Social•Feb 20, 2026

S&P Reverses Gains, Slides Downward After Recent Surge

S and P now down on the day (reversing 45 handles in last few minutes) From an hour ago... on @thestreetpro Dougie Kass Ludacris Day? @dougkass

By Doug Kass

Social•Feb 20, 2026

Ex‑US Value Soars, Advisors Still Underweight Benchmark

Value ex-US ripping again this year, spreading to US value too. Not a lot of discussion about it in my world yet. Every advisor we speak to still way underallocated relative to benchmark...

By Meb Faber

Social•Feb 20, 2026

Cooling Volatility Triggers Machine Re‑Leverage, Expect Upward Grind

Volatility is cooling. 30D realized volatility (yellow line) just rolled over and is now below 90D (blue line). When short-term vol drops, the machines re-lever. Vol control funds start buying. Right now, the signal says grind higher until proven otherwise.

By Kurt S. Altrichter

Social•Feb 20, 2026

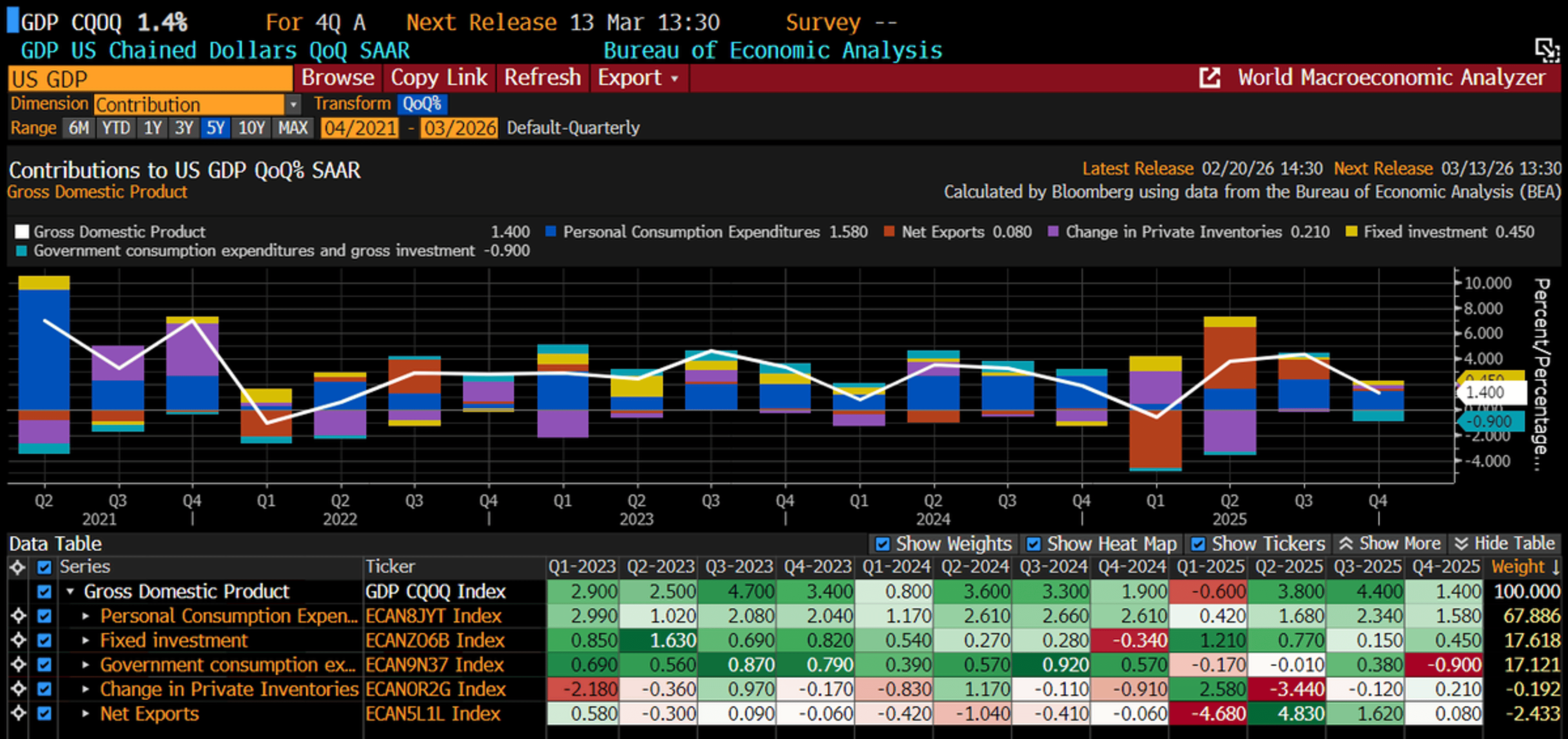

US Q4 Growth Stalls at 1.4% Amid Shutdown

The US econ grew less than expected in the fourth quarter, weighed down by a record-long govt shutdown, weaker consumer spending, and softer trade. GDP expanded at an annualized rate of 1.4% in Q4, down sharply from 4.4% in Q3....

