Acquisition

St Barbara Agrees to Sell 50% of Simberi to Lingbao Gold and Kumul for up to A$470M

•February 11, 2026

0

Participants

Why It Matters

The Nova Scotia push positions St Barbara to tap a high‑grade gold corridor while the Simberi sale finances a sulphide expansion, potentially accelerating cash‑flow and shareholder returns.

Key Takeaways

- •697 sq km land package assembled in Nova Scotia

- •56 targets identified within 75 km of 15-Mile hub

- •Prefeasibility forecasts 103k oz/year at $1,188/oz

- •NPV A$1.4bn, IRR 80% assuming $3,000 gold

- •Simberi stake sale funds $325‑$345m sulphide expansion

Pulse Analysis

St Barbara’s aggressive land‑acquisition strategy in Nova Scotia reflects a broader industry shift toward stable, low‑risk jurisdictions. By focusing on the Moose River Formation and Goldenville Group metasediments, the company targets classic mesothermal systems akin to historic goldfields in Victoria and California. The 697 sq km parcel, now home to 56 drill targets, offers shallow‑depth deposits that can be accessed with relatively modest capital, reducing the exploration risk profile and aligning with investors’ appetite for near‑term upside.

The financial underpinnings of the 15‑Mile project are compelling. A recent prefeasibility study forecasts 103,000 ounces of gold annually at an all‑in sustaining cost of $1,188 per ounce, translating to a post‑tax net present value of A$1.4 billion and an internal rate of return near 80% when gold trades at $3,000 per ounce. Coupled with a projected 12‑month payback on the C$283 million plant relocation, the economics position the mine as a cash‑generating asset that could significantly boost St Barbara’s earnings profile.

Strategically, the divestiture of a 50% stake in the Simberi operation provides up to A$470 million to fund a $325‑$345 million sulphide expansion, targeting 200,000 ounces of annual output. This capital reallocation underscores a deliberate pivot from higher‑cost, marginal oxide operations in Papua New Guinea to a more predictable, growth‑oriented portfolio in Atlantic Canada. The market’s positive reaction—shares rising over 10%—signals confidence that the combined exploration upside and funded expansion will drive long‑term value creation for shareholders.

Deal Summary

St Barbara announced it has agreed to sell a combined 50% stake in its Simberi gold project in Papua New Guinea to China’s Lingbao Gold Group and PNG’s Kumul Mineral Holdings for up to A$470 million in staged cash payments and loans. The transaction, expected to close by the end of March, will fund St Barbara’s sulphide expansion at Simberi. The deal follows the miner’s renewed focus on its Canadian exploration program.

Article

Source: MINING.com

Australia’s St Barbara (ASX: SBM) has unveiled an aggressive exploration strategy in Nova Scotia as it advances plans to redevelop its 15-Mile open pit gold mine and processing hub project and reshapes its global portfolio.

