AI Disrupts Financials. Bad Data Misleads On Economy.

•February 11, 2026

0

Why It Matters

AI‑enabled services are reshaping wealth management, forcing incumbents to accelerate digital transformation, while revised economic data temper growth expectations across markets.

Key Takeaways

- •Altruist adds AI tax planning, triggers financial stock sell‑off

- •Schwab, LPL, Morgan Stanley shares dip on AI competition fears

- •Author maintains overweight on banks despite short‑term volatility

- •Software ETF sell‑off deemed excessive, potential rebound expected

- •Q4 GDP revised to 3.7%, consumer spending slowdown noted

Pulse Analysis

Artificial intelligence is moving beyond hype and entering the core of wealth‑management workflows. Altruist’s new tax‑planning engine automates a traditionally high‑touch service, delivering personalized recommendations at scale. This capability threatens the fee‑based models of established broker‑dealers, prompting a defensive market reaction as investors scramble to reassess the competitive moat of legacy firms. The sell‑off underscores a broader narrative: fintech innovators can leverage AI to undercut pricing and capture market share faster than traditional institutions can adapt.

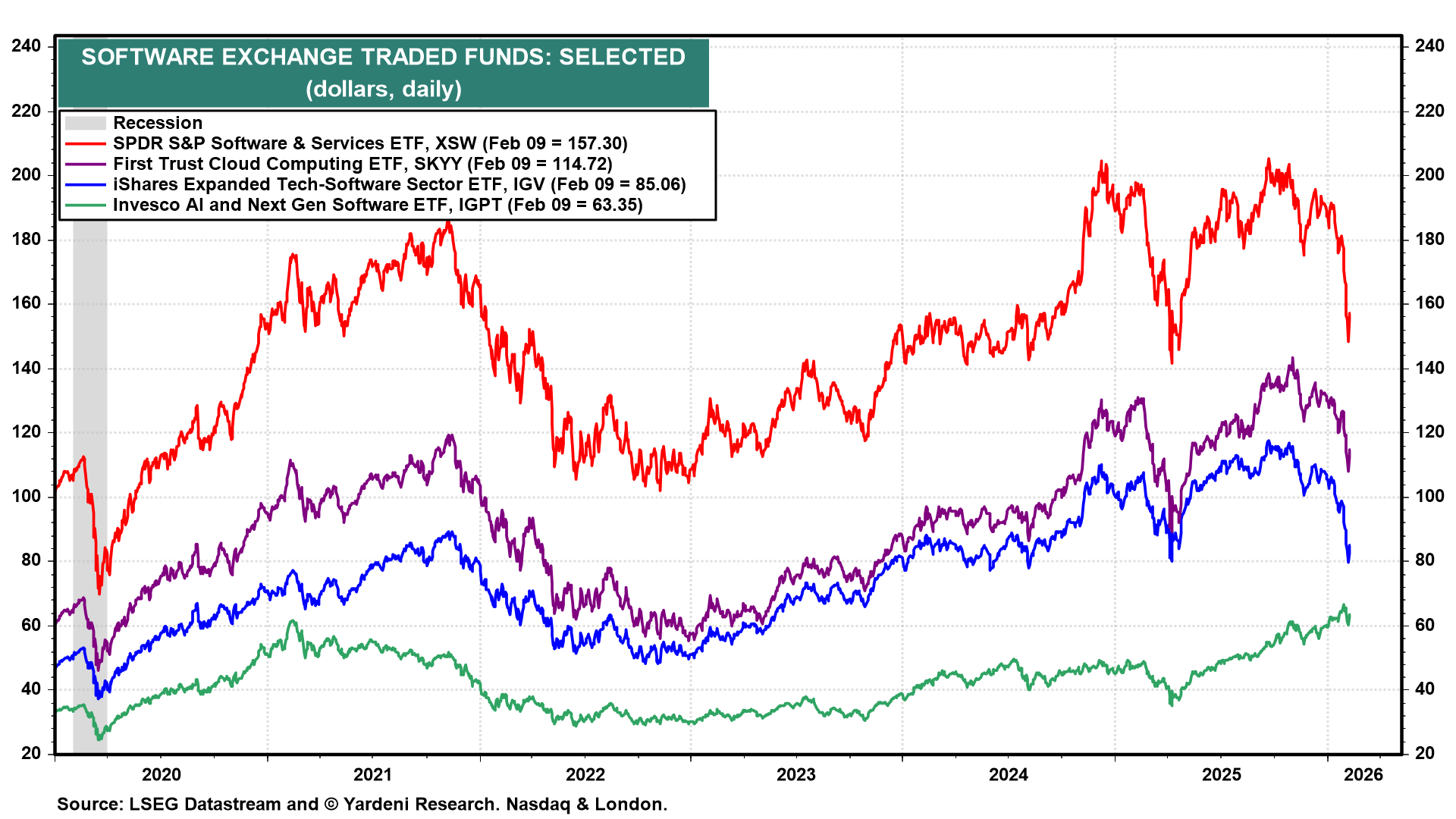

For the broader financial sector, the immediate volatility may mask longer‑term opportunities. Banks with robust data infrastructure—especially money‑center and regional banks—can integrate AI to enhance risk analytics, streamline compliance, and offer next‑generation advisory tools. Investment banks stand to benefit from AI‑driven deal sourcing and valuation models, potentially offsetting revenue pressure from wealth‑management displacement. Meanwhile, the software sector’s recent pullback appears premature; many AI‑focused ETFs remain undervalued as enterprises continue to invest in cloud‑based automation platforms.

