Why It Matters

A successful ramp‑up secures ATR’s dominance in regional aviation and safeguards the broader aerospace supply chain, while hybrid‑electric research could reshape future short‑haul travel.

Key Takeaways

- •2025 marked stabilization after supply‑chain disruptions

- •2026 target: increase turboprop deliveries amid rising demand

- •U.S. market revival central to ATR’s growth strategy

- •Hybrid‑electric research aims for 2029 technology roadmap

- •Competitors D328eco, Dash‑8, MA700 pressure ATR’s market share

Pulse Analysis

ATR’s recent interview with The Air Current signals a turning point for the European turboprop specialist after years of supply‑chain turbulence that rippled through its Toulouse hub. By 2025 the company claims it has restored production stability, a prerequisite for any meaningful capacity increase. This recovery is especially critical given the broader aerospace sector’s reliance on dependable regional aircraft to feed larger networks, and it underscores the importance of resilient supplier ecosystems in a post‑pandemic market.

Looking ahead, ATR’s 2026 agenda centers on a decisive output surge, with the United States identified as the primary growth engine. The firm plans to leverage its sole‑producer status in the turboprop segment to capture renewed demand from regional carriers seeking cost‑effective, short‑haul solutions. However, the competitive landscape is heating up: Deutsche Aircraft’s D328eco, De Havilland’s revived Dash‑8‑400 line, and China’s emerging MA700 all aim to erode ATR’s market share. The company’s strategy therefore blends aggressive production scaling with targeted market outreach to reinforce its incumbency.

Beyond immediate volume goals, ATR is charting a longer‑term technological shift toward hybrid‑electric propulsion, targeting a 2029 roadmap. This initiative reflects industry pressure to lower emissions and operating costs, and it could position ATR as a pioneer in next‑generation regional aircraft. The anticipated "massive investment" will fund research, certification pathways, and potential retrofits, ensuring the turboprop remains viable into its fifth decade. If successful, ATR could set a new benchmark for sustainable regional aviation, influencing fleet renewal cycles worldwide.

ATR maps out the rest of its decade

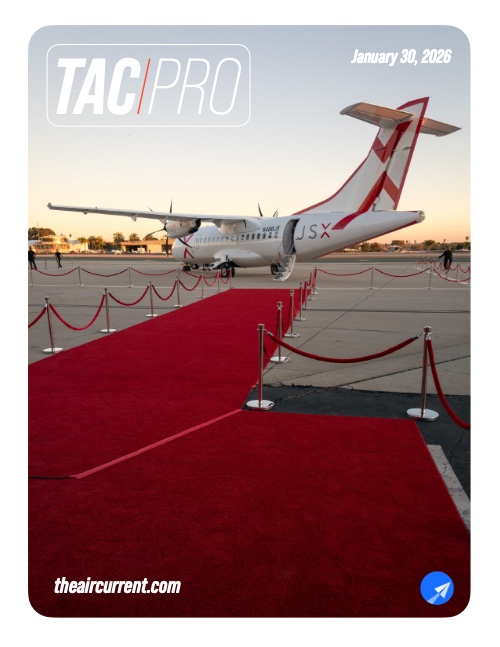

SANTA MONICA, Calif. — When the industry scrutinizes the health of the aerospace supply chain feeding manufacturing in Toulouse, turboprops from ATR are not the first aircraft that come to mind. The Airbus‑Leonardo joint venture builds in the shadow of Airbus’s final assembly lines at Blagnac Airport, but has not escaped the industrial struggles felt by its massive neighbor.

In a wide‑ranging interview with The Air Current, ATR CEO Nathalie Tarnaude Laude laid out the rest of the decade for the European turboprop manufacturer as it aims to move past a half‑decade of supply chain reconstitution, rebuild its dormant position in the United States and fully understand by 2029 what a hybrid‑electric evolution would look like for the venerable regional aircraft.

Tarnaud Laude described the company’s 2025 as a “very, very difficult” year spent preparing, though she said she is increasingly confident the plane maker last year reached “stabilization” for its production and is preparing for a significant acceleration in output on the back of resurgent demand.

Related: Special Report: ATR is making a run at its loneliest market

“This is the number one priority for 2026,” Tarnaud Laude said. “Really, the target is to ramp up and to deliver more aircraft, because this demand is there, because we are the only turboprop manufacturer today.”

Today — emphasis hers — is an important qualifier with Deutsche Aircraft’s 40‑seat D328eco expected to fly this year; De Havilland Canada continuing to evaluate the resumption of Dash 8‑400 production at its greenfield facility east of Calgary, Alberta; and signs of life from ATR’s nascent Chinese competitor, the Xi’an MA700. Tarnaud Laude said ATR’s strategy is designed to leverage its incumbency and set itself up for a “massive investment” that will push the turboprop into its fifth decade of production.

0

Comments

Want to join the conversation?

Loading comments...