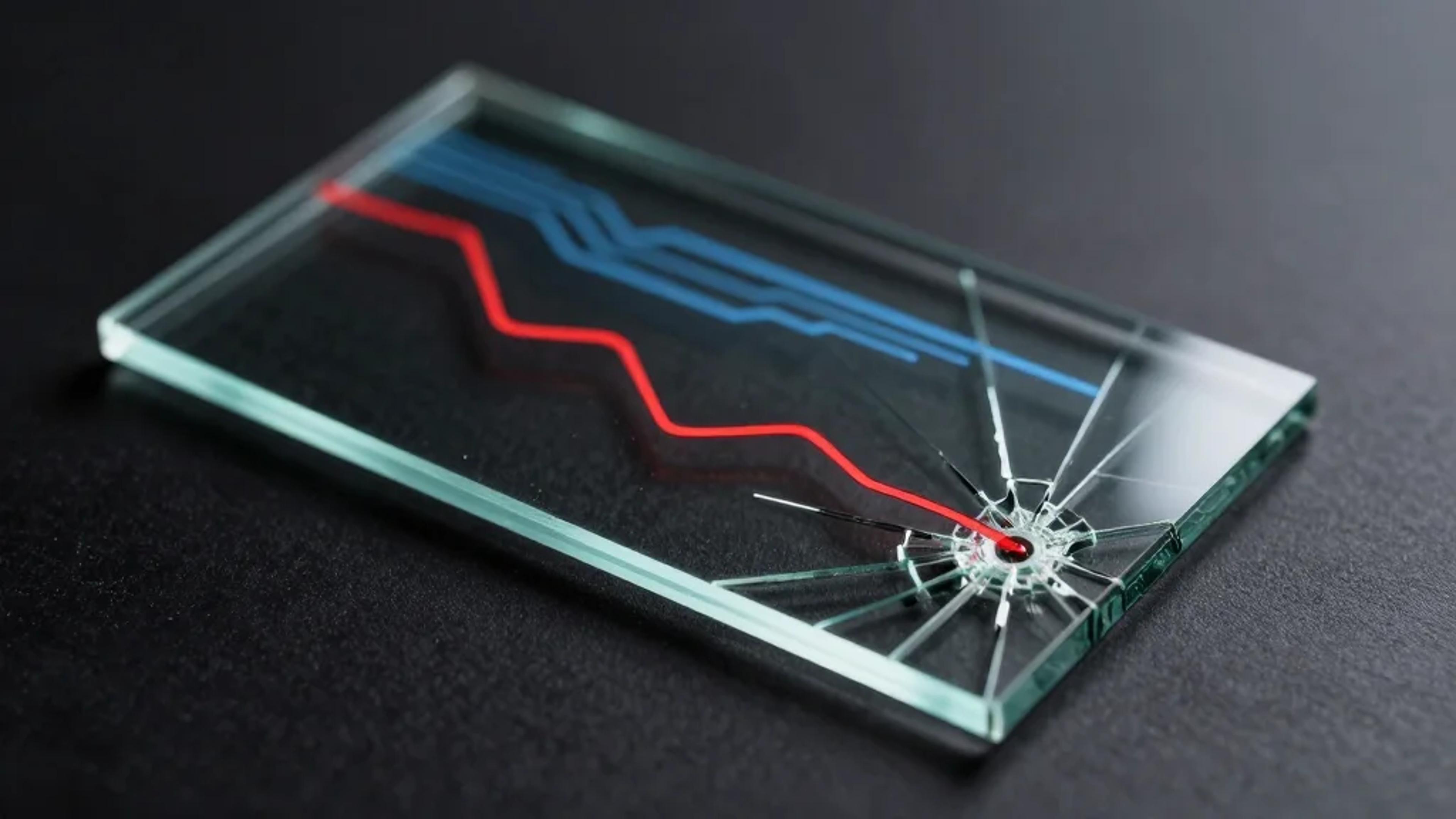

Market Highlights: Sensex Settles 1,048 Pts Lower, Nifty Below 25,500; HUL, Eternal Drop 4% Each

•February 13, 2026

0

Companies Mentioned

Why It Matters

The sharp equity pullback underscores heightened sensitivity to technology risk and macro‑headwinds, signaling tighter risk appetite for investors across sectors. It also highlights earnings volatility among blue‑chip names, which could reshape portfolio allocations in the coming weeks.

