China Weekly Wrap: Markets, Macro & Tech

•January 25, 2026

0

Why It Matters

Understanding these nuanced market shifts helps investors navigate China’s uneven recovery and allocate capital toward sectors with genuine growth tailwinds. The episode’s focus on North Asia leadership underscores broader global supply‑chain and AI trends that are reshaping investment opportunities across the region.

China Weekly Wrap: Markets, Macro & Tech

Good Evening,

Another week flew by with lots of excitement in the China market. Quite a lot on macro in this note and a surprising amount of content too, for this time of year. Do dive in responsibly, but before you so, please check out the update on the property management companies we put out earlier.

We prepare this note over teh course of the week, and we’ve noticed that it is now runing at 3k words, occasionally more. We’re trying to add flags to titles for easier navigation, but overall we’re quite please that this note has evolved in to being the only weekly summary of china news that one needs to read on any given week.

IMPORTANT NOTE: We are presently in the process of getting a license with a major regulator, and while that process is ongoing we are not able to publish the portfolio update and company notes. We’ll do a big reveal of the new plans as soon as we’re in a position to do thusly. We apologise for it taking time, but this is unfortunately a fact of life. With that we’re also putting the opinion part of this behind the wall.

NOTE: Panda+ is now closed to new joiners. We thank everyone for their interest and custom.

Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.

[

](https://substackcdn.com/image/fetch/$s_!rzzx!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F6faf2eb6-3bcd-4949-a551-508ca13f4e91_604x360.jpeg)

📊 Weekly Relative Performance Observations

Week of 19–24 January 2026

📉 Broad Takeaway

Greater China delivered a constructive but still clearly two-speed tape this week, with offshore resilience contrasting with mixed onshore performance and continued weakness in large-cap exposures.

Onshore, the headline read was mixed: SSE Composite (+0.83%) finished higher while the CSI 300 (-0.62%) declined, but the internal picture was more nuanced. Shenzhen-led indices outperformed, with SZSE Composite (+1.11%) and SME Innovation (+2.92%) both finishing higher, while ChiNext (-0.34%) slipped modestly. In contrast, SOE-heavy / dividend / mega-cap exposures lagged (SSE Conglomerates -2.40%, Dividend -1.39%, Mega-cap -1.49%). In other words: growth and “new economy” held up, while carry and state-heavy factors softened.

Offshore, Hong Kong was modestly positive at the headline level. HSI (+0.36%) advanced slightly while Hang Seng Tech (-0.42%) edged lower, with participation more mixed across sectors. Utilities (+1.96%), Red Chips (+1.88%), and Property (+0.44%) outperformed, while Financials (-1.26%) lagged. Volatility moved higher (VHSI +2.90%), reinforcing the impression that positioning was active rather than complacent.

Across Asia, the regional scoreboard was still North Asia-led. Japan and Taiwan continued to lead clearly, while Hong Kong sat mid-pack. China onshore, meanwhile, remained mixed: Shenzhen held firm, but the Shanghai-heavy complex lagged.

Bottom line: Asia is still rewarding earnings leverage + growth + exporters, with North Asia firmly in control. Within China, leadership remains selective, with Shenzhen/growth holding up and SOE/dividend exposure lagging, while Hong Kong is contributing to Greater China beta without doing the heavy lifting.

🇨🇳 China A-shares

Weekly performance

SSE Composite: +0.83%

CSI 300: -0.62%

SZSE Composite: +1.11%

ChiNext: -0.34%

Shenzhen 100: +1.47%

SSE SME Innovation: +2.92%

SSE 50 / SSE 180: -1.54% / -0.87%

SSE Mid Cap / Mega-cap: +0.65% / -1.49%

SSE Commodity Equity: +6.30%

SSE Dividend Index: -1.39%

What stands out is the style dispersion:

Shenzhen/growth resilience: SME Innovation (+2.92%) led, confirming continued preference for innovation exposure.

Shanghai/mega-cap drag: Mega-cap (-1.49%) and the SSE 50 (-1.54%) weighed on the headline.

Carry/yield lagged: Dividend (-1.39%) underperformed, consistent with weak demand for defensives.

Commodities surged: Commodity Equity (+6.30%) broadened participation meaningfully, though not enough to pull the large-cap complex decisively higher.

Interpretation: onshore risk appetite remains selective rather than broad-based. Investors continue to pay for innovation, commodities, and thematic exposure while fading state-heavy and yield factors.

🇭🇰 Hong Kong

Weekly performance

HSI: +0.36%

Hang Seng Tech: -0.42%

HSCEI: +0.28%

HS Red Chips: +1.88%

Financials: -1.26%

Utilities: +1.96%

Property: +0.44%

Commerce & Industry: +0.31%

VHSI: +2.90%

Hong Kong’s message was mixed rather than clean: participation was present, but leadership was uneven.

Tech lagged modestly, while defensives and Red Chips provided support.

Property was positive (+0.44%), but the move was modest and the sector remains the most policy-sensitive pocket.

