Medtronic Completes First Hugo Case in the US

•February 17, 2026

0

Companies Mentioned

Why It Matters

The U.S. launch positions Medtronic to diversify its surgical portfolio and potentially erode Intuitive Surgical’s market share, a shift that could reshape revenue dynamics in the high‑growth robotic surgery sector.

Key Takeaways

- •First US Hugo prostatectomy performed at Cleveland Clinic

- •Hugo cleared by FDA, previously CE‑marked in Europe

- •Medtronic targets Intuitive Surgical’s urology market share

- •Additional US hospitals (Duke, Atrium Health) installing Hugo

- •FY26 Q3 revenue hit $9.02 billion, 8.7% YoY growth

Pulse Analysis

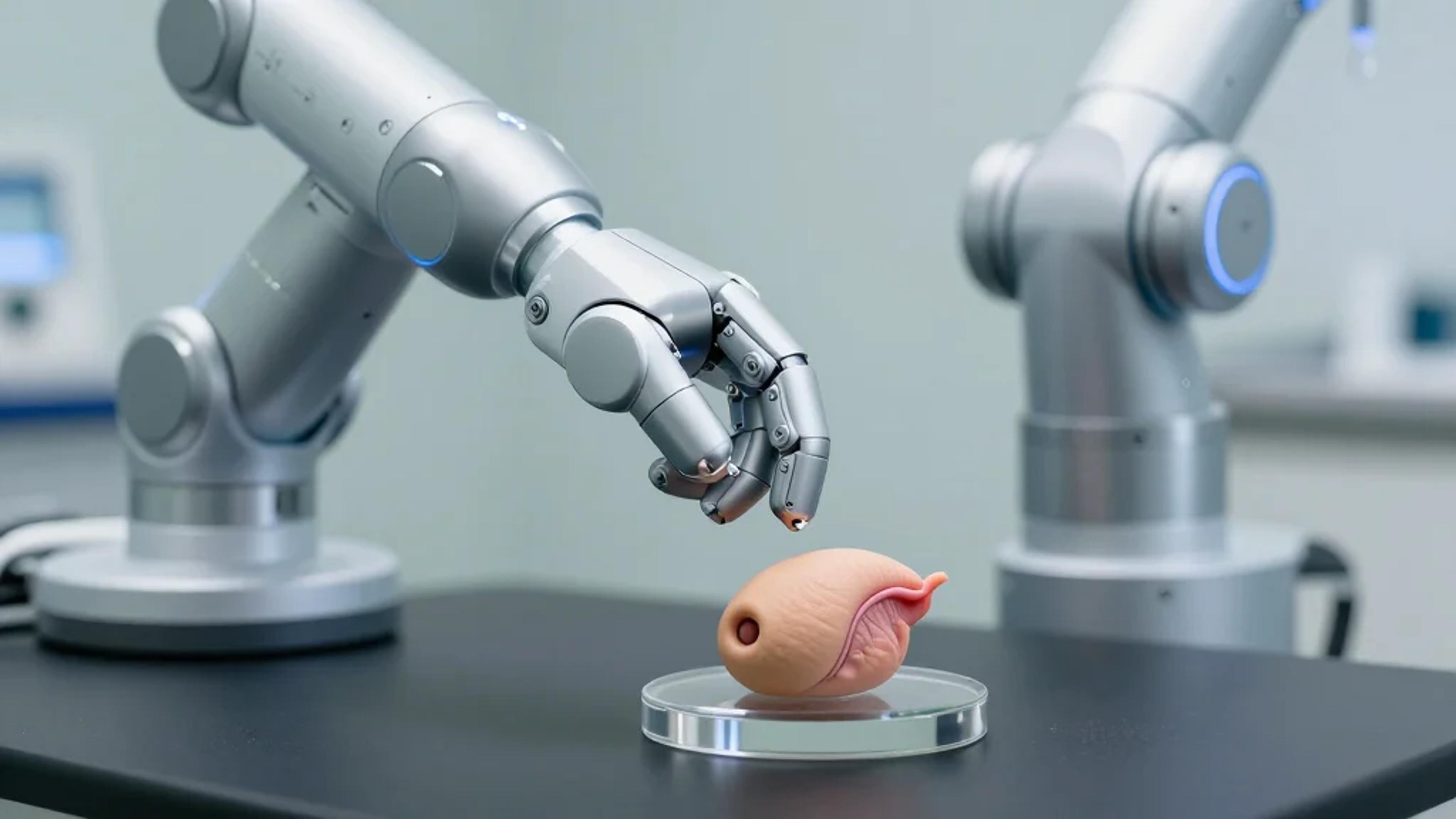

The robotic surgery market has long been dominated by Intuitive Surgical’s da Vinci platform, but Medtronic’s Hugo system introduces a credible alternative as it gains FDA clearance. Hugo’s European pedigree—available in over 35 countries since 2021—provides a proven technology foundation, while the U.S. debut at a leading academic center signals strong clinical endorsement. Investors are watching closely, as the entry could accelerate competitive pricing and spur innovation across the soft‑tissue robotics segment.

