From Tea to Tech: UK’s Halma Rides Wave of Hyperscaler Spending

•February 16, 2026

0

Why It Matters

The earnings boost signals that legacy industrial firms can capture growth from AI‑centric cloud spending, reshaping UK market dynamics. Investors view Halma as a proxy for broader hyperscaler‑driven demand.

Key Takeaways

- •Halma shares rise eighth consecutive day

- •All‑time high stock price reached

- •Analysts forecast earnings boost from hyperscaler spending

- •Company evolved from tea to technology

- •AI data‑center demand drives revenue growth

Pulse Analysis

The rise of hyperscale cloud providers has turned AI infrastructure into a multi‑billion‑dollar market, prompting massive capex on data‑centres worldwide. In the UK, this trend is spilling over into traditional industrial groups that supply safety, monitoring and automation equipment for these facilities. Halma Plc, historically known for its tea‑plantation origins, now offers a portfolio of sensors, fire‑protection and diagnostic tools that are essential for high‑density server farms, positioning it to capture a slice of the AI‑driven spending wave.

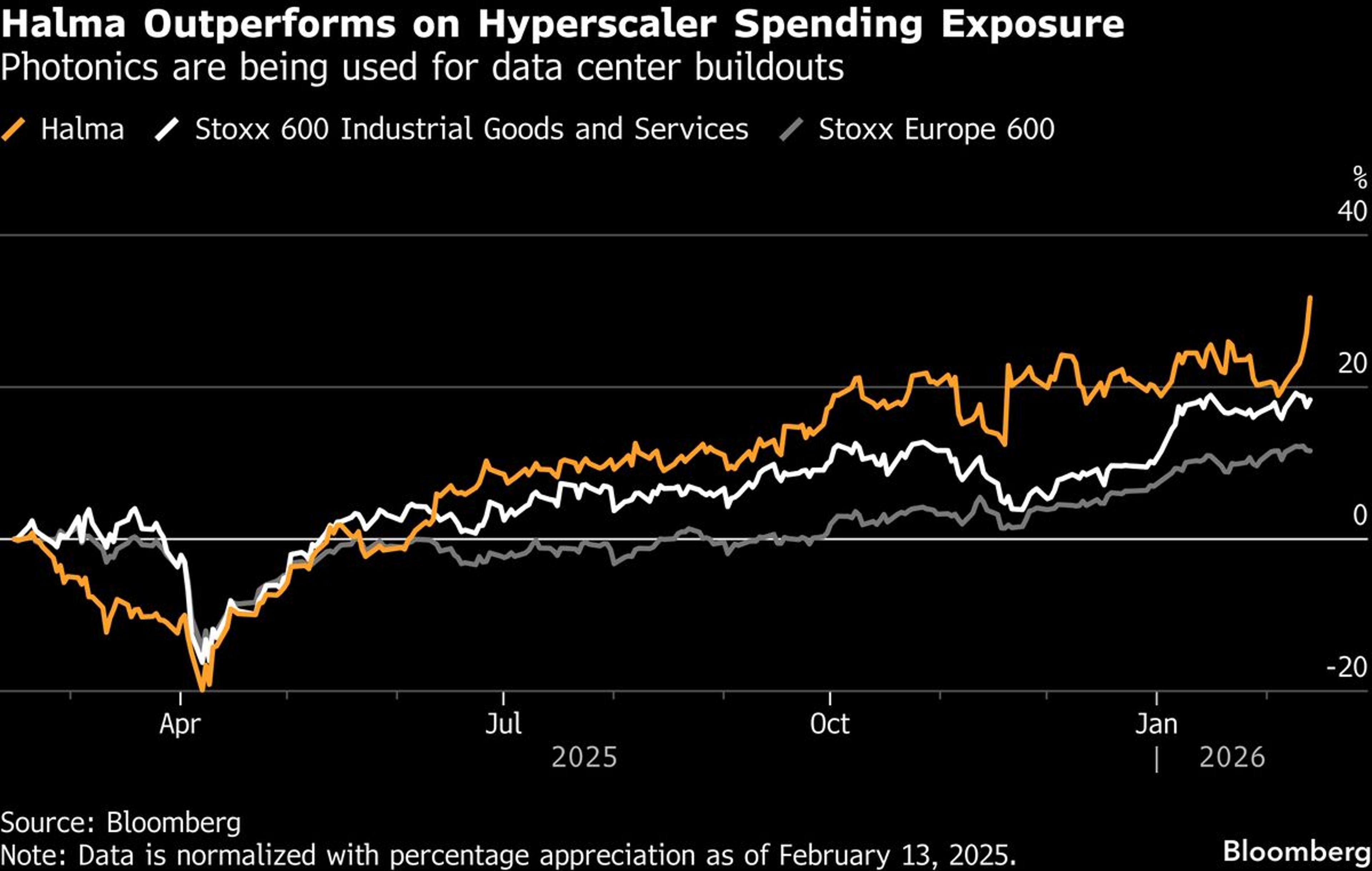

Market reaction has been swift. Halma’s stock has logged an eight‑day winning streak, pushing the share price to an unprecedented level. Barclays and JPMorgan analysts cite the company’s exposure to hyperscaler projects as a catalyst for earnings acceleration in the upcoming quarters. The firm’s diversified revenue streams—spanning life‑sciences, safety, and environmental technologies—provide a resilient base, while the AI‑focused data‑centre segment adds a high‑growth tail. This blend of stability and upside is resonating with investors seeking exposure to both defensive and emerging tech themes.

Looking ahead, Halma’s trajectory illustrates how legacy manufacturers can reinvent themselves amid the AI boom. Continued expansion of cloud infrastructure, especially in Europe, will likely sustain demand for the company’s safety and monitoring solutions. For shareholders, the stock’s momentum offers both capital appreciation and a hedge against broader market volatility. As hyperscalers deepen their AI investments, firms like Halma that embed intelligence into physical assets are poised to become indispensable partners in the next wave of digital transformation.

From Tea to Tech: UK’s Halma Rides Wave of Hyperscaler Spending

February 16, 2026 at 12:00 PM UTC · by Bloomberg AI

Takeaways

A FTSE 100 company whose origins trace back to 19th‑century tea plantations is riding the wave of AI‑driven data‑center spending.

Halma Plc shares were headed for an eighth‑straight gain on Monday — their longest winning run for two years — and trading at an all‑time high. The technology firm’s rally comes as analysts at banks including Barclays Plc and JPMorgan Chase & Co. predict an earnings boost from increased spending by so‑called hyperscalers.

0

Comments

Want to join the conversation?

Loading comments...