Why It Matters

Understanding the $90/bbl breakeven for a 10% return helps investors gauge when oil equities may regain relative strength against broader markets. It also signals broader economic implications, as Saudi Arabia’s fiscal health and global energy supply dynamics are linked to this price level, making the discussion timely for policymakers and market participants alike.

Industry needs $90/bbl.

The Gist: Achieving a 10% return on capital for the industry would require approximately $90/bbl oil — roughly the same level at which Saudi Arabia needs to improve its fiscal position.

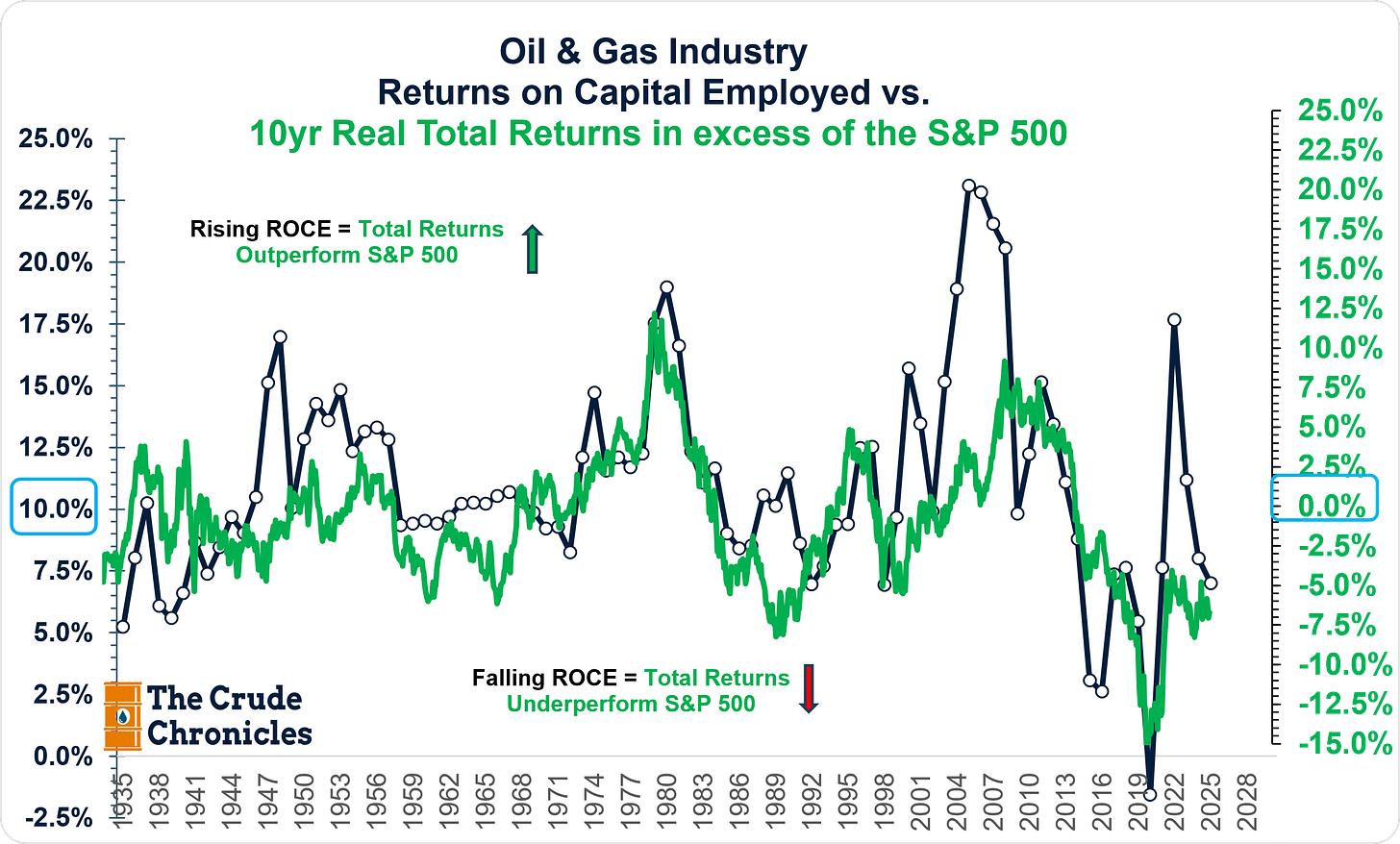

A 10% return on capital is an important benchmark, as it has historically marked the point at which traditional oil and gas equities begin to outperform the S&P 500.

