Counterparty Risk in Silver Exposed

•January 16, 2026

0

Why It Matters

Understanding counterparty risk in silver is crucial as it can trigger sharp price swings that affect portfolios and broader market stability. The discussion is timely given the current surge in silver prices and the growing exposure of market participants to leveraged positions, making it essential knowledge for anyone involved in precious metal investing.

Counterparty risk in silver exposed

[

](https://substackcdn.com/image/fetch/$s_!J9QS!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F48e1a626-f647-4bce-8718-b579f3d3c2c8_1284x930.png)

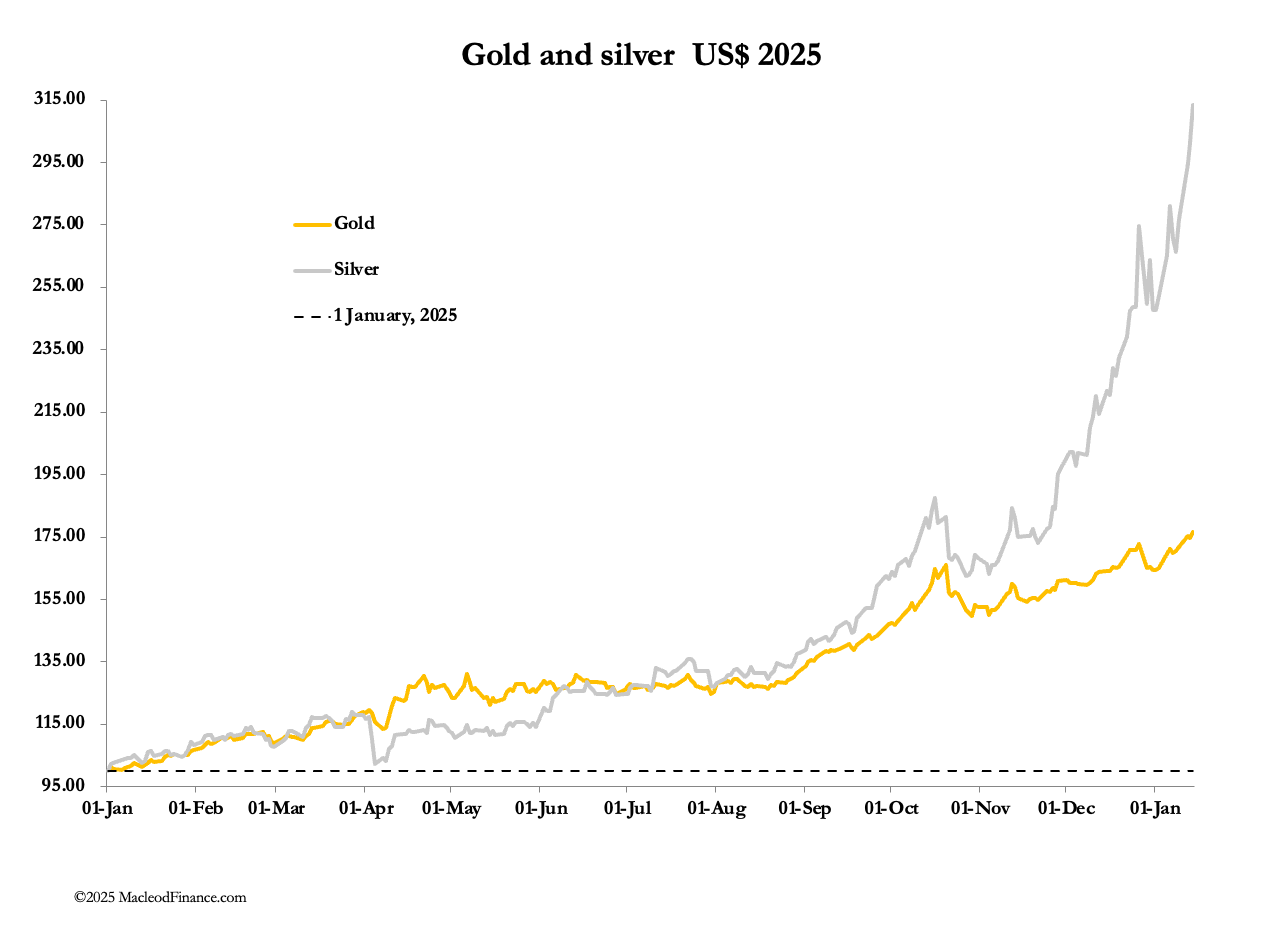

This week, gold gently marched higher while silver continued its moonshot. In mid-morning European trading, gold at $4606 was up $100 from last Friday’s close, while silver at $90.75 was up $10.85.

Technically, gold is in an old-fashioned bull market, the price rising with increasing open interest on Comex, illustrated below:

0

Comments

Want to join the conversation?

Loading comments...