Health Cover to Be Bundled with Pension Schemes, Says PFRDA Chief

•February 13, 2026

0

Why It Matters

Combining retirement savings with health cover addresses rising medical costs and could boost NPS enrollment, while the alternative‑asset mandate aims to enhance long‑term returns.

Key Takeaways

- •Up to 30% of pension corpus allocated for medical expenses

- •ICICI, Axis, Tata funds testing Swasthya health‑pension product

- •Pooled investors enable cheaper insurance and faster hospital payments

- •PFRDA targets 5% allocation to alternative investment funds

- •Digital onboarding via UPI aims to expand NPS participation

Pulse Analysis

India’s demographic shift and rising healthcare inflation have forced regulators to rethink retirement products. By integrating a dedicated health‑pension layer, the PFRDA’s Swasthya initiative seeks to make the National Pension System more attractive to a broader audience. The model allows contributors to earmark a portion of their corpus for medical needs, creating a dual‑purpose fund that addresses both long‑term savings and immediate health security. This approach aligns with global trends where pension schemes are evolving into holistic financial protection tools, potentially reversing the current low enrollment of just one crore participants.

From a financial‑services perspective, bundling health cover with pension assets unlocks economies of scale. Aggregated investor pools give pension fund managers leverage to negotiate lower premiums and bulk‑rate top‑ups from insurers, while hospitals benefit from near‑real‑time reimbursements, reducing cash‑flow bottlenecks typical of government schemes. The anticipated cost efficiencies could translate into higher net returns for retirees, especially as the PFRDA also pushes a 5% allocation to alternative investments such as project finance and real‑estate. Early AIF deployments slated for March signal a strategic shift toward diversified, higher‑yielding portfolios that aim to sustain double‑digit growth over longer horizons.

The broader regulatory landscape is equally transformative. With banks like Axis and a consortium led by Union Bank eyeing entry into the pension market, competition is set to intensify, prompting innovation in product design and distribution. Simultaneously, the partnership with NPCI’s Unified Payments Interface leverages a KYC‑verified user base of over 800 million, streamlining digital onboarding and expanding reach. As the PFRDA balances health integration, alternative‑asset exposure, and digital acquisition, the NPS could evolve from a niche retirement vehicle into a comprehensive wealth‑and‑wellness platform for India’s emerging middle class.

Health cover to be bundled with pension schemes, says PFRDA chief

The scheme allows up to 30% of an investor’s corpus to be earmarked for medical expenses · Updated · February 14, 2026 at 12:06 AM · Mumbai