Key Takeaways

- •Sensex fell 1,048 points; Nifty slipped below 25,500

- •IT index dropped over 5% amid AI disruption fears

- •HUL profit fell 30%, shares down 3%

- •Hindalco profit down 45%, stock down 4%

- •Arbitrage fund inflows surged 2,500% in January

Pulse Analysis

The Indian equity market entered a risk‑averse phase on February 13, 2026, as the Sensex plunged more than 1,000 points and the Nifty breached the 25,500 barrier. The sell‑off was anchored by a pronounced decline in the technology sector, where the IT index slumped over 5% amid growing concerns that rapid AI adoption could compress margins for software services firms. Coupled with a weaker rupee and a backdrop of soft global equity performance, investors retreated from growth‑oriented stocks, prompting a broad‑based correction across metals, realty, and media.

Corporate earnings added to the market’s nervousness. Hindustan Unilever reported a 30% drop in Q3 profit, pushing its shares down roughly 3%, while Hindalco’s net profit plunged 45% year‑on‑year, resulting in a 4% stock decline and a downgrade to neutral. Conversely, Muthoot Finance saw its shares plunge 14% despite a near‑doubling of net profit, illustrating that earnings strength alone could not offset sector‑wide sentiment. Meanwhile, arbitrage mutual funds experienced an unprecedented inflow surge of over 2,500% in January, reflecting investors’ search for low‑volatility havens amid equity turbulence.

For market participants, the episode signals a pivot toward defensive positioning and heightened scrutiny of technology exposure. The confluence of AI‑related risk, a firming dollar, and fragile global cues suggests that volatility may persist, prompting portfolio managers to favor financials, consumer staples, and high‑quality bonds. Monitoring central bank policy, especially any debt‑switch measures that could ease bond yields, will be crucial as investors navigate the evolving risk landscape.

Market Highlights: Sensex settles 1,048 pts lower, Nifty below 25,500; HUL, Eternal drop 4% each

The Economic Times · 13 Feb 2026, 10:54 AM IST

Indian benchmark indices traded sharply lower on Friday.

Synopsis

Benchmark indices Sensex and Nifty opened sharply lower on Friday, extending losses for a second straight session as a deepening sell‑off in IT stocks rattled investor sentiment amid mounting fears of AI‑led disruption. Markets witnessed broad‑based selling with all sectoral indices trading in the red. Technology stocks led the decline, dragging sentiment lower, while metals, realty and media also faced sharp pressure. Defensive sectors showed relative resilience but could not offset weakness, reflecting a cautious, risk‑averse mood among investors.

Key drivers of today’s market weakness

-

IT sell‑off

-

Weak global equity markets

-

Dollar strength, weak rupee

-

Weak technical setup

-

Geopolitical tensions linger

Global Markets Updates

-

S&P 500 futures were little changed as of 10:30 a.m. Tokyo time

-

Japan’s Topix fell 1.1%

-

Australia’s S&P/ASX 200 fell 1.3%

-

Hong Kong’s Hang Seng fell 1.5%

-

Shanghai Composite fell 0.4%

-

Euro Stoxx 50 futures rose 0.2%

10:54:34 AM – Muthoot Finance shares plunge 14% despite Q3 net profit soaring 95%

Muthoot Finance shares fell sharply even though the company reported a near‑doubling of net profit and a substantial increase in total income and assets under management. Analysts from Jefferies, CLSA and Nuvama maintained positive ratings, citing strong performance and growth prospects.

10:46:02 AM – Gold rates in physical markets

-

Delhi: 22‑carat gold ₹1,16,272 / 8 g; 24‑carat gold ₹1,26,832 / 8 g

-

Mumbai: 22‑carat gold ₹1,16,152 / 8 g; 24‑carat gold ₹1,26,712 / 8 g

-

Chennai: 22‑carat gold ₹1,16,792 / 8 g; 24‑carat gold ₹1,27,416 / 8 g

-

Hyderabad: 22‑carat gold ₹1,16,152 / 8 g; 24‑carat gold ₹1,26,712 / 8 g

10:39:46 AM – Realty stocks struggle to post gains

10:33:53 AM – Indian bonds give up early gains as profit‑taking blunts debt‑switch boost

-

Government bonds likely to extend gains after a debt‑switch with the central bank that could ease redemption pressures.

-

10‑year benchmark (2035) yield expected around 6.64 %–6.69 %; it ended at 6.6833 % on Thursday, down 8 bps over the previous three sessions.

-

One‑year OIS rate ended at 5.5050 %; two‑year at 5.64 %; five‑year at 6.09 %.

10:27:52 AM – Arbitrage mutual funds see 2,507 % jump in inflows in January

Arbitrage funds surged more than 2,500 % in monthly inflows in January, following the Union Budget 2026 announcements on higher STT and tax changes for futures. Investors are debating whether these measures could temper the category’s appeal and affect future inflows and returns.

10:24:00 AM – Hindalco shares fall 4% after Q3 results

Hindalco Industries declined 4% to ₹926.65 after its consolidated net profit for the December quarter dropped 45 % YoY to ₹2,049 crore. Citi downgraded the stock to “Neutral” from “Buy” and raised its target price to ₹1,000 from ₹920.

