KOSPI Surges +1.57%: Hardware Sovereignty (Samsung)

•February 4, 2026

0

Why It Matters

The discussion underscores a structural shift in capital flows toward tangible compute assets, suggesting that hardware demand may remain resilient even as broader tech valuations decline. For investors, recognizing this pivot can inform timing and positioning in semiconductor and AI infrastructure stocks, making the episode especially relevant amid ongoing AI hype and monetary tightening.

KOSPI Surges +1.57%: Hardware Sovereignty (Samsung)

FINALIZED Feb 04, 2026 Wall Street Execution Report · Feb 04, 2026 · 17:00 EST

The Asian Edge: Revised 🔄 Wall Street rejected the Asian hardware signal as the Nasdaq 100 failed to sustain its 25,500 pivot during the New York session. Scenario B triggered immediately after the index breached the 25,300 risk threshold following the disappointing AMD guidance. The hardware vault thesis identified in Seoul collapsed under the weight of a broader AI valuation de-rating cycle.

From Seoul to New York: Data Correlation The KOSPI Index rose 1.57 percent to 5,371.10 during the Asian session. Samsung Electronics (005930.KS) gained 1.57 percent to reach the 169,000 KRW milestone. The Nasdaq Composite Index fell 1.51 percent to 22,904.58. Advanced Micro Devices (AMD) plummeted 17.00 percent to 201.61. Micron Technology (MU) dropped 9.97 percent to 377.85 on significant volume. The MSCI South Korea ETF (EWY) slumped 3.27 percent to 120.26 in the US market.

The Next Leading Signal The intensity of foreign net selling in Samsung Electronics at the Seoul open will determine if the AI infrastructure liquidation has reached a structural floor.

Final Conclusion The session is archived as a failed hardware decoupling event driven by an aggressive global AI valuation reset.

Deep Dive: Full Market Audit Access the full analysis of today’s US market close here: 👉

Hello, LoRosha here.

Today’s Asian session delivered a masterclass in “Decoupling.”

While foreign investors sold the broader KOSPI index to manage macro risk, they could not suppress the supply chain itself. Samsung Electronics surged 1.57%, acting as a lone pillar against the tide. This confirms that capital is rotating from “Speculative Software” to “Essential Hardware.”

Here is your data-driven roadmap for the US session.

🎧 Audio Deep Dive

“Prefer listening on the go? Hear the full breakdown of the ‘Physical Moat’ theory.”

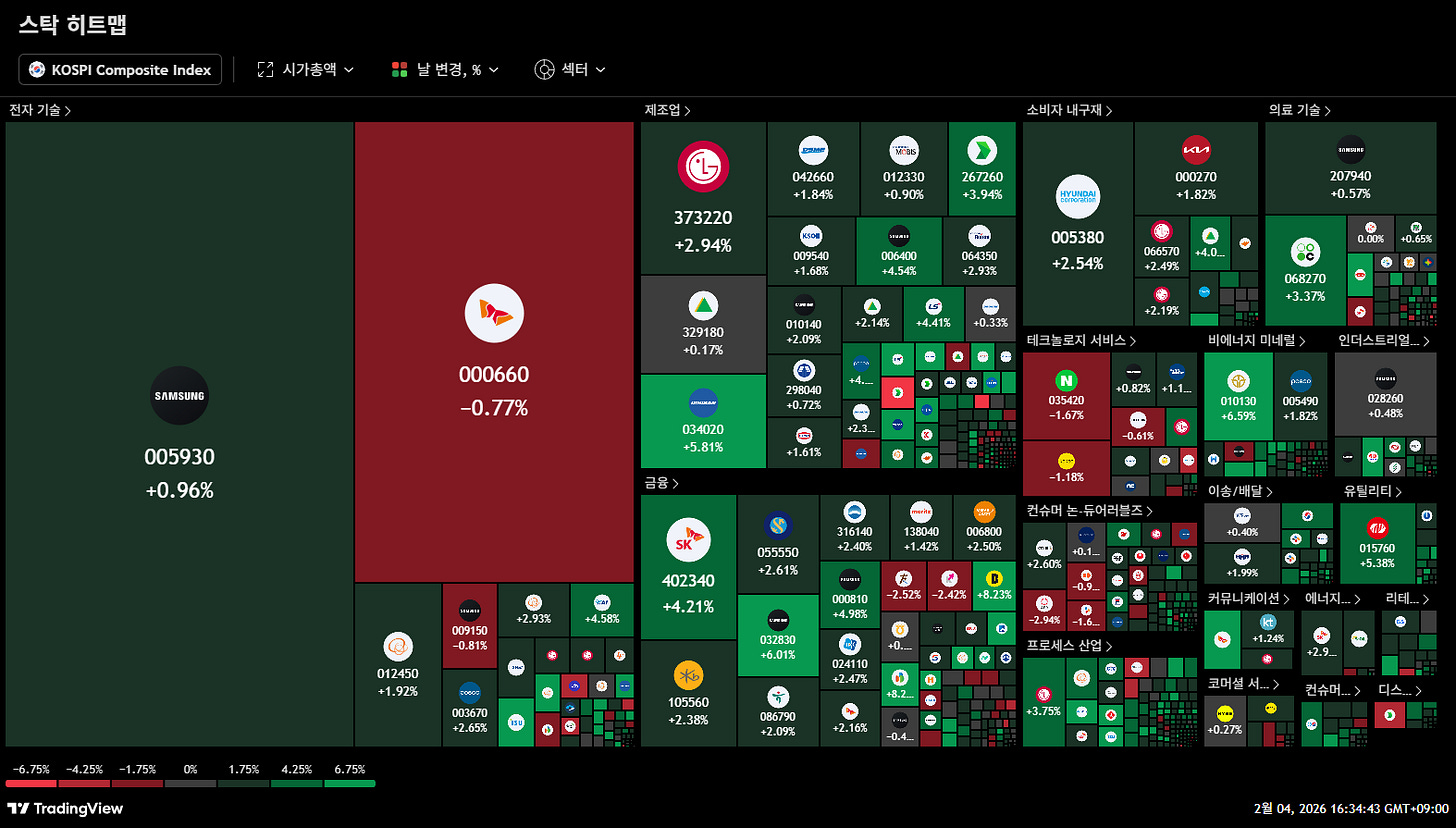

The Market Scorecard (Feb 04)

