Forecast: Tariff Policies Will Weaken Container Imports in First Half of 2026

•February 10, 2026

0

Why It Matters

Reduced import volumes tighten supply‑chain capacity and push higher costs onto U.S. consumers, while the pending court decision adds policy risk for import‑dependent firms.

Key Takeaways

- •2026 H1 container imports forecast down 2% YoY.

- •Full‑year 2026 TEU volume down 0.4% from 2024.

- •Supreme Court decision on IEEPA tariffs could reshape policy.

- •Potential new tariffs may increase cost uncertainty for shippers.

- •Forecast volatility hampers supply‑chain planning and pricing.

Pulse Analysis

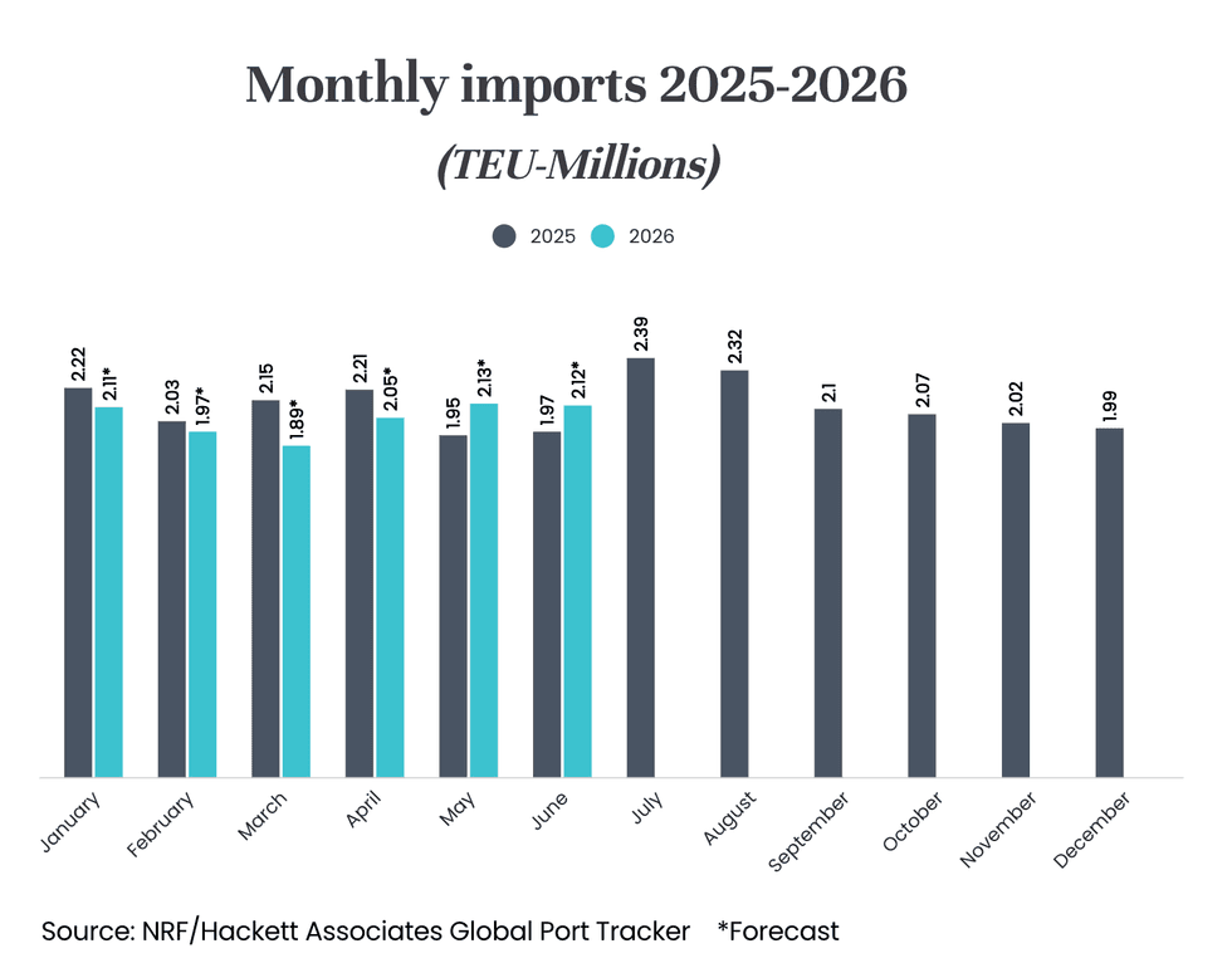

The NRF and Hackett Associates' Global Port Tracker report shows lingering tariff disputes curbing U.S. container traffic. After a flat 2025, the forecast predicts a 2 percent drop in TEU volume for H1 2026, to 12.27 million units. The decline follows a 6.6 percent YoY dip in December and reflects the shadow of the Trump administration’s IEEPA tariffs, still under Supreme Court review. If the Court strikes down those duties, policymakers may shift to other trade authorities, extending import uncertainty. Higher import costs ultimately flow to consumers, raising retail prices across categories.

For ports and logistics firms, the slowdown means tighter berth usage and lower throughput margins. Full‑year TEU volume is projected at 25.4 million, a 0.4 percent dip from 2024, reducing container moves and pressuring labor productivity. Shippers must now embed tariff‑related price volatility into freight contracts and inventory buffers. The May‑June rebound, driven by last year’s tariff‑induced slump, shows how policy swings can create artificial demand cycles that distort capacity planning. Equipment leasing firms also see tighter utilization, prompting renegotiations of lease terms.

Companies reliant on imports should adopt scenario‑based planning until trade policy steadies. Diversifying sourcing, locking longer‑term carrier agreements, and boosting digital supply‑chain visibility can soften the shock of sudden duties. Meanwhile, policymakers face pressure to deliver transparent, predictable rules that protect manufacturers and keep consumer prices stable. Financial teams can hedge exposure with commodity futures or tariff‑linked derivatives to smooth earnings. The upcoming Supreme Court ruling will test the industry’s ability to adapt, making strategic flexibility a key competitive edge.

Forecast: Tariff policies will weaken container imports in first half of 2026

Import volume at the nation’s major container ports is expected to see a significant year-over-year decline during the first half of 2026 as the impact of tariffs continues, according to the Global Port Tracker report released today by the National Retail Federation (NRF) and Hackett Associates.

