News•Feb 18, 2026

Tech-Powered Credit Reform Could Add £7bn to the UK’s GDP, Report Claims

ClearScore’s new white paper argues that modernising credit‑worthiness assessments with open‑banking data and AI could add up to £7 bn to the UK’s annual GDP. It highlights that 17 million adults face a £2 bn credit supply gap, with up to 60% of those currently denied credit potentially credit‑worthy under richer data models. The report notes a 14% rise in marketplace‑lending volumes where open‑banking is already employed, suggesting technology can expand credit access without raising risk.

By UKTN (UK Tech News)

News•Feb 18, 2026

Milo Tops $100 Million in Crypto-Backed Mortgages, Closes Record $12 Million Deal

Milo, a U.S. crypto‑lending firm, has originated more than $100 million in crypto‑backed mortgages, highlighted by a record $12 million loan. The company operates in ten states and offers loans up to $25 million secured by Bitcoin or Ether, with interest starting at...

By CoinDesk

News•Feb 18, 2026

Businesses Move to Rein In AI in the Shift to Autonomous Finance

Enterprises are granting AI agents authority to initiate payments, approve refunds, and orchestrate cross‑functional workflows, shifting from assistance to autonomous action. Security researchers warn that more than 1.5 million deployed agents could be exposed to misuse, expanding the attack surface faster...

By PYMNTS

News•Feb 18, 2026

Wells Fargo Sees ‘YOLO’ Trade Driving $150B Into Bitcoin and Risk Assets

Wells Fargo analyst Ohsung Kwon predicts that a surge in U.S. tax refunds could channel up to $150 billion into risk‑on assets, notably equities and Bitcoin, by the end of March. The influx is tied to a revival of the retail “YOLO”...

By Cointelegraph

News•Feb 18, 2026

EBA Issues Opinion to the European Commission on the Draft Amended European Sustainability Reporting Standards

The European Banking Authority (EBA) has issued an Opinion to the European Commission on the draft amended European Sustainability Reporting Standards (ESRS) prepared by EFRAG. While the EBA welcomes the simplifications that reduce reporting costs, it warns that permanent reliefs...

By EBA – News

News•Feb 18, 2026

Matic and nCino Embed Home Insurance Into Digital Mortgages

Matic and nCino have teamed up to embed a home‑insurance marketplace directly into nCino’s digital mortgage platform. The integration lets borrowers compare and purchase policies from more than 70 carriers without leaving the loan application flow. Lenders gain earlier access...

By Fintech Global

News•Feb 18, 2026

Experience Economy Pushes Payments to $20B Super Bowl Test

The 2026 Super Bowl generated roughly $20.2 billion in experience‑economy spending, spanning tickets, merchandise, streaming and legal wagering. Paysafe’s CEO Bruce Lowthers highlighted the need for payment platforms that can process massive, real‑time transactions across multiple methods without friction. AI‑driven fraud...

By PYMNTS

News•Feb 18, 2026

As Tax Refunds Tackle Debt, Installment Payments Become a Budget Tool

Tax refunds rose 10.9% to an average $2,290, but tariffs on consumer goods have erased 70‑95% of their purchasing power for most households. The 2024 One Big Beautiful Bill Act expanded tax cuts, yet higher tariffs and price inflation offset...

By PYMNTS

News•Feb 18, 2026

Nearly Half of Digital Bank Customers Prefer Digital Wallets

A PYMNTS Intelligence survey of 2,071 U.S. bank customers finds that 44.6% of digital‑bank users prefer paying with digital wallets, outpacing other groups. When paired with discounts and clear buyer protection, 35.4% say they would shift account‑to‑account spending to pay‑by‑bank....

By PYMNTS

News•Feb 18, 2026

Banco Itaú Teams Up with iCapital to Enhance Private Markets Offering with New Tech Solution

Banco Itaú International and Banco Itaú (Suisse) have expanded their partnership with fintech platform iCapital, embedding iCapital’s technology into the bank’s private‑markets offering. The integration delivers an end‑to‑end digital ecosystem covering marketing, onboarding, documentation, reporting and analytics, and introduces iCapital’s...