Hugo’s current indication is limited to urology, specifically prostatectomy, which narrows its immediate addressable market compared with da Vinci’s broader portfolio. However, Medtronic’s roadmap includes expansions into gynecologic and general‑surgery procedures, such as hernia repair, which could substantially increase case volume. Early adoption by hospitals like Cleveland Clinic, Duke, and Atrium Health suggests a favorable reception among surgeons seeking integrated solutions tied to Medtronic’s extensive device ecosystem. If the rollout scales as anticipated, Hugo could become a significant revenue driver and a strategic lever in Medtronic’s broader surgical business.

Beyond robotics, Medtronic’s FY26 Q3 results underscore robust growth across its core segments, with total sales of $9.02 billion and a near‑14% rise in cardiovascular revenue. The company’s pulsed‑field ablation (PFA) platform is also gaining momentum, posting over 80% worldwide growth. Together, these trends highlight Medtronic’s multi‑pronged strategy to capture high‑margin, technology‑driven opportunities, reinforcing confidence among analysts that the Hugo launch, while nascent, fits within a larger narrative of diversified, billion‑dollar growth avenues.

Medtronic completes first Hugo case in the US

Medtronic’s Hugo robotic surgery system gets first U.S. procedure

By Ricky Zipp

Published Feb. 17, 2026

CEO Geoff Martha said that while Hugo may not “move the needle” for Medtronic’s surgical business yet, the system is growing “pretty fast.”

Medtronic said Tuesday that a surgeon completed the first U.S. procedure for its Hugo robotic surgery system, shortly after the company received Food and Drug Administration clearance for the platform.

The first surgery was a prostatectomy performed at the Cleveland Clinic. Along with the Cleveland Clinic, Duke University Hospital and Atrium Health Wake Forest Baptist High Point Medical Center are among the first U.S. hospitals to install Hugo, with Atrium Health being the first hospital outside the investigational device exemption clinical study to do so.

CEO Geoff Martha told investors on an earnings call that the first cases were completed earlier this month, with more procedures scheduled this week. Martha did not specify the number of Hugo installations or procedures.

“We like where we sit,” the CEO said. “[We’re] really excited about getting in the U.S. market, and the reception that we’re getting and the orders that we have.”

Medtronic announced in December that Hugo gained FDA clearance for U.S. market access. Hugo received Europe’s CE mark in 2021 and is available in more than 35 countries.

Medtronic hopes the system can take share away from long‑time market leader Intuitive Surgical in the soft‑tissue robotics space. Several companies are looking to challenge Intuitive; however, Medtronic and Johnson & Johnson — which submitted its Ottava system to the FDA in early January — are the largest contenders. Both have more resources than smaller firms, as well as existing surgical businesses and strong connections with hospitals and surgeons.

While Hugo is kicking off in the U.S., Wall Street has questioned whether the system can be a meaningful competitor to Intuitive because of its sole urology indication and the advancements Intuitive has made with its da Vinci robot. UBS analyst Danielle Antalffy told MedTech Dive that while hospitals and academic centers will likely want a Hugo system, “I think it’s a stretch to think that Hugo is going to get much traction in the U.S.”

Medtronic said it plans to expand Hugo’s indications into gynecologic and general‑surgery procedures, including hernia repair.

By the numbers

-

FY26 Q3 revenue: $9.02 billion (8.7% growth YoY)

-

Cardiovascular revenue: $3.46 billion (nearly 14% growth YoY)

-

Diabetes revenue: $796 million (nearly 15% growth YoY)

PFA growth

Medtronic announced the Hugo news alongside earnings results for the third quarter of its fiscal year 2026, which began in April 2025. The company reported total sales of $9.02 billion, generating year‑over‑year growth of 8.7%.

Medtronic continues to grow its cardiac ablation solutions business (CAS), fueled by sales and procedure growth for pulsed‑field ablation systems. CAS revenue grew by more than 80% worldwide YoY, including 137% in the U.S. The company is looking to keep up amid intense competition in the PFA market.

“Our PFA trajectory is strong, and we’re progressing on multiple billion‑dollar opportunities,” Martha said.

Overall, Medtronic’s cardiovascular business brought in revenue of $3.46 billion in the quarter, representing growth of nearly 14% over the year‑ago period.

0

Comments

Want to join the conversation?

Loading comments...