portfolios from Glenmark Pharmaceuticals in October that year. It bought Glenmark’s gynaecology business for ₹115 crore in cash and its orthopaedic and pain‑management (OPM) business in India and Nepal, valuing that transaction at ₹635 crore.

In 2021, Integrace further strengthened its gynaecology franchise by acquiring Mifegest and Cytolog from Zydus Healthcare. The company manufactures branded generics focused on OPM and gynaecology therapies across India and Nepal.

Spokespersons for True North and Warburg Pincus declined to comment.

Integrace is led by CEO Kedar Rajadnye, formerly president and COO of the consumer‑products division at Piramal Enterprises, who joined the company in 2018. It reported revenue of about ₹300 crore and EBITDA of ₹60‑70 crore in FY 26, the people said, citing the latest available data.

In FY 24, the OPM segment contributed 74 % to total revenue, followed by the gynaecology segment at 23 %.

Integrace has high dependence on key products, deriving 69 % of revenue from its top five products in FY 24, India Ratings and Research said in a report. The top three products from its OPM portfolio contributed 45 % to total revenue and the top product from the gynaecology portfolio contributed 12 % to total revenue in FY 24.

Nevertheless, these products have large volumes and a stable demand environment, which mitigates product‑concentration risk to some extent, the report added.

Integrace’s brands in the OPM segment include Lizolid and Stiloz, each contributing 16 % of FY 24 revenue, followed by Esoz at 13 %. In the gynaecology segment, Mifegest was the major contributor at 12 %, followed by Cytolog, Fenza and Mumfer at 3 % each.

Warburg Pincus has been an active investor in the Indian pharmaceuticals and healthcare space. In April 2024, it bought a majority stake in Chennai‑based cataract‑lens maker Appasamy Associates at a valuation of ₹3,000‑3,200 crore. In 2022, it took about an 11 % stake in medical‑devices maker Micro Life for $210 million, valuing the firm at roughly $2 billion. Earlier, in 2014, Warburg Pincus picked up a minority stake in API maker Laurus Labs for around ₹550 crore and exited in 2020.

Separately, a consortium led by Warburg Pincus and Abu Dhabi‑based sovereign investor Mubadala is in advanced talks to buy a majority stake in contract manufacturer Encube Ethicals, ET reported last week.

0

Comments

Want to join the conversation?

Loading comments...