Kazakhstan, Venezuela, and Iran: Key Wildcards Driving Oil Price Volatility

•January 14, 2026

0

Why It Matters

Understanding these geopolitical flashpoints is crucial for investors and policymakers because they can quickly shift the balance of global oil supply, influencing prices and market volatility. As the world watches these regions, the episode offers timely insight into risks that could affect energy security and investment strategies in the coming months.

Kazakhstan, Venezuela, and Iran: Key Wildcards Driving Oil Price Volatility

Oil Prices

WTI continues its advance trading close to $61. You can take partial profits of almost $5 but hold most of your long positions. Dale’s long term price target remains $78. Tomorrow he will cover Nat Gas which has a heartbeat down here.

Kazakhstan

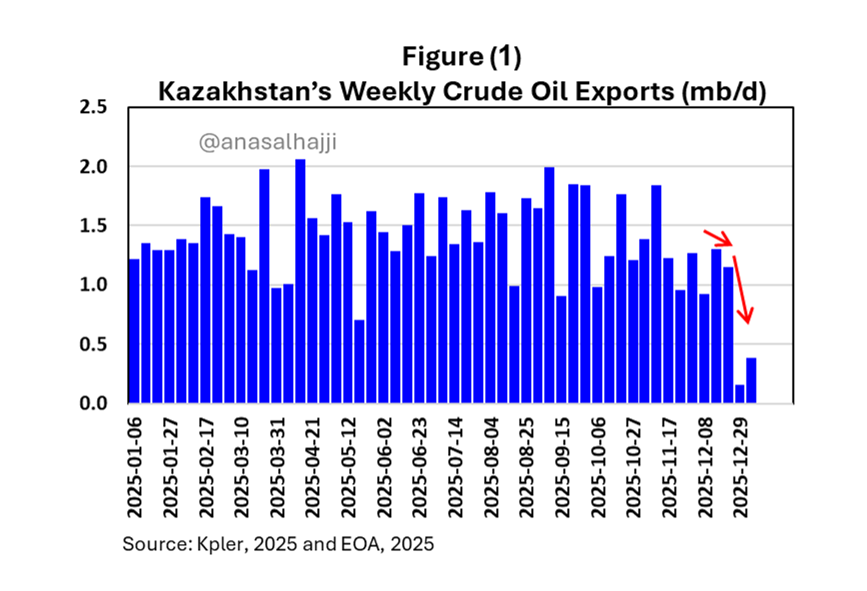

EOA: Major Decline in Kazakhstan Crude Exports

[

](https://substackcdn.com/image/fetch/$s_!Co0n!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F9d969e73-304e-4764-951c-87b1d84f14ee_867x591.png)

Founding Plan: One-on-One Guidance

Summary

Kpler data shows that Kazakhstan’s crude oil exports continued to decline into early 2026. This downturn stems from a combination of Ukrainian drone attacks and adverse weather conditions, which have collectively forced reductions in production and loadings, as illustrated in Figure 1.

Nearly all of Kazakhstan’s crude exports transit through the Caspian Pipeline Consortium (CPC) terminal, located on Russia’s Black Sea coast near Novorossiysk. Some Kazakh oil fields lie close to the Russian border, with associated oil and gas often processed at nearby Russian facilities.

Meanwhile, three oil tankers en route to load Kazakh crude at the CPC terminal were recently attacked (reported on January 13, 2026). This raises several questions:

-

Does it make strategic sense for Ukraine to target infrastructure that primarily disrupts Kazakhstan’s crude exports?

-

Is it logical for Ukraine to attack tankers specifically loading Kazakh (rather than Russian) oil at the CPC terminal?

-

Why would Ukraine significantly curtail Kazakhstan’s exports while allowing Russia’s own crude exports to increase?

What’s really happening here? A discussion of the underlying causes and broader impacts follows below.

EOA’s Main Takeaways

0

Comments

Want to join the conversation?

Loading comments...