Video•Feb 20, 2026

WMT Downgrade, DECK Upgrade, TXRH Double Miss in Earnings

Texas Roadhouse (TXRH) gained Friday morning despite posting a double miss in earnings. HSBC downgraded Walmart (WMT) to hold from buy over growth concerns. Deckers (DECK) stepped up thanks to an upgrade from Argus. Diane King Hall talks about the analyst and earnings movers to watch on the last day of the trading week. ======== Schwab Network ======== Empowering every investor and trader, every market day. Subscribe to the Market Minute newsletter - https://schwabnetwork.com/subscribe Download the iOS app - https://apps.apple.com/us/app/schwab-network/id1460719185 Download the Amazon Fire Tv App - https://www.amazon.com/TD-Ameritrade-Network/dp/B07KRD76C7 Watch on Sling - https://watch.sling.com/1/asset/191928615bd8d47686f94682aefaa007/watch Watch on Vizio - https://www.vizio.com/en/watchfreeplus-explore Watch on DistroTV - https://www.distro.tv/live/schwab-network/ Follow us on X – https://twitter.com/schwabnetwork Follow us on Facebook – https://www.facebook.com/schwabnetwork Follow us on LinkedIn - https://www.linkedin.com/company/schwab-network/ About Schwab Network - https://schwabnetwork.com/about #walmart #deckers #texasroadhouse #economy #finance #investing #marketnews #stock #stockmarket #trading #live #schwabnetwork #wmt #deck #txrh #earnings #guidance #retail #ecommerce #shoes #ugg #hoka #restaurant #chart

By Schwab Network (ex‑TD Ameritrade Network)

Video•Feb 20, 2026

Stocks Slide as Oil Jumps on Rising US-Iran Tensions | The Close 2/19/2026

The Close highlighted a sharp equity sell‑off on Feb 19, 2026 as Brent crude surged to its highest level since July amid escalating U.S.–Iran tensions. The S&P 500 slipped about 0.6% and the Nasdaq 100 fell roughly 0.7%, while the VIX nudged back...

By Bloomberg Television

Video•Feb 19, 2026

Figma's AI Outlook, Blue Owl Stokes Credit Concerns | Bloomberg Businessweek Daily 2/19/2026

Bloomberg Businessweek Daily highlighted two contrasting stories on Thursday, February 19: Figma’s AI‑driven growth trajectory and Blue Owl Capital’s liquidity curtailment in a private‑credit fund. The market backdrop featured modest equity declines, a VIX edging toward 21, and oil prices...

By Bloomberg Television

Video•Feb 19, 2026

Charting DE After Earnings Send Shares to All-Time High

Agriculture companies have taken a much bigger investor focus to start 2026, and no company may have muscled more gains than Deere & Co. (DE). Shares of the company have climbed more than 40% in the last few weeks, helped...

By Schwab Network

Video•Feb 19, 2026

Amazon Dethrones Walmart

The video highlights that Amazon finally eclipsed Walmart in total sales for 2025, reporting $717 billion versus Walmart’s $713.2 billion, cementing a shift from the traditional Walmart‑Target rivalry to a direct Amazon‑Walmart showdown. Analysts note Walmart’s strategic pivot toward technology: a $40 billion free‑cash‑flow...

By Yahoo Finance

Video•Feb 19, 2026

"Damage Already Done" To MSFT? Sell-Off Presents New Mag 7 Opportunity

Microsoft (MSFT) hit 9-month lows and currently trades around $400 after shares hit $555 last summer. @CharlesSchwab's Ben Watson highlights key levels in Microsoft's chart that offer opportunities for bulls following the Mag 7 stock's substantial repricing. Kevin Hincks joins...

By Schwab Network

Video•Feb 19, 2026

'The Markets Are Fine but the Gyrations Under the Hood Have Become a Bit Unnerving': Basinger

The interview with Craig Bassinger, Chief Market Strategist at Purpose Investments, centered on how AI‑driven hype is unsettling equity markets despite the S&P 500 hovering near all‑time highs. Bassinger warned that headlines suggesting AI will upend industries—from wealth services to trucking—have sparked...

By BNN Bloomberg

Video•Feb 19, 2026

Microsoft Investing Into 'Infrastructure to Make Sure Their Business Stays Competitive': O'Connell

John O'Connell, chairman and CEO of Davis Ray, used the interview to highlight Microsoft’s aggressive infrastructure spending as a defensive moat against the AI‑driven market panic. He argued that while headlines warn AI will render traditional software obsolete, Microsoft, Amazon and...

By BNN Bloomberg

Video•Feb 19, 2026

The Close for Wednesday, Feb. 18, 2026

The Close segment recapped the day’s market outlook, highlighting upcoming earnings from RioCam and IA Financial, a slump in Canadian housing prices, Japan’s $36 bn investment in U.S. energy and minerals, Berkshire Hathaway’s portfolio shift, and General Motors’ $63 m Oshawa plant...

By BNN Bloomberg

Video•Feb 19, 2026

IA Financial Tumbles on Q4 EPS Miss

IA Financial’s shares tumbled after the insurer reported fourth‑quarter core earnings per share that fell short of analyst expectations, prompting a sharp market reaction. The company’s president and CEO Denis Ricard appeared on a call to contextualize the miss, emphasizing that...

By BNN Bloomberg

Video•Feb 19, 2026

RioCan Sees Rising Demand From Leading Retailers

RioCan reported a fourth‑quarter profit increase despite lower revenue, citing a surge in demand from leading retailers for its open‑air, necessity‑based shopping centres. CEO Jonathan Gitlin highlighted that Canada’s retail landscape remains robust, with limited supply of well‑located space driving a...