Business interests have challenged the Trump Administration’s tariff policies in court, and a U.S. Supreme Court decision could come at any time on their legality under the International Emergency Economic Powers Act (IEEPA). However, if the court strikes down the IEEPA tariffs, there are concerns that the administration could implement tariffs under other trade authorities, creating further challenges and uncertainty, the report said.

“With tariffs still a matter of debate in the courts and in Congress, their effect on imports is being clearly seen,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said. “The situation underscores the need for clear and predictable trade policies that support supply chain certainty and reliability, business planning and consumer affordability. Tariffs are a tax on U.S. businesses that is ultimately paid by consumers through higher prices.”

And Hackett Associates Founder Ben Hackett said tariffs have brought “a global change in trade relations” that is affecting import volumes. “The continuing use of tariffs against friend and foe alike combined with the uncertainty of when or if they will be implemented makes trade forecasting very difficult,” Hackett said, adding that last year’s government shutdown is still making up-to-date government data difficult to come by. “Following essentially flat container import volumes in 2025 compared with 2024, we expect a decline during the first half of 2026 and likely longer.”

By the numbers, U.S. ports covered by Global Port Tracker handled 1.99 million twenty-foot equivalent (TEUs) in December, although the Ports of Houston and Charleston have not yet reported their data. That was down 1.7% from November and down 6.6% year over year. Imports for the full year in 2026 totaled 25.4 million TEU, down 0.4% from 25.5 million TEU in 2024.

Ports have not yet reported numbers for January, but Global Port Tracker projected the month at 2.11 million TEU, which would be up from December ahead of Lunar New Year factory shutdowns in Asia but down 5.2% year over year. February is forecast at 1.97 million TEU, down 3.1% year over year; March at 1.89 million TEU, down 12%; April at 2.05 million TEU, down 7.1%; May at 2.13 million TEU, up 9.3%, and June at 2.12 million TEU, up 8%.

Those numbers would bring the first half of 2026 to 12.27 million TEU, down 2% from 12.53 million TEU during the same period in 2025. The May and June results show a year over year increase largely because of the sharp drop-off in imports during those months last year after “Liberation Day” tariffs announced in April 2025.

0

Comments

Want to join the conversation?

Loading comments...