By Crowdfund Insider

News•Feb 18, 2026

Standard Chartered Partners with B2C2 to Enhance Institutional Crypto Access

Standard Chartered has teamed up with digital‑asset liquidity provider B2C2 to create a seamless bridge between traditional banking infrastructure and crypto markets. The alliance will give institutional investors—such as asset managers, hedge funds, corporates and family offices—direct access to spot...

By The Fintech Times

News•Feb 17, 2026

IPO-Bound Kissht's NBFC Arm Gets Crisil Rating Upgrade on Strong Growth

Kissht’s NBFC subsidiary Si Creva Capital Services received a CRISIL rating upgrade, moving its long‑term rating to A‑/Stable and short‑term to A1. The upgrade follows a surge in assets under management, which climbed to Rs 5,533 crore by September 2025, driven by rapid expansion...

By The Economic Times – Markets

News•Feb 17, 2026

Carlyle, BlackRock Buy Cheap Software Loans to Boost CLO Profits

Carlyle Group, BlackRock, Benefit Street Partners and Oak Hill Advisors are buying pools of low‑yield, software‑focused bank loans. The acquisitions are intended to seed new collateralized loan obligations (CLOs) after a year of compressed margins in the loan market. Buyers...

By Bloomberg — Business

News•Feb 17, 2026

Thai Banks’ Bad Loans Dip Slightly

Thai banks’ non‑performing loan ratio slipped to 2.84% at December, down from 2.94% in September. Bank lending fell 1.1% in Q4 2025, marking the sixth straight quarter of contraction, driven by tighter credit to SMEs and consumers. Household debt remains...

By Bangkok Post – Investment (subset within Business)

News•Feb 17, 2026

Velera’s Chuck Fagan: ‘Speed to Member Impact’ Is the Only KPI That Matters for Credit Unions

Chuck Fagan, CEO of Velera, told PYMNTS that credit unions must make "speed to member impact" their primary KPI, measuring how quickly they deliver solutions from concept to market. He warned that the term "credit" alienates millennials and Gen Z,...

By PYMNTS

News•Feb 17, 2026

What CFOs Need From Banks and FinTechs in Cross-Border Payments

Cross‑border payments are undergoing a structural shift as CFOs demand more predictable, liquid, and compliant solutions. FinTech firms have accelerated speed and API‑driven usability, opening new corridors and transparent pricing. At the same time, banks are investing in modern settlement,...

By PYMNTS

News•Feb 17, 2026

Nairagram Completes ₦10 Billion Capital Raise to Deepen Financial Connectivity Across Africa

Pan‑African payments firm Nairagram completed a ₦10 billion commercial paper issuance, fully subscribed within 48 hours after regulatory clearance from the Central Bank of Nigeria. The capital will fund operations across 37 African countries, accelerating expansion in key markets such as Nigeria,...

By Techpoint Africa

News•Feb 17, 2026

Fibe Crosses Rs 1,200 Cr Revenue in FY25; Profit Spikes 13%

Fibe, the former EarlySalary, posted FY25 operating revenue of Rs 1,228 crore, a 49% increase from the prior year, while net profit rose 13% to Rs 114 crore. Interest on loans remained the dominant revenue stream, exceeding Rs 1,000 crore and representing over...

By Entrackr

/file/dailymaverick/wp-content/uploads/2025/08/GettyImages-1952436000.jpg)

News•Feb 16, 2026

MONETARY POLICY: Sarb Proposes Major Reform — Ditching Prime Lending Rate for Repo Rate

The South African Reserve Bank (Sarb) has released a consultation paper proposing to scrap the prime lending rate (PLR) and use the repo rate, known as the SARB policy rate (SPR), as the benchmark for loan pricing. The PLR currently...