10:16:39 AM – Top losers at opening hour

10:10:57 AM – HUL shares down 3% as Q3 PAT falls 30 % to ₹2,118 crore

Hindustan Unilever fell 2.5 % to ₹2,351.40 after reporting a sharp decline in consolidated net profit from continuing operations for Q3 FY26 (₹2,188 crore vs. ₹3,027 crore a year earlier).

10:03:37 AM – Top gainers at this hour

09:56:49 AM – SpiceJet shares down 2% after Q3 loss of ₹261 crore

SpiceJet fell 2.05 % to ₹19.98 after reporting a consolidated net loss of ₹261.38 crore for the December quarter, compared with a net profit of ₹20.43 crore in the same period last year.

09:52:32 AM – All sectors in red

Markets witnessed broad‑based selling with all sectoral indices trading in the red. Technology stocks led the decline, while metals, realty and media also faced pressure. Defensive sectors showed relative resilience but could not offset the overall weakness.

09:36:40 AM – Sensex tumbles over 800 pts

09:35:01 AM – Silver rebounds Rs 5,500 after 10 % crash, gold up Rs 2,000/10 g amid bargain buying

-

MCX silver futures (Mar 2026) gained 2.2 % to ₹2,41,798 per kg.

-

April gold futures advanced ₹2,001 (1.3 %) to ₹1,54,837 per 10 g.

-

In the prior session, March silver futures had plunged 10 % to ₹2,36,435 per kg, while gold fell over ₹6,000 (4 %) to ₹1,52,836 per 10 g.

09:27:18 AM – Rupee falls 8 paise to 90.69 against the US dollar in early trade

09:27:00 AM – Opening bell: IT index bleeds for the second consecutive day

09:18:12 AM – Opening bell: Sensex tumbles over 700 pts, Nifty tests 25,600; IT index sinks 5 %

09:10:15 AM – Sensex falls over 750 points in pre‑opening session, Nifty below 25,600

08:59:01 AM – Indian rupee opens down 0.1 % at 90.67 per US dollar (previous close 90.59)

08:59:00 AM – HAL shares in focus as Q3 net profit rises 30 % to ₹1,867 crore; margins improve

08:53:00 AM – Mutual funds raise bets on financials, trim IT and FMCG in January

Leading mutual funds increased exposure to financials, adding banking and insurance stocks while reducing holdings in select IT and FMCG names. Lenders such as Axis Bank, ICICI Bank, Union Bank and IndusInd Bank saw buying interest; small‑finance bank Equitas also received selective additions.

08:50:00 AM – Honasa Consumer shares in focus as Q3 net profit soars 93 % to ₹50 crore

08:43:00 AM – Agro‑chemical stocks surge on strong Q3, trade deal

Agro‑chemical and animal‑feed companies surged after robust Q3 earnings and lower US tariffs that brightened the sector’s near‑term outlook.

08:40:00 AM – Citi rates Hindalco with Neutral rating, target price ₹1,000

08:36:00 AM – IT stocks go into a tailspin as US data adds to AI disruption

Indian software services stocks faced intense selling pressure, dragging the Nifty IT index down more than 5 % for the second time in under 10 days after stronger‑than‑expected US jobs data compounded AI‑related concerns.

08:33:00 AM – Nuvama rates Coal India with Reduce rating, target price ₹375

08:30:00 AM – Nuvama rates Indian Hotels with Reduce rating, target price ₹636

08:20:00 AM – Accor, InterGlobe weigh IPO for joint hospitality venture

Europe’s largest hospitality group Accor and InterGlobe are exploring a potential public listing for their joint hotel venture, planning to open 300 properties by 2030. CEO‑South Asia Ranju Alex said the partners are evaluating capital‑market options.

08:10:00 AM – HUL sees demand recovery as rural, urban traction improves; Q3 volumes rise 4 %

08:00:00 AM – Oil set for weekly drop as Iran risks recede, oversupply concerns

Oil prices were largely steady after a prior decline and are poised for a second straight weekly loss as fears of an Iranian conflict eased and global supply is expected to outpace demand.

07:50:00 AM – Gold and silver rise from near one‑week lows on bargain‑hunting

07:42:22 AM – Tech jitters rock Wall Street: Nasdaq tumbles 2 %, S&P 500 falls over 1 % as AI worries rattle investors

07:42:00 AM – Yen on track for best week in nearly 15 months

The yen was on track for its strongest weekly performance in nearly 15 months, rising after Japanese Prime Minister Sanae Takaichi’s election victory eased concerns over fiscal stability.

0

Comments

Want to join the conversation?

Loading comments...