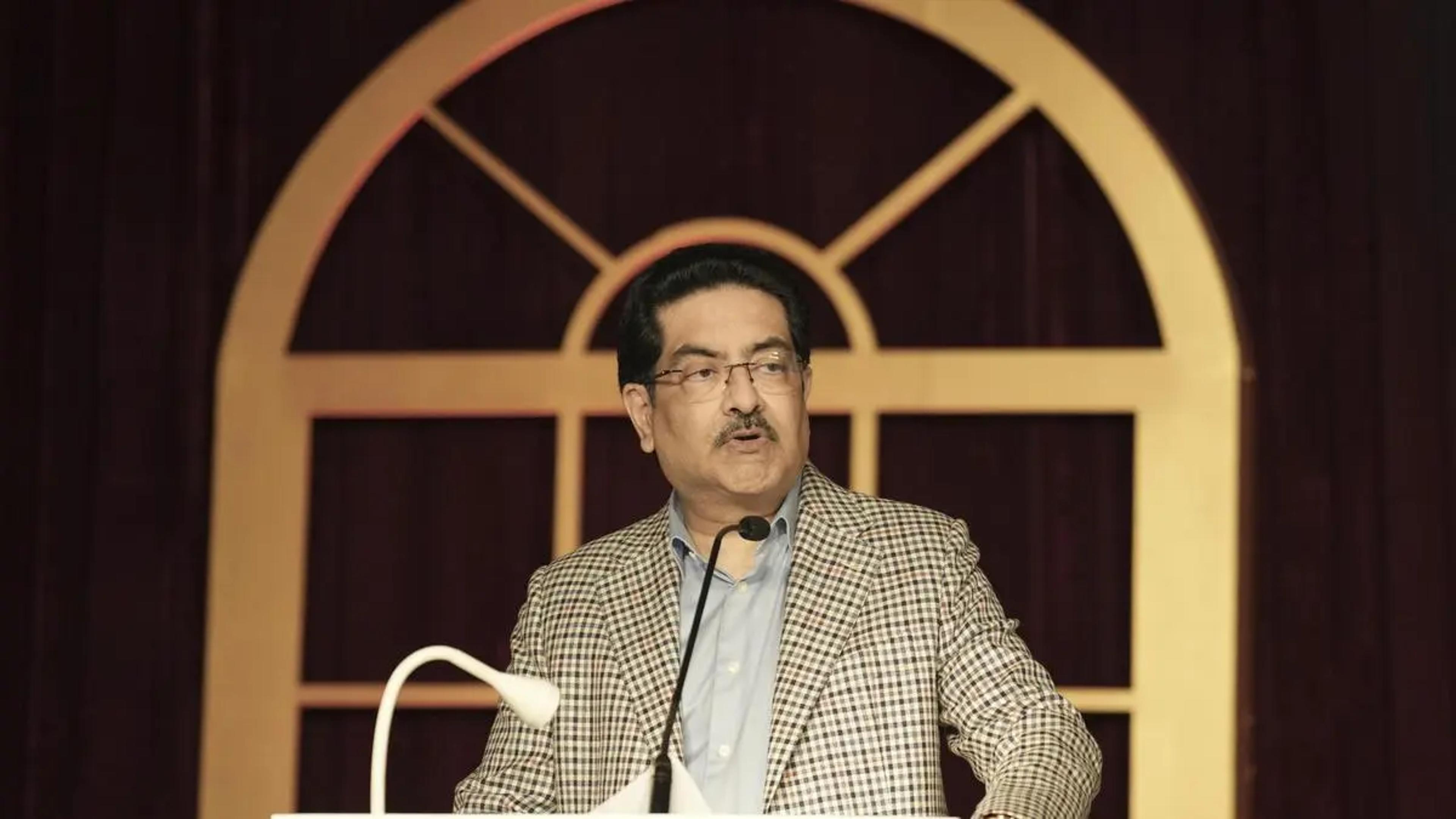

Kumar Mangalam Birla Hikes Stake in Vodafone Idea, Stock Jumps 4%

•February 10, 2026

0

Companies Mentioned

Why It Matters

The stake increase signals promoter confidence, supporting Vi’s turnaround amid a softened debt burden. It could accelerate network upgrades and improve competition in India’s telecom market.

