Oracle Shares Surge as Big Tech Spending Eases Software Worries

•February 9, 2026

0

Why It Matters

The heightened capex from leading tech firms validates demand for enterprise software and cloud infrastructure, bolstering Oracle’s growth outlook. It also signals that AI concerns may be receding as hardware investments rise.

Key Takeaways

- •Oracle shares rose 12% after Amazon's $200B capex pledge.

- •Big‑tech spending eases concerns over AI‑driven software competition.

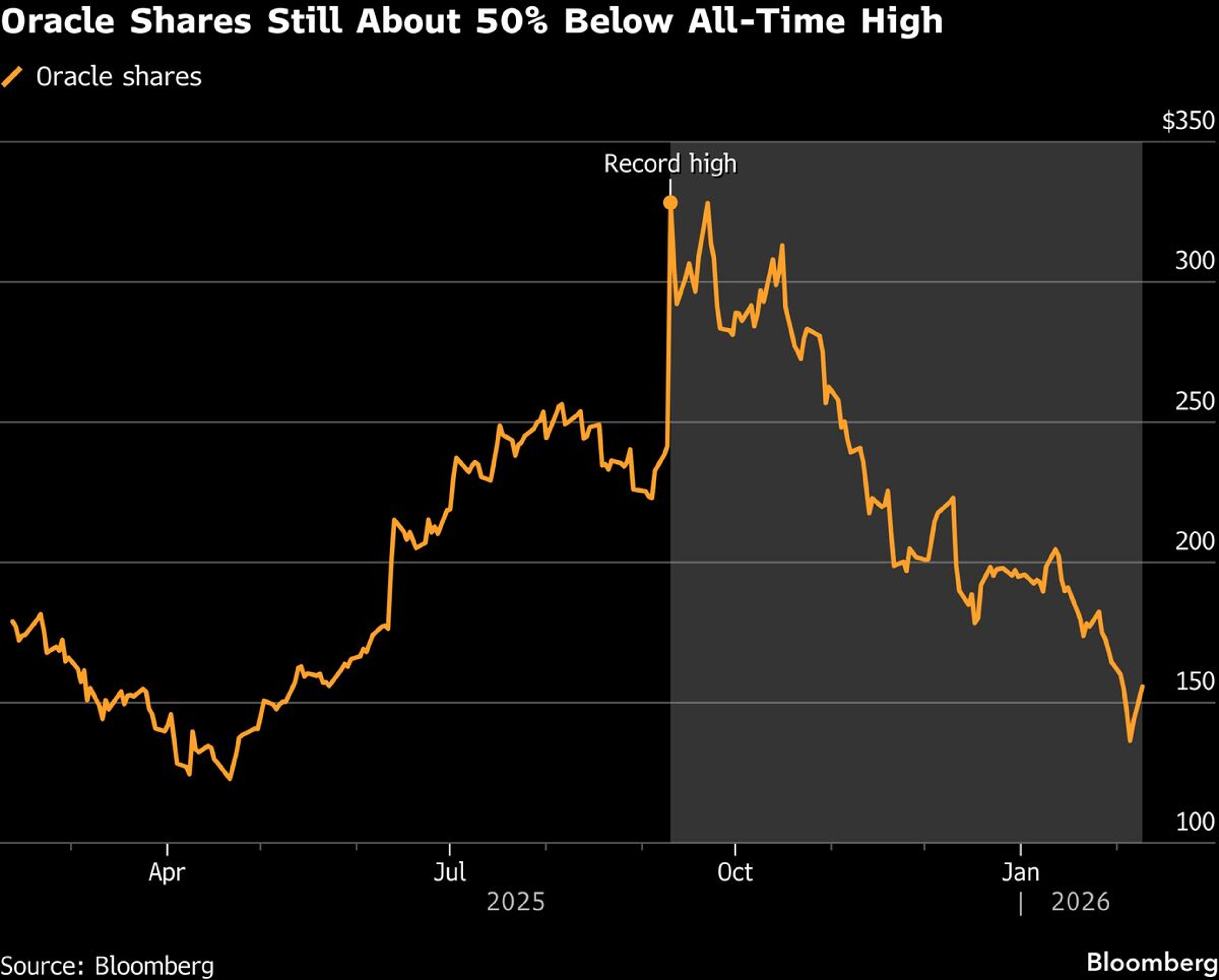

- •Stock remains ~50% below September peak despite rebound.

- •Oracle benefits from enterprise software demand amid AI hype.

- •Market views capex surge as tailwind for cloud providers.

Pulse Analysis

Oracle’s recent stock rally reflects a broader shift in investor sentiment toward enterprise software providers. After months of volatility driven by fears that generative AI could erode traditional software margins, the market is now rewarding firms that stand to benefit from the infrastructure spend required to power those models. Oracle, with its extensive database and cloud offerings, is positioned to capture a slice of the growing demand for high‑performance computing resources, which helps mitigate earlier concerns about AI‑induced disruption.

The catalyst behind the surge is the unprecedented $200 billion capital‑expenditure pledge from Amazon, signaling that the largest cloud players are committing massive resources to data centers, custom chips, and related equipment. This wave of spending ripples through the technology ecosystem, boosting demand for the underlying software stacks that manage, secure, and analyze massive data workloads. For Oracle, whose revenue streams include licensing, cloud services, and hardware integration, the increased capex translates into higher potential sales and longer‑term contracts with enterprises seeking to modernize their IT environments.

For investors, the rally offers a reminder that macro‑level capex trends can quickly reshape sector dynamics. While Oracle’s shares remain about half of their September peak, the current bounce suggests a floor has been established, with upside potential tied to continued big‑tech investment cycles. Analysts will watch whether the company can translate this hardware‑driven momentum into sustained software revenue growth, especially as competition intensifies from other cloud giants and emerging AI‑focused platforms. The interplay between capex intensity and software adoption will likely dictate Oracle’s performance throughout the year.

Oracle Shares Surge as Big Tech Spending Eases Software Worries

February 9, 2026 at 5:49 PM UTC

Oracle Corp. shares extended their rebound on Monday, as ramped‑up capex spending by U.S. technology giants helped soothe nerves over the threat posed to the company by developments in artificial intelligence.

Shares in the software bellwether rallied as much as 12%, their biggest intraday rise since Sept. 10. Even with that move — which came on the heels of Amazon.com Inc.’s pledge to spend $200 billion this year on data centers, chips and other equipment — the stock is down around 50% from its September highs.

0

Comments

Want to join the conversation?

Loading comments...