Peter Lewis’ Money Talk

PETER LEWIS'MONEY TALK - Wednesday 11 February 2026

Peter Lewis’ Money Talk

•February 11, 2026•0 min

0

Peter Lewis’ Money Talk•Feb 11, 2026

Why It Matters

Japan’s inflation surge threatens the world’s third‑largest economy and has ripple effects across global markets, making the policy debate highly relevant for investors and policymakers alike. Understanding the trade‑offs between growth stimulus and price stability helps listeners navigate emerging risks and identify opportunities in a pivotal moment for Asian finance.

Key Takeaways

- •TSMC revenue jumps 37% on AI-driven chip demand.

- •Japan's new prime minister faces aging workforce and reform challenges.

- •US retail sales flat; markets hover near record highs.

- •Trump touts 15% growth, contrasting World Bank 2.2% forecast.

- •Bilateral trade focus rises as multilateral institutions face criticism.

Pulse Analysis

The episode opened with a rapid market roundup: AI‑driven demand propelled TSMC’s January revenue up 37% to $12.7 billion, underscoring the semiconductor boom. Singapore’s economy grew 5% in 2025, outpacing forecasts, while the U.S. equity market lingered near all‑time highs, the S&P 500 slipping slightly and the Dow breaking the 50,000 barrier. Treasury yields fell to 4.14% after weak retail sales, and currencies shifted—yen strengthened, yuan hit its strongest level since May 2023, and gold slipped modestly. These data points set the stage for deeper geopolitical analysis.

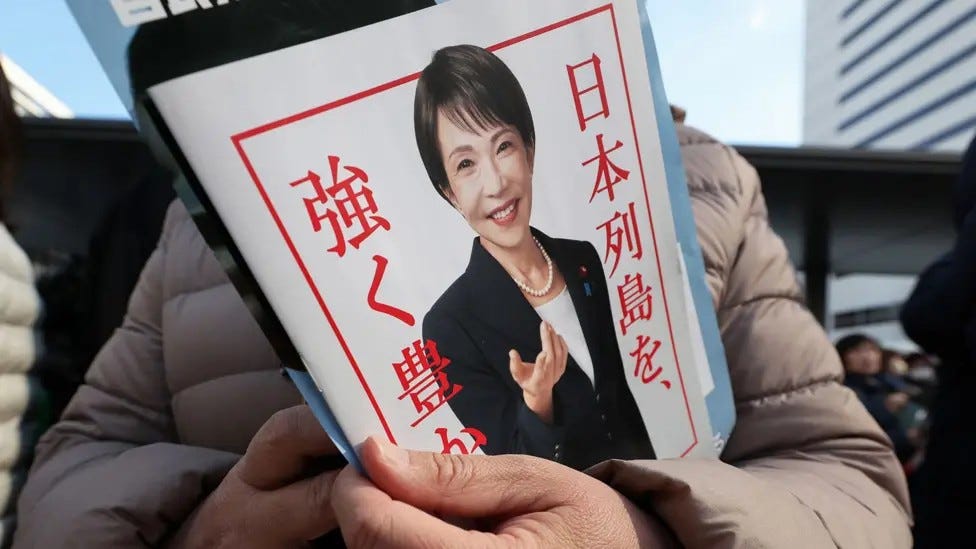

A major focus was Japan’s post‑election landscape. Prime Minister Senai Takechi secured a super‑majority, giving her a rare window to address chronic challenges: an aging population, shrinking labor force, and high public debt. Guests debated whether she will pursue bold fiscal stimulus, tax cuts, or structural reforms such as easing immigration and leveraging automation. The conversation also explored how her stance could reshape Japan‑China dynamics, with China weighing whether to intensify pressure or risk pushing Japan further into a Western alignment that includes the United States and India.

The discussion then pivoted to trade policy. Donald Trump’s claim that the U.S. could achieve 15% growth contrasted sharply with the World Bank’s modest 2.2% forecast, highlighting divergent economic narratives. Panelists examined the Trump administration’s shift toward bilateral agreements, arguing that while this approach simplifies negotiations, it may erode the tariff reductions and multilateral cooperation achieved under WTO frameworks. Coupled with flat U.S. retail sales and rising global tariff averages, the episode warned investors to monitor how these policy currents could affect supply chains, emerging market exposure, and overall market volatility.

Episode Description

● Trump says US economy can grow 15% with Warsh as Fed chair ● Taiwan’s TSMC reports a 37% jump in January revenues ● Japan’s Nikkei 225 closes at record high for 2nd day

Show Notes

[

](https://substackcdn.com/image/fetch/$s_!R2Pl!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F21456677-c812-4861-ac49-3d52b55dd0c4_976x549.jpeg)

Takaichi’s challenge following her landslide election win is to revive growth without fuelling the inflation that has already eroded household purchasing power, with staples like rice doubling in price in 2025.

On Wednesday’s “Peter Lewis’ Money Talk” podcast, I’m joined by Richard Harris, Chief Executive Officer at Port Shelter Investment Management, and Tony Nash, the Founder of Complete Intelligence. With a view from Japan is John Beirne, Principal Economist at the Asian Development Bank.

The podcast is also available on Apple Podcasts, YouTube Studio and Spotify.

Spotify

YouTube Studio

https://www.youtube.com/playlist?list=PLnwqOJD9ie5gHH29bNfuG1Nscy8rdJo6O

Apple Podcasts

This podcast is sponsored by Surfin Group, which is headquartered in Singapore and offers online financial services to 60 million customers across 10 countries. You can find out more about them by going to their website www.surfin.sg

[

](http://www.surfin.sg)

0

Comments

Want to join the conversation?

Loading comments...