By Daily Maverick – Business

News•Feb 16, 2026

Andrew Baker Is New CIO of Capitec

Andrew Baker has been promoted from chief technology officer to chief information officer at Capitec, succeeding Wim de Bruyn who led the role since 2014. Baker joins the CIO post after four years driving Capitec’s migration to Amazon Web Services and...

By TechCentral (South Africa)

News•Feb 16, 2026

Letters to the Editor Dated February 16, 2026

The Hindu BusinessLine letters highlight three regulatory concerns. First, they argue that the credit‑deposit ratio alone cannot gauge bank health and call for abolishing the Cash Reserve Ratio to improve deposit mobilisation amid RBI’s new risk‑based insurance premiums. Second, they...

By The Hindu Business Line – All

News•Feb 16, 2026

RBI Issues Draft Norms for Reporting on Forex Derivative Transactions Involving Rupee

The Reserve Bank of India released draft norms requiring Authorised Dealer Category‑I banks to report all rupee‑denominated foreign‑exchange derivative transactions undertaken by their related parties worldwide. This follows earlier steps that mandated primary dealers and banks to disclose rupee interest‑rate...

By The Economic Times – Markets

News•Feb 16, 2026

Brokers to Approach RBI as Tighter Norms Squeeze Funding for Proprietary Desks

The Reserve Bank of India’s new capital‑market exposure framework, effective April 1 2026, mandates 100 percent collateral backing for all bank loans to brokerage firms and bars banks from financing proprietary trading desks. Brokers plan to petition the RBI for clarifications as the...

By The Hindu BusinessLine – Markets

News•Feb 16, 2026

Fed's Bowman Wants to Boost Banks' Share of Mortgage Market

Federal Reserve Vice Chair for Supervision Michelle Bowman announced that the Fed will soon propose two mortgage‑related regulatory changes aimed at lowering banks' capital costs and encouraging greater bank participation in mortgage origination and servicing. The proposals could revise Basel...

By American Banker Technology

News•Feb 16, 2026

RBI Approves Rajan Bajaj as MD and CEO of Slice

Fintech firm Slice announced that its founder Rajan Bajaj has been appointed Managing Director and Chief Executive Officer, with the appointment cleared by the board, shareholders and the Reserve Bank of India. Bajaj, who previously served as Executive Director, steered Slice...

By Entrackr

News•Feb 16, 2026

Eaglestone Management: Experience Forged in Global Infrastructure Finance

Eaglestone Management’s leadership team combines deep project‑finance banking experience with hands‑on infrastructure execution. CEO Pedro Neto brings over 30 years and involvement in more than €50 billion of global projects across energy, transport and concessions. Managing Partner Nuno Gil adds 25...

By CFI.co (Capital Finance International)

News•Feb 16, 2026

FCA Exchanges Letters on Cooperation with India Regulator, IFSCA

The Financial Conduct Authority (FCA) has signed an Exchange of Letters with India’s International Financial Services Centres Authority (IFSCA), the regulator for GIFT City. The pact commits both bodies to share regulatory knowledge and best‑practice insights, aiming to strengthen links...

