Annual Review of EU’s Gas Market in 2025 and the Outlook for 2026

•January 20, 2026

0

Why It Matters

Understanding the EU’s pivot to U.S. LNG and the resulting price changes is crucial for policymakers, investors, and energy companies navigating a rapidly reshaping European energy landscape. The 2026 outlook signals how supply diversification and geopolitical shifts will influence market stability and future energy security across the continent.

Annual Review of EU’s Gas Market in 2025 and the Outlook for 2026

January, 20, 2026

[

](https://substackcdn.com/image/fetch/$s_!fbFz!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fdb83223d-cc4b-40c6-b55d-aadc9aa99375_630x453.png)

Related Reports:

Annual Review of the Global LNG Market in 2025 and Outlook for 2026

Annual Review of Russian Gas Exports in 2025 & Outlook for 2026: Implication for LNG Gas Markets

In 2025, the EU’s gas market featured:

-

A modest recovery in gas demand, with a slight year-on-year increase (around 1.2%) after two years of declines.

-

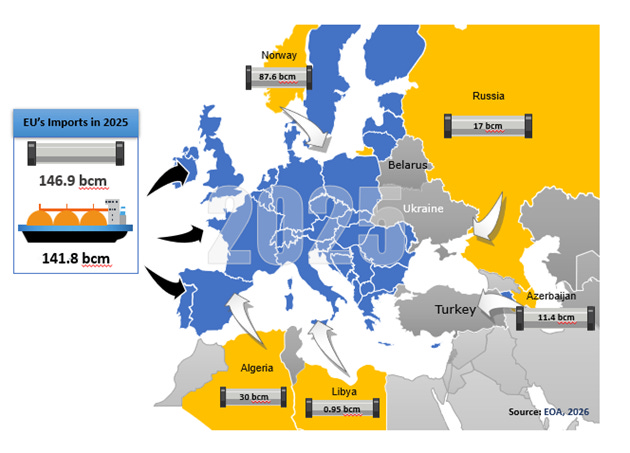

A substantial rise in LNG imports to compensate for the roughly 15 bcm loss of Russian pipeline gas following the end of the Ukraine transit agreement on December 31, 2024. The United States solidified its role as the leading LNG supplier to the EU, with its share reaching record levels (56.2%).

-

Lower gas prices relative to 2024, driven by strong LNG inflows and subdued economic growth.

2026 outlook and related issues are discussed below.

First Annual Increase in Three Years

0

Comments

Want to join the conversation?

Loading comments...