AcquisitionCommodities

Vale Sells Control of Thompson Nickel Complex to Investor Group for up to $200M Injection

•February 19, 2026

0

Participants

Why It Matters

The deal secures long‑term investment in a critical‑metal asset, bolstering North American nickel supply for EV batteries and preserving jobs in northern Manitoba.

Key Takeaways

- •Vale sells 81.1% stake to investor group

- •New company named Exiro Nickel

- •Up to $200M capital injection

- •Thompson output rose 21% to 12,000 tonnes

- •Deal closes by end 2026, Vale retains ops

Pulse Analysis

The nickel market is entering a pivotal growth phase as electric‑vehicle demand accelerates, prompting miners to lock in stable supply chains. Vale’s strategic review of its Thompson operations reflects a broader industry shift toward regionalizing critical‑metal production, reducing reliance on geopolitically sensitive sources. By partnering with Canadian investors, Vale not only unlocks capital for expansion but also aligns the project with national policies aimed at securing domestic sources of battery‑grade nickel.

The consortium—Exiro Minerals, Orion Resource Partners and the Canada Growth Fund—will command 81.1% of the newly formed Exiro Nickel, injecting up to $200 million to fund mine development, exploration and infrastructure upgrades. Vale’s retained 18.9% stake ensures continuity of expertise while the off‑take agreement guarantees a market for the concentrate. This ownership structure balances private sector agility with public‑sector strategic oversight, positioning Thompson as a flagship Canadian critical‑minerals asset.

Beyond the financial mechanics, the transaction safeguards thousands of jobs in northern Manitoba and reinforces Canada’s ambition to become a global leader in clean‑energy commodities. With production already up 21% to 12,000 tonnes, the capital boost is expected to sustain higher output levels, supporting battery manufacturers and downstream processors. The deal also signals confidence in the long‑term viability of North American nickel projects, encouraging further investment across the sector.

Deal Summary

Brazilian miner Vale announced the sale of its 18.9% stake in the Thompson nickel complex in Manitoba to a consortium of Exiro Minerals, Orion Resource Partners and the Canada Growth Fund. The investors will form a new company, Exiro Nickel, and inject up to $200 million, with the transaction expected to close by end‑2026.

