Anzu Discontinues Raptor Drone Series Amid Supply Chain Crisis

•February 17, 2026

0

Why It Matters

The move highlights how geopolitical tensions and fragile supply chains can derail emerging drone manufacturers, reshaping the competitive landscape for U.S. enterprise UAVs.

Key Takeaways

- •Component shortages force Raptor line discontinuation.

- •NDAA 2025 demand accelerated stock depletion.

- •DJI licensing scrutiny raises security concerns.

- •Half of components sourced from China, exposing supply risk.

- •Anzu plans next‑gen drone to meet regulatory demands.

Pulse Analysis

The U.S. commercial drone market has been in flux as manufacturers scramble to replace foreign‑origin hardware amid tightening security rules. Anzu Robotics entered the arena by licensing DJI’s Mavic 3 Enterprise platform, allowing it to offer domestically assembled drones with American‑hosted data services. This strategy promised a homegrown alternative to Chinese‑made UAVs, appealing to federal agencies and enterprises wary of supply‑chain vulnerabilities. However, the reliance on licensed components and software kept Anzu tethered to the very ecosystem it sought to distance itself from, inviting regulatory attention.

Supply chain disruptions proved decisive for the Raptor series. A surge in demand linked to the upcoming NDAA 2025 requirements quickly exhausted inventory, while half of the critical parts still originated from China or affiliated networks. Global semiconductor shortages and logistics bottlenecks compounded the problem, leaving Anzu unable to secure the necessary components despite multiple sourcing attempts. The resulting production halt underscores how even well‑funded startups can be crippled by geopolitical headwinds and the lack of diversified component sources.

Looking ahead, Anzu’s shift toward a next‑generation drone signals a broader industry trend: manufacturers must build resilience through localized supply chains, transparent licensing structures, and compliance‑first designs. Customers will likely prioritize vendors that can guarantee data sovereignty and component traceability, especially in public‑safety and defense sectors. For investors and policymakers, the Anzu case serves as a cautionary tale that strategic partnerships with foreign technology providers must be balanced against supply‑risk mitigation and regulatory scrutiny.

