The RMB Weakness that Wasn't

•January 17, 2026

0

Why It Matters

Understanding the trajectory of the RMB is crucial for investors with exposure to China, as currency moves directly affect corporate earnings, valuation multiples, and cross‑border capital flows. The episode’s analysis links macro‑policy shifts to market opportunities, offering timely insight for anyone navigating the evolving landscape of Chinese finance.

The RMB weakness that wasn't

Good Morning,

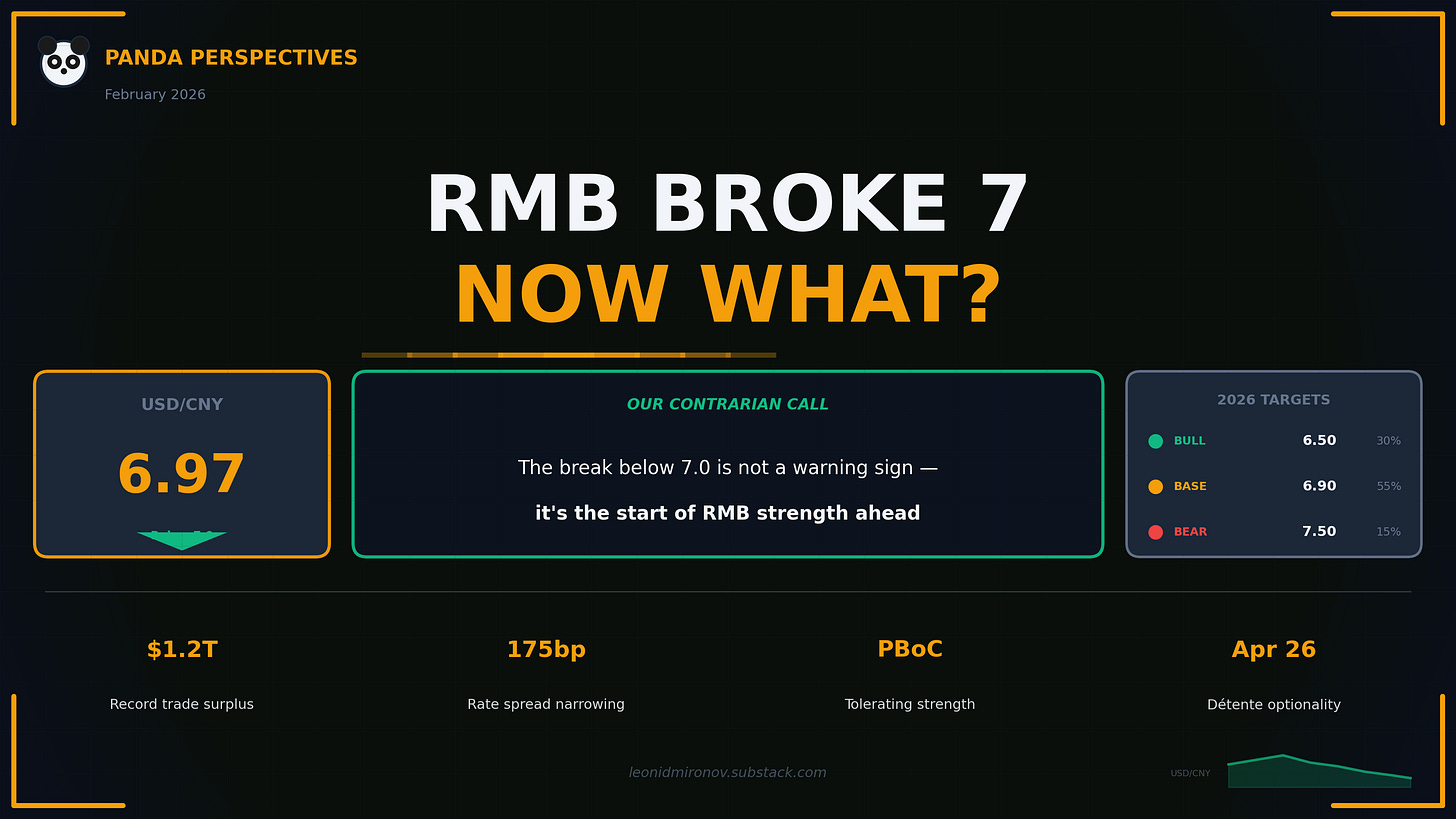

Another piece that deals with a big theme for the entire year ahed - the RMB. We’ve touched on it in the outlook, but it feels like a topic worth dwelling on, given the move that happened, the difference to what was expected by a lot of “observers” and the potential for further surprises. Recall this time last year the narratives were shaping up around the “balance sheet recession” in China. We have pushed back on that narrative. Not because there aren’t similarities, there certainly are, but because we didn’t believe that the natural prescription to solve a balance sheet recession, currency weakness, would apply here. On balance we’re quite happy with how this played out, despite the curveball of tariffs that was thrown our way in between.

All good and well to pat oneself on the back but, a) we were arguing to a potentially much bigger appreciation, that not only did not happen but wasn’t even on the cards and b) the 7 was broken at the very end of 2025 or early 2026 depending on which rate you’re following. Squeaking in last second is hardly worth getting too excited about. Still we believe we got the principle right, and with it some allocation decisions.

It is exactly what we’ll try to do here - look in to what the fundamentals are telling us and what if anyhting changed in out view. Do join us for this voyage of discovery (its nto the journey its the friends we make along the way - right?)

IMPORTANT NOTE: We are presently in the process of getting a license with a major regulator, and while that process is ongoing we are not able to publish the portfolio update and company notes. We’ll do a big reveal of the new plans as soon as we’re in a position to do thusly. We apologise for it taking time, but this is unfortunately a fact of life. With that we’re also putting the opinion part of this and all other pieces behind the wall.

NOTE: Panda+ is now closed to new joiners. We thank everyone for their interest and custom.

Nothing in this Substack is Investment Advice. This information is provided for informational purposes only and does not constitute financial, investment, or other advice. Any examples used are for illustrative purposes only and do not reflect actual recommendations. Please consult a licensed financial advisor or conduct your own research before making any investment decisions. The authors, publishers, and affiliates of this content do not guarantee the accuracy, completeness, or suitability of the information and are not responsible for any losses, damages, or actions taken based on this information. Past performance is not indicative of future results.

[

](https://substackcdn.com/image/fetch/$s_!jNAb!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F43da1544-5c56-4dbb-8c7d-5158245835ab_3200x1800.png)

After months of stubborn defence, the Chinese renminbi finally broke the 7.00 per USD barrier – just as we at Panda anticipated. In our earlier outlooks, we argued that despite policymakers’ resistance, macro forces would push the RMB past 7.0, and we were proven right. Now, with the psychological line in the sand crossed, the key question is what comes next for China’s currency and its equity markets. Consensus views are divided: some see RMB weakness as a red flag, while others expect only mild appreciation. Our take differs – we believe RMB strength could continue, with the potential to accelerate significantly under the right conditions. In this post, we build on prior analyses of China’s 2026 equity strategy and policy signals, revisiting the mechanics behind the RMB’s move and exploring implications for stocks. We’ll also outline who wins or loses from a stronger yuan, and map out scenarios for how the RMB might trade through 2026, including a potential game-changer scenario – a U.S.-China détente (a “Mar-a-Lago accord”) that could turbocharge the yuan’s ascent.

0

Comments

Want to join the conversation?

Loading comments...