[

](https://substackcdn.com/image/fetch/$s_!kceJ!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F28ac948f-ecc4-47db-8fa7-e32dcc7ffc41_1574x895.png)

[

](https://substackcdn.com/image/fetch/$s_!bs2t!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fe375197f-b26a-46d4-bc23-1224d7c1f62b_1534x921.png)

[

](https://substackcdn.com/image/fetch/$s_!k7td!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F1cc51478-47d1-4a6d-bb2e-f97895aea832_1534x921.png)

Korea Markets (Close): KOSPI 5,371.10 (+1.57%) | KOSDAQ 1,149.43 (+0.45%)

FX Rate: USD/KRW 1,426.3

Capital Flow: Foreign Net Sell -477.7B KRW | Retail Net Buy +346.6B KRW

U.S. Futures (Current): Nasdaq 100 Futures ~25,438

The Core Analysis: The Hardware Vault

1. The Flap (The Headwind):

Foreign investors executed a Tactical Sell-off (-477.7B KRW). They used the KOSPI index as a liquidity source to hedge against rising US yields.

2. The Hidden Signal (The Anchor):

Samsung Electronics decoupled from this selling pressure.

The Milestone: It closed at 169,000 KRW, officially crossing the 1 Quadrillion KRW (~$720B) market cap threshold.

The Meaning: This is not retail FOMO. This is the market pricing in HBM4 (Next-Gen Memory) as a sovereign asset.

3. The Mechanism (The Logic):

We call this “The Hardware Vault Effect.”

When uncertainty rises, smart money stops buying “Future Growth Stories” and starts buying “Tangible Production Capacity.” Domestic institutions defended the price, betting that the US AI ecosystem cannot function without this specific supply chain.

🧠 LoRosha’s Insight (The Learning Curve)

The Lesson: The Physical Moat Paradox

Concept: Why do chip manufacturers rally when interest rates rise? Because they hold the “Physical Moat.”

Deep Logic: In the AI era, code (Software) is abundant, but compute (Hardware) is scarce. Samsung’s fab lines are “Inelastic Assets.” Regardless of the Fed’s rate decision, Nvidia needs chips, and Data Centers need HBM.

The Paradox: Liquidity dries up for hopes (Unprofitable Tech), but concentrates on necessities (Infrastructure). This is why the “Korea Discount” applied to the country, but the “AI Premium” applied to the company.

The Logic Check (Validation):

If this rally were fake, the foreign sell-off would have dragged Samsung down with the index (-1% or more). The fact that Samsung rose +1.57% against a -477B KRW sell flow proves Structural Demand exists.

Why It Matters:

This sets a “Hard Floor” for US Semiconductor stocks (NVDA, MU, AMAT) tonight. The supply chain has signaled that demand is real.

The Outlook (Tonight’s US Check)

The Asian signal is Bullish for Hardware, but the US Macro setup remains Fragile.

Nasdaq 100 Futures are hovering at 25,438, trapped below the breakout level.

📅 Market Triggers: Data & Event Response Guide

No major economic data prints. Price action is the sole driver.

Execution Guide (Consensus: Wait & See)

If Nasdaq Futures > 25,500: The “Samsung Signal” is accepted. The market will rotate into Semi Equipment (AMAT, ASML).

If Nasdaq Futures < 25,400: The “Macro Fear” overrides the supply chain. The Asian rally will be ignored as an outlier.

📊 Daily Action Checklist (Execution Guide)

Target Asset: Nasdaq 100 Futures (NQ)

Key Pivot Level: 25,500

Action (If Breaks Above): Confirm trend. Long positions in NVDA, VRT are valid.

Action (If Breaks Below): Invalidation Point. If 25,400 breaks, switch to Cash/Hedging. The “Time-Lag” risk is active.

Target Asset: US Semiconductor Sector (SOX)

Key Signal: Divergence.

Strategy: Even if the Nasdaq Index is flat, if Micron (MU) or Applied Materials (AMAT) are green, the “Hardware Vault” thesis is working. Prioritize these over software stocks.

🛡️ LoRosha’s Strategy & Risk Check (Scenario B)

The Bull Case:

“If Nasdaq Futures reclaim 25,500 (Closing Basis on 30m chart), we treat the Asian close as a ‘Leading Indicator’. Aggressively target AI Infrastructure stocks.”

The Bear Case (The Trap):

“However, if the index drifts below 25,300, the ‘Samsung Milestone’ is officially ignored by Wall Street. This confirms a ‘False Breakout’ in Asia. Do not fight the Fed. Exit long positions immediately.”

Tonight’s Focus

Watch List: AMAT, ASML (CapEx Beneficiaries), VRT (Power Infra).

Actionable Advice: Do not buy at the open. Wait for the 25,500 confirmation. The trend is your friend, but the pivot is your judge.

🎙️ Missed the Nuance?

“Catch the detailed breakdown and scenario analysis in the audio report above.”

Subscribe to LoRosha’s Investment Desk

0

Comments

Want to join the conversation?

Loading comments...