Why It Matters

The colour‑display rollout could transform E Ink from a niche component maker into a mainstream display provider, reshaping device economics and investor returns.

Key Takeaways

- •E Ink holds near‑exclusive e‑paper market share globally

- •Current P/E ratio sits around 16×, indicating valuation premium

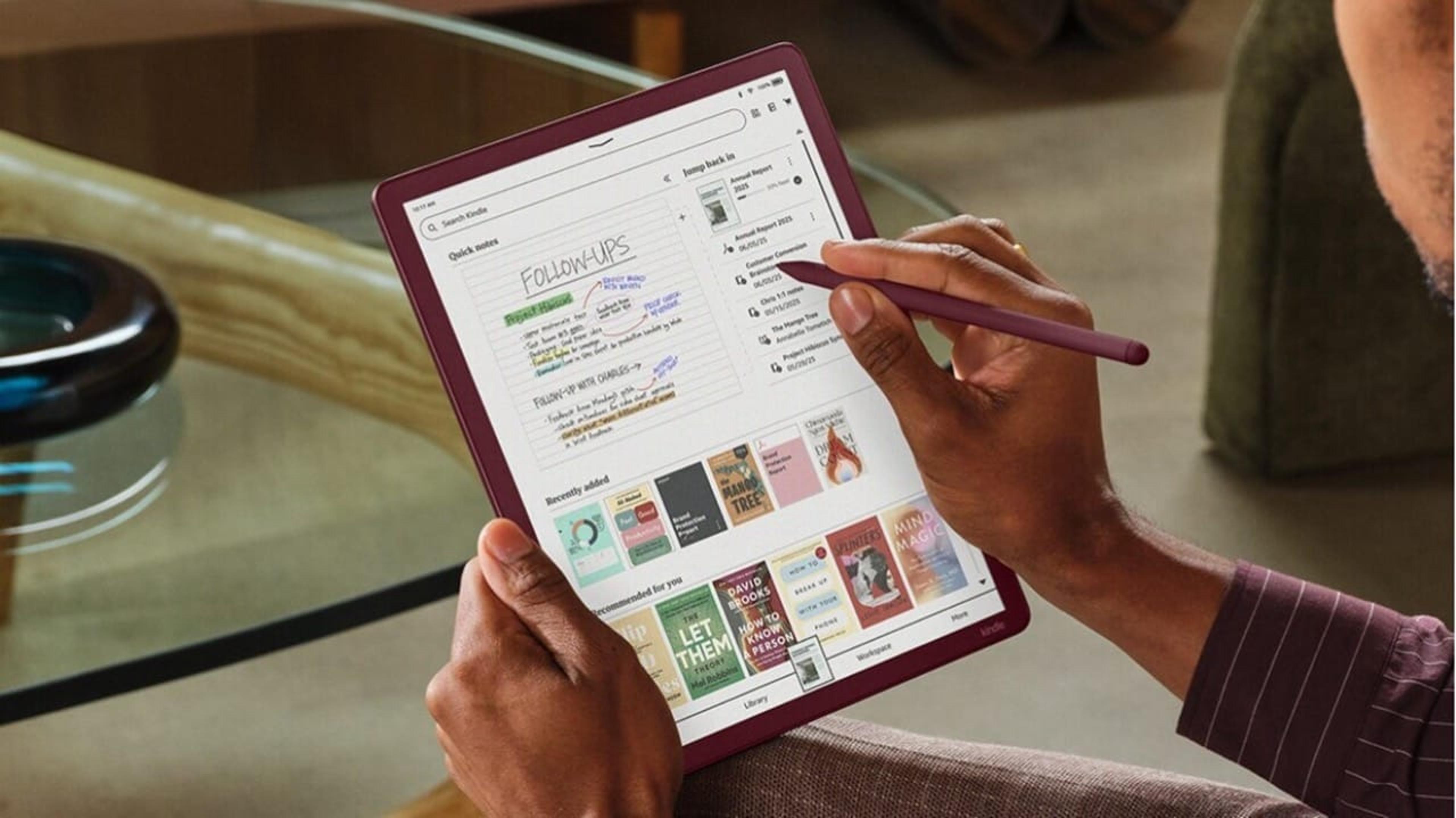

- •New colour‑display technology could unlock broader device applications

- •Competitors still lack comparable low‑power, flexible panels

- •Investor sentiment hinges on successful colour rollout and pricing

Pulse Analysis

E‑paper technology has become the backbone of low‑power, high‑readability devices, from e‑readers to digital signage. E Ink’s vertical integration—from substrate manufacturing to final panel assembly—has created high barriers to entry, allowing the company to dominate a market valued at several billion dollars. This monopoly grants pricing power but also concentrates risk; any disruption in supply chain or technology could reverberate across the entire ecosystem.

Financially, E Ink trades at roughly a 16‑times price‑to‑earnings ratio, a premium that signals confidence in future growth but also raises questions about sustainability. The company’s revenue streams remain heavily weighted toward traditional monochrome displays, which have plateaued in demand. However, the announced colour‑display catalyst promises to open new revenue channels, such as tablets, smart watches, and automotive dashboards, potentially accelerating top‑line growth and justifying the elevated multiple.

For investors and industry watchers, the success of the colour rollout is the decisive catalyst. If E Ink can deliver vibrant, low‑power colour panels at scale, it could fend off emerging competitors and capture a larger share of the broader display market. Conversely, delays or cost overruns could pressure the stock, given its already high valuation. Monitoring production yields, partnership announcements, and adoption rates will be critical to assessing whether E Ink can transition from a niche e‑paper monopoly to a diversified display powerhouse.

E Ink (8069 TT)

The global monopoly in e‑paper displays at 16× P/E with a colour‑display catalyst · Michael Fritzell · 25 January 2026 · 12:42 PM

Reading time: 5 min

0

Comments

Want to join the conversation?

Loading comments...