[

](https://substackcdn.com/image/fetch/$s_!ONmA!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F73a6ee95-fee4-4a74-ad5e-31c2dff77165_2535x1529.png)

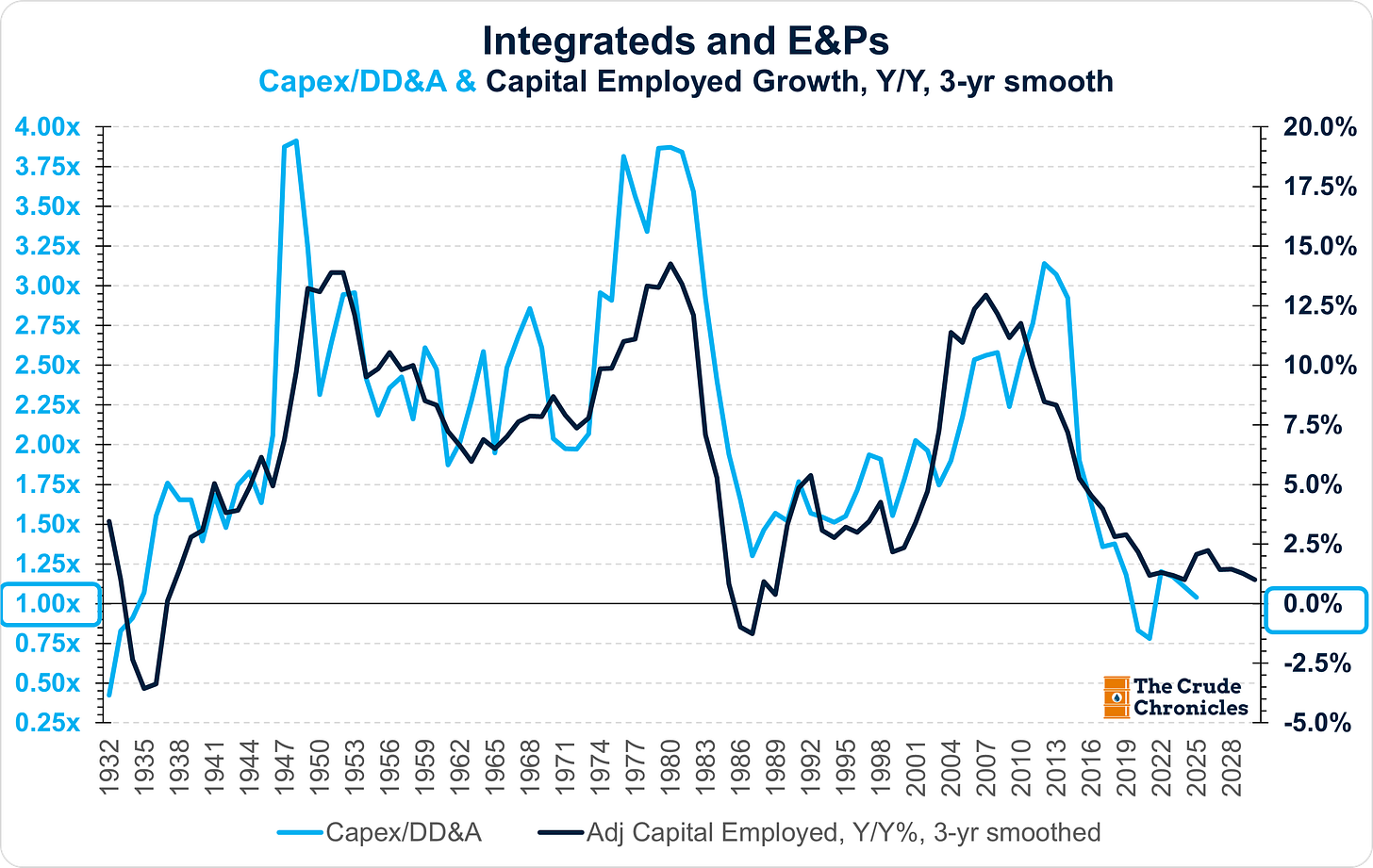

Reinvestment rates, defined as capex divided by DD&A, remain low at just above 1.0x. The industry is effectively investing only enough to offset current depletion and usage of its assets. At these levels, capital employed growth in the upstream segment is likely to average approximately 1% per annum through the remainder of the decade.