By Holger Zschaepitz

Social•Feb 20, 2026

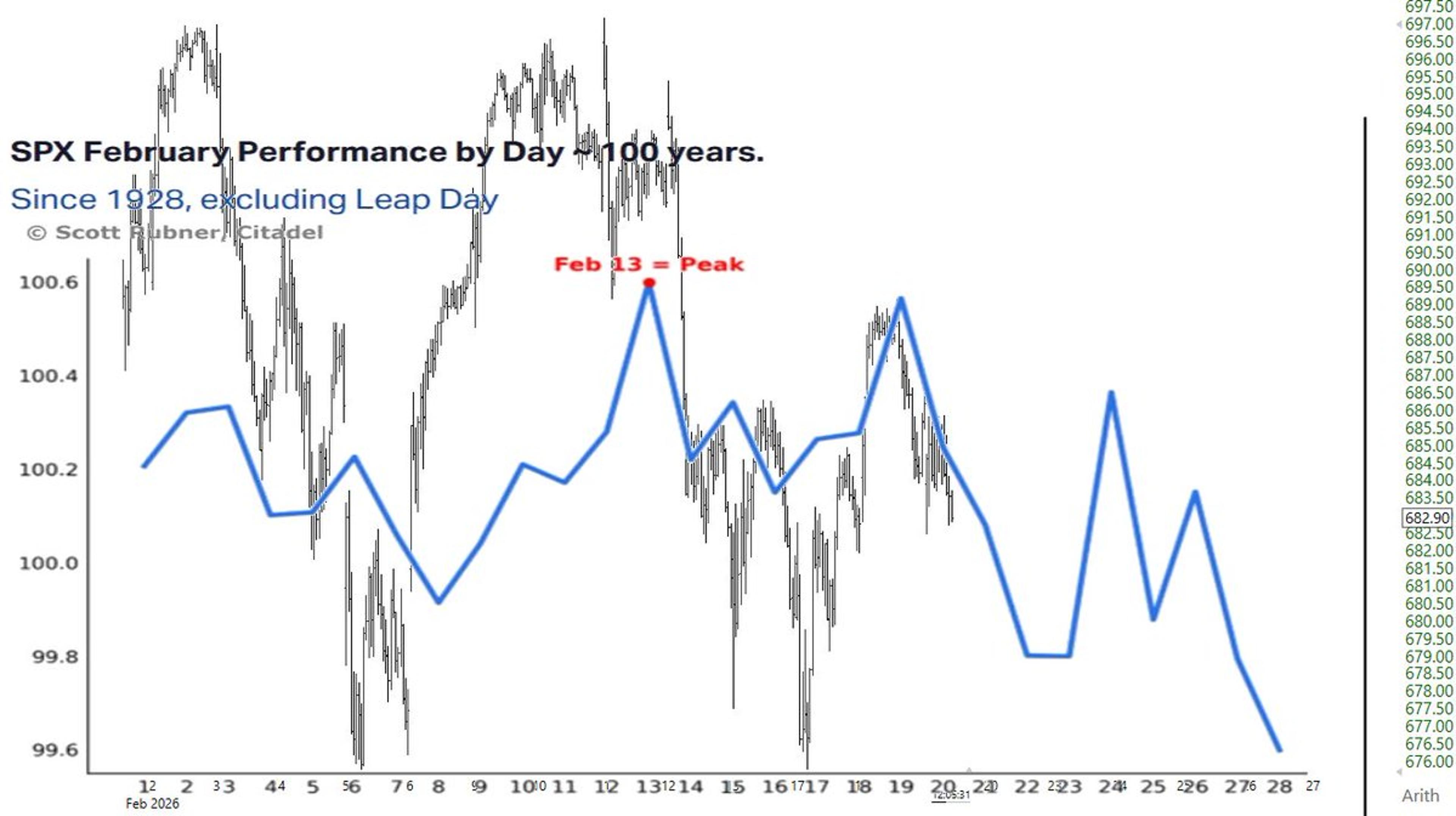

Current Feb Mirrors Century‑Long SPY Performance Trends

$SPX.X $SPY Feb performance by day 100 years overlaid on MTD action of SPY https://t.co/x1W4uABOCj

By Brian Shannon, CMT

Social•Feb 20, 2026

Short the Rips, Buy the Dips: Grinder’s Strategy

Grinder on the short side of the Indices for several months. Short the rips, buy the dips... for now, Bill. @DougKass

By Doug Kass

Social•Feb 20, 2026

VWAP Highlights Week-Long Choppiness Across Major Indices

The 🔵WTD ⚓️VWAP tells the story of the choppy week in $ES_F $SPY $NQ_F $QQQ https://t.co/ihrFlZV1FZ