By UK FCA – News

News•Feb 16, 2026

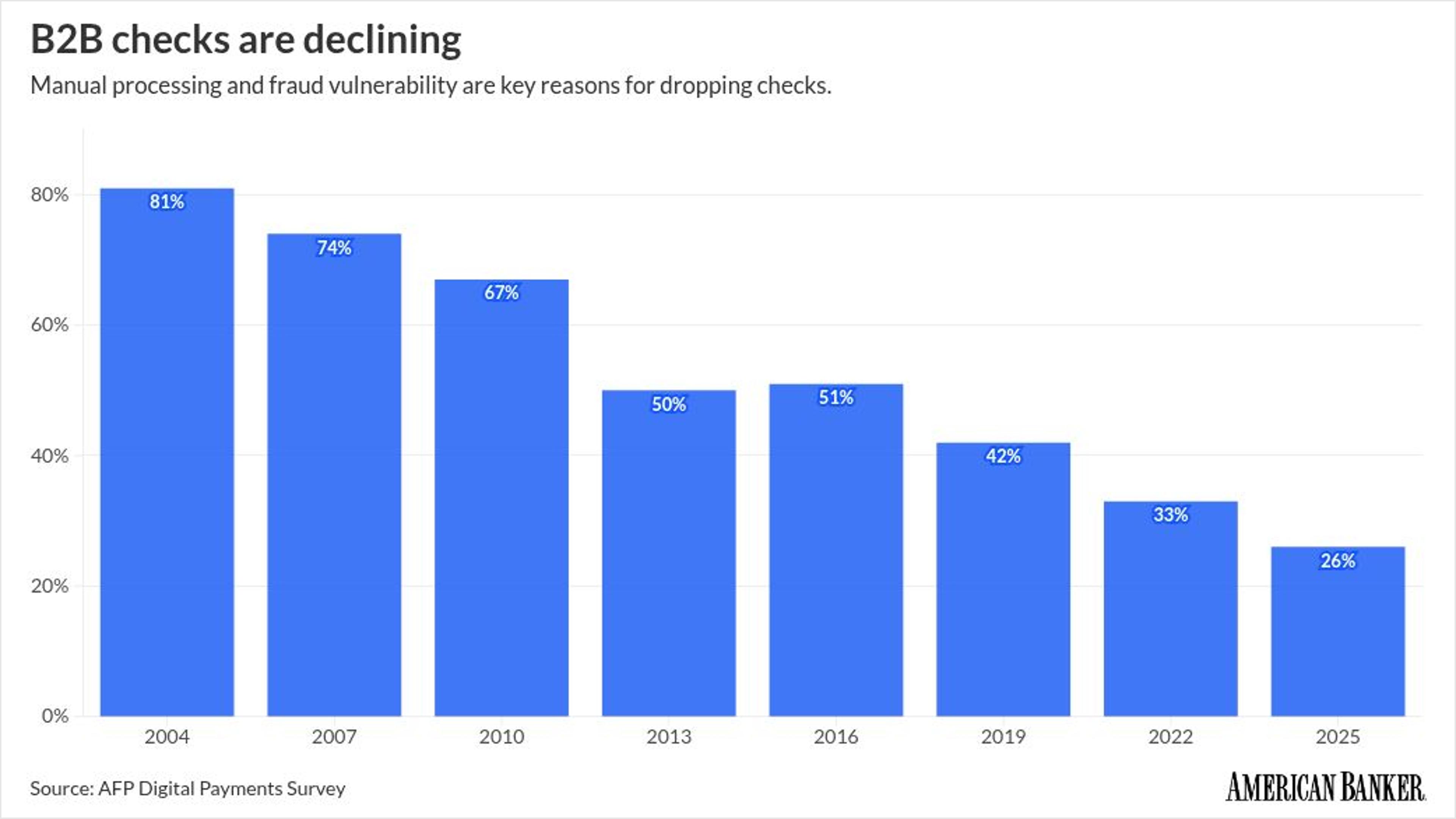

ACH Volume Is Soaring. Here's How that Threatens Banks.

ACH network volume surged in 2025, reaching 35.2 billion payments worth $93 trillion, a 5 percent rise year‑over‑year. Person‑to‑person transfers grew 19.8 percent and business‑to‑business payments rose 9.9 percent, while check usage in B2B fell to 26 percent. Nacha has proposed lifting the same‑day ACH transaction...

By American Banker

News•Feb 16, 2026

Whistleblowing Quarterly Data 2025 Q4 – Financial Conduct Authority | FCA

The Financial Conduct Authority (FCA) released its Q4 2025 whistleblowing report, revealing a 12% rise in total disclosures compared with the previous quarter. The data shows 1,842 new reports, with fraud and market abuse accounting for 58% of cases. Of...