Article

Source: MINING.com – Gold

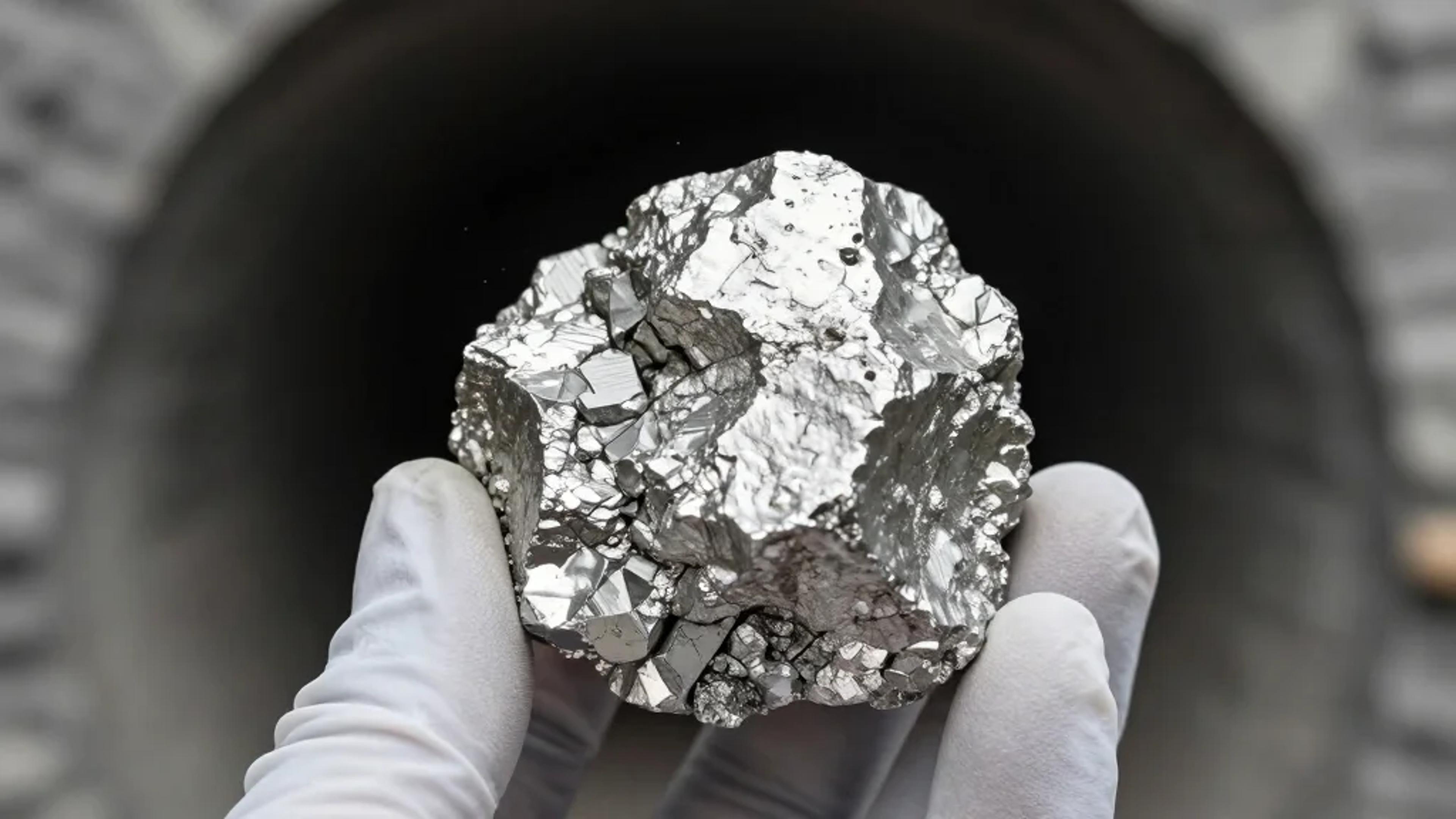

Brazilian mining giant Vale (NYSE: VALE) is selling control of Manitoba’s Thompson nickel mine complex to a trio of investors that agreed to inject up to $200 million in the operation.

Privately held Canadian explorer Exiro Minerals, Orion Resource Partners and the federally owned Canada Growth Fund (CGF) will form a new company alongside Vale’s base metals unit to invest in Thompson, according to a statement issued Thursday. Exiro, Orion and CGF will own 81.1% of the new company, which will be called Exiro Nickel, compared with 18.9% for the Brazilian miner.

“Today’s announcement secures the future of mining at Thompson, a site with a significant endowment and great people, and which is a key part of northern Manitoba’s rich mining history,” Vale Base Metals CEO Shaun Usmar said in the statement. “We believe in the strategic value of nickel and are proud to be part of Thompson’s new future.”

Thompson is one of Canada’s largest underground nickel mining operations, which Vale took on when it bought former Toronto-based miner Inco in 2006 for $17 billion. Inco discovered the ore body in 1956 and mining began in 1961.

The transaction follows a strategic review launched by Vale in early 2025 aimed at securing a long-term future for the Thompson nickel belt, one of Canada’s historic mining districts. The new owners are to focus on mine development, exploration and infrastructure upgrades intended to sustain operations and employment in the region.

Major employer

Thompson is a major employer in northern Manitoba. The agreement provides stability for the workforce while positioning the assets under owners dedicated to growing the operation, Vale said Thursday.

The transaction is expected to close by the end of 2026, subject to certain closing conditions including customary regulatory and government authorization. If approved, the transaction will conclude the strategic review that Vale launched for the Thompson operations in January 2025. Vale will maintain day-to-day operational responsibility for the mining complex until the deal closes.

Vale has signed an offtake agreement for the nickel concentrate produced at the Thompson mill.

Thompson includes two underground operating mines, an adjacent mill and significant exploration opportunities on the 135-km long Thompson nickel belt. Thompson produced 12,000 tonnes of Vale’s finished nickel last year – 21% more than the 9,900 tonnes produced in 2024.

“The Thompson mine is a strategic asset, both for the nickel that supports critical supply chains and for the significant economic benefits it delivers to Manitoba and Canada,” said Yannick Beaudoin, CEO of the C$15 billion Canada Growth Fund.

“This transaction builds on CGF’s growing portfolio of mining investments and strengthens Canada’s position as a global leader in critical minerals.”

0

Comments

Want to join the conversation?

Loading comments...