AI Software Testing Startup BotGauge AI Raises $2 Mn Led by Surface Ventures

•February 10, 2026

0

Companies Mentioned

Why It Matters

The investment highlights accelerating demand for AI‑based testing tools, which can dramatically shorten release cycles and lower development costs across the software industry.

Key Takeaways

- •$2 million Series A led by Surface Ventures.

- •AI agents automate end‑to‑end software testing.

- •Funding targets product development and US market expansion.

- •Founded 2024 by four Indian tech entrepreneurs.

- •Aims to cut manual QA effort, speed releases.

Pulse Analysis

The software testing landscape is undergoing a rapid transformation as AI technologies mature. Traditional manual QA processes are increasingly seen as bottlenecks, prompting enterprises to adopt autonomous agents that can generate, execute, and analyze test cases at scale. BotGauge AI’s platform exemplifies this shift, offering a unified environment where AI orchestrates the entire testing pipeline, from test design to defect reporting, thereby freeing engineers to focus on higher‑value tasks.

BotGauge’s $2 million Series A, led by Surface Ventures, arrives at a time when venture capital is gravitating toward AI‑enabled developer tools. The participation of IA Seed Ventures and Saka Ventures signals broader market validation for AI‑first QA solutions. The funding will be allocated to accelerate product enhancements, recruit additional engineering talent, and establish a foothold in the U.S. market, where demand for rapid, reliable release cycles is especially high. This capital infusion positions BotGauge to compete with established players while scaling its autonomous testing capabilities.

For software firms, the emergence of platforms like BotGauge AI promises measurable efficiency gains. Automated testing can reduce regression testing time by up to 70%, cut defect leakage, and enable continuous delivery pipelines with greater confidence. As more organizations adopt AI‑driven QA, the competitive pressure on legacy testing vendors will intensify, driving further innovation and consolidation in the sector. BotGauge’s growth trajectory will be a bellwether for how quickly AI can become a standard component of the software development lifecycle.

AI software testing startup BotGauge AI raises $2 Mn led by Surface Ventures

By Gyan Vardhan · 10 Feb 2026 09:49 IST

/entrackr/media/media_files/2026/02/10/botgauge-ai-2026-02-10-08-54-35.png)

Software testing startup BotGauge AI has raised $2 million (around ₹17 crore) in a funding round led by Surface Ventures, with participation from IA Seed Ventures and Saka Ventures.

The fresh capital will be used to strengthen product development, expand its engineering team, and scale operations in international markets, including the United States.

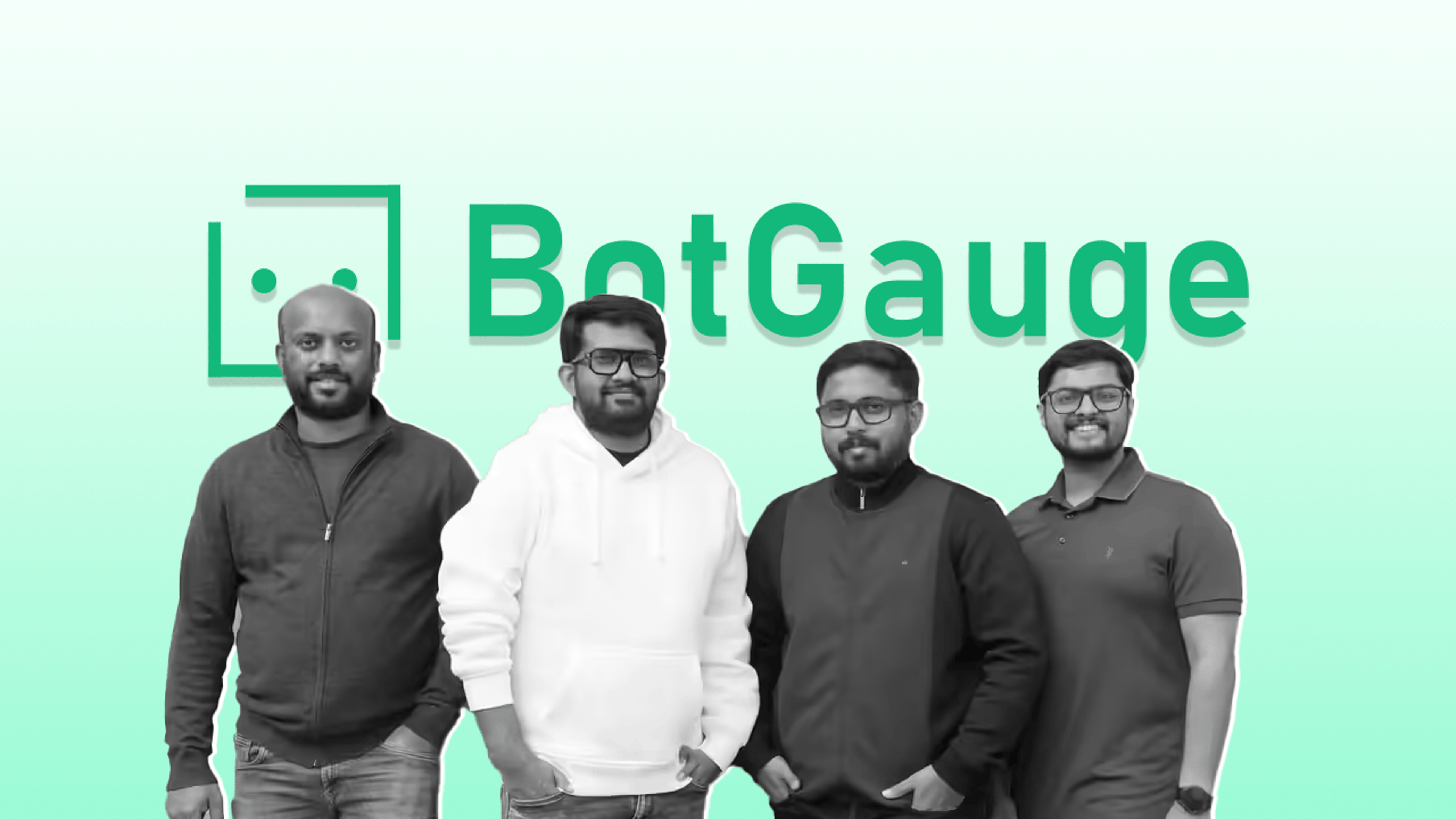

Founded in 2024 by Pramin Pradeep, Naresh Kumar Rajendran, Vivek Nair, and Sreepad Krishnan Mavila, BotGauge AI builds a software‑testing platform focused on automating quality‑assurance processes. The platform uses autonomous AI agents to handle end‑to‑end testing workflows.

BotGauge AI targets software teams looking to reduce manual testing effort and improve release cycles through automated QA systems.

Disclaimer: Bareback Media has recently raised funding from a group of investors. Some of the investors may directly or indirectly be involved in a competing business or might be associated with other companies we might write about. This shall, however, not influence our reporting or coverage in any manner whatsoever. You may find a list of our investors here.

0

Comments

Want to join the conversation?

Loading comments...