Concurrently, macroeconomic indicators are being revised downward, with Q4‑2025 GDP now estimated at 3.7% and consumer spending growth slowing to 2.4%. These adjustments highlight the fragility of data‑driven forecasts and the importance of high‑quality inputs. As AI becomes a primary engine for data aggregation and real‑time analysis, market participants must scrutinize the provenance of economic metrics to avoid misreading trends. In this environment, firms that combine AI precision with rigorous data validation are poised to navigate uncertainty and capture incremental market share.

AI Disrupts Financials. Bad Data Misleads On Economy.

AI is an extremely disruptive technology. It has already turned on its masters: The software stocks have been pounded by fears that AI will make coders redundant (chart). Now it is turning on the financial industry.

The most direct hit today comes from news that Altruist, a wealth management startup, has launched new AI‑enabled tax planning features. This has sparked a “sell first, ask questions later” reaction among investors who fear that legacy firms will struggle to compete with AI‑automated services. Charles Schwab, LPL Financial, and Morgan Stanley got clipped. Nevertheless, we are sticking with our overweight recommendation for Financials, especially the money‑center banks, regional banks, and investment banks. We also think that the sell‑off in software stocks is overdone.

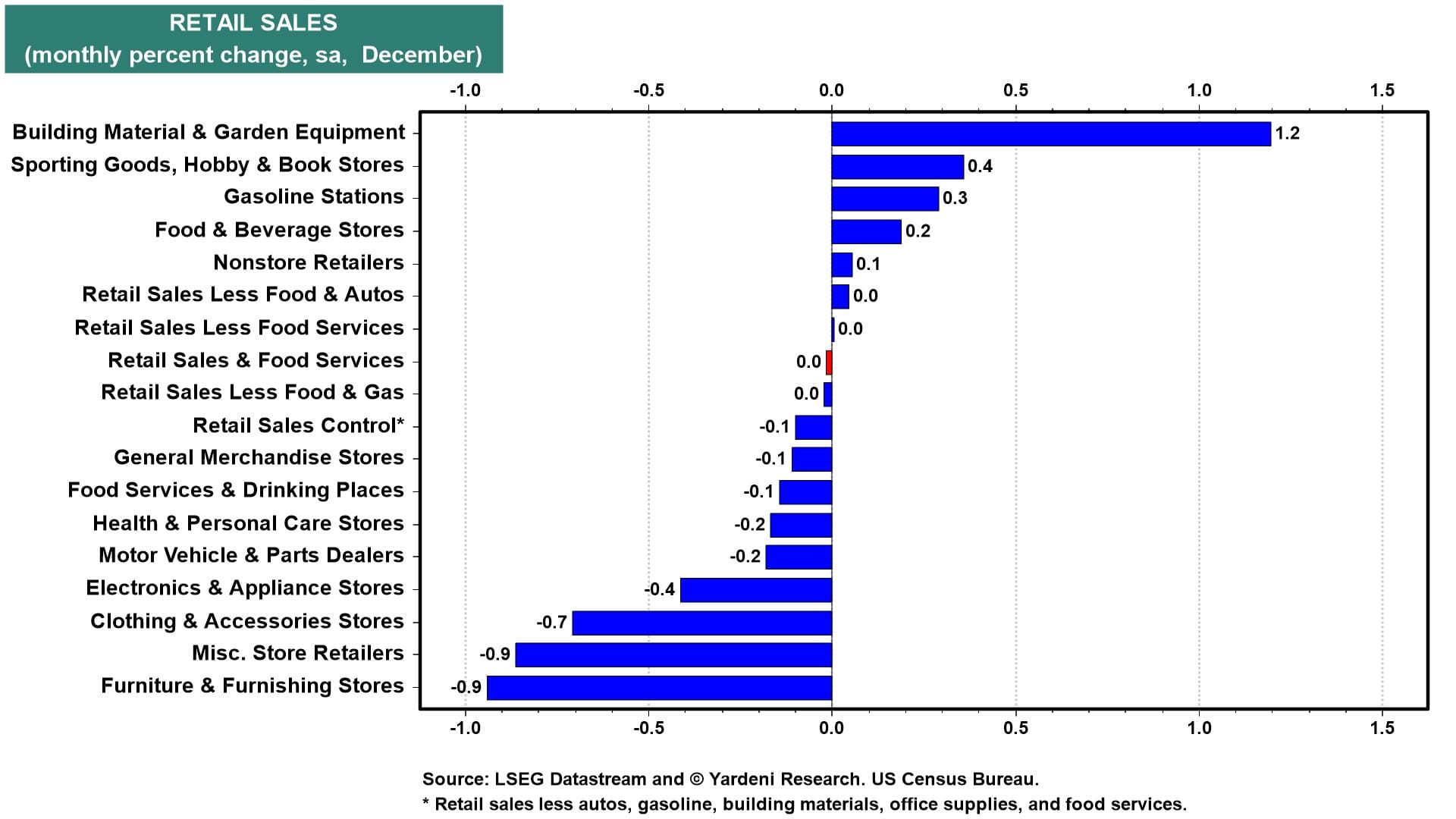

In economic news yesterday, January’s ADP private payroll employment rose just 22,000. Today, December’s retail sales growth was reported at 0.0 % m/m, with the control group down 0.1 % (chart). As a result, real GDP growth for Q4‑2025 was revised down from 4.2 % to 3.7 %, led by a drop in real consumer spending from 3.1 % to 2.4 %, according to the Atlanta Fed’s GDPNow.

As we’ve occasionally said in the past: any data that doesn’t support our forecast is either bad data or it will be revised to show we were right after all! Consider the following:

0

Comments

Want to join the conversation?

Loading comments...