By Brian Shannon, CMT

Social•Feb 20, 2026

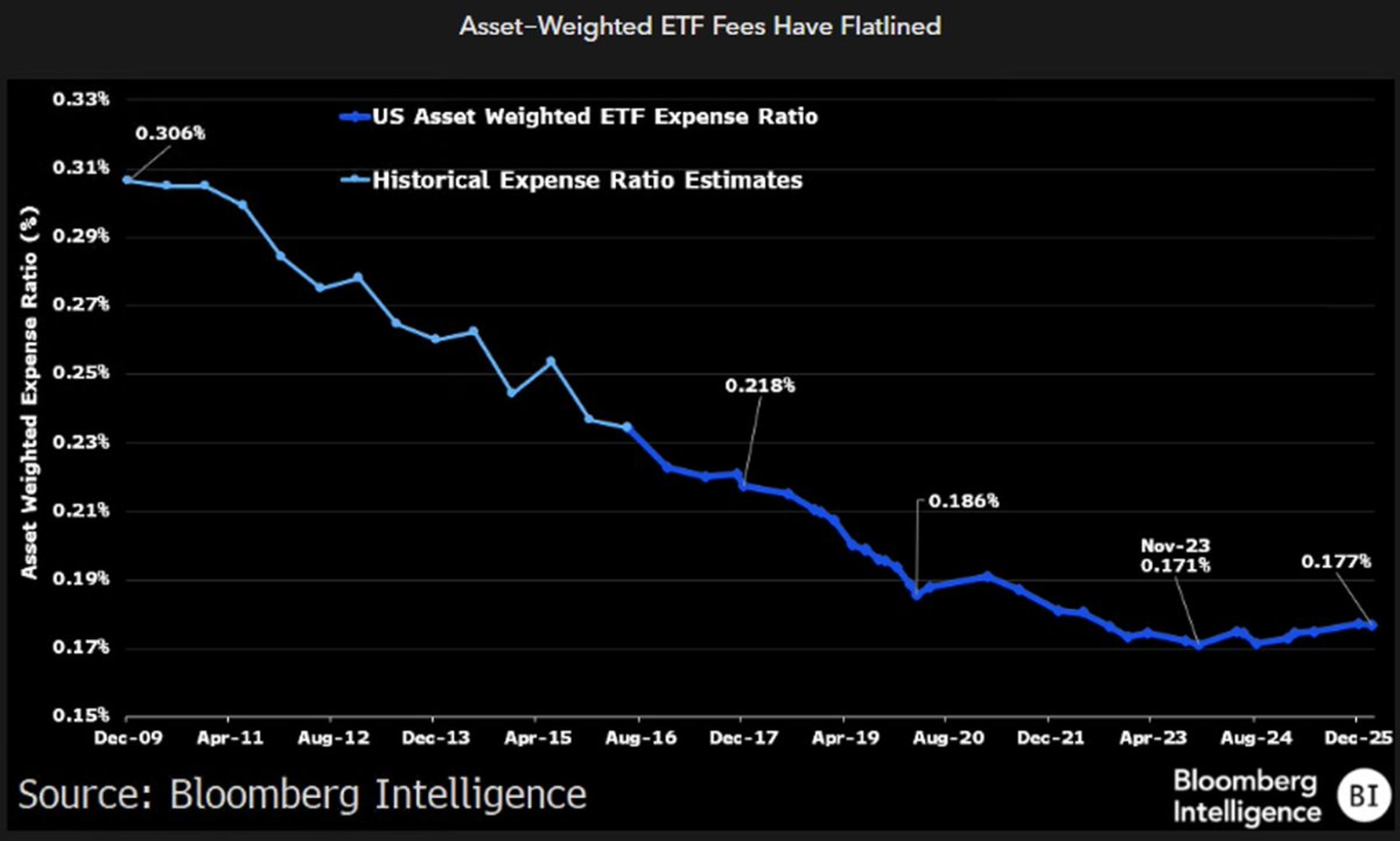

ETF Fees Halt Decline as Higher‑cost Products Gain Traction

The race to zero has hit a wall as the asset weighted average ETF fee has finally stopped its descent and even reversed a bit (this chart is one of the scariest, albeit slow moving ones for Wall St, equiv...