Anzu discontinues Raptor drone series amid supply chain crisis

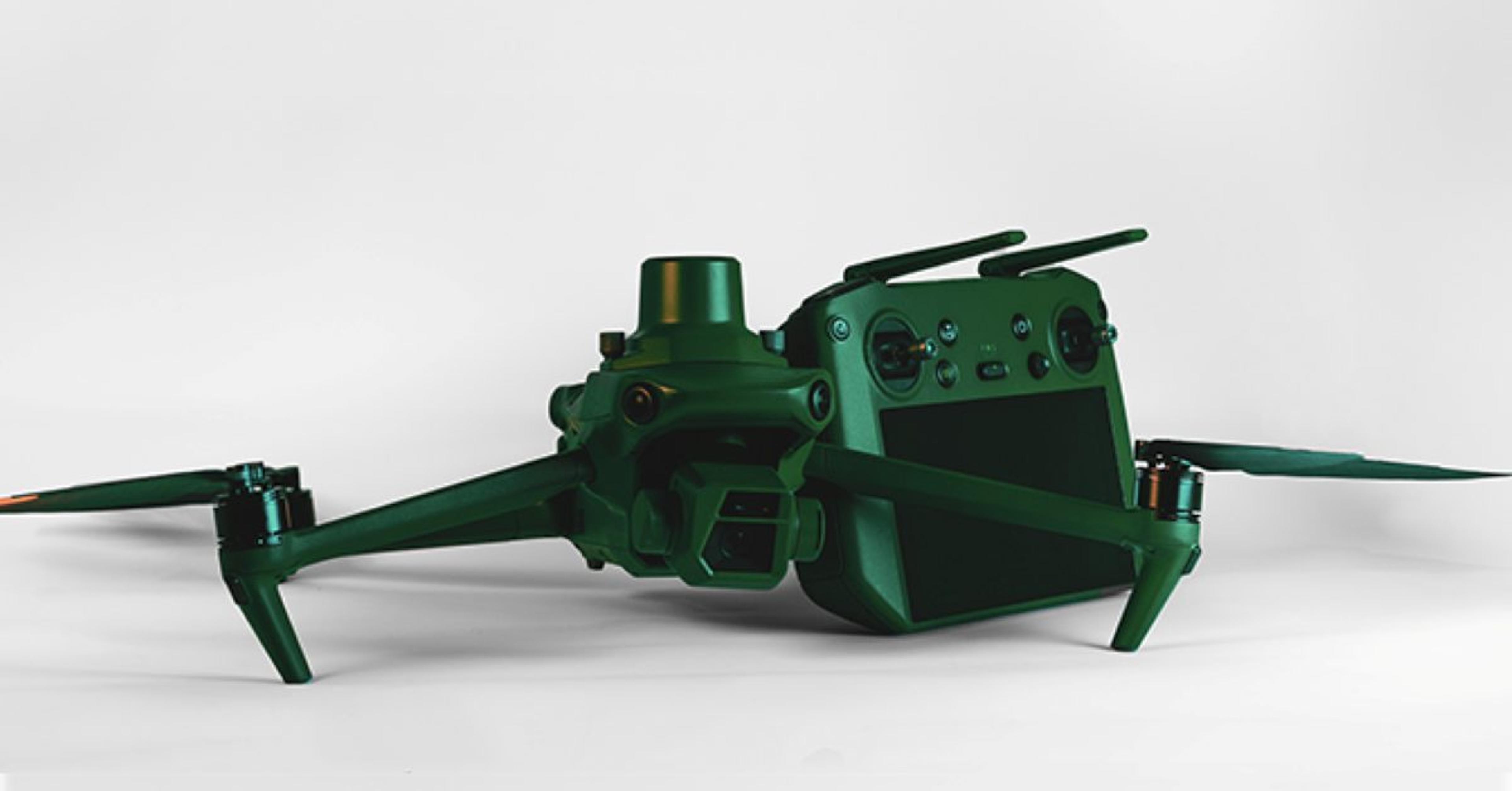

Anzu Robotics Raptor series discontinued due to component shortages

Anzu Robotics, a Texas‑based drone manufacturer that launched its Raptor series as an alternative to DJI in 2024, has announced that the line is no longer available for purchase due to persistent component shortages that have stalled further production. In an official notice from CEO Randall Warnas, the company said it had pursued multiple supply solutions without success and will instead shift focus to a “next generation” product designed to meet new commercial and regulatory demands.

“This is an official notice that the Anzu Raptor‑series is no longer available for purchase due to several component shortages mandatory for further production,” Warnas wrote, adding that strong demand late last year, driven in part by behavior tied to the NDAA 2025, caused earlier‑than‑expected stock depletion and disrupted manufacturing timing. However, he emphasized, “We are far from done… We are committed to being a leading drone manufacturer.”

The Raptor family — consisting of the baseline Anzu Raptor and the thermal‑equipped Raptor T — debuted in the US in spring 2024 as competitive alternatives to foreign drones that faced regulatory and geopolitical challenges here. The drones were built on the popular DJI Mavic 3 Enterprise platform. They offered features such as 45‑minute flight times, hybrid zoom imaging, and optional RTK positioning modules at price points generally below comparable US models.

DJI licensing: A strategic, yet controversial, partnership

From the beginning, Anzu’s approach was grounded in a technology licensing agreement with China’s DJI, allowing Anzu to modify and locally manufacture licensed hardware and software. According to Anzu, this deal gave it the rights to produce the Raptor series domestically in Malaysia and offer it in the US without sharing royalties, customer data, or ownership with DJI.

Yet that licensing arrangement quickly drew intense scrutiny from lawmakers and industry observers alike. In August 2024, members of the House Select Committee on the Strategic Competition Between the United States and the Chinese Communist Party issued detailed questions to Anzu regarding the nature of its ties to DJI. Lawmakers raised concerns that Anzu could be serving as a “passthrough company” for DJI technology in the US, possibly circumventing existing and anticipated restrictions against Chinese‑linked products. They also pressed for transparency around manufacturing partners, the degree of DJI involvement in software and technical support, and the potential for foreign data access.

Battling geopolitical headwinds and supply chain strains

These debates have played out against a broader backdrop of regulatory tensions. The US federal government has been moving toward stricter controls on Chinese‑manufactured drones over national security concerns. Though Anzu took the opportunity to market the Raptor series as an American‑oriented alternative that paired trusted technology with US data hosting and support, it also relied on global supply chains that proved fragile when demand surged.

Corporate filings and public statements indicate that roughly half of Anzu’s component base came from China or related supply networks, and some software elements were originally developed abroad, fueling further questions about how distinct the product really was from its roots.

The discontinuation of the Raptor series reinforces just how challenging it can be for emerging drone manufacturers to balance geopolitical expectations, international supply chain constraints, and technical dependencies on established technology providers. For Anzu’s enterprise and public‑safety customers who invested early in the Raptor platform, the announcement marks an unexpected pivot point, and one that sets a new stage for whatever product comes next.

0

Comments

Want to join the conversation?

Loading comments...