Key Takeaways

- •Birla bought 4.09 crore shares at ₹11.13 each.

- •Vi stock rose 4% after stake increase.

- •Emkay upgraded Vi to Add, target ₹12.

- •Govt moratorium cuts AGR liability NPV 60‑80%.

- •Vi aims 4G/5G expansion, subscriber retention.

Pulse Analysis

India’s telecom sector has been under pressure from high spectrum costs and intense price competition, leaving Vodafone Idea (Vi) with a fragile balance sheet. The recent purchase of 4.09 crore shares by promoter Kumar Mangalam Birla not only nudged his holding to 0.02 percent but also sent a clear market signal of confidence. The stock’s 4 percent rally to ₹11.58 reflects investor optimism that the promoter’s backing could stabilize the company’s governance and provide a catalyst for further capital inflows.

The most consequential development is the government’s approval of a moratorium on Vi’s Adjusted Gross Revenue (AGR) liabilities, which Emkay Global Research highlighted as a 60‑80 percent reduction in net present value of the debt burden. This fiscal relief dramatically improves Vi’s cash‑flow profile, enabling the firm to meet minimal annual payments through FY35 and freeing resources for strategic investments. Emkay’s upgrade of Vi from Sell to Add, coupled with a target price jump from ₹6 to ₹12, underscores the perceived upside from this debt restructuring and the expectation of a turnaround.

With a clearer balance sheet, Vi can now prioritize its 4G and upcoming 5G network expansion, a critical step to arrest subscriber churn and regain market share lost to rivals. Enhanced funding prospects and a more competitive tariff structure could boost ARPU and attract high‑value customers. If the company successfully leverages the moratorium’s breathing room, it may re‑emerge as a viable third player in India’s telecom arena, reshaping the competitive dynamics and offering consumers more choices.

Kumar Mangalam Birla hikes stake in Vodafone Idea, stock jumps 4%

Birla purchased 2.21 crore shares on January 30 and another 1.88 crore shares on February 1 at ₹11.13 per share

Updated – February 10, 2026 at 12:06 PM

Published – February 9, 2026

Vodafone Idea (Vi) promoter Kumar Mangalam Birla has increased his stake marginally in the telecom major.

Vi stock rose 4.04 per cent to ₹11.58 on the BSE on Monday. Birla purchased 2.21 crore shares on January 30 and another 1.88 crore shares on February 1 at ₹11.13 per share. He held 1.94 crore shares or 0.02 per cent stake in Vi as of December 31, 2025, while total promoters’ holding stood at 25.57 per cent as per shareholding‑pattern data uploaded on BSE.

Emkay Global Research upgraded Vi to Add from Sell and doubled the target price to ₹12 from ₹6.

“The government has approved a major moratorium for VI’s AGR liabilities, with minimal annual payments until FY35. We believe this will provide significant cash‑flow relief and a turnaround opportunity. The relief reduces the net present value (NPV) of the burden by 60‑80 per cent, easing immediate survival pressure, along with the possibility of further reduction on reassessment of AGR dues,” said Emkay.

This enables Vi to access bank funding for 4G/5G expansion, helping the company arrest subscriber churn and market‑share loss. The key risks remain the inability to increase: subscriber market share, ARPU with tariff repair, and upgrade of the subscriber base from 2G to 4G/5G.

In his reflection note, Birla applauded Vi for weathering “the shocks and volatility in the telecom sector” for over two decades and voiced confidence in its revival as the third major telecom company in India.

Stating that India deserves a successful Vi, Birla attributed the company’s survival to the loyalty of employees and customers, the belief of business partners and shareholders, the Supreme Court’s judgment, and the government’s intervention.

Vi’s last earnings call was also attended by Sushil Agarwal, Group Chief Financial Officer at promoter Aditya Birla Group, who said the promoters remain positive on Vi and will extend support if required.

0

Comments

Want to join the conversation?

Loading comments...