Volatility rose over the week, pointing to active repositioning rather than stress.

Interpretation: Hong Kong contributed to Greater China beta this week, but leadership was selective and less decisive than in prior risk-on phases.

🌏 Regional Scorecard

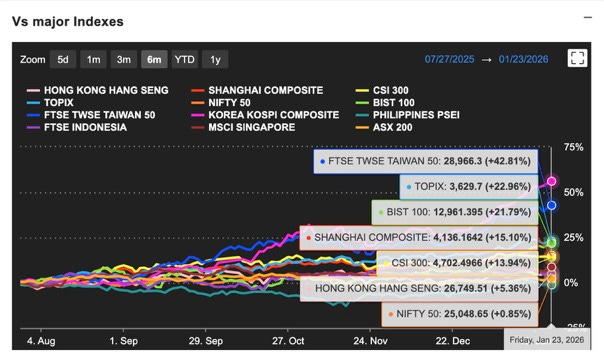

This week remained a North Asia-led risk-on tape, with Japan and Taiwan continuing to do the heavy lifting. Over the medium-term horizon, that leadership is even clearer. Taiwan (FTSE TWSE Taiwan 50 +42.8%) and Japan (TOPIX +23.0%) sit firmly at the top of the regional performance stack. Outside that core, performance was more mixed: Hong Kong is positive but lagging (+5.4%), China onshore has delivered solid but unspectacular gains (Shanghai Composite +15.1%, CSI 300 +13.9%), while India has barely moved over the same period (Nifty 50 +0.9%). Southeast Asia has remained constrained by earnings and FX sensitivity, while higher-beta EM outliers have traded on domestic liquidity rather than regional momentum.

🇯🇵 Japan – clear leader

Japan continues to outperform decisively, with TOPIX up roughly +23.0% over the period, extending its role as Asia’s most investable “quality cyclical” market this cycle.

What stands out is not just index strength, but breadth. Industrials, autos, machinery, and broader capital goods have all worked, consistent with Japan’s positioning as the region’s most direct beneficiary of global capex, reshoring, and automation dynamics.

Why it worked:

Strong leverage to global industrial momentum (autos and capital goods)

Structural reform narrative continues to support multiple rerating

Japan still screens well as “cyclical without fragile balance sheets”

🇹🇼 Taiwan – still the cleanest AI/semis proxy

Taiwan remains the clear standout, with the FTSE TWSE Taiwan 50 up roughly +42.8%, making it the strongest major market in the region by a wide margin.

Momentum has become more incremental versus late 2025, but Taiwan continues to attract flows because the market structure remains very “pure play”. Semiconductors and hardware winners dominate index outcomes, making Taiwan the cleanest listed proxy for AI and advanced compute demand.

Why it worked:

Semiconductors remain the structural anchor for Asia

AI capex narrative continues to support earnings confidence

Taiwan remains the most liquid, clean beta expression of the cycle

🇰🇷 Korea – positive, but still not leading

Korea has delivered positive returns over the period, but it continues to lag Japan and Taiwan despite overlapping exposure to the same global tech and export cycle.

That relative underperformance is typical when investors want semiconductor beta but prefer Taiwan’s cleaner index composition, while Korea’s domestic cyclicals and sentiment sensitivity dilute the trade.

Why it lagged North Asia peers:

Less “pure play” AI and semis exposure versus Taiwan

Higher sensitivity to swings in global risk appetite

Domestic cyclicals tend to cap momentum in short bursts

🇸🇬 Singapore – steady but unexciting

Singapore has remained stable but firmly outside the leadership group, behaving like a market dominated by financials, defensives, and dividend carry.

In a North Asia-led tape, Singapore tends to participate partially, but rarely leads unless global rates or financials are the dominant macro driver.

Read: defensive participation, not a momentum market.

🇦🇺 Australia

Australia has delivered positive performance, but well behind North Asia leaders. The market continues to trade as a blend of global risk appetite and commodity trends. It participates when sentiment is constructive, but attention remains focused on exporters and technology-linked exposures further north.

🇮🇳 India

India stands out as a relative laggard, with the Nifty 50 up only around +0.9% over the same period. Relative performance continues to suffer as valuation remains elevated and the market lacks near-term catalysts that would justify renewed multiple expansion. India remains more sensitive to rotational flows when investors are prioritising export-driven North Asia and technology-linked earnings leverage.

🇮🇩 Indonesia

Indonesia has remained constrained and has not meaningfully joined the rally. FX sensitivity, sector composition, and a more mixed earnings backdrop continue to limit upside relative to North Asia.

🇲🇾 Malaysia

Malaysia has remained range-bound, reflecting the broader Southeast Asia pattern. Stability is present, but leadership is absent due to limited incremental earnings drivers and a more defensive index mix.

🇵🇭 Philippines

Philippines has also stayed muted. The market continues to trade as a lower beta, domestically driven tape, responding more to local macro and rates dynamics than to the external tech and capex cycle.

📰 In the News This Week

0

Comments

Want to join the conversation?

Loading comments...