By Eric Balchunas

Social•Feb 20, 2026

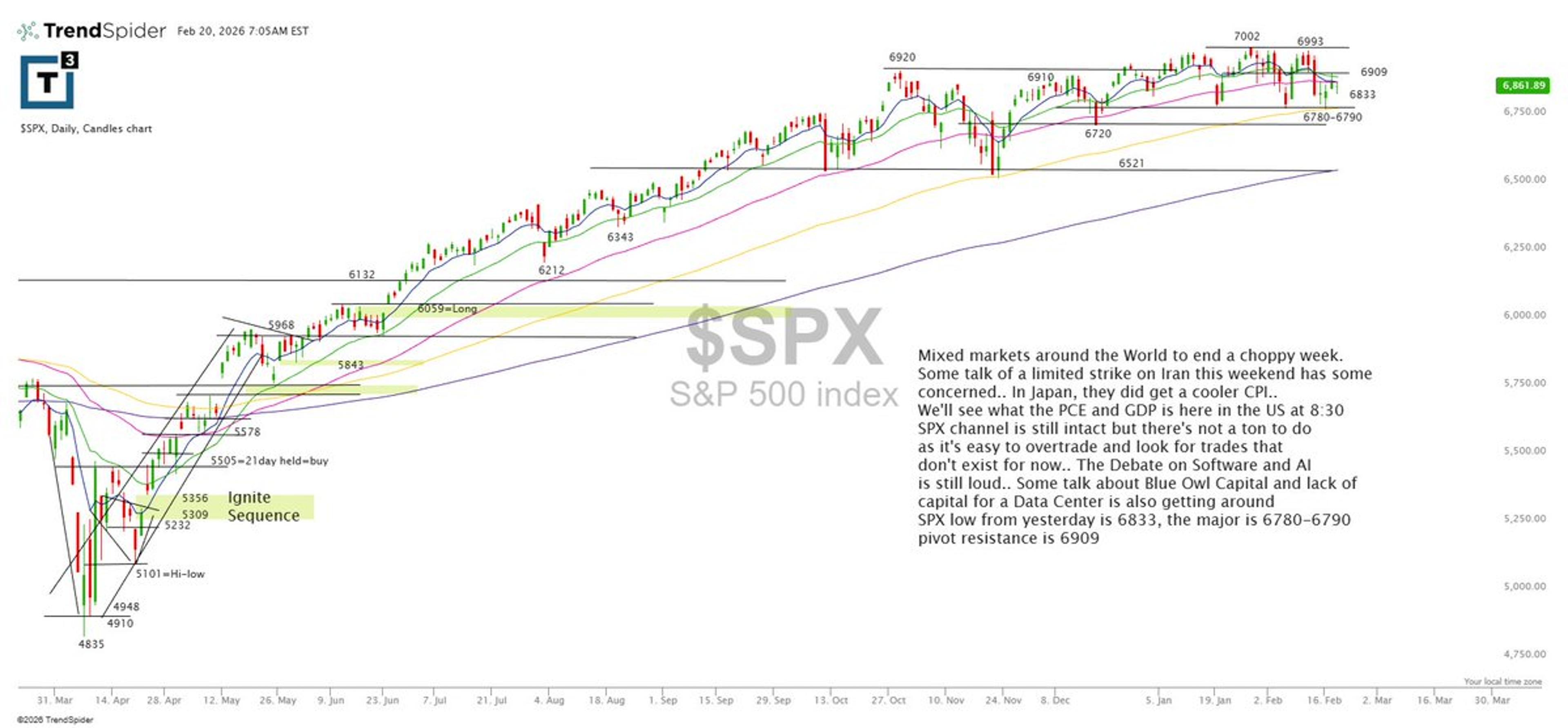

SPX Holds Channel—Stay Selective, Await Clean Setups

$SPX is still holding its channel, it’s an easy tape to overtrade, so stay selective and wait for clean setups. Key levels: support 6780–6790, yesterday’s low 6833, and pivot resistance 6909, with PCE and GDP on deck at 8:30. https://t.co/lvzBNkDdkK

By Scott Redler

Social•Feb 20, 2026

Software’s Value Mispriced; Embedded Platforms Gain From AI

Software Is Not Dead. It’s Being Mispriced. AI disruption fears, multiple compression, and why embedded platforms may be the real beneficiaries of automation. Read here: https://www.leadlagreport.com/p/software-is-not-dead-its-being-mispriced

By Michael A. Gayed, CFA (Lead-Lag Report)

Social•Feb 20, 2026

US Stock Market Hits Record Concentration: Top 10 Own 40%

🚨US market concentration BUBBLE in one chart: The top 10 US stocks make up a record 40% of the S&P 500 market value. At the same time, the weight of the largest stock in the S&P 500 relative to the 75th percentile...

By Global Markets Investor (newsletter author)

Social•Feb 19, 2026

McGough’s CVNA Sell Call Beats CNBC’s Coverage

Great SELL call by McGough @HedgeyeRetail on $CVNA that CNBC failed, once again, to cover

By Keith McCullough

Social•Feb 19, 2026

Buybacks Drop as Capex Takes Priority, ESO Dilution Fades

There are two reasons why buybacks are falling and likely to fall more 1. CApex as a use of FCF is deemed more important than share count reduction or SBC dilution offset 2. To the extent stocks fade the ESO awards provided...

By Andy Constan

Social•Feb 19, 2026

China Cuts US Treasury Holdings to Crisis Low

🚨Chinese officials had urged banks to limit purchases of US government bonds, and instructed those with high exposure to SELL their positions. Data shows China’s holdings of US Treasuries fell to $682.6 billion, the lowest since the Financial Crisis.👇 https://globalmarketsinvestor.beehiiv.com/p/is-the-us-dollar-gradually-losing-its-safe-haven-status

By Global Markets Investor (newsletter author)

Social•Feb 19, 2026

TCS Likely to Meet Lower Targets Despite Chart Decline

TCS will still achieve my lower targets I think - the chart is already wrecked - targets given by Indiacharts Research

By Rohit Srivastava