News•Feb 20, 2026

Investors Returned to Gold ETFs in 2nd Week After Booking Profits in 1st Week

Gold exchange‑traded funds saw a sharp $3.87 billion outflow in the week ending Feb 6, before a modest $2.34 billion inflow the following week, leaving assets under management at $664.2 billion. The swing reflects investors reacting to the Fed‑chair nominee Kevin Warsh’s hawkish stance and broader geopolitical tension. Regional patterns showed Europe and the UK leading early withdrawals, while the United States and China turned net buyers in the second week. Despite the rebound, the market remains net negative as investors balance safe‑haven demand against rising rate expectations.

By The Hindu BusinessLine – Markets

News•Feb 20, 2026

Markets Cheer ₹80,000-Crore Divestment Target

The Indian government has set an ₹80,000‑crore dis‑investment target for the next fiscal, sparking a rally in public‑sector undertaking (PSU) stocks and lifting equity markets. The plan combines strategic stake sales and asset monetisation to generate fiscal inflows while unlocking...

By The Hindu BusinessLine – Markets

News•Feb 20, 2026

JSW Infra to Issue Shares to Meet Minimum Public Stake Norm

JSW Infrastructure approved an equity raise of up to 25 crore shares, valued at roughly ₹6,325 crore, to satisfy SEBI’s requirement of a 25% public shareholding within three years of its October 2023 listing. The proceeds will back a ₹39,000 crore capital‑expenditure programme that...

By The Hindu BusinessLine – Markets

News•Feb 20, 2026

Broker’s Call: Timken India (Accumulate)

Timken India reported a 14% YoY rise in Q3‑FY26 revenue to ₹764.3 crore, driven by strong performance across all segments. The Process segment led growth, jumping 24% YoY to ₹167 crore despite temporary cost pressures from the Bharuch plant ramp‑up. The broker...

By The Hindu BusinessLine – Markets

News•Feb 20, 2026

Broker’s Call: Aadhar Housing (Buy)

Broker Badri Narayanan rates Aadhar Housing a Buy, setting a target price of ₹650 versus the current ₹479.40. The firm projects a 20‑22% medium‑term AUM growth, aiming for a ₹50,000 crore portfolio within three years. A dual‑market model—urban “A” markets for...

By The Hindu BusinessLine – Markets

News•Feb 20, 2026

Samsung Electronics, KT Hit Record 6G Speeds in 7GHz Band

Samsung Electronics, Korean carrier KT and test‑equipment firm Keysight reported a record 3 Gbps downlink in the 7 GHz band, a core frequency earmarked for 6G. The speed was achieved using a prototype base station with massive MIMO architecture that transmitted eight...

By The Korea Herald – Business

News•Feb 18, 2026

First Gen Powers Lyceum Satellite Campuses

First Gen Corp. will supply over 1,150 kW of geothermal electricity to Lyceum of the Philippines University’s satellite campuses in Batangas and Laguna. The deal, enabled by the retail aggregation program, lets the campuses pool demand to meet the 500‑kW threshold...

By Philstar – Business

News•Feb 18, 2026

US Stocks: Trump Adviser Hassett Suggests New York Fed Researchers Be Punished for Tariffs Argument

Kevin Hassett, former Trump economic adviser, blasted a New York Fed research paper that argued tariffs mainly hurt American consumers, calling it "shoddy scholarship" and the worst paper in Fed history. He urged that the authors be disciplined for their...

By The Economic Times – Markets

News•Feb 18, 2026

Market Trading Guide: Bank of India Among 2 PSU Bank Stocks Offering up to 8% Upside

The Nifty 50 logged a third straight gain, breaking above the 25,500 support and 25,800 resistance as consumer, financial and metal stocks led the rally. Bank of India and Bank of Maharashtra each posted decisive breakouts from consolidation zones, prompting...

By The Economic Times – Markets

News•Feb 18, 2026

Broker’s Call: Ipca Laboratories (Buy)

Ipca Laboratories posted a robust 19% year‑on‑year EBITDA increase to ₹530 crore, surpassing broker estimates, while revenue rose 6.6% to ₹2,400 crore. Domestic formulation sales grew 12% and export formulation climbed 17%, offset by flat API sales overall but a 26% rebound...