[

](https://substackcdn.com/image/fetch/$s_!fBYE!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4a13658a-fe99-49e7-9537-013c8b4542e6_2869x1814.png)

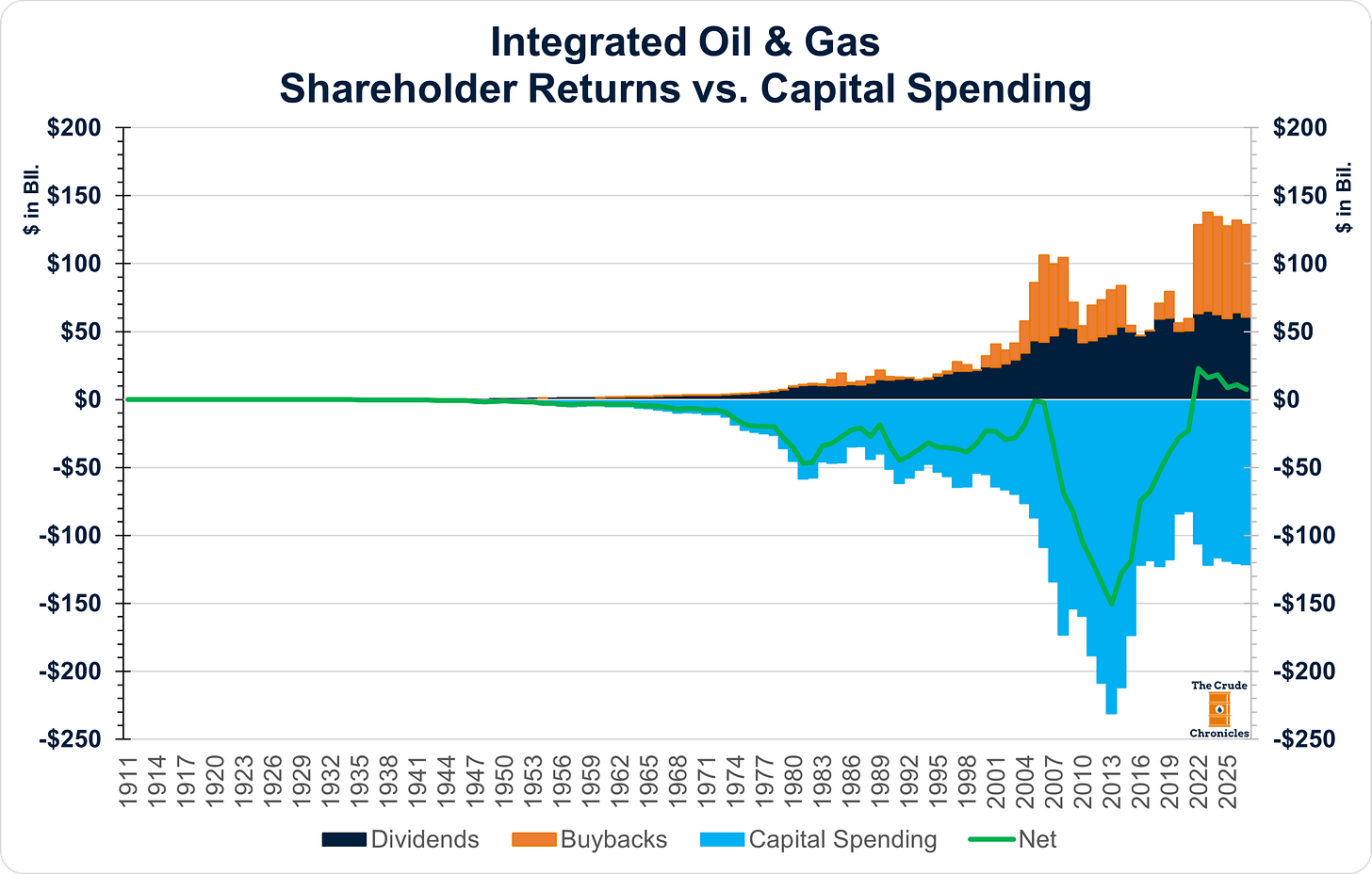

Ongoing consolidation, a continued emphasis on shareholder returns and limited appetite for incremental growth will most likely keep this trajectory unchanged.

[

](https://substackcdn.com/image/fetch/$s_!WNw0!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F11db2e7e-e8fd-4503-bc66-4c90ed64e339_2787x1777.png)

Now that we have greater visibility into the direction of the denominator in the NOPAT ROCE equation, we can assess actual net operating profit after tax (NOPAT) relative to the historical NOPAT required to generate a 10% return on capital.

0

Comments

Want to join the conversation?

Loading comments...