Oil Context Weekly (W6)

•February 6, 2026

0

Why It Matters

Understanding these dynamics helps traders and investors gauge short‑term price pressures and longer‑term market structure, especially as speculative positioning may amplify downside moves. The episode’s timely insights into inventory swings, geopolitical shifts, and policy developments provide critical context for anyone navigating the volatile oil market.

Oil Context Weekly (W6)

Happy Friday, Oil Watchers!

Every week, I summarize and analyze developments in flat crude prices, calendar spreads, high-frequency inventories, refined products, and positioning data, as well as a taste of the themes I’ve been thinking about or following closely.

Note to paid subscribers: Please note that the February North American Oil Data Deck will be published on Monday given the US Energy Information Administration’s decision to delay the publication of the Petroleum Supply Monthly report due to the lagged trade data catch-up by Census Bureau.

Become a paid subscriber today to read the full Oil Context Weekly report every Friday and join me in my hunt for ever-deeper oil market context.

If you’re already subscribed and/or appreciate the free chart and summary, hitting the LIKE button is one of the best ways to support my ongoing research.

[

](https://substackcdn.com/image/fetch/$s_!SCWL!,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F97fc0e3c-81c0-4d79-9c6b-d321a4876b03_2048x1169.png)

Summary

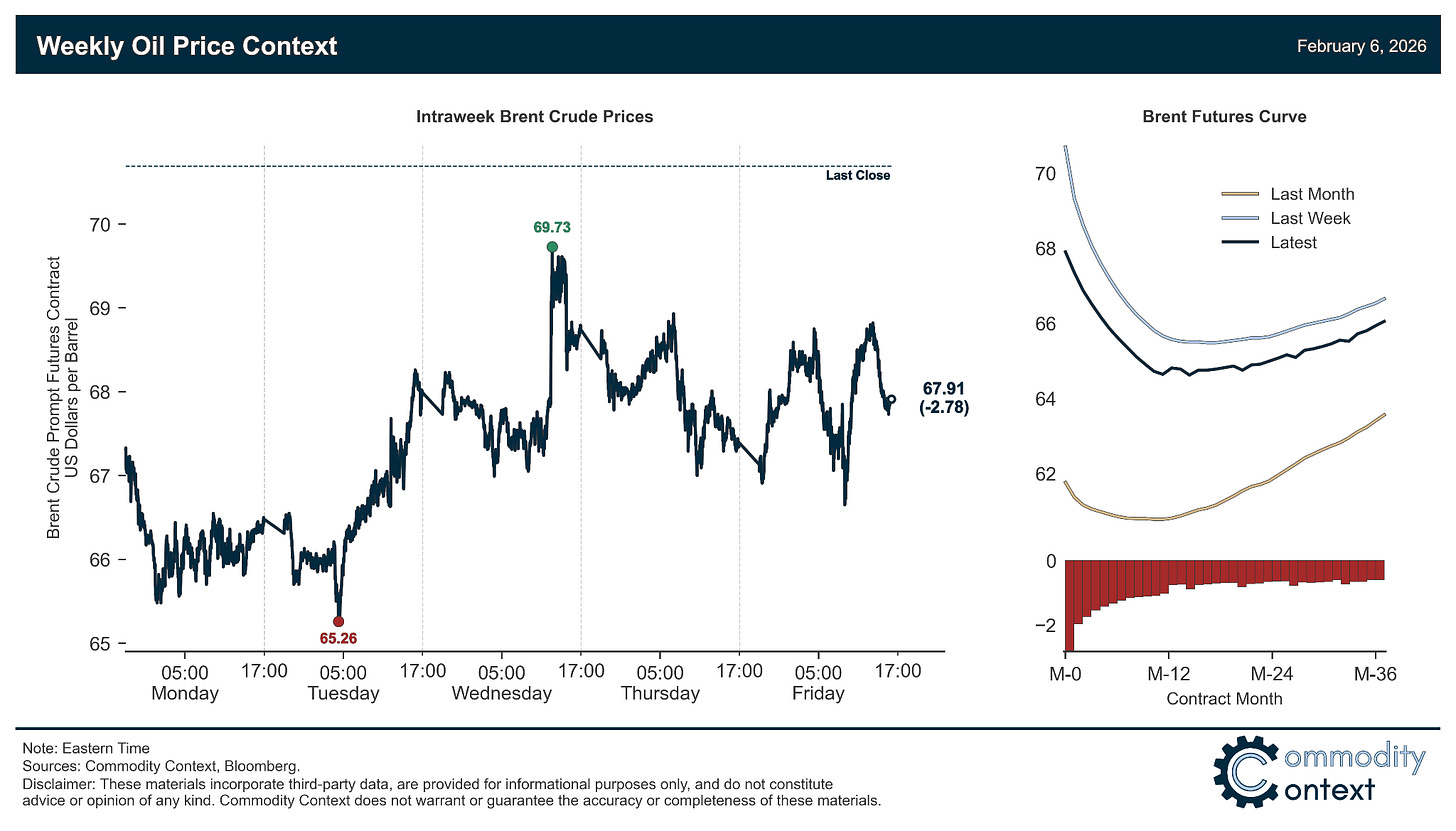

Flat Prices started the week sharply lower, following a statement from President Trump that Washington was talking with Tehran, but prices pared back losses to end just below $68/bbl Brent, down just less than $3/bbl on the week.

Timespreads remain modestly but steadily backwardated at the front of all major crude curves; the more notable aspect of our current crude term structure is the return and lingering smiley-faced futures curve, with its depressed belly currently backwardated out through summer 2027.

Inventories data was leaned heavily—though idiosyncratically—bullish thanks to a truly enormous winter storm-driven headline draw in the US, juxtaposed against a surge in Singaporean product stocks to higher year-to-date from weeks of steep declines.

Refined Products converged toward a sense of normality as the previous, exceptional rally in diesel crack spreads—related to winter-storm related demand pressures—gave back more than $10/bbl and, in the other direction, gasoline margins, under pressure from rapidly rising stocks, reversed course back to seasonal levels.

Market Positioning data confirmed that speculators were, once again, large net buyers of crude futures and options contracts, the cumulative effect of which has been to lift the net speculative position as a proportion of total open interest in these contracts to near its highest level over the past year; accordingly, we now believe that speculative flows are a net drag on crude pricing going forward, with incrementally less to give on the upside and more to rapidly take back on the downside.

As Well As Iranian headline risk abates but professional hedges remain ever-more wary; EU Russian Maritime Services Ban; Russian barrels under pressure; Surprise US-India Trade Deal; US production plateau; and Alberta premier sees many potential routes for West Coast pipeline

What Happened This Week

0

Comments

Want to join the conversation?

Loading comments...