Are the Attacks on Kazakhstan’s Petroleum Sector Potentially Linked to Retaliation Against Trump’s Venezuela Strategy?

•January 19, 2026

0

Why It Matters

Understanding whether the Kazakh attacks are geopolitically motivated reshapes expectations for global oil supply and price stability, directly affecting investors, policymakers, and energy‑dependent economies. The episode is timely as markets anticipate a supply contraction in January, which could overturn the assumed surplus and influence future energy policy decisions.

Are the attacks on Kazakhstan’s petroleum sector potentially linked to retaliation against Trump’s Venezuela strategy?

Jan 19, 2026

Today is Martin Luther King Jr. Day in the United States, a federal holiday honoring the legacy of Dr. King.

U.S. financial markets are closed in observance.We typically don’t publish reports on holidays, but we wanted to make an exception and share this short Note with you today.

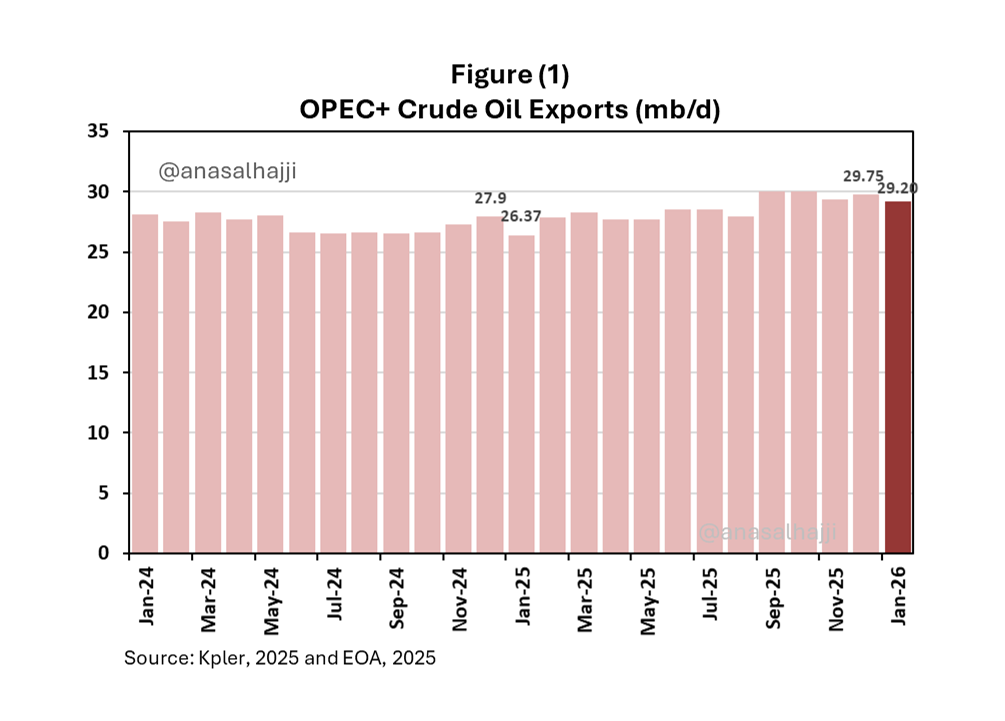

We anticipate a meaningful decline in OPEC+ supplies starting in January — a significant development that directly challenges the prevailing narrative of a large, sustained global oil surplus. Here’s a clear view of the recent monthly trends in OPEC+ exports, including our forecast for January:

[

](https://substackcdn.com/image/fetch/$s_!QDGS!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fff237fad-8795-4761-8e5e-42ade1fb6d4a_1005x721.png)

What are the main reasons behind the ongoing supply drop?

0

Comments

Want to join the conversation?

Loading comments...