Blog•Feb 20, 2026

Gold and Silver Recovering

The episode reviews a recent rally in gold and silver prices, noting modest gains in Europe and unusually low trading volumes on the U.S. Comex market due to a holiday. It highlights the scant speculative interest and low open interest in both contracts, suggesting a market cleanse of weak long positions. The discussion points to Shanghai’s market as the primary price driver, especially for silver, and mentions geopolitical tension with potential U.S. action against Iran that could further influence metal prices.

By McleodFinance (Alasdair Macleod)

Blog•Feb 18, 2026

Gold & Silver Rebound After Latest Selloff, While Warsh's 'Treasury Accord' Looms...

Gold and silver prices bounced back after a recent sell‑off, with gold futures climbing $121 to $5,026 and silver futures up $4.50 to $78.04, while the Shanghai silver market remains closed for a holiday. The episode notes regional price differences,...

By Arcadia Economics’ Gold & Silver Daily

Blog•Feb 17, 2026

Industry Needs $90/Bbl.

The episode explains that the oil industry needs oil prices around $90 per barrel to achieve a 10% return on capital, the threshold where oil stocks typically outperform the S&P 500. It highlights that current reinvestment rates are just above...

By The Crude Chronicles

Blog•Feb 17, 2026

Wheat at the Ceiling: Is This Rebound Real?

The episode examines the recent rebound in wheat prices, noting a 3.6% weekly gain that places futures just below the long‑term technical ceiling. While global production remains near record levels—841.8 million tonnes—with strong output from Russia, Argentina, and the EU, U.S....

By CropGPT Soft Commodity Pricing

Blog•Feb 15, 2026

Silver Paper's Problem

The episode examines the severe liquidity crunch in both physical and paper silver, highlighted by a sharp drop in COMEX open interest and widening spreads that deter speculators. It explains how banks and traders are constrained by the high value...

By McleodFinance (Alasdair Macleod)

Blog•Feb 9, 2026

Interview with Triangle Investor

In this episode, economist Alasdair Macleod outlines a 2026 outlook where a tightening silver market, driven by massive physical shortages and surging demand from China and India, is creating a sharp premium between Shanghai and Western markets. He warns that...

By McleodFinance (Alasdair Macleod)

Blog•Feb 8, 2026

I Talk Silver with Danny of CapitalCosm

In this episode Alasdair Macleod talks with Danny from CapitalCosm about the current state and outlook for silver as an investment. They explore silver's price dynamics, its relationship to gold, and the macroeconomic factors—like inflation, monetary policy, and industrial demand—shaping...

By McleodFinance (Alasdair Macleod)

Blog•Feb 8, 2026

Silver Post-Smash Outlook

Alasdair Macleod analyzes the aftermath of a recent sharp drop in silver derivatives, noting that hedge fund long positions are near a 20‑year low while physical liquidity in COMEX and London vaults is extremely thin. He warns that a massive...

By McleodFinance (Alasdair Macleod)

Blog•Feb 4, 2026

US Weekly Oil Data

The episode breaks down the latest U.S. weekly oil production and inventory figures, highlighting recent shifts in crude output, refinery utilization, and stockpile levels. It explains how these data points are influencing price movements and market sentiment, especially in the...

By Anas Alhajji (Energy Outlook Advisors)

