SpendRule Launches AI-Powered Contract Intelligence Platform with OSF HealthCare and MemorialCare

•February 17, 2026

0

Why It Matters

The technology promises to recover billions in wasted spend for hospitals while streamlining AP processes, reshaping how healthcare providers manage service contracts.

Key Takeaways

- •Purchased services spend totals $323 billion in U.S. hospitals.

- •SpendRule adds contract terms as fourth validation layer.

- •AI automates compliance, catching $32 billion annual overpayments.

- •Platform integrates with existing ERP/AP without disruption.

- •Early adopters include OSF HealthCare, MemorialCare, Kettering.

Pulse Analysis

Hospitals face a massive financial challenge: non‑labor services—housekeeping, IT, food, and more—represent a $323 billion spend that is notoriously opaque. Traditional three‑way matching checks purchase orders, receipts, and invoices, but it cannot verify whether the invoice aligns with nuanced contract clauses such as volume discounts or service level penalties. This gap has allowed an estimated $32 billion in preventable overpayments to slip through each year, prompting providers to seek smarter, data‑driven solutions.

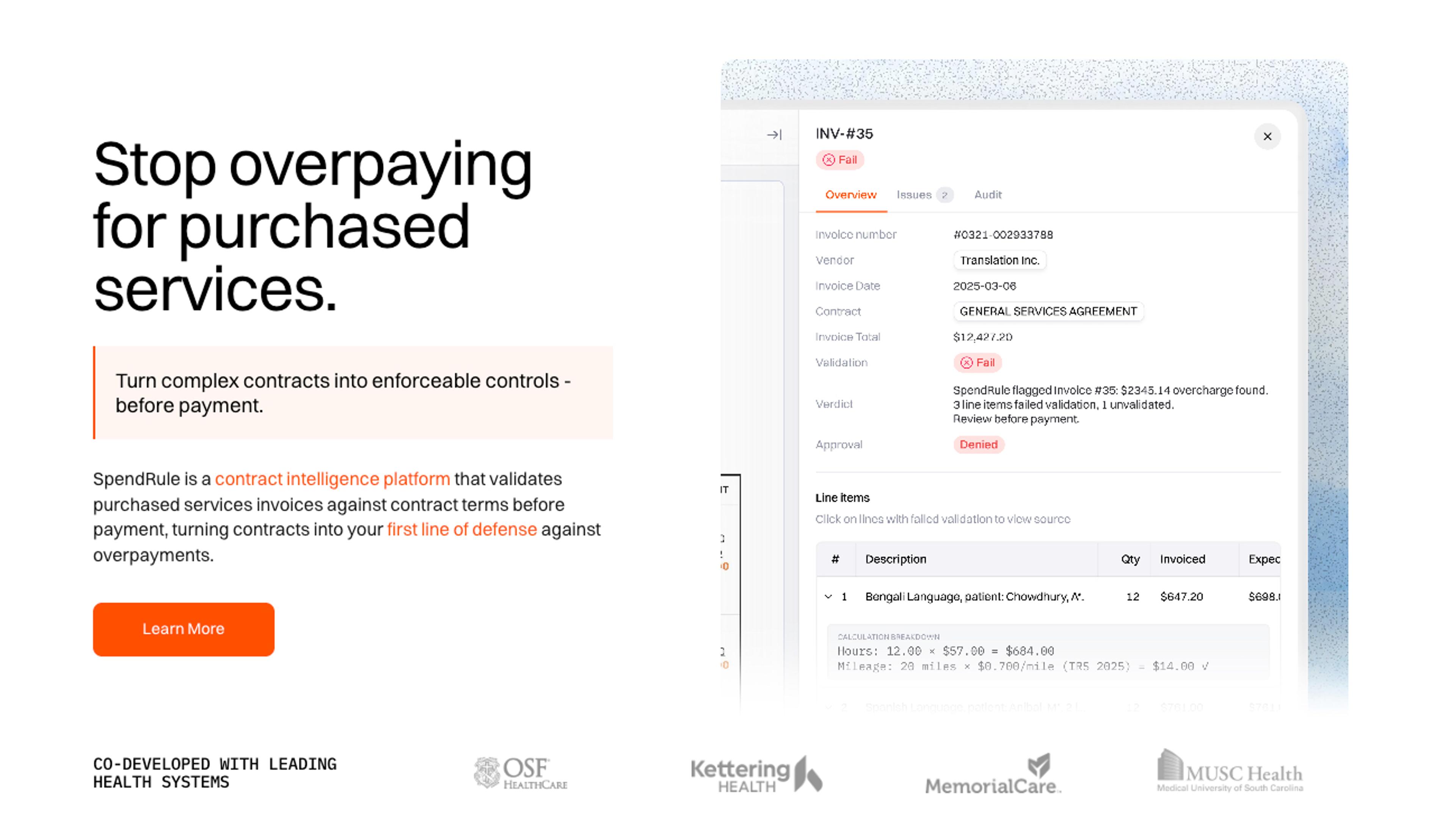

SpendRule’s platform tackles this inefficiency by converting contracts into executable code and embedding that logic directly into existing accounts payable workflows. The AI engine performs a "4‑Way Match," comparing the invoice not only to the PO and receipt but also to the digitized contract terms before any payment is issued. Discrepancies are highlighted in real time, allowing finance teams to resolve issues upstream without disrupting ERP or AP systems. The solution’s low‑code integration model means hospitals can adopt the technology without costly system overhauls, preserving legacy investments while gaining immediate compliance benefits.

The market response has been swift. Backed by investors like Abundant Venture Partners and the MemorialCare Innovation Fund, SpendRule has already rolled out across major health systems including OSF HealthCare, MemorialCare, Kettering Health and MUSC Health. As providers grapple with tightening margins and heightened scrutiny over spend management, the platform’s ability to automate contract enforcement positions it as a strategic asset. Analysts expect broader adoption across the healthcare sector, potentially reshaping the economics of purchased services and setting a new standard for AI‑enabled financial governance.