By The Hindu BusinessLine – Markets

News•Feb 18, 2026

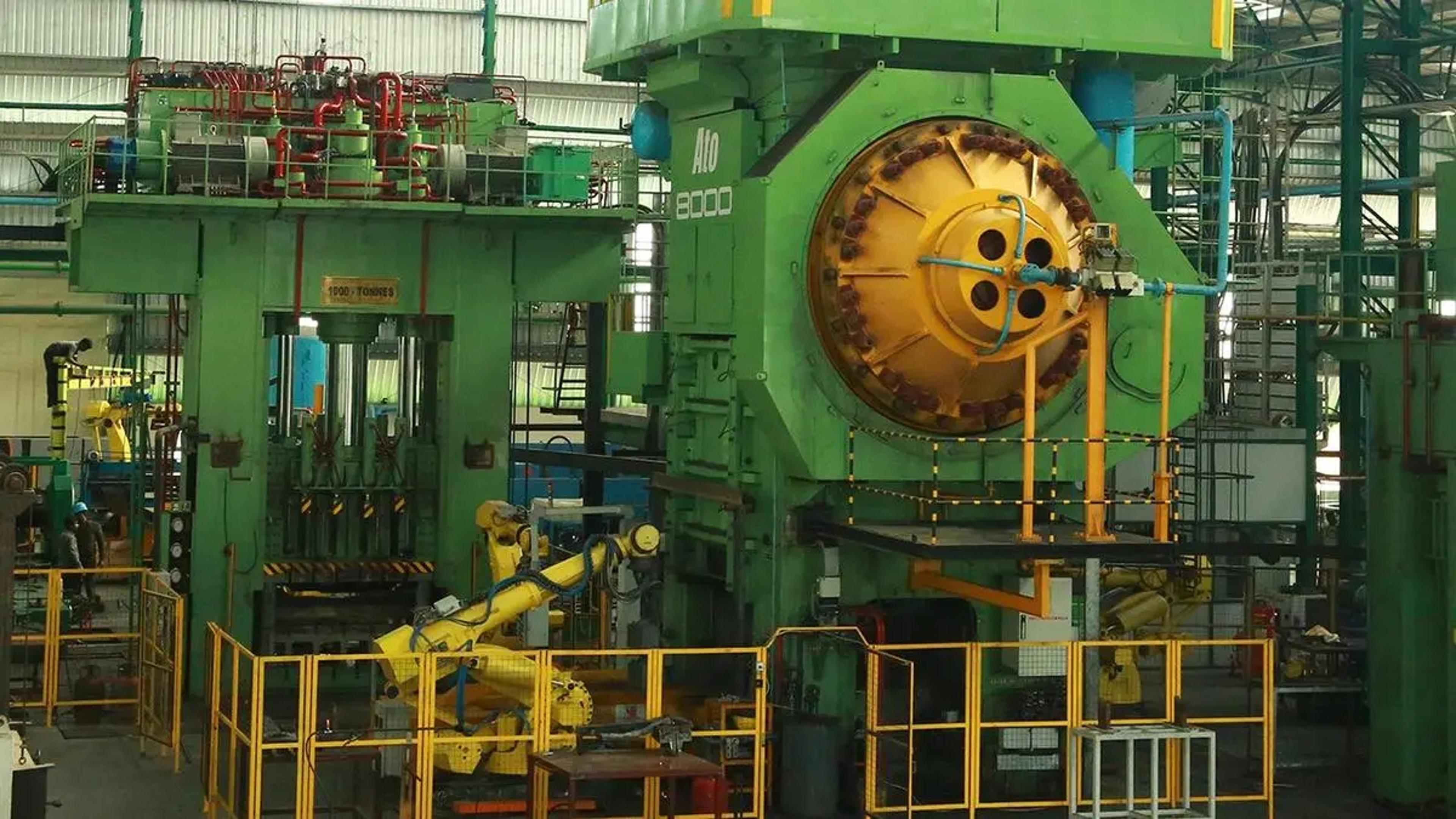

Broker’s Call: MM Forgings (Buy)

MM Forgings posted a Q3FY26 EBITDA of ₹71.6 crore, a 2% YoY decline, while revenue rose 11% to ₹405 crore, beating estimates. Domestic sales grew 14% and exports 7%, reflecting stronger overseas demand. The broker retains a BUY rating with a revised...

By The Hindu BusinessLine – Markets

News•Feb 18, 2026

Rupee Rises 5 Paise to Close at 90.67 Against US Dollar

The Indian rupee edged higher, closing at a provisional 90.67 per U.S. dollar, up five paise on the day. The modest gain was driven by fresh foreign fund inflows and a buoyant domestic equity market, which saw the Sensex climb...

By The Hindu BusinessLine – Markets

News•Feb 18, 2026

India Relaxes Chinese Equipment Import Curbs for Power, Coal Amid Project Delays

India has begun easing its 2020‑era restrictions on Chinese equipment, allowing state‑run power companies to import limited transmission components and considering similar exemptions for coal‑sector gear. The move responds to mounting shortages and project delays that threaten the country’s ambitious...

By The Hindu BusinessLine – Markets

News•Feb 18, 2026

SBI Funds Management Plans $1.5 Billion IPO in March

India’s largest asset manager, SBI Funds Management, is preparing to file a draft prospectus for an IPO in March that could raise up to $1.5 billion, targeting a valuation near $15 billion. The offering would represent roughly a 10% stake held jointly...

By The Hindu BusinessLine – Markets

News•Feb 18, 2026

Bumi Resources Minerals Says Palu Operations Unaffected by Site Closure

Bumi Resources Minerals (BRM) confirmed that the government‑ordered closure of a contested gold mine in its Palu concession will not disrupt its core operations because the site was never active. The enforcement action targeted an area where illegal miners had...

By The Jakarta Post – Business (site)