Blog•Feb 4, 2026

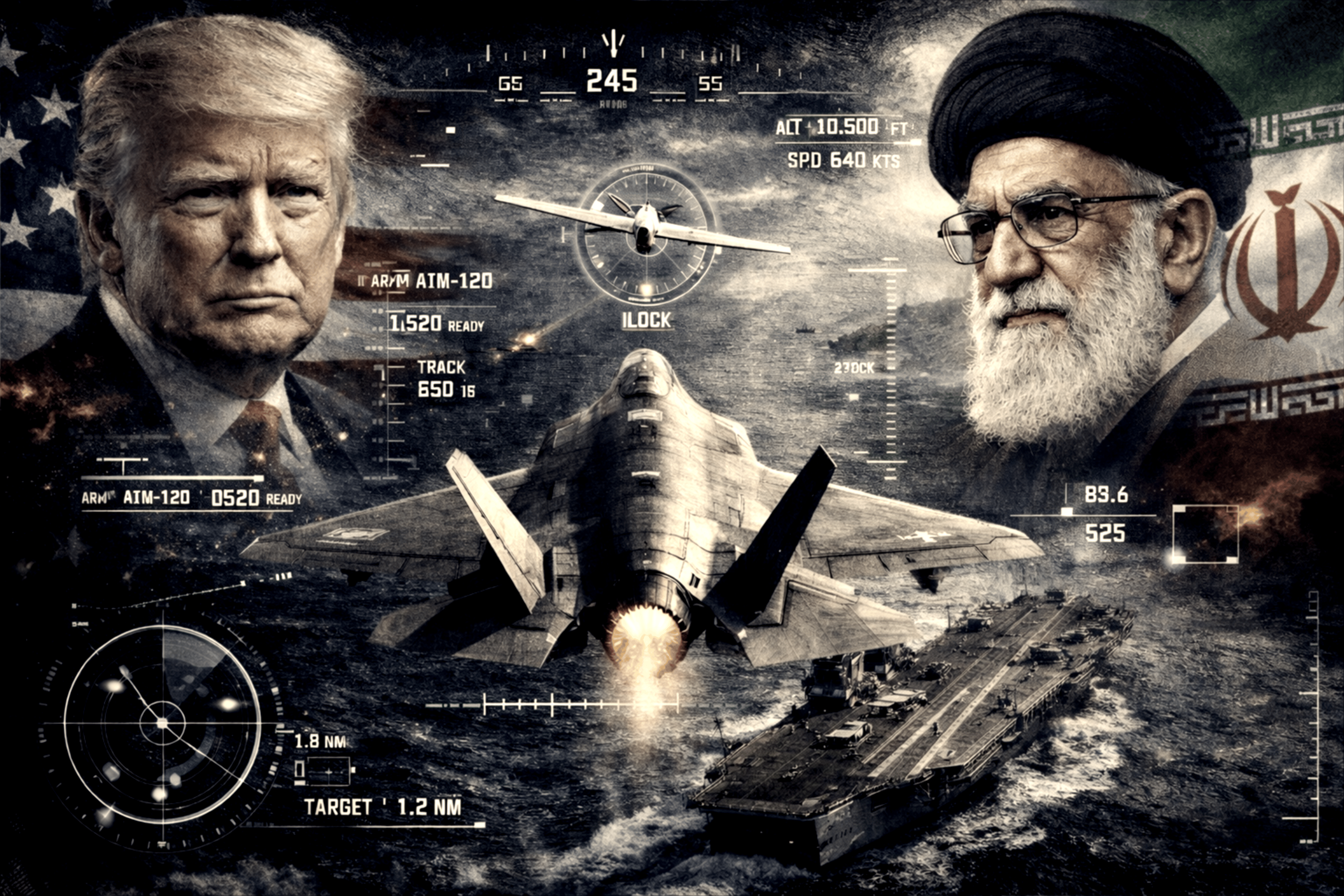

Hormuz on the Brink?

U.S. forces escalated the standoff with Iran after an F‑35 shot down an Iranian drone that approached a carrier in the Arabian Sea. Both sides have scheduled high‑level talks in Istanbul, raising hopes for a diplomatic de‑escalation. The dispute centers...

By Energy Flux

Blog•Feb 4, 2026

Watch Out for Japan’s Election on Sunday

The episode analyzes the recent collapse in gold and silver prices, attributing it to extremely low speculative open interest on COMEX and a lack of buyers, which created a price vacuum. It notes that the market has now stabilized as...

By McleodFinance (Alasdair Macleod)

Blog•Feb 4, 2026

Interview with Jasmine of Money Magpie

In this episode, Alasdair Macleod discusses the potential collapse of the fiat currency system, drawing parallels to the Weimar Republic's hyperinflation and the subsequent surge in gold prices. He argues that fiat money depends on confidence and credit, but governments...

By McleodFinance (Alasdair Macleod)

Blog•Feb 1, 2026

Interview with Jesse Day of Commodity Culture

In this episode, host Alasdair Macleod and guest Jesse Day of Commodity Culture explore the theory that China is amassing silver to eventually back the yuan with a silver standard, a move that could accelerate the dollar’s decline. They discuss...

By McleodFinance (Alasdair Macleod)

Blog•Feb 1, 2026

No Glut in Sight: Why Oil Bears Remain Mistaken—Despite OPEC+ V8 Easing the Taps in April

The episode explains that recent oil price gains are driven primarily by sharp production cuts in the United States and Mexico caused by an unusually harsh winter, rather than by OPEC+ policy changes. Geopolitical tension, including rumors of a possible...

By Anas Alhajji (Energy Outlook Advisors)

Blog•Jan 29, 2026

Inventories Before and During the Storm: A Reliable Predictor of… Nothing

The episode examines U.S. oil inventory data, highlighting that the Strategic Petroleum Reserve (SPR) has accumulated more barrels since early 2025 than the increase in domestic crude production. This discrepancy undermines claims of a true global oil surplus, as much...

By Anas Alhajji (Energy Outlook Advisors)