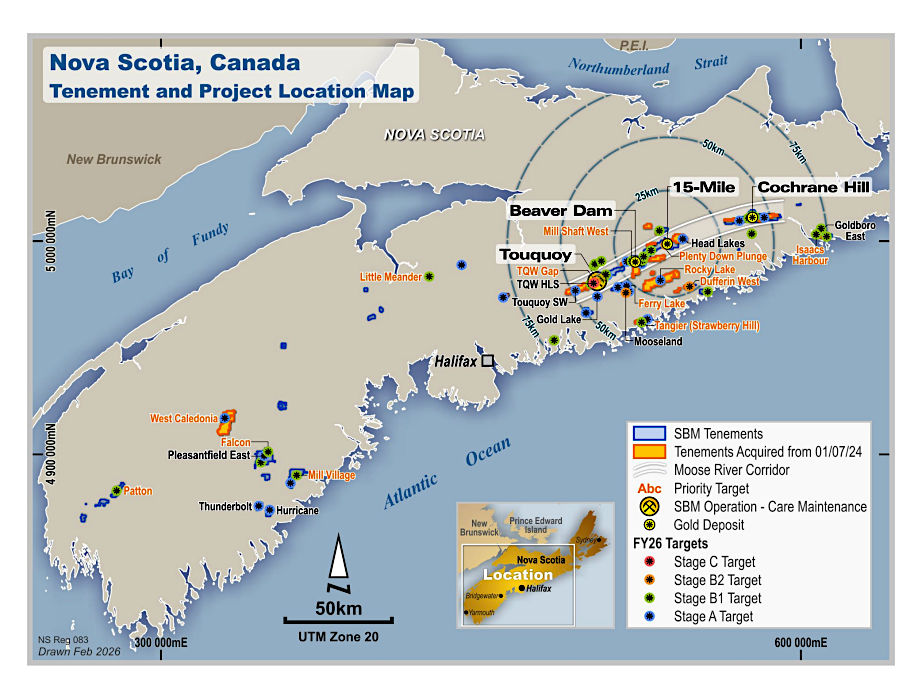

The company has assembled a 697 sq. km land package in the Canadian province over the past two years, consolidating ground around its proposed 15-Mile hub despite licence reviews that trimmed its overall tenure and ongoing permitting challenges as the Touquoy mine winds down.

Since acquiring Atlantic Gold in 2019, St Barbara has built a dominant position across prospective ground, identifying 56 targets within a 75 km radius of the planned hub. The targets focus on the Moose River Formation and 12 regional prospects within the Goldenville Group metasediments.

Its landholding spans 164 km of prospective anticlines, including 75 km where the favourable Moose River Formation is exposed at surface or lies beneath shallow cover, in some areas less than 30 metres deep.

St Barbara describes the targeted gold systems as classic mesothermal deposits, comparable to those in Victoria’s goldfields, New Zealand’s South Island and California’s Mother Lode belt.

(Courtesy of St Barbara.)

Fieldwork is set to begin in May, combining surface sampling and reverse circulation drilling, with targets refined through a comprehensive structural review supported by newly acquired geophysical data. The company has also secured ground at Rocky Lake to test for northeast extensions of the Mooseland Anticline.

The exploration push supports redevelopment plans at 15-Mile. A prefeasibility study released earlier this year projected annual production of 103,000 oz at all-in sustaining costs of $1,188/oz over an initial 11-year mine life. At a gold price of $3,000/oz, the project carries a post-tax net present value of A$1.4 billion and an 80% internal rate of return. St Barbara estimates the C$283 million cost to relocate the Touquoy plant and rebuild infrastructure could be repaid in about 12 months.

Spot gold remains above $5,000 per ounce. Before 15-Mile enters production, St Barbara expects to process Touquoy stockpiles containing 38,000 ounces of the precious metal.

Renewed Canadian focus

The Nova Scotia push follows last year’s aborted attempt to spin off or sell the former Atlantic Gold assets. After failing to attract sufficient interest, St Barbara opted to advance development instead, citing what it sees as a more workable permitting environment.

At the same time, the company is moving to exit its Simberi gold project in Papua New Guinea. It agreed to sell a combined 50% stake to China’s Lingbao Gold Group and PNG’s Kumul Mineral Holdings for up to A$470 million in staged cash payments and loans. The deal, expected to close by the end of March, aligns with a final investment decision on Simberi’s next phase.

St Barbara said the transaction would fully fund its share of the $325–345 million sulphide expansion, which aims to lift production to 200,000 ounces a year. Simberi’s remaining oxide operations are considered marginal due to high costs.

Shares in St Barbara rose 10.5% to 79 Australian cents in Sydney on Wednesday, valuing the company at A$950 million ($677 million). The stock has gained 34% year to date and traded traded between 19 and 82 Australian cents over the past year.

Much of the gold sector’s growth in Atlantic Canada — Nova Scotia, New Brunswick and Prince Edward Island — has occurred only in the last decade, as investors are slowly discovering the region’s potential.

0

Comments

Want to join the conversation?

Loading comments...