By Crowdfund Insider

News•Feb 16, 2026

Firms Report Improved Financial Performance Linked to Use of Embedded Finance

A new PYMNTS Intelligence study of 515 senior leaders shows embedded finance is now a strategic imperative for mid‑size and large firms. Nearly 90% of respondents prioritize strengthening customer and employee relationships, while 75% plan technology upgrades within the next...

By PYMNTS

News•Feb 16, 2026

Stablecoin Payments Show Up at Checkout Despite Crypto Markets Slump

Despite a broad crypto market downturn, stablecoin‑linked cards are gaining traction at U.S. checkout counters. Monthly payment flows through these cards have surpassed $1.5 billion, and annualized spend now tops $18 billion. The growth is driven by card networks embedding stablecoins as...

By PYMNTS

News•Feb 16, 2026

Rethinking SARs in the Fight Against Financial Crime

Suspicious Activity Reports (SARs) remain the cornerstone of global AML frameworks, yet many institutions misunderstand their purpose, treating them as accusations rather than suspicion flags. Regulatory pressure and soaring transaction volumes have driven firms to prioritize filing speed over narrative...

By Fintech Global

News•Feb 16, 2026

Bitpanda Teams Up with LuLu Financing Holdings to Support Digital Assets Trading

Bitpanda has partnered with LuLu Financial Holdings to embed regulated crypto trading into LuLuFin's existing digital and physical channels across the MENA, APAC and Indian subcontinent regions. Leveraging Bitpanda’s VARA‑compliant brokerage infrastructure, LuLuFin users will be able to buy, sell...

By Crowdfund Insider

News•Feb 16, 2026

Bahrain Courts Stablecoin Issuers as AlloyX Taps Fintech Hub

AlloyX, a digital‑asset infrastructure firm owned by Solowin Holdings, has partnered with Bahrain FinTech Bay to develop a regulated stablecoin in the Gulf. The collaboration gives AlloyX access to Bahrain's fintech ecosystem while it seeks regulatory approval under the Central...

By Crowdfund Insider

News•Feb 16, 2026

Koxa, Bottomline Announce ERP Embedded Banking Partnership

Koxa and Bottomline have formed a partnership to embed banking services directly within ERP systems, leveraging Koxa’s platform and Bottomline’s Commercial Digital Banking API framework. The joint solution lets banks offer integrated payments, approvals, reconciliation and statement access without building...

By Crowdfund Insider

News•Feb 15, 2026

How Are NHIs Ensuring Protected Data Exchanges in Financial Services?

The episode explores how Non‑Human Identities (NHIs), or machine identities, are essential for securing protected data exchanges in financial services. It explains the lifecycle of NHIs—from discovery and classification to secret rotation and decommissioning—and why holistic management platforms outperform point...

By Security Boulevard

News•Feb 15, 2026

Singapore to Form National AI Council Chaired by PM Wong

Singapore will establish a National AI Council chaired by Prime Minister Lawrence Wong to coordinate AI policy and accelerate adoption across the economy. The council will review regulations, create sandboxes, and launch four national AI Missions targeting advanced manufacturing, connectivity,...

By Crowdfund Insider

News•Feb 15, 2026

ZeroDrift Announces $2M Round to Automate Compliance

ZeroDrift emerged from stealth with a $2 million pre‑seed round led by a16z speedrun, aiming to automate compliance for financial‑services communications. The AI‑native platform acts as a real‑time firewall that encodes SEC, FINRA and firm‑specific policies into machine‑readable rulepacks. By integrating...

By Crowdfund Insider

News•Feb 14, 2026

Marriott Bonvoy Launches Its First Ever Co-Brand Credit Card in Indonesia with Bank Mandiri

Marriott Bonvoy and Bank Mandiri have launched Indonesia’s first Marriott co‑branded credit card. The Marriott Bonvoy Mandiri Credit Card provides Indonesian members with welcome bonus points, elite status, and up to 5× points on eligible spend. The card is linked to...

By Breaking Travel News

News•Feb 13, 2026

New Rules for M&A Financing, Loans Against Shares

The Reserve Bank of India issued final guidelines allowing banks to fund acquisitions only when the acquirer already controls the target and seeks to increase its stake from 26% to 90%. Borrowers must have at least ₹500 crore net worth, three...

