Memory Chip Crunch Ripples Through Markets, With Worse to Come

•February 9, 2026

0

Companies Mentioned

Why It Matters

The widening cost gap threatens margins for consumer‑electronics firms while boosting earnings for memory makers, reshaping sector dynamics. Continued price volatility could ripple through technology supply chains and affect broader market sentiment.

Key Takeaways

- •Memory chip prices surged dramatically in early 2026.

- •Device makers face profit pressure from rising component costs.

- •Memory manufacturers' stocks hit record highs.

- •Firms seek supply contracts, price hikes, or redesigns.

- •Market volatility expected to continue.

Pulse Analysis

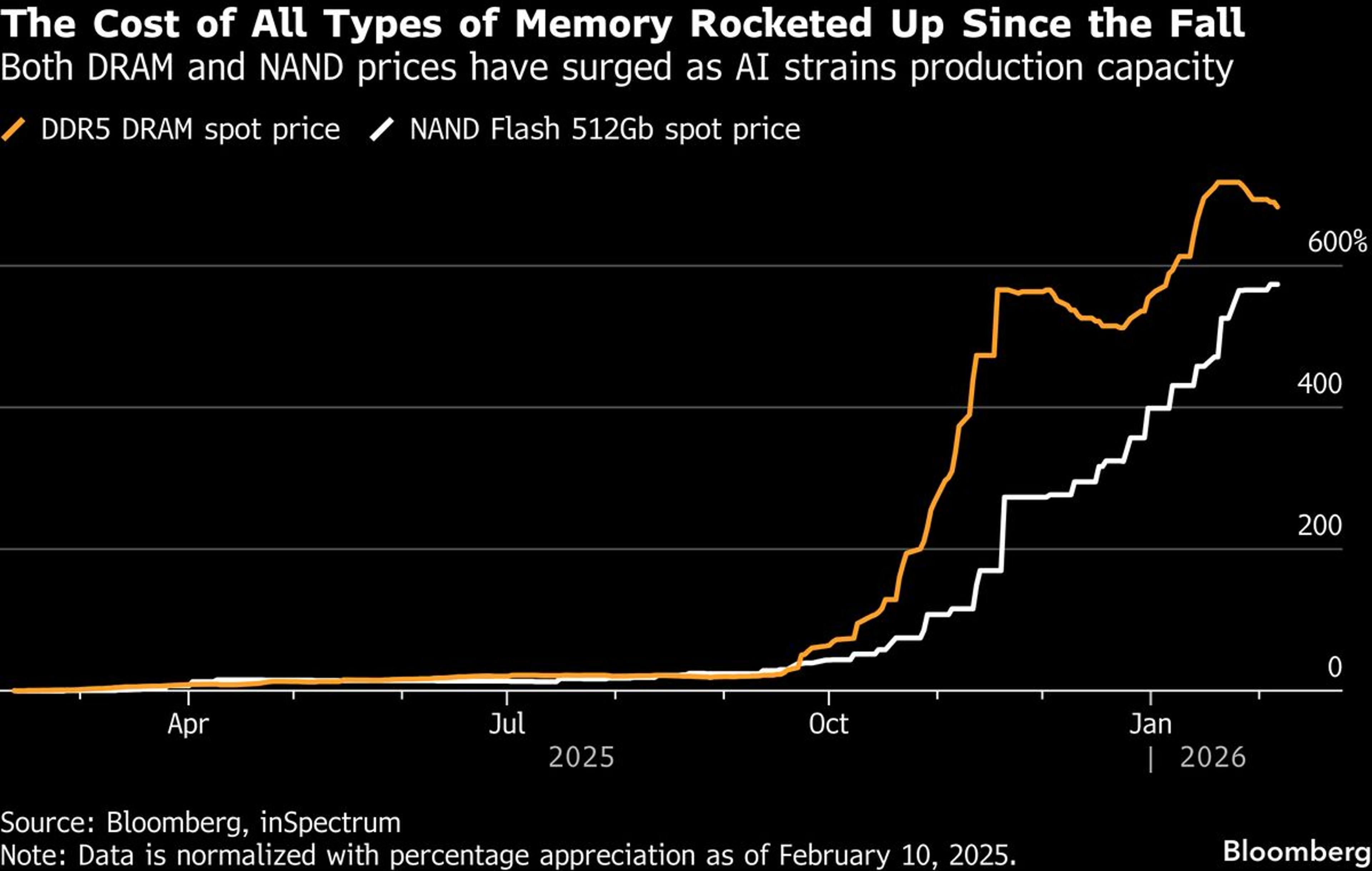

The current memory‑chip crunch stems from a perfect storm of supply bottlenecks and exploding demand. Global DRAM and NAND production has struggled to keep pace with data‑intensive workloads, from generative‑AI training to high‑resolution gaming, while fab expansions face long lead times and rising material costs. As a result, spot prices for key memory modules have climbed by more than 40 % since the start of the year, pushing inventories to historic lows. This scarcity has amplified price volatility, prompting traders to treat memory as a quasi‑commodity with speculative upside.

Manufacturers of consumer electronics feel the pressure first. Companies like Nintendo, Dell and Apple’s component partners report narrowing gross margins as bill‑of‑materials costs surge. To protect earnings, many are locking in long‑term supply agreements, passing higher costs to end‑users through price hikes, or engineering devices that rely on lower‑density memory. Some firms accelerate the shift to alternative storage technologies, such as emerging MRAM or HBM, to reduce exposure. These tactical moves, however, can increase R&D spend and delay product rollouts, creating a trade‑off between short‑term profitability and market timing.

From an investment standpoint, the memory rally has generated a rare divergence: chipmakers’ stocks are soaring while downstream players lag. Analysts caution that the current uptrend may be unsustainable if new fabs come online or demand eases, which could trigger a sharp correction. Meanwhile, policymakers in key producing regions are monitoring the imbalance, considering incentives to expand capacity and mitigate geopolitical risks. For investors, the key will be identifying firms that have secured reliable supply chains or can monetize higher memory prices without sacrificing product competitiveness.

Memory Chip Crunch Ripples Through Markets, With Worse to Come

February 9, 2026 at 11:40 PM UTC

Takeaways – Bloomberg AI

The relentless surge in memory chip prices over the past few months has driven a vast divide between winners and losers in the stock market, and investors don’t see any end in sight.

Companies from game‑console maker Nintendo Co. and big PC brands to Apple Inc. suppliers are seeing shares slump on profitability concerns. Memory producers, meanwhile, are soaring to unprecedented heights. Money managers and analysts are now assessing which firms can best navigate the squeeze by locking in supplies, raising product prices, or redesigning to use less memory.

0

Comments

Want to join the conversation?

Loading comments...