SpendRule Launches AI-Powered Contract Intelligence Platform with OSF HealthCare and MemorialCare

What You Should Know

-

The Launch: SpendRule has officially launched its AI-powered contract intelligence platform, backed by investors like Abundant Venture Partners and MemorialCare Innovation Fund.

-

The Problem: “Purchased Services” (non-labor spend like housekeeping, IT, and food service) represent a $323 billion category where hospitals often overpay due to complex contracts. Industry estimates suggest $32 billion is wasted annually on preventable overpayments.

-

The Solution: SpendRule introduces “4-Way Matching.” While traditional systems match the Purchase Order, Receipt, and Invoice, SpendRule adds the Contract Terms as a fourth layer of validation before payment is made, automating compliance for complex service agreements.

The “4-Way Match” Innovation

Standard accounting relies on a “3-Way Match”: The Purchase Order, the Receiving Document, and the Invoice. If those three agree, the bill gets paid.

But for services, this fails. If a laundry vendor invoices for “5,000 lbs of linen,” the 3-way match confirms you received the linen. It doesn’t check if the contract specified a volume discount at 4,000 lbs that the vendor “forgot” to apply.

SpendRule introduces 4-Way Matching:

-

Purchase Order

-

Receipt

-

Invoice

-

Contract Terms

By validating the invoice directly against the digitized contract logic before payment, the platform catches discrepancies upstream.

SpendRule addresses this gap by turning purchased services contracts into enforceable logic operating directly within existing accounts payable workflows. “Most purchased services contracts sit in a filing cabinet – literal or digital – disconnected from the payments they’re supposed to govern,” said Joseph Akintolayo, CTO and co-founder of SpendRule. “We change that by turning those agreements into code – encoding the actual terms, conditions, and obligations into real-time payment controls. This enables true 4-way matching – Purchase Order, Receipt, Invoice, and Contract Terms – automatically validating invoices against their contract before payment. Discrepancies are flagged with evidence and resolved upstream, without disrupting existing ERP or AP systems.”

SpendRule enters the market with significant momentum, having already deployed across major systems including OSF HealthCare, Kettering Health, MemorialCare, and MUSC Health.

0

Comments

Want to join the conversation?

Loading comments...