By The Economic Times (India) – Economy

News•Feb 12, 2026

Consultation: The Appointed Representatives Regime

The UK government has opened a consultation to amend the Appointed Representatives (AR) regime, which lets non‑financial firms provide financial services without full authorisation. The move follows an August 2025 policy statement that flagged weak oversight of certain ARs and the...

By HM Treasury – Atom feed

News•Feb 11, 2026

Lloyds Banking Group to Close Another 95 Branches

Lloyds Banking Group announced it will shut 95 more branches – 53 Lloyds, 31 Halifax and 11 Bank of Scotland locations – between May 2024 and March 2027. The closures will leave the group with about 610 branches after the...

By BBC News – Business

News•Feb 11, 2026

Commonwealth Bank of Australia (CMWAY) Q2 2026 Earnings Call Transcript

Commonwealth Bank of Australia reported a solid second‑half 2025 performance, with cash net profit climbing 6% and earnings per share increasing $0.19. The bank highlighted disciplined growth across its core retail and business segments despite cost‑of‑living pressures and global uncertainty....

By Seeking Alpha — Site feed

News•Feb 11, 2026

The High Cost of Going Cashless: Why Payment Choice Is Essential for Economic Equity

The push toward a cashless economy is accelerating, but the hidden fees and infrastructure demands are creating a financial burden for low‑income and unbanked consumers. As merchants adopt digital terminals and fintech platforms expand, cash‑only transactions become increasingly costly or...

By PaySpace Magazine

News•Feb 11, 2026

EximPe Gets Final PA-CB Licence to Process UPI Cross-Border Payments

EximPe, a cross‑border payment startup, has secured the Reserve Bank of India’s final Payment Aggregator Cross‑Border (PA‑CB) licence. The authorisation lets the firm enable global merchants to collect Indian consumer payments via UPI, cards, wallets and other methods, with settlements...

By Entrackr

News•Feb 11, 2026

Spark Looks to Build Building a Safe Bridge Between Onchain Capital and TradFi

Spark introduced Spark Prime and Spark Institutional Lending, extending more than $9 billion of stablecoin liquidity to hedge funds, trading firms and fintechs operating under traditional custody rules. The offerings combine over‑collateralized loan structures with a unified risk framework that spans...

By CoinDesk

News•Feb 11, 2026

ESAs Publish Joint Guidelines on ESG Stress Testing

The European Supervisory Authorities (EBA, EIOPA and ESMA) released joint Guidelines on ESG stress testing, offering a unified framework for national banking and insurance supervisors. The document outlines how to embed environmental, social and governance risks into existing stress‑test models...

By ESMA – Press

News•Feb 11, 2026

Principles for Risk-Based Supervision: A Critical Pillar for ESMA’s Simplification and Burden Reduction Efforts

ESMA has published a set of Principles for Risk‑Based Supervision to create a unified supervisory culture across the EU. The framework outlines how regulators should identify, assess, prioritize and address risks to investor protection, financial stability and market order. By...

By ESMA – Press

News•Feb 11, 2026

ESMA Promotes Clarity in Communications on ESG Strategies

On 14 January 2026, the European Securities and Markets Authority (ESMA) issued its second thematic note addressing sustainability‑related claims, specifically ESG integration and ESG exclusions. The guidance highlights the varied interpretations of these terms and warns that ambiguous usage can...

By ESMA – Press

News•Feb 11, 2026

The European Supervisory Authorities and UK Financial Regulators Sign Memorandum of Understanding on Oversight of Critical ICT Third-Party Service Providers...

The European Supervisory Authorities (EBA, EIOPA and ESMA) have signed a Memorandum of Understanding with the Bank of England, the Prudential Regulation Authority and the Financial Conduct Authority to coordinate oversight of critical ICT third‑party service providers under the Digital...

By ESMA – Press