By BNN Bloomberg

Video•Feb 19, 2026

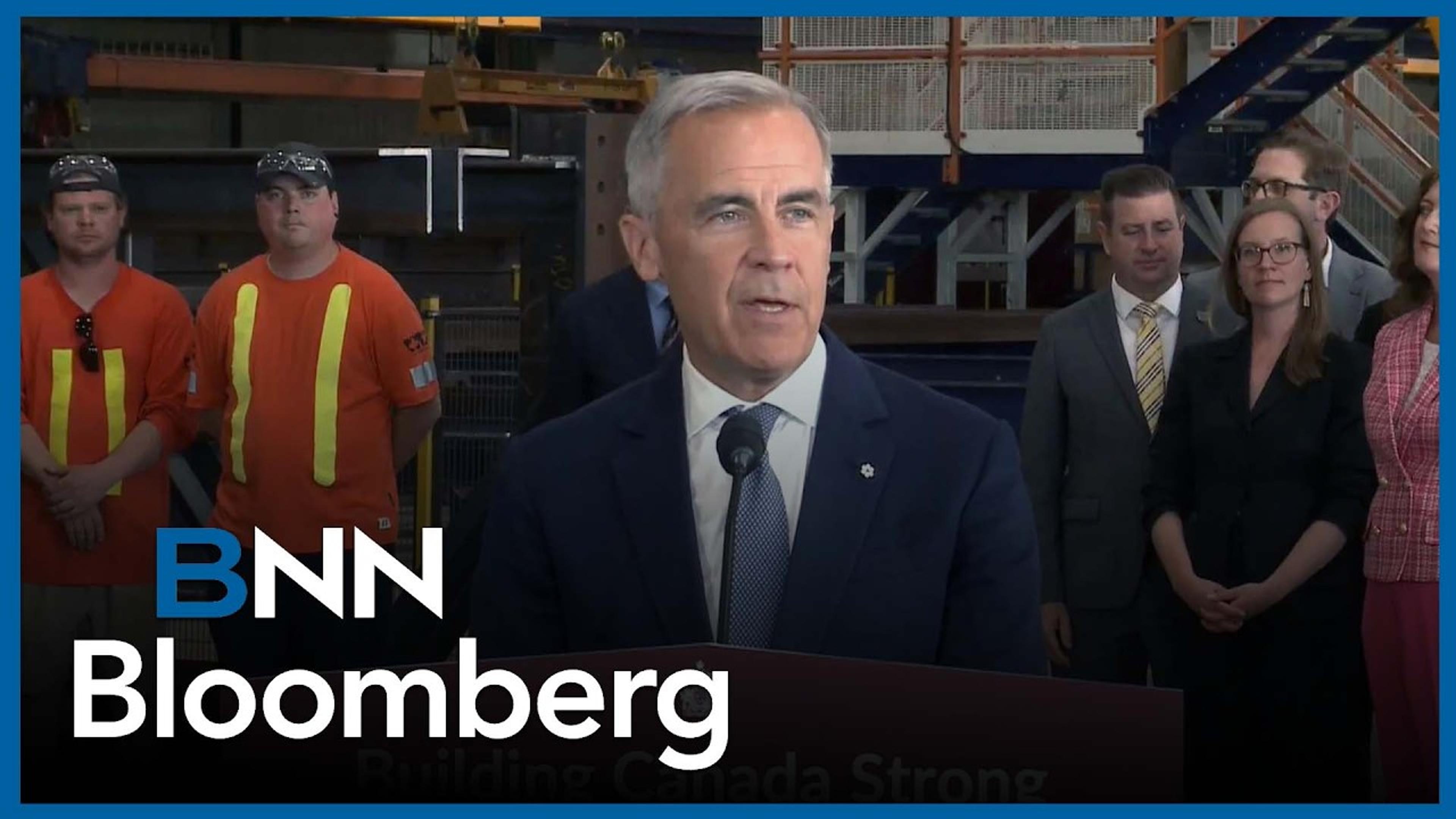

'New Canadian Government Has Really Taken the Opportunity to Focus on Areas We Can Control': Bai

The interview with John Bay, CIO of NEI Investments, centered on today’s market rally, a 3% oil price jump, and the broader impact of geopolitical tensions on North‑American equities. Bay linked the oil surge to stalled Russia‑Ukraine talks and heightened U.S.–Iran...

By BNN Bloomberg

Video•Feb 19, 2026

'This Is a Global Bull Market, and We Don't Think It's Going to End Any Time Soon': Detrick

Ryan Detrick, chief market strategist at Carson Group, told viewers that the S&P 500 is poised for double‑digit gains this year, underscoring a broader belief that the current rally is part of a global bull market that shows no signs of...

By BNN Bloomberg

Video•Feb 18, 2026

Squawk Box Asia - 19-Feb-26

Morgan Stanley’s Squawk Box Asia segment framed current market dynamics around technological innovation and changing consumer behavior, arguing these forces are driving significant growth and industry transformation. The piece emphasizes that navigating these trends requires strategic foresight and bespoke financial...

By CNBC International Live

Video•Feb 18, 2026

Bullish on AI, Realistic on Timing

The Money Talk podcast episode centered on the timing of artificial‑intelligence’s economic payoff, with TD Epic’s Kevin Hebner and TD Asset Management’s Michael Craig arguing that the promised profit surge is a long‑term story, likely beyond 2030, rather than an...

By BNN Bloomberg