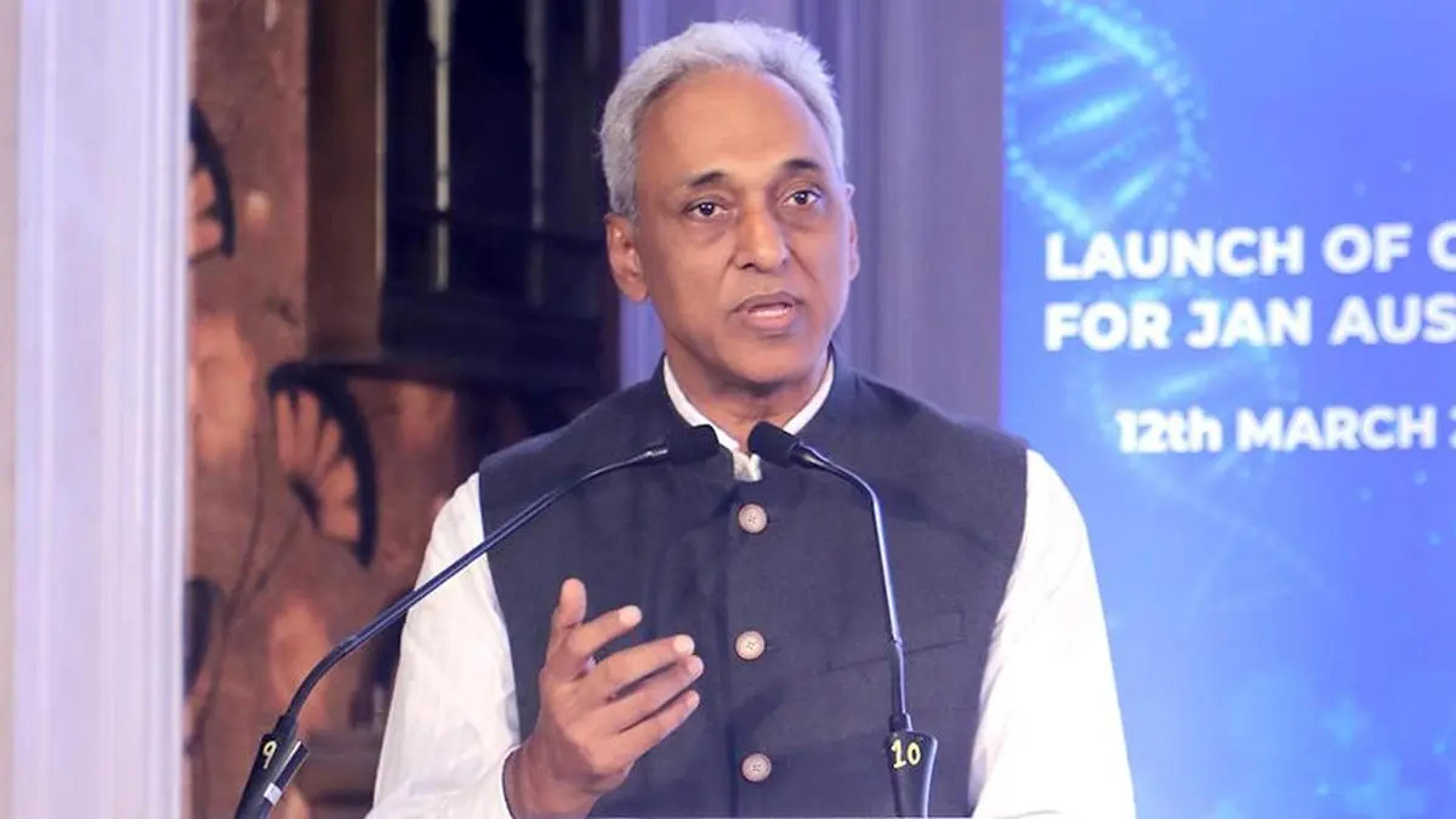

Pension Fund Regulatory And Development Authority (PFRDA) Chairman S Ramann said on Friday that three pension funds are working on introducing plans bundled with health covers for the benefit of investors.

The health covers may come either through tie‑ups with health‑insurance companies or with healthcare providers, Ramann told reporters.

Explaining the new pension‑scheme “Swasthya” idea, under which the offerings are being planned, Ramann said, “Our aim is to try and get people to understand that they have to protect themselves. We want them to save money in a medical pension scheme. And it is dedicated for payment to medical purposes only.” It can be noted that the PFRDA launched the Swasthya platform in January this year with this intent. As per the scheme, up to 30 percent of an investor’s money can be set aside for covering medical expenses during the period of a pension plan.

Ramann said aggregation of investors is among the biggest advantages that the NPS offers, which allows pension funds to negotiate better deals while making some health covers available for investors.

This may also include cheaper top‑ups from health‑insurance companies, which will be over and above the 30 percent amount that is set aside, he added, noting that hospitals will also be able to give better deals for treatments because of the high volumes.

Healthcare facilities will also get their money immediately after treating a patient, which is unlike a central‑government health scheme that takes months to release payments.

Ramann named pension funds sponsored by ICICI, Axis, and Tatas as ones conducting “experiments” on launching such coverage right now, and added that he expects ICICI to come up with a final product for customers soon.

The PFRDA chief also said efforts are underway to study how double‑digit returns can be sustained over longer periods, and added that investments in asset classes like project finance and real estate will also be undertaken.

He expects the maiden pension‑fund investment into an alternative investment fund to happen before the end of March, and added that this is part of the mandate to invest up to 5 percent in alternative avenues.

Investments in gold and silver exchange‑traded funds will be part of that and will not exceed 1 percent levels, he said.

At least four banks, or a consortium of banks, have shown interest in getting into the pension‑fund business after the PFRDA allowed such a move, he said, adding that this includes Axis Bank and a consortium of Union Bank of India, Indian Bank, and Star Daichi.

Admitting that NPS coverage is dismally low at just 1 crore people, Ramann said the PFRDA is in talks with the National Payments Corporation of India for help in investor acquisition.

The NPCI‑run Unified Payments Interface is used by over 800 million people who have done KYC with a bank, and having acquisition possibilities through third‑party application providers, he said, stressing that this can help ensure digital onboarding.

Published on February 14, 2026

0

Comments

